System, method and computer program product for authorizing transactions using enhanced authorization data

a technology of enhanced authorization data and authorization data, applied in the field of fraud detection, can solve problems such as fraud, theft of information about the transaction instrument necessary to make purchases, and charge for numerous fraudulent purchases

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

example embodiment

IV. EXAMPLE EMBODIMENT

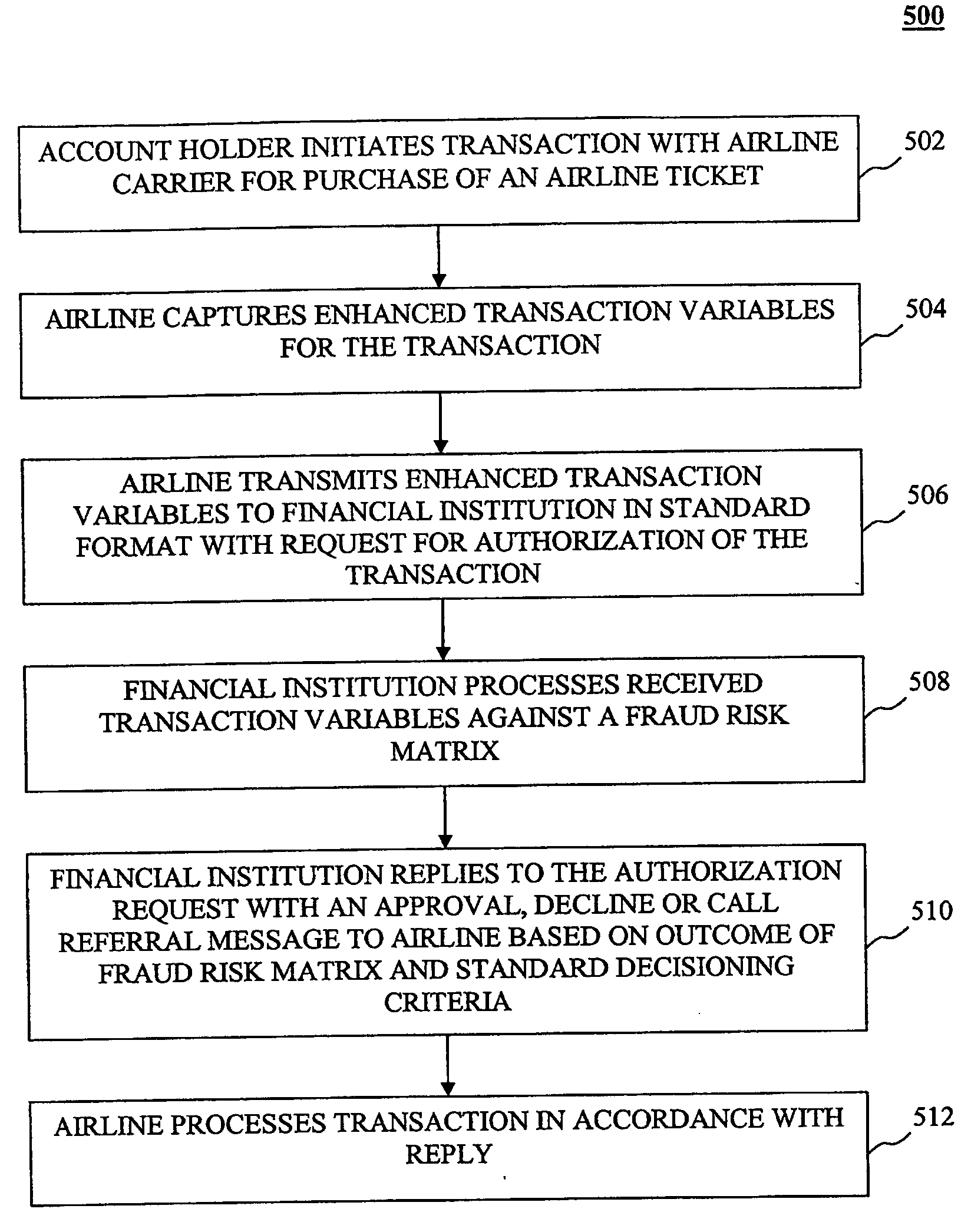

[0062] An example embodiment, according to the present invention, is provided below with reference to enhanced authorization data as it relates to merchants dealing with airline travel tickets.

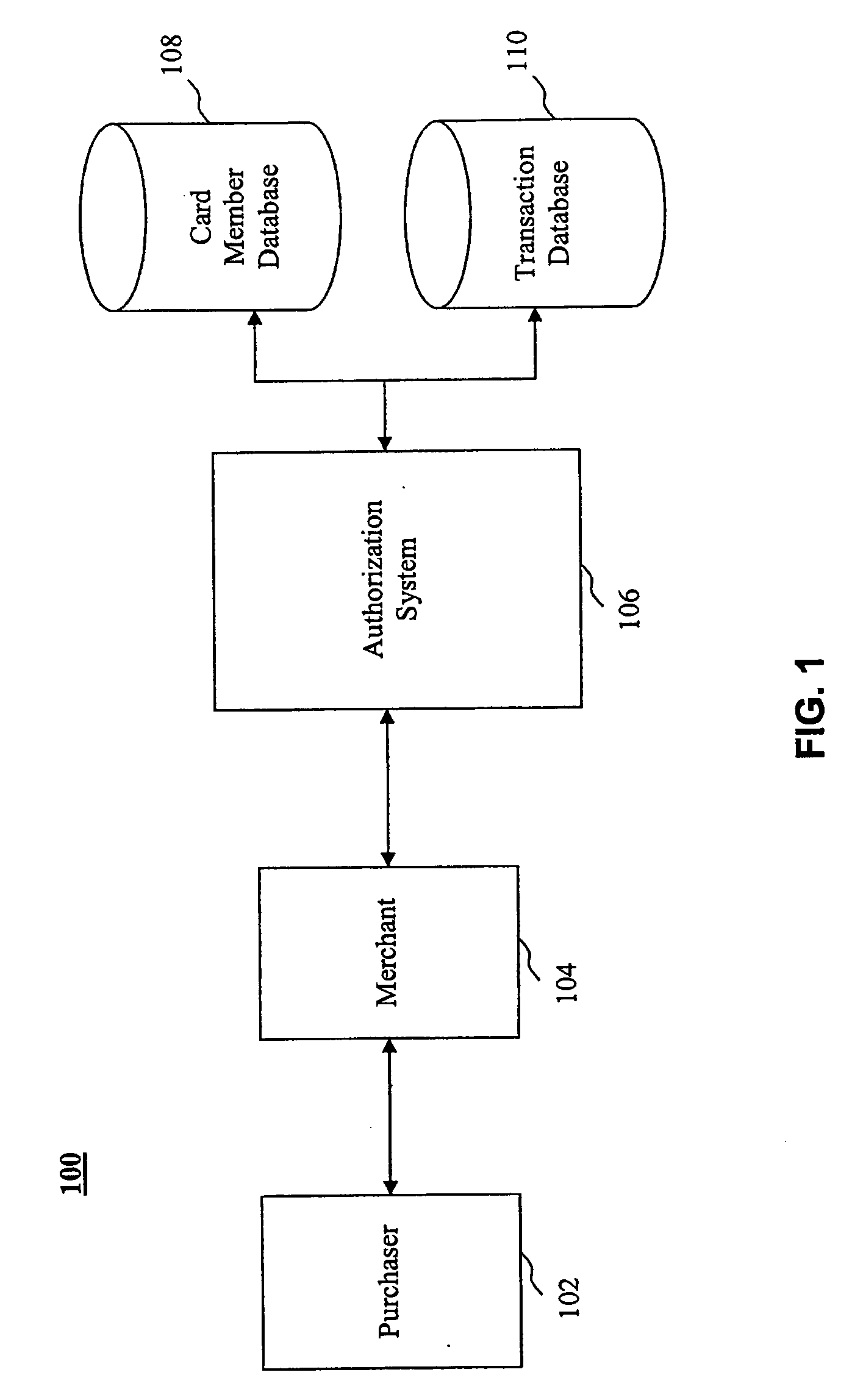

[0063] Financial institutions currently have existing transaction networks over which financial transactions between its account holders and various merchants may be completed. Financial institutions are therefore uniquely positioned to offer advanced risk identification and prevention measures to its customers, merchants and partners by leveraging these existing networks, or by establishing new networks where these capabilities are provided.

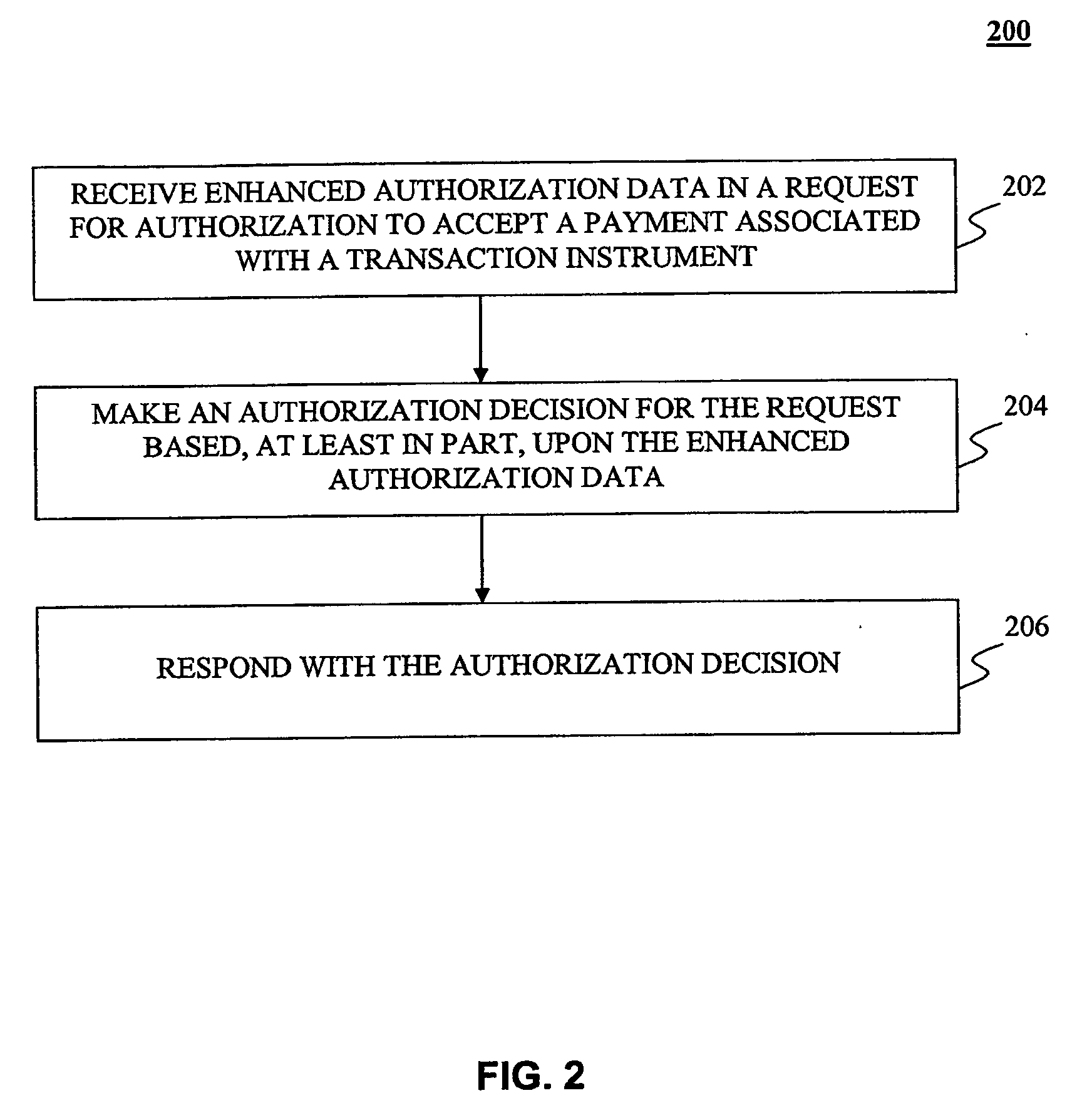

[0064] The processes introduced herein enable financial institutions to make improved fraud risk management decisions for transactions, particularly those involving travel tickets such as airline tickets. By capturing and analyzing certain additional information at the point of authorization of a charge, the risk that the transactio...

example implementations

V. EXAMPLE IMPLEMENTATIONS

[0092] The present invention may be implemented using hardware, software or a combination thereof and may be implemented in one or more computer systems or other processing systems. However, the manipulations performed by the present invention were often referred to in terms, such as adding or comparing, which are commonly associated with mental operations performed by a human operator. No such capability of a human operator is necessary, or desirable in most cases, in any of the operations described herein which form part of the present invention. Rather, the operations are machine operations. Useful machines for performing the operation of the present invention include general purpose digital computers or similar devices.

[0093] In fact, in one embodiment, the invention is directed toward one or more computer systems capable of carrying out the functionality described herein. An example of a computer system 800 is shown in FIG. 8.

[0094] Computer system 8...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com