Electronic signature realization method and system for electronic invoice

A technology of electronic invoices and electronic signatures, which is applied in the electronic signature realization method and system field of electronic invoices, can solve problems such as tax loss, deceiving consumers, after-sales service for consumers, and difficulty in rights protection, so as to ensure authenticity and guarantee Authoritativeness and authenticity, the effect of guaranteeing non-repudiation

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

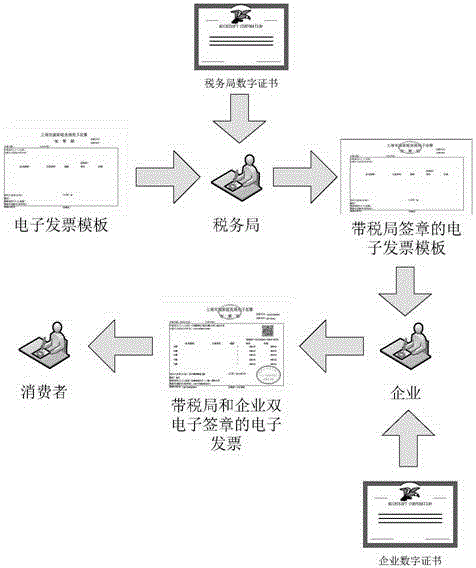

[0095] see Figure 4 , Embodiment 1 of the present invention provides a method for realizing an electronic signature of an electronic invoice, which includes the following steps:

[0096] First of all, the tax bureau needs to make invoice templates suitable for different purposes, and use its own digital certificate and electronic seal to generate an electronic signature of the tax bureau on the invoice template, indicating that the invoice template is certified by the tax bureau; then the enterprise purchases it from the tax bureau The corresponding and certified electronic invoice template, when a consumer purchases the product, fills in the corresponding product information into the invoice template to generate an electronic invoice; finally, the enterprise needs to use its own digital certificate and electronic seal to generate the enterprise's electronic invoice on the electronic invoice. Signature, so that the entire electronic invoice double-signature business process i...

Embodiment 2

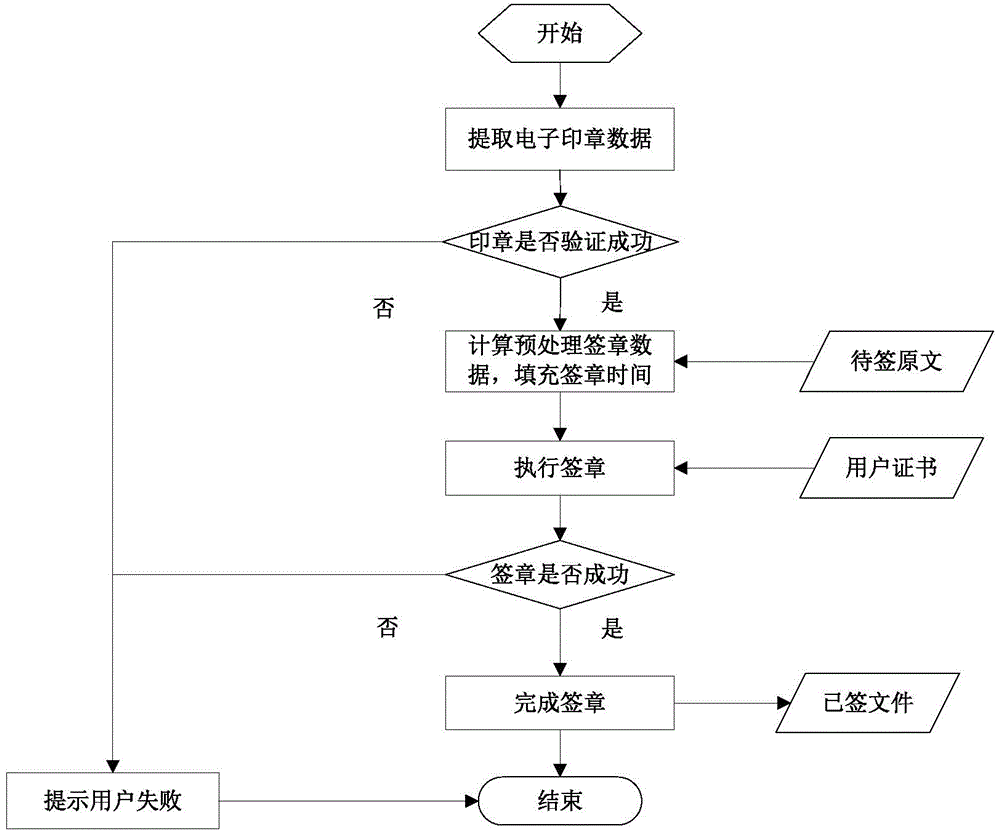

[0099] see Figure 5 , Embodiment 2 of the present invention provides a method for realizing an electronic signature of an electronic invoice, which includes the following steps:

[0100] Step S110, the step of tax bureau signature: generating the tax bureau electronic signature of the tax bureau on the template of the electronic invoice.

[0101] The tax bureau's electronic signature is generated by the tax bureau's electronic seal, specifically, it is encrypted by using an asymmetric encryption algorithm. The asymmetric encryption algorithm has a public key + a private key. The tax bureau uses the private key in the electronic seal (stored in the electronic seal in the form of a certificate) to calculate the summary information based on the template data, and encrypts the summary information to generate the tax bureau electronic certificate. Sign and seal, and insert the generated electronic signature of the tax bureau into the electronic invoice template to form an electro...

Embodiment 3

[0112] see Figure 6 , Embodiment 3 of the present invention provides a method for implementing dual electronic signatures for electronic invoices, which includes the following steps.

[0113] (1) Call the tax bureau's electronic signature service to electronically sign the electronic invoice template to be signed.

[0114] (2) Determine whether the electronic signature is successful, if the signature is successful, obtain the invoice module with the electronic signature of the tax bureau, and continue to execute (3); if the signature fails, skip to (6).

[0115] (3) Insert data into the invoice template with the electronic signature of the tax bureau to generate an invoice, thereby obtaining an invoice with the electronic signature of the tax bureau.

[0116] (4) Invoke the enterprise electronic signature service to perform enterprise electronic signature.

[0117] (5) After the electronic signature of the enterprise is judged whether the signature is successful, if success...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com