Construction enterprise credit evaluation method and system based on big data technology

A big data technology and construction technology, applied in the field of credit evaluation of construction enterprises based on big data technology, can solve the problems of qualitative and quantitative relationship and proportion difficult to determine, credit rating deviation, not taking into account characteristics, etc., to achieve saving The effect of labor cost and time cost, rapid generation, and improvement of evaluation accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

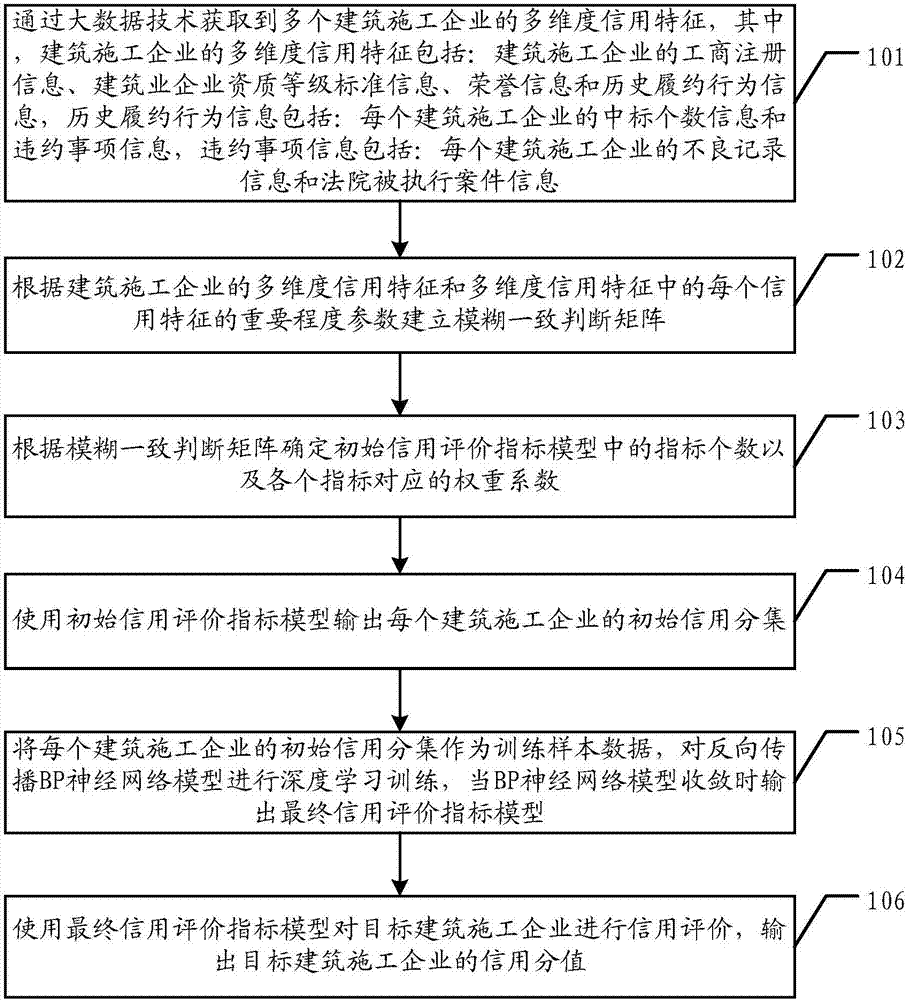

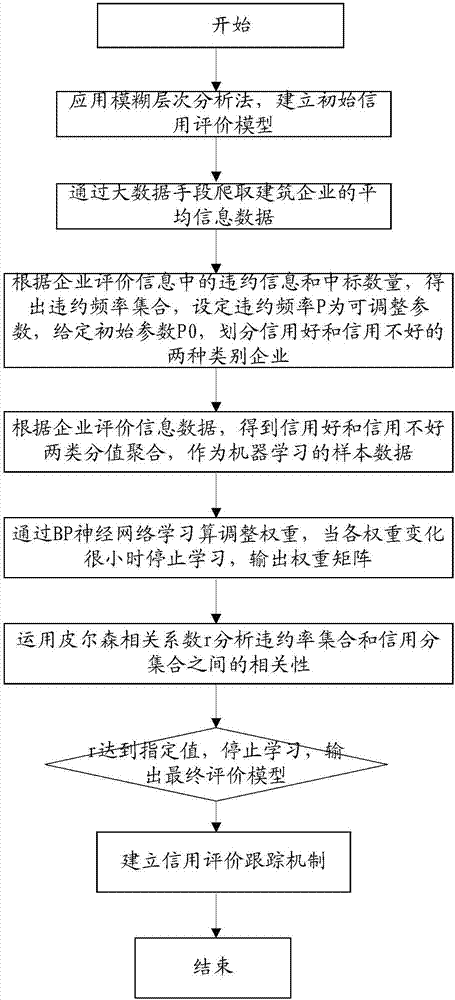

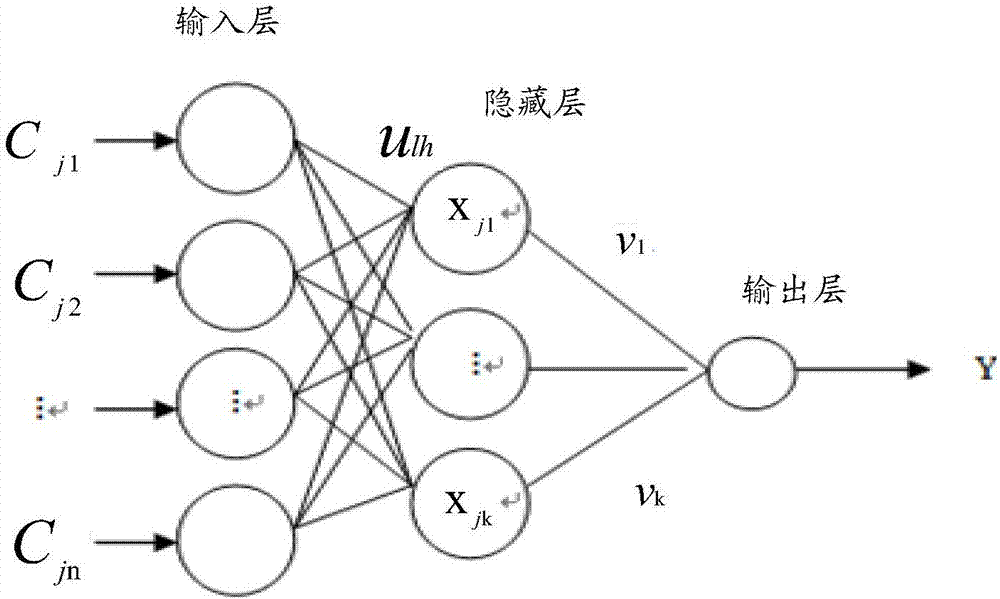

[0027] The embodiment of the present invention provides a credit evaluation method and system for construction enterprises based on big data technology, provides an enterprise credit evaluation mechanism suitable for the construction industry, and realizes credit evaluation for construction enterprises.

[0028] In order to make the purpose, features and advantages of the present invention more obvious and understandable, the technical solutions in the embodiments of the present invention will be clearly and completely described below in conjunction with the accompanying drawings in the embodiments of the present invention. Obviously, the following The described embodiments are only some, not all, embodiments of the present invention. All other embodiments obtained by those skilled in the art based on the embodiments of the present invention belong to the protection scope of the present invention.

[0029] The terms "first", "second" and the like in the description and claims ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com