A risk conduction evaluation system and method for public credit customer risk early warning

An evaluation system and customer technology, applied in the field of risk transmission evaluation system, can solve the problems of poor interpretability of model results, few models for quantitative analysis, and adjustment, etc., to avoid subjectivity, good effect, and stable model.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

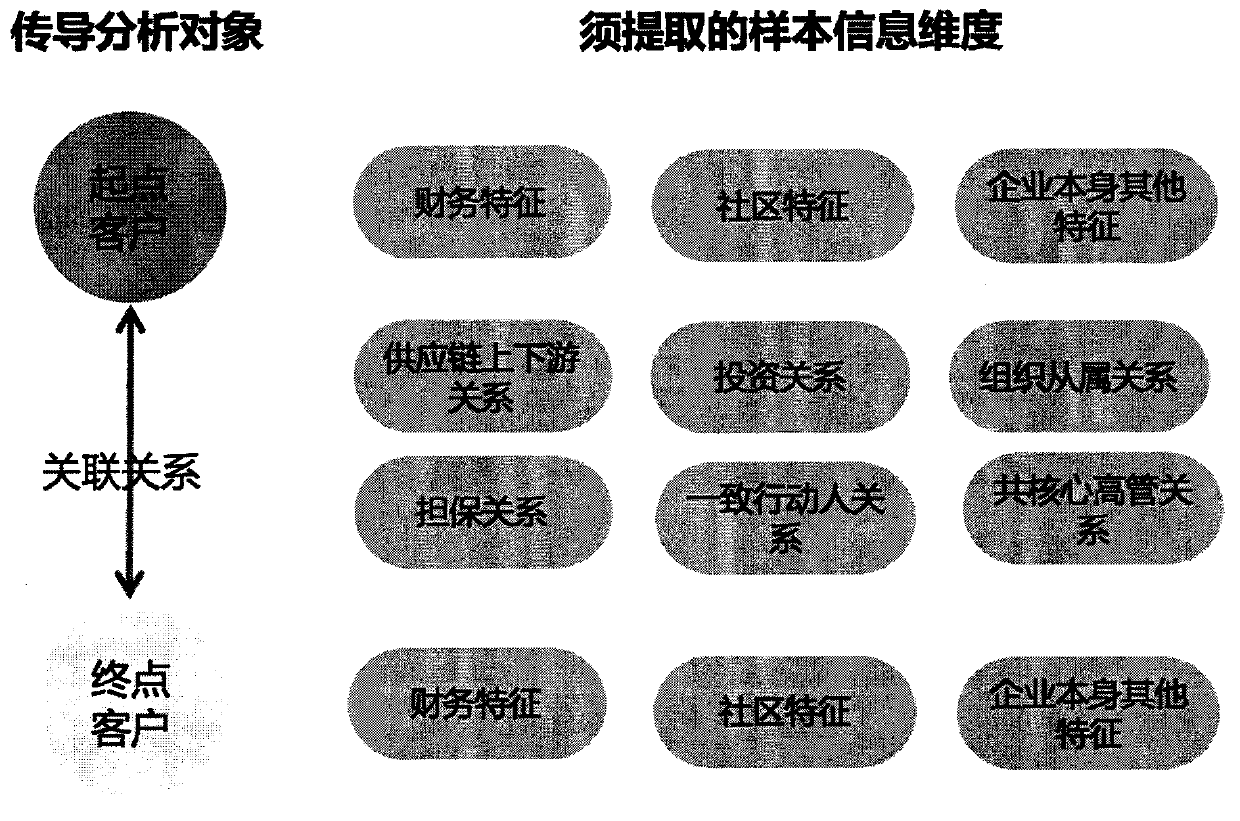

[0062] Such as figure 1 As shown, the risk conduction assessment system and method for risk early warning of public credit customers of the present invention include the following systems and steps:

[0063] (1) Risk transmission unit

[0064] 1. The composition of the risk transmission unit

[0065] Assuming that companies (or "customers", the same below) have various related relationships, including guarantee relationships, investment relationships, actual control relationships and group affiliation relationships, etc. constitute a graph, and the present invention constructs a risk transmission process between customers The model is a supervised machine learning problem, and the modeling unit is a pair of customers. The risk of each risk transmission customer pair's starting point customer and end point customer's risk occurs successively as the label for the training and prediction of the supervised machine learning model , the characteristics of the starting point custom...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com