Method used for constructing and verifying credit scoring equation and system design

A technology for credit scoring and system design, applied in computing, data processing applications, special data processing applications, etc.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

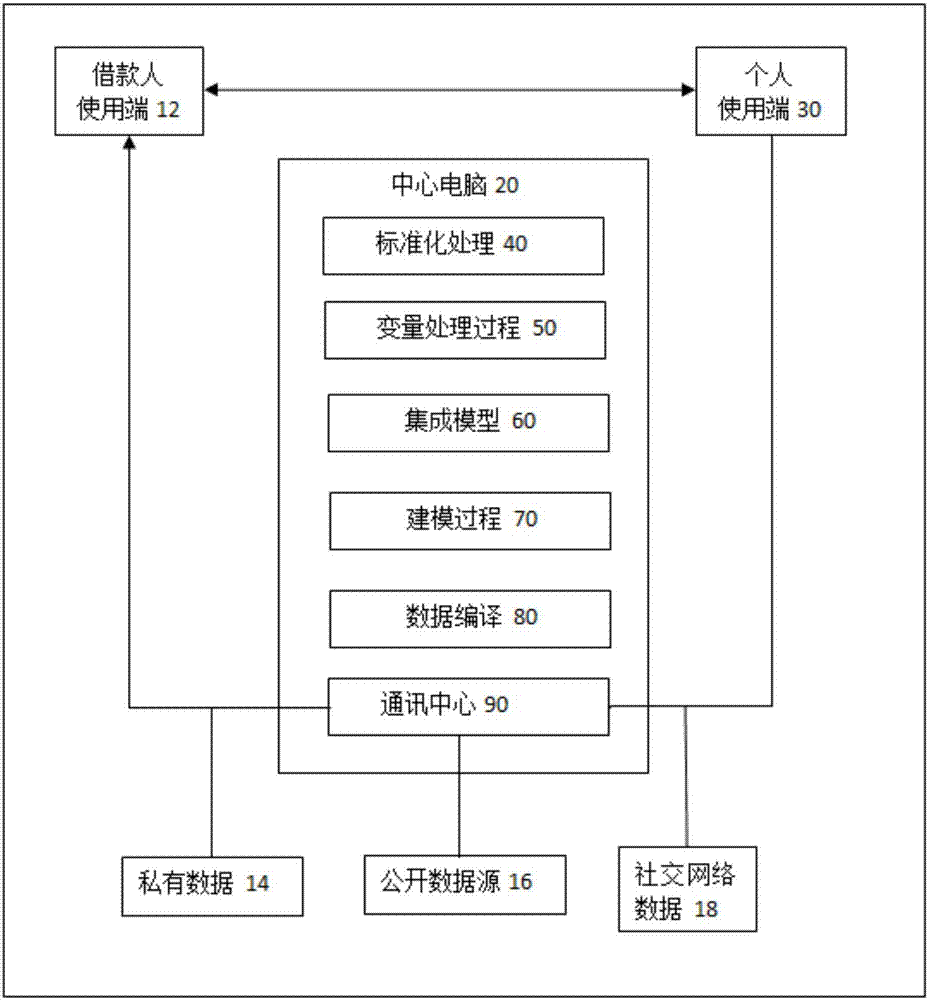

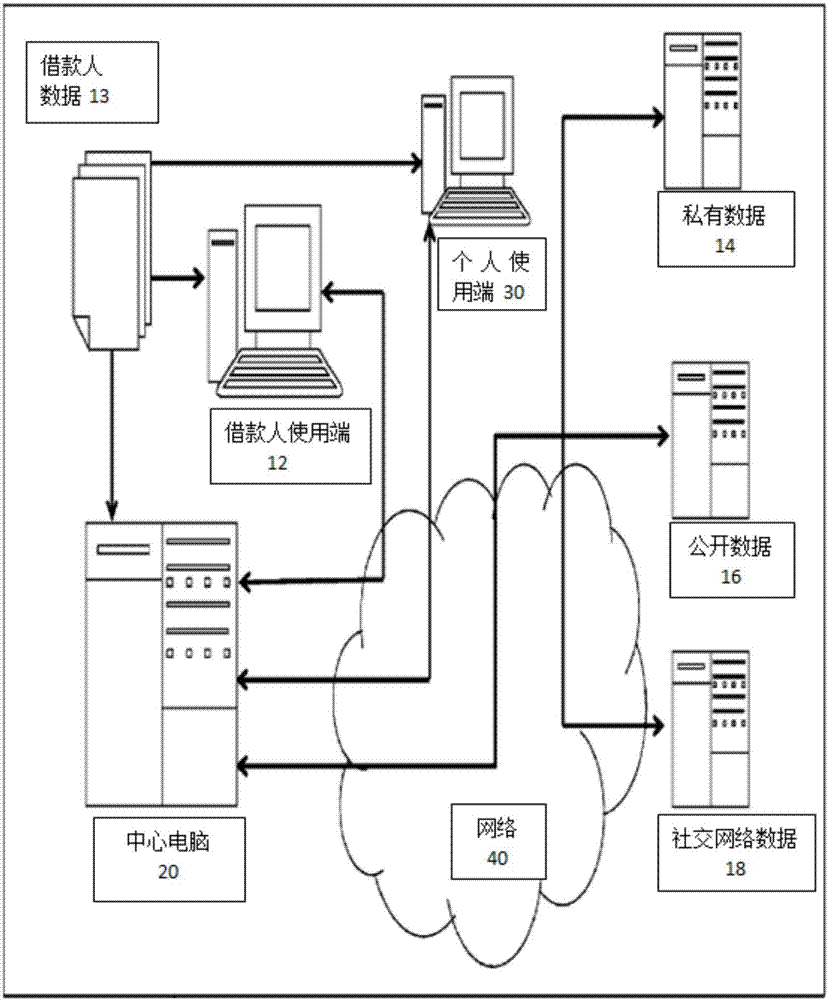

[0047] A method and system design for constructing and verifying a credit scoring equation, a central computer server connected to a public network, the central computer server having a computer usable medium based on a series of instructions executed by a processor causing the processor to perform an evaluation of a borrower The electronic process of credit risk includes the following processes:

[0048] 1) Search and collect data sets of borrowers from at least one of the following data sources via public networks: borrowers, private data, public data, or social network data sources;

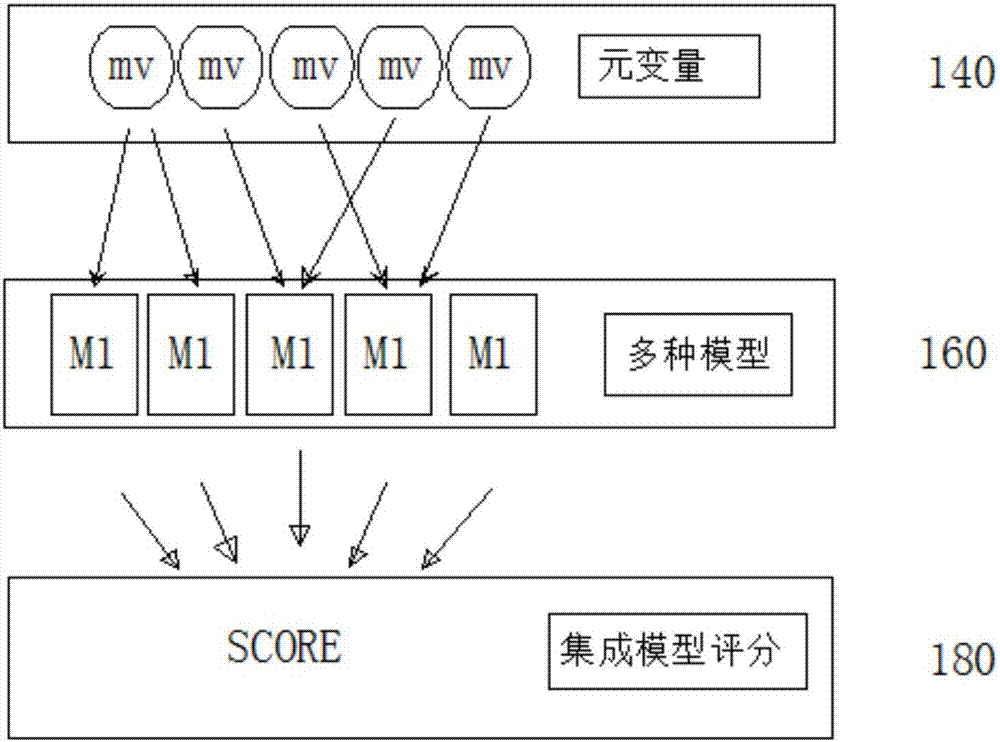

[0049] 2) Transform the data set into some variables related to the borrower's credit risk;

[0050] 3) Treat each variable independently using statistical or machine learning methods to generate meta-variables that describe specific aspects of the borrower;

[0051] 4) Calculate the target credit risk score based on multiple variables and meta-variables of the borrower.

[0052] Collecting ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com