Stock market valuation method based on grey prediction algorithm and multiple regression analysis model

A technology of multiple regression analysis and gray forecasting, applied in forecasting, calculation, instruments, etc., can solve problems such as difficulty in accurate judgment and large uncertainty, and achieve the effect of increasing applicability and flexibility and solving stock market valuation problems

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

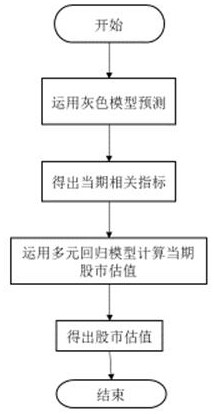

[0035] The technical solution of the present invention will be further described in detail below in conjunction with the accompanying drawings.

[0036] This embodiment proposes a stock market valuation method based on gray prediction algorithm and multiple regression analysis model, including the following steps:

[0037] Through the analysis of fundamentals such as annual operating income, annual net profit attributable to the parent company, and annual return on net assets, as well as liquidity indicators such as annual single stock trading volume, annual single stock transaction amount, and annual average turnover rate of single stocks, etc. The first-order accumulation of data forms the data sequence of these valuation indicators.

[0038] S1: Set the time series of stock market indicators such as fundamental indicators and liquidity indicators X (0) There are n observations

[0039] x (0) ={X (0) (1),X (0) (2),...,X (0) (n)}.

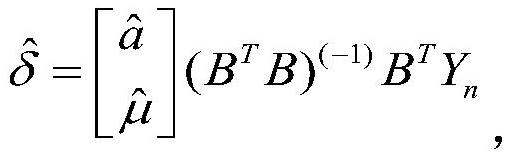

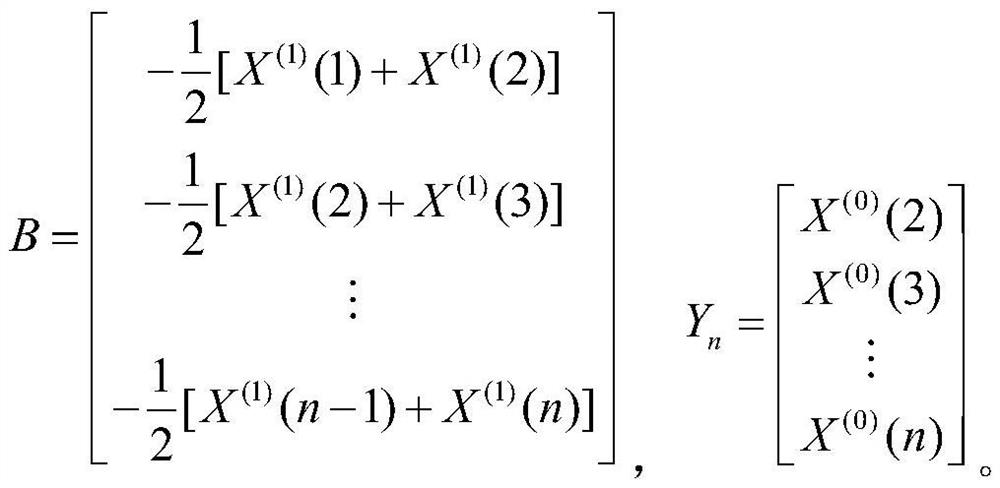

[0040] S2: Generate a new sequence X...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com