Digital household shopping merchant credit evaluation method

A credit evaluation and digital home technology, applied in data processing applications, commerce, instruments, etc., can solve problems such as disrupting customer judgment, blurring concepts, and reducing the subjectivity of buyers' judgments, avoiding credit fraud, improving merchant service levels and The effect of platform management level

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

no. 1 example

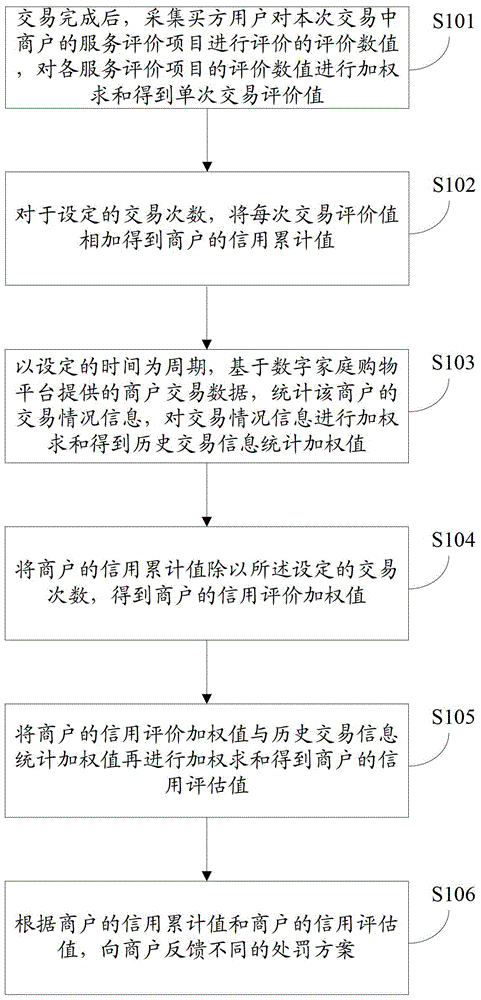

[0056] In the first embodiment of the present invention, a digital home shopping merchant credit evaluation method, such as figure 1 shown, including the following specific steps:

[0057] Step S101, after the transaction is completed, collect the evaluation value of the buyer user on the service evaluation items of the merchant in this transaction, and perform weighted summation of the evaluation values of each service evaluation item to obtain a single transaction evaluation value.

[0058] Specifically, the transaction status information includes: transaction success rate, transaction return rate, transaction replacement rate, transaction complaint rate and transaction growth rate;

[0059] Each service evaluation item includes: product quality evaluation, information quality evaluation, distribution quality evaluation and service quality evaluation, among which, product quality evaluation includes: whether the delivery is correct, whether the product is authentic, and wh...

no. 2 example

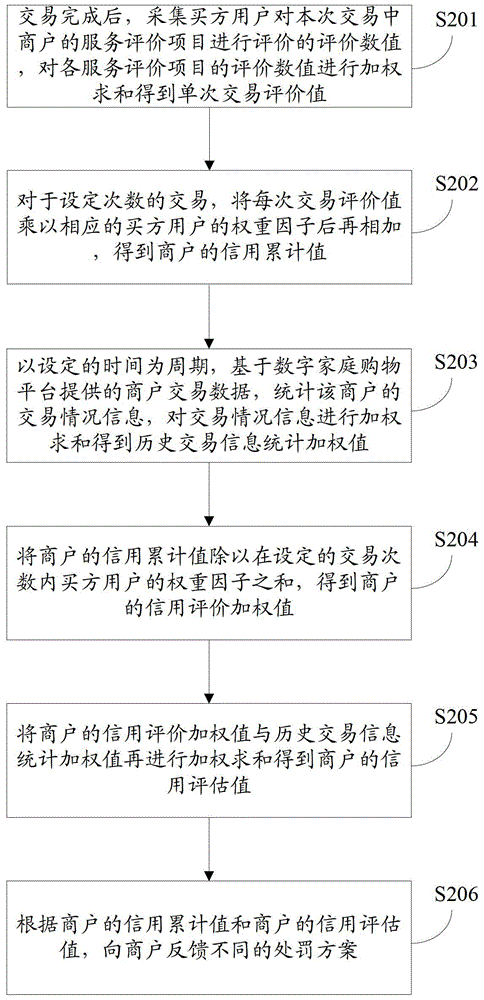

[0066] In the second embodiment of the present invention, a digital home shopping merchant credit evaluation method, such as figure 2 shown, including the following specific steps:

[0067] Step S201, after the transaction is completed, collect the evaluation value of the buyer user on the service evaluation items of the merchant in this transaction, and perform weighted summation of the evaluation values of each service evaluation item to obtain a single transaction evaluation value;

[0068] Step S202, for the set number of transactions, multiply the evaluation value of each transaction by the weight factor of the corresponding buyer user and add them together to obtain the accumulated credit value of the merchant.

[0069] Specifically, the weighting factors of the buyer user corresponding to each transaction include: the buyer's transaction amount weight and the buyer's transaction times weight. The buyer's transaction amount weight is set according to the transaction ...

no. 3 example

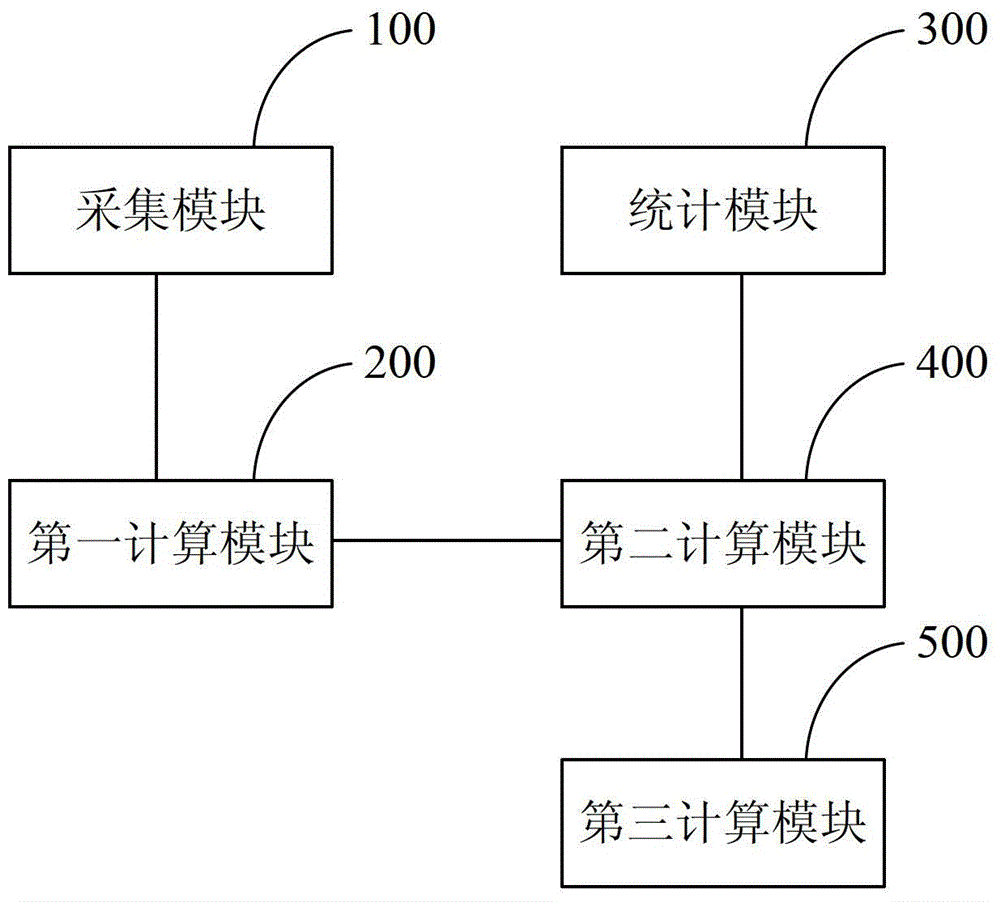

[0075] In the third embodiment of the present invention, a digital home shopping merchant credit evaluation device corresponds to the method in the first embodiment, as image 3 As shown, the device includes the following components:

[0076] The collection module 100 is used to collect the evaluation value of the buyer user's evaluation of the service evaluation items of the merchant in this transaction after the transaction is completed, and perform weighted summation of the evaluation values of each service evaluation item to obtain a single transaction evaluation value;

[0077] The first calculation module 200 is configured to add up the evaluation value of each transaction for the set number of transactions to obtain the accumulated credit value of the merchant.

[0078] Preferably, this embodiment may correspond to the method in the second embodiment. In the case of introducing the buyer user weight factor, the first calculation module is used to: for the set number o...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com