Credit risk monitoring method, device and equipment and storage medium

A risk monitoring and credit technology, applied in the field of financial technology, can solve the problems of insufficient accuracy and inability to comprehensively judge the borrower's credit risk, and achieve the effect of improving accuracy and comprehensiveness

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0046] It should be understood that the specific embodiments described here are only used to explain the present invention, not to limit the present invention.

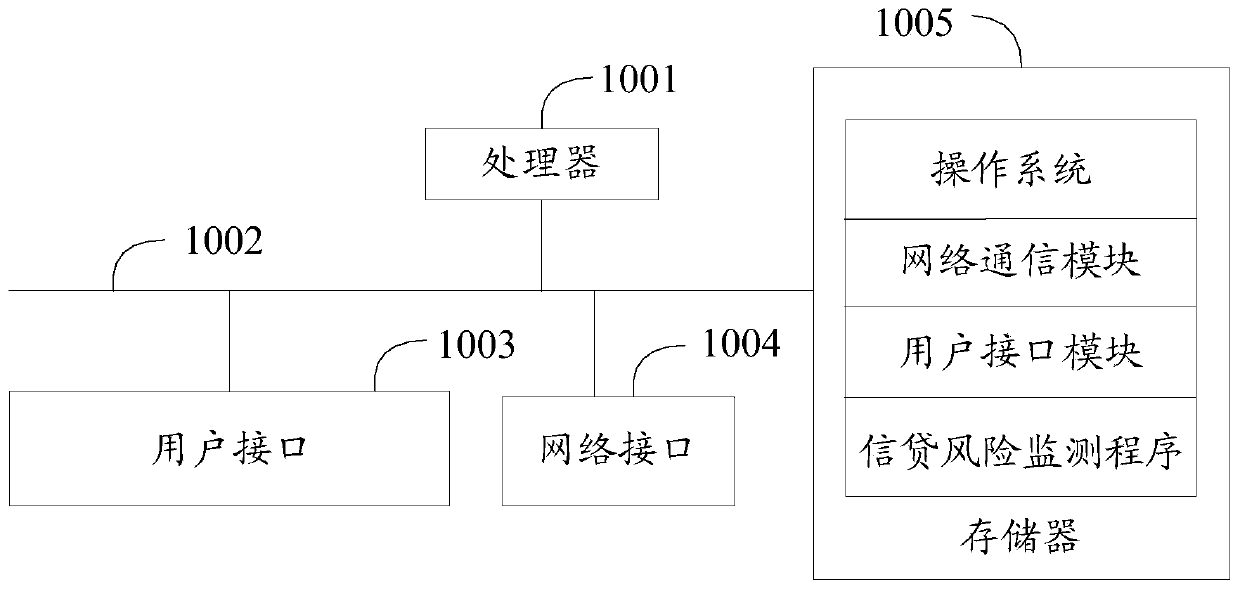

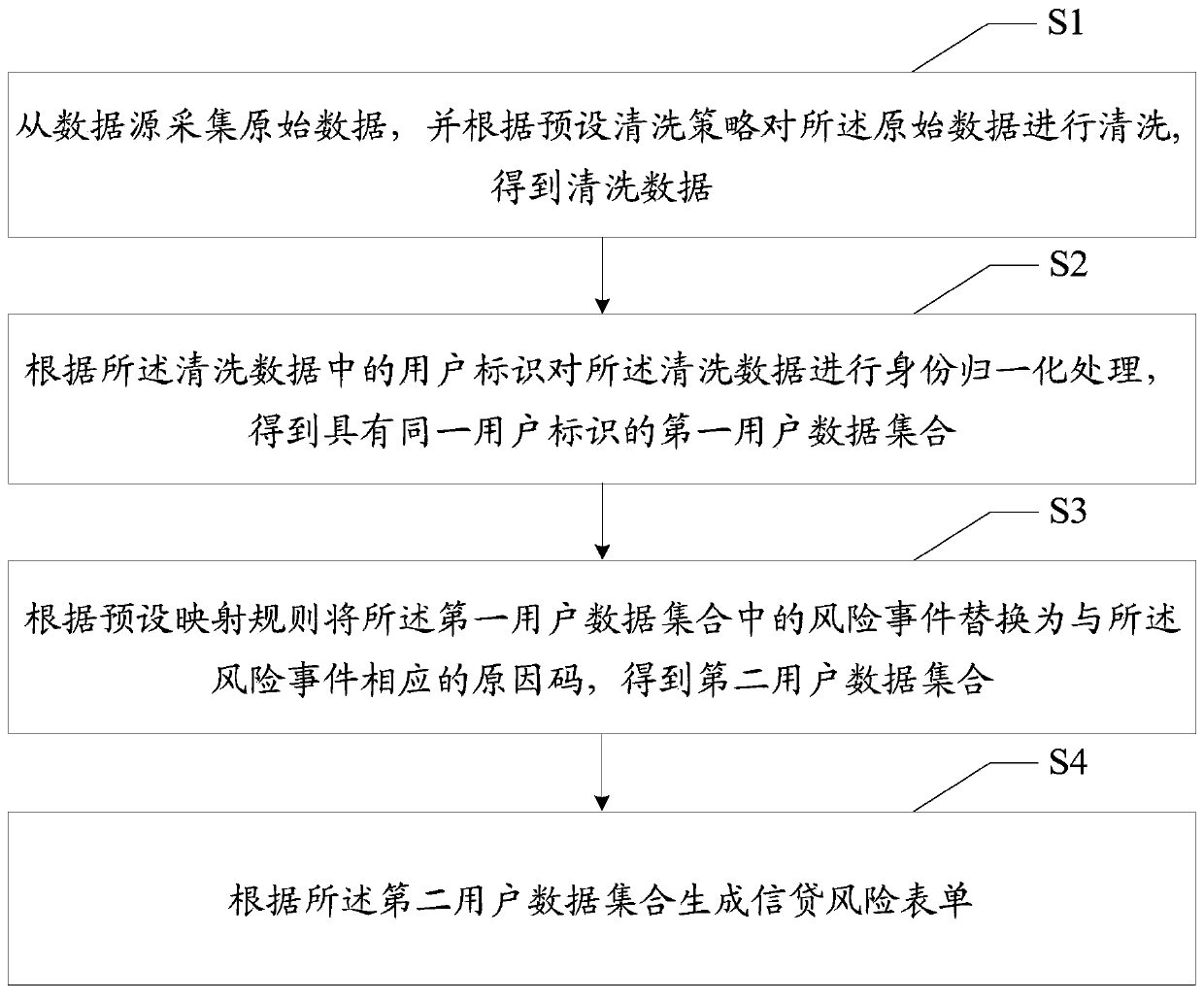

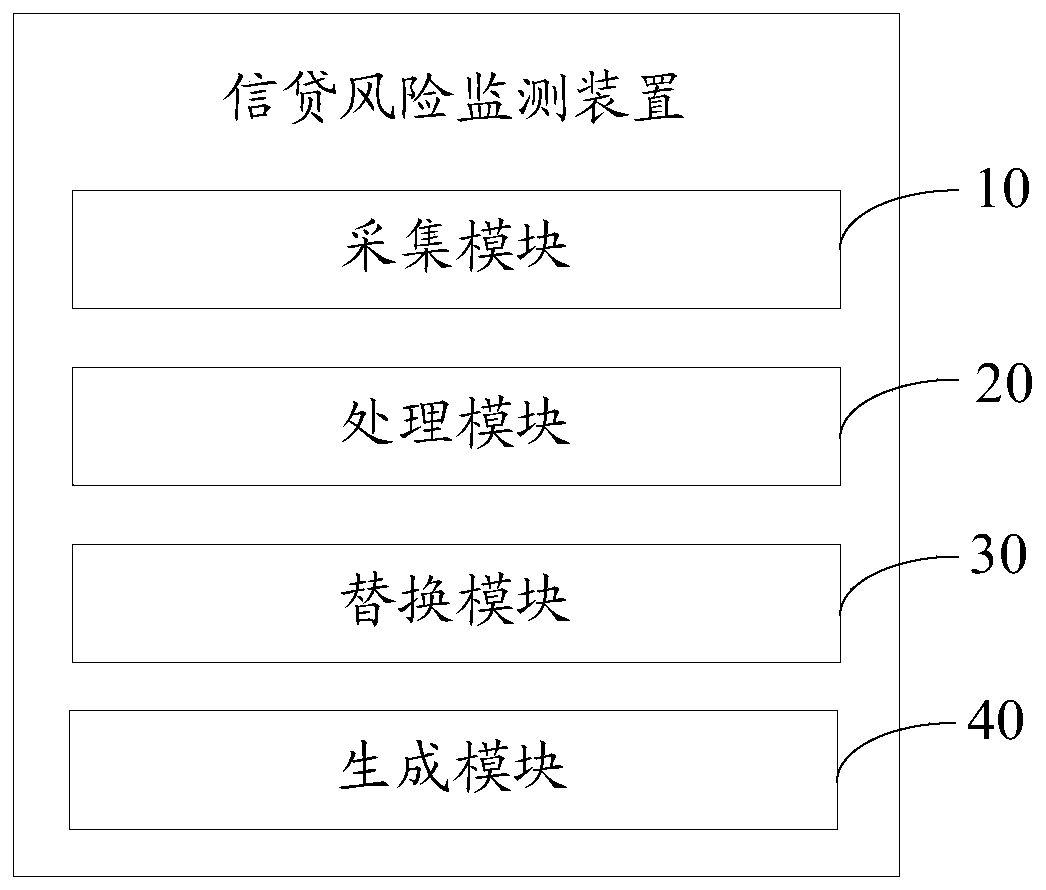

[0047] The main solution of the embodiment of the present invention is to collect the original data from the data source, and clean the original data according to the preset cleaning strategy to obtain the cleaned data; identify the cleaned data according to the user identification in the cleaned data Normalize to obtain the first user data set with the same user ID; replace the risk event in the first user data set with the reason code corresponding to the risk event according to the preset mapping rules to obtain the second user A data set; generating a credit risk form according to the second user data set. Through the above-mentioned method, the present invention performs data cleaning, identity normalization, and event cause coding on the original data, thereby providing accurate, orderly, and integrated data col...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com