Method and system for investment trading venue selection

a technology for investment trading and venue selection, applied in the field of management of investment trade orders, can solve the problems of low investment value, lack of resources for such elaborate trade order management systems, and inability to verify the performance of systems

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

Introduction

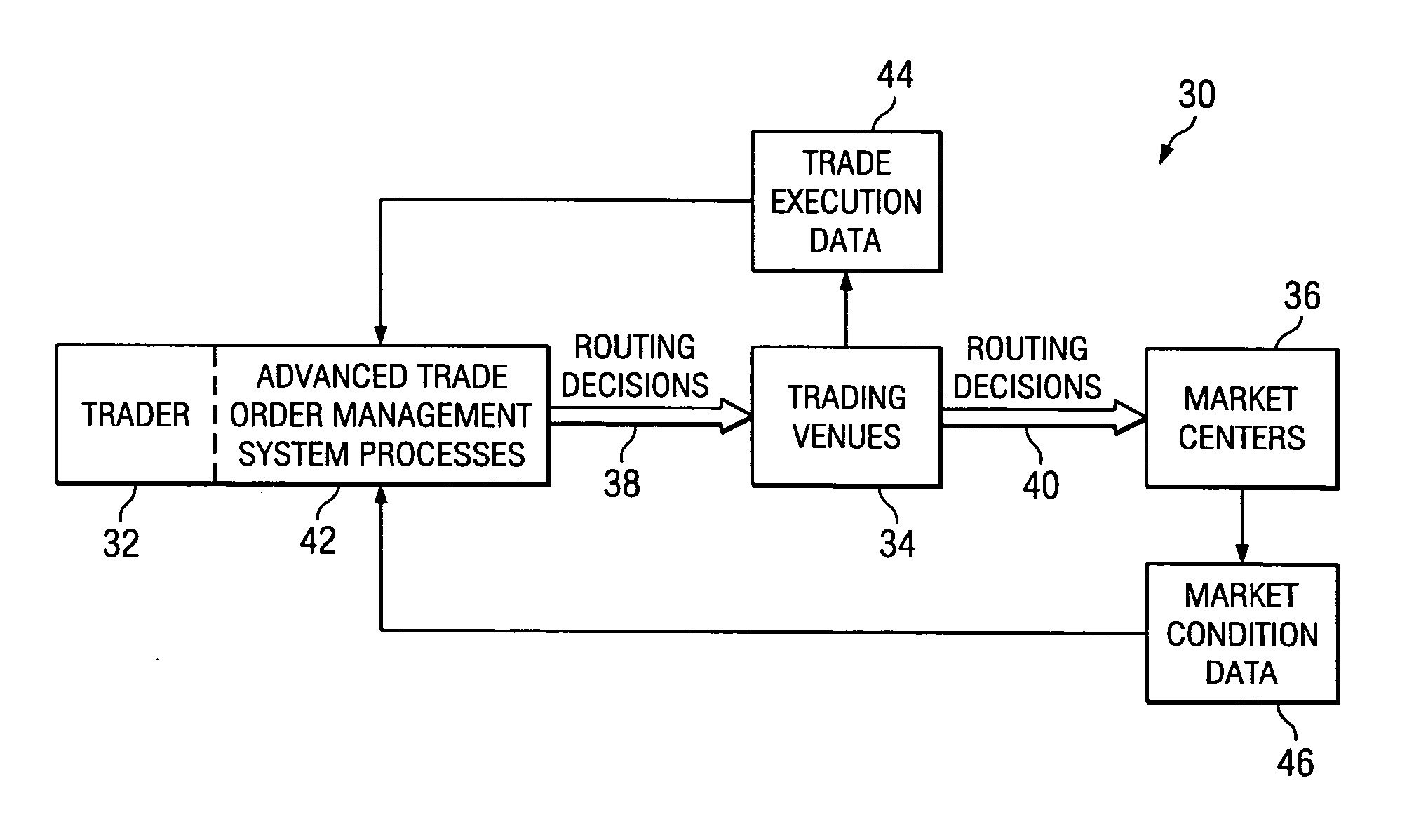

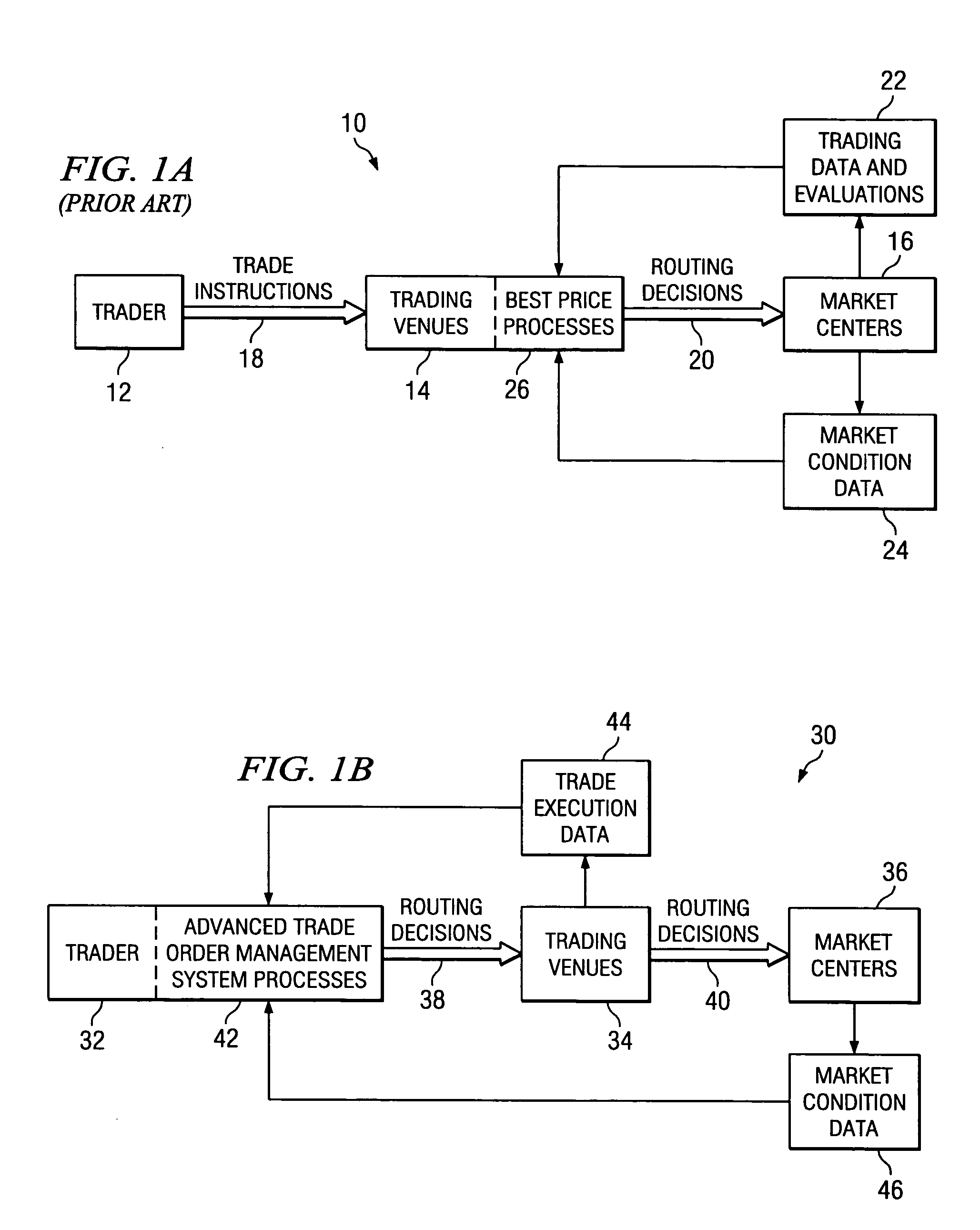

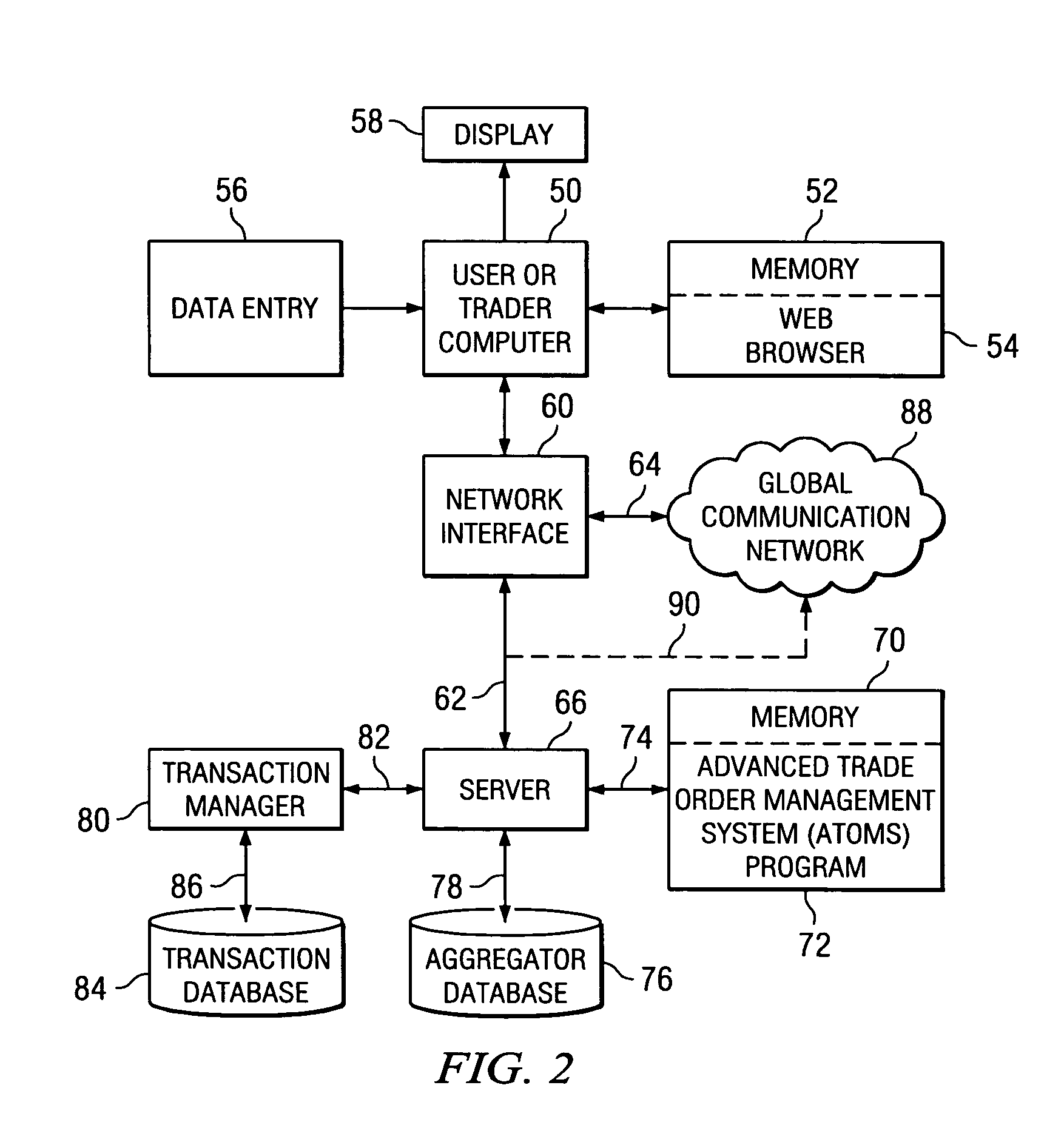

[0026] There is disclosed herein an Advanced Trade Order Management (ATOM) system to be made available as a software product for use with a computer to hedge fund managers and registered investment advisors. The software is particularly well suited for enabling the under serviced strata of hedge fund managers and investment advisors with less than $500 million under management to significantly improve their trading venue routing decisions. The system allows these investors to service their accounts more effectively by normalizing and automating transaction and allocation data. It is attractive to hedge fund and investment managers because it requires no information technology investment beyond a typical office computer and the ATOM system, and perhaps a network interface connection and web browser if the ATOM system is to be used on a network or on a global communication network such as the Internet. Furthermore, the ATOM system software product offers access to all ma...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com