Loaner credit rating method and system based on machine learning

A machine learning and credit scoring technology, applied in the field of computer applications, can solve the problems of long formulation and modification cycles, slow data change speed, insufficient comprehensiveness and convenience, etc.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0049] The present invention will be further explained and described below in conjunction with the accompanying drawings and specific embodiments of the description.

[0050] Aiming at the problems that the existing credit rating method cannot reflect the situation of new users under the new situation, the period of formulation and modification is generally long, the speed of data change is slow, and it is not comprehensive and convenient enough, the present invention proposes a brand-new credit rating method for loan users And the system, credit scoring through machine self-learning, can quickly iterate and quickly adapt to the development needs of the new situation.

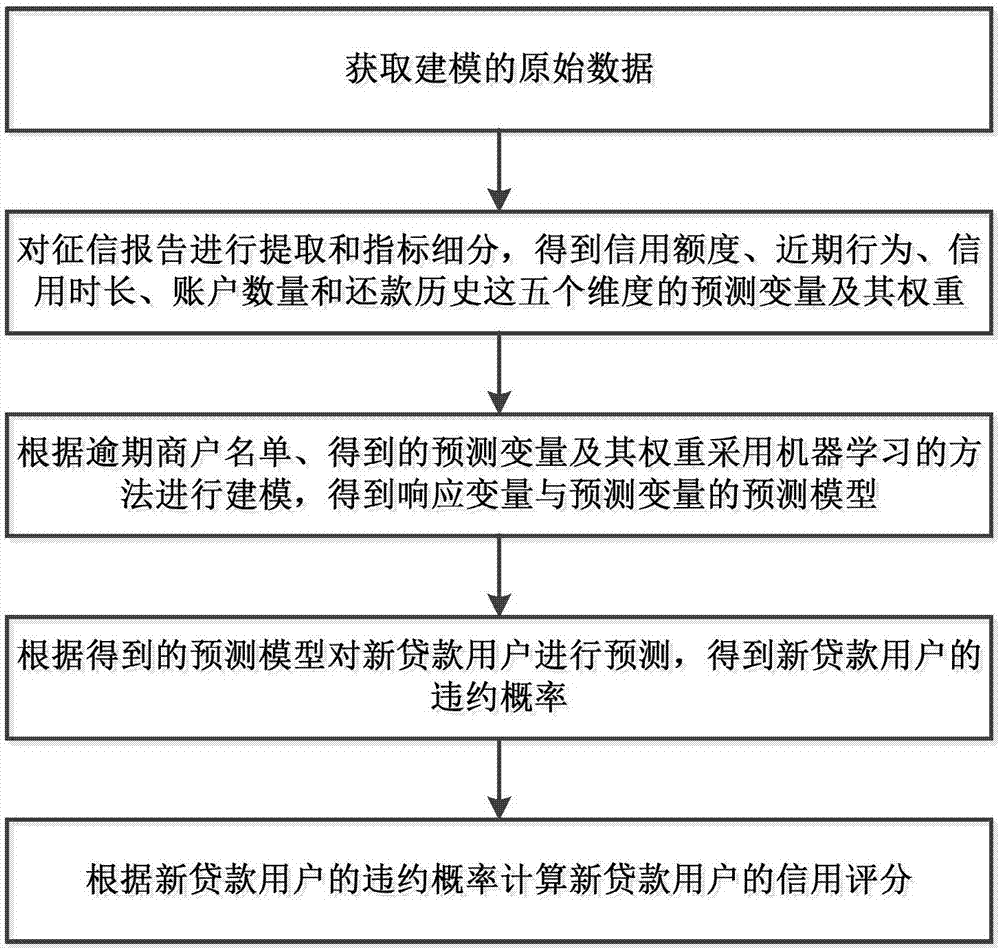

[0051] Such as figure 1 As shown, the loan user credit rating method mainly includes:

[0052] (1) Obtaining the original data for modeling

[0053] The original data of modeling in the present invention includes two parts, the first part is the credit investigation report of the People's Bank of China (includi...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com