Option volatility automatic fitting method and system

An automatic fitting and volatility technology, which is applied in the fields of instruments, finance, and data processing applications, can solve problems such as reduction and option value reduction, and achieve the effect of liberating manual operations, low use threshold, and simple and clear parameters

- Summary

- Abstract

- Description

- Claims

- Application Information

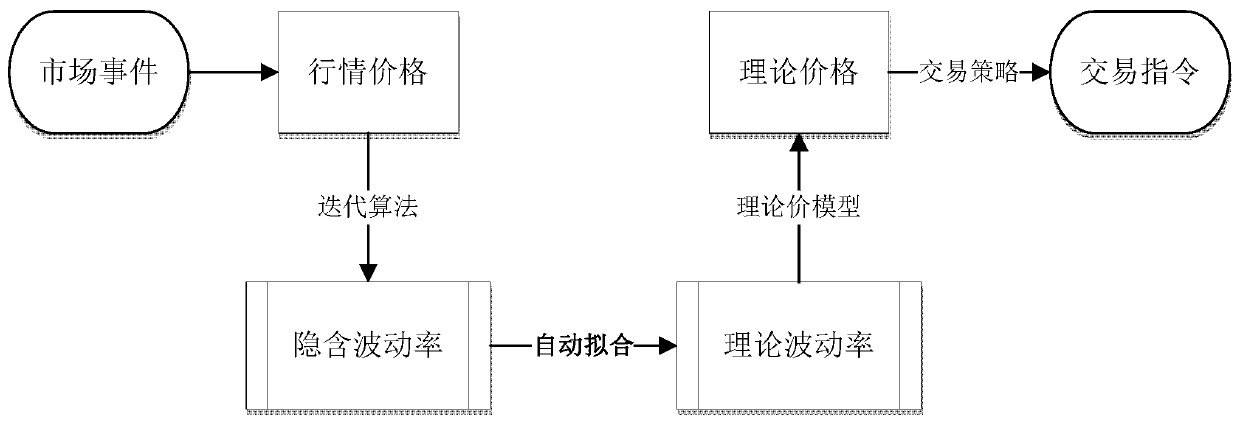

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0061] The present invention will be described in detail below in conjunction with the accompanying drawings and specific embodiments. Note that the aspects described below in conjunction with the drawings and specific embodiments are only exemplary, and should not be construed as limiting the protection scope of the present invention.

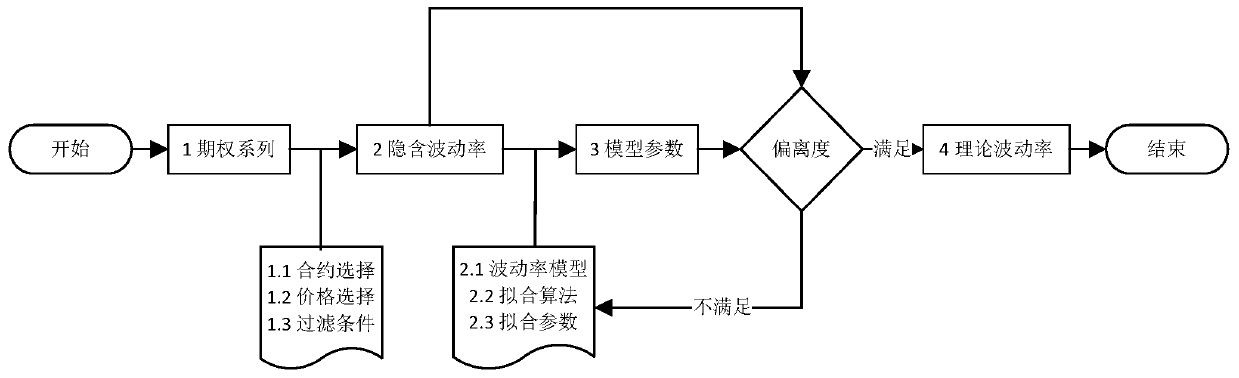

[0062] Figure 2A and 2B Together, it shows the flow of an embodiment of the automatic fitting method of option volatility of the present invention. See also Figure 2A and 2B , the implementation steps of the automatic fitting method in this embodiment are described in detail as follows.

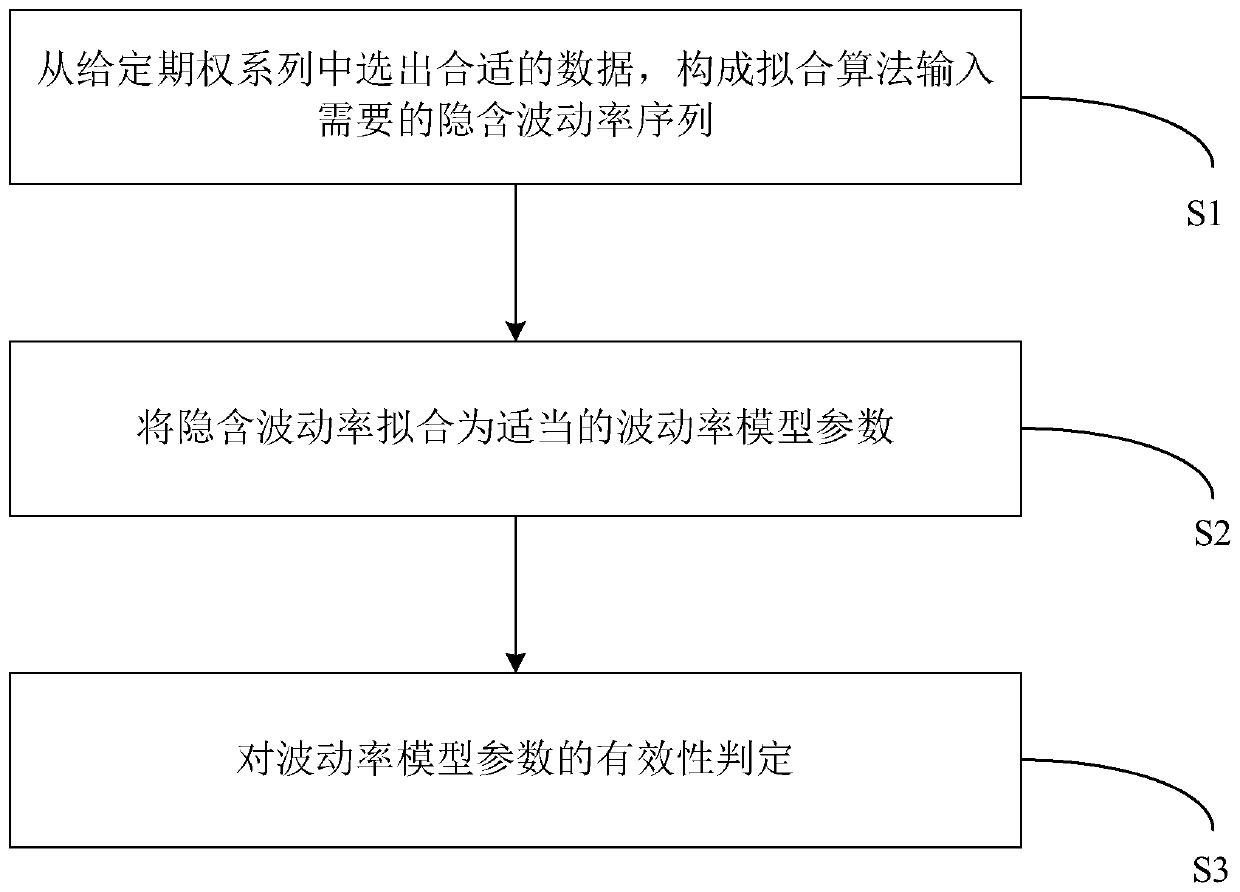

[0063] Step S1: Select appropriate data from the given option series to form the implied volatility series required for the input of the fitting algorithm.

[0064] Firstly, choose the contract. An option series will be divided into two types: call option (CALL) and put option (PUT) according to the different expectations of the price change direction ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com