Investor preference-based investment product combination recommendation method and system

A product combination and recommendation method technology, applied in data processing applications, finance, instruments, etc., can solve the problems of inability to accurately know the transaction status, increase the error rate of the investment product portfolio transaction plan, and not apply to specific scenarios of matching transactions. The effect of ensuring the authenticity of information

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

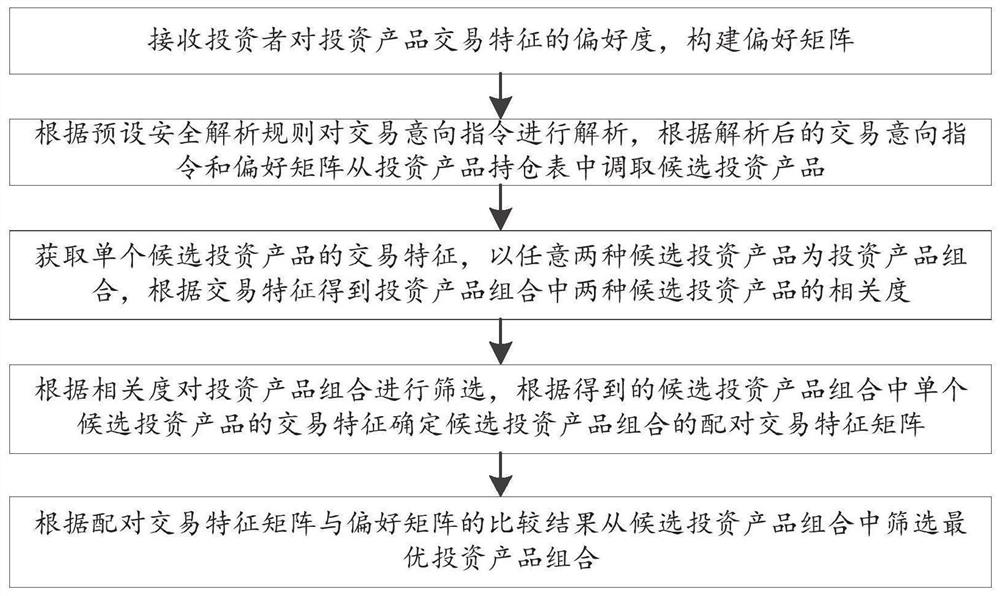

[0039] Such as figure 1 As shown, this embodiment provides a method for recommending investment product portfolios based on investor preferences, including:

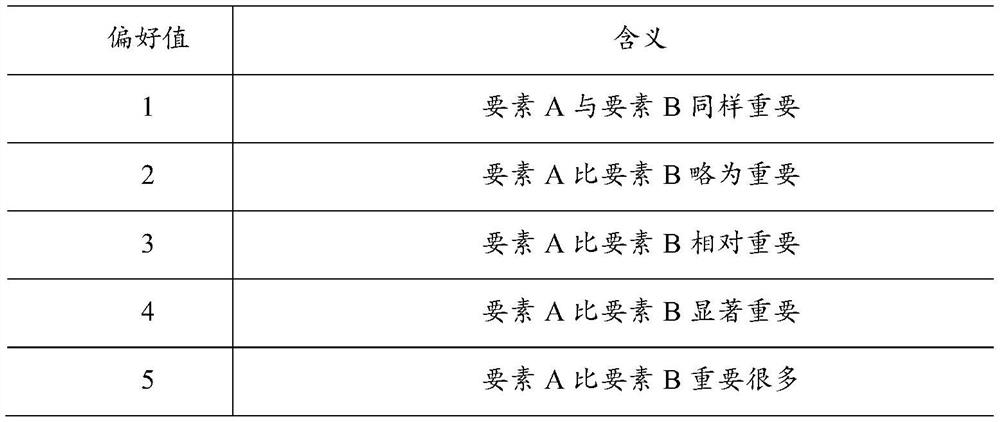

[0040] S1: Receive investors' preferences for investment product transaction characteristics, and construct a preference matrix;

[0041] S2: Analyze the transaction intention instruction according to the preset security analysis rules, and retrieve candidate investment products from the investment product position table according to the analyzed transaction intention instruction and preference matrix;

[0042] S3: Obtain the transaction characteristics of a single candidate investment product, take any two candidate investment products as the investment product portfolio, and obtain the correlation between the two candidate investment products in the investment product portfolio according to the transaction characteristics;

[0043] S4: Screen the investment product portfolio according to the correlation, and determine...

Embodiment 2

[0085] This embodiment provides a device for recommending investment product portfolios based on investor preferences, including:

[0086] The preference matrix construction module is configured to receive the investor's preference for investment product transaction characteristics, and construct a preference matrix;

[0087] The calling module is configured to analyze the transaction intention instruction according to the preset security analysis rules, and retrieve candidate investment products from the investment product position table according to the analyzed transaction intention instruction and preference matrix;

[0088] The correlation calculation module is configured to obtain the transaction characteristics of a single candidate investment product, take any two candidate investment products as the investment product portfolio, and obtain the correlation degree of the two candidate investment products in the investment product portfolio according to the transaction ch...

Embodiment 3

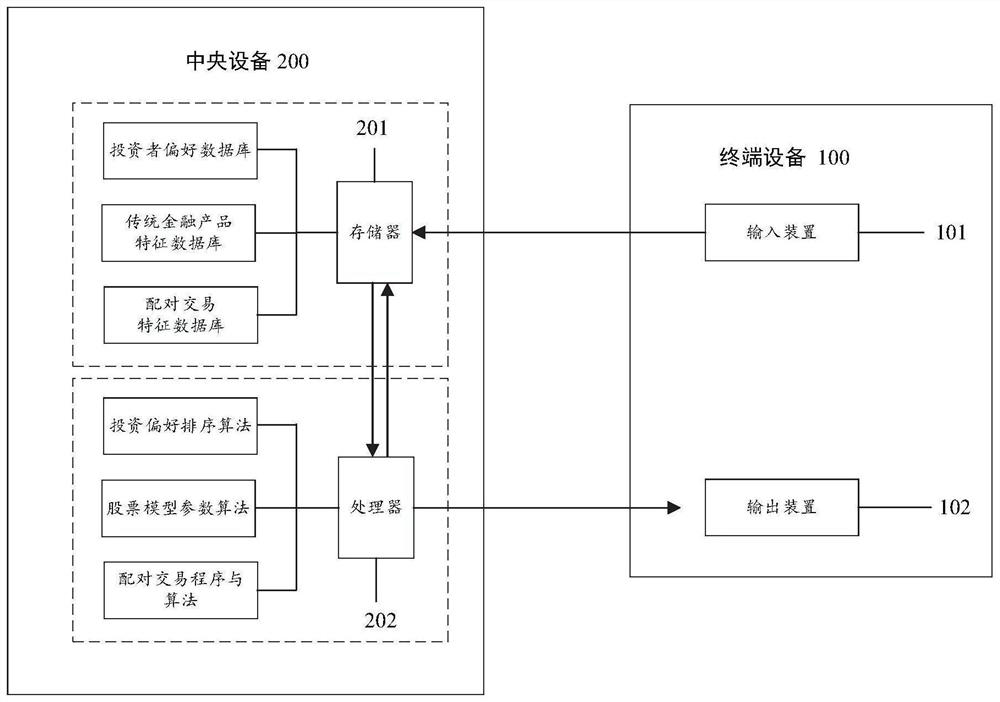

[0093] In this embodiment, an investment product combination recommendation system based on investor preference is provided, including: a server and a terminal; the server is used to receive the investor's preference degree and transaction intention instruction for investment product transaction characteristics sent by the terminal, And use the method described in the first aspect to obtain the optimal investment product portfolio, and push the optimal investment product portfolio to the terminal.

[0094]The investment product portfolio recommendation method based on investor preference provided in this embodiment can be applied to such as figure 2 In the recommended system application environment shown, the server and the terminal communicate through the network to form an intelligent interactive system.

[0095] In this embodiment, the terminal device 100 can be, but not limited to, electronic devices such as personal computers, notebook computers, smart phones, tablet com...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com