Listed company suspected financial risk discrimination method and device

A discrimination method and financial technology, applied in the field of data processing, can solve the problems of not undertaking the obligation and responsibility to identify financial risks, joint damage to shareholders of listed companies, and bad debt losses of enterprises, so as to protect investors and economic interests from Loss, low cost effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0032] The present invention will be further described in detail below in conjunction with the accompanying drawings, so that those skilled in the art can implement it with reference to the description.

[0033] It should be understood that terms such as "having", "comprising" and "including" used herein do not exclude the presence or addition of one or more other elements or combinations thereof.

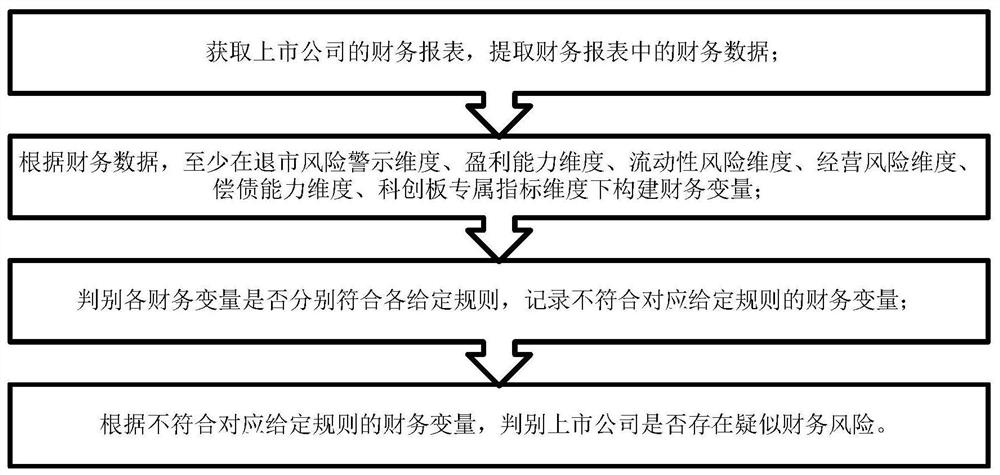

[0034] In a technical solution, such as figure 1 As shown, the methods for identifying suspected financial risks of listed companies include:

[0035] Methods for identifying suspected financial risks of listed companies, including:

[0036] Obtain the financial statements of listed companies and extract the financial data in the financial statements;

[0037] According to the financial data, construct financial variables at least in the dimensions of delisting risk warning, profitability, liquidity risk, business risk, solvency, and exclusive indicators for the Science and Techn...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com