Principal guaranteed savings and investment system and method

a technology of investment system and investment method, applied in the field of investments, can solve the problems of hedge funds not being available to the general public, more difficult for fund managers to outperform the market, and fewer than one hundred investors in typical hedge funds

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

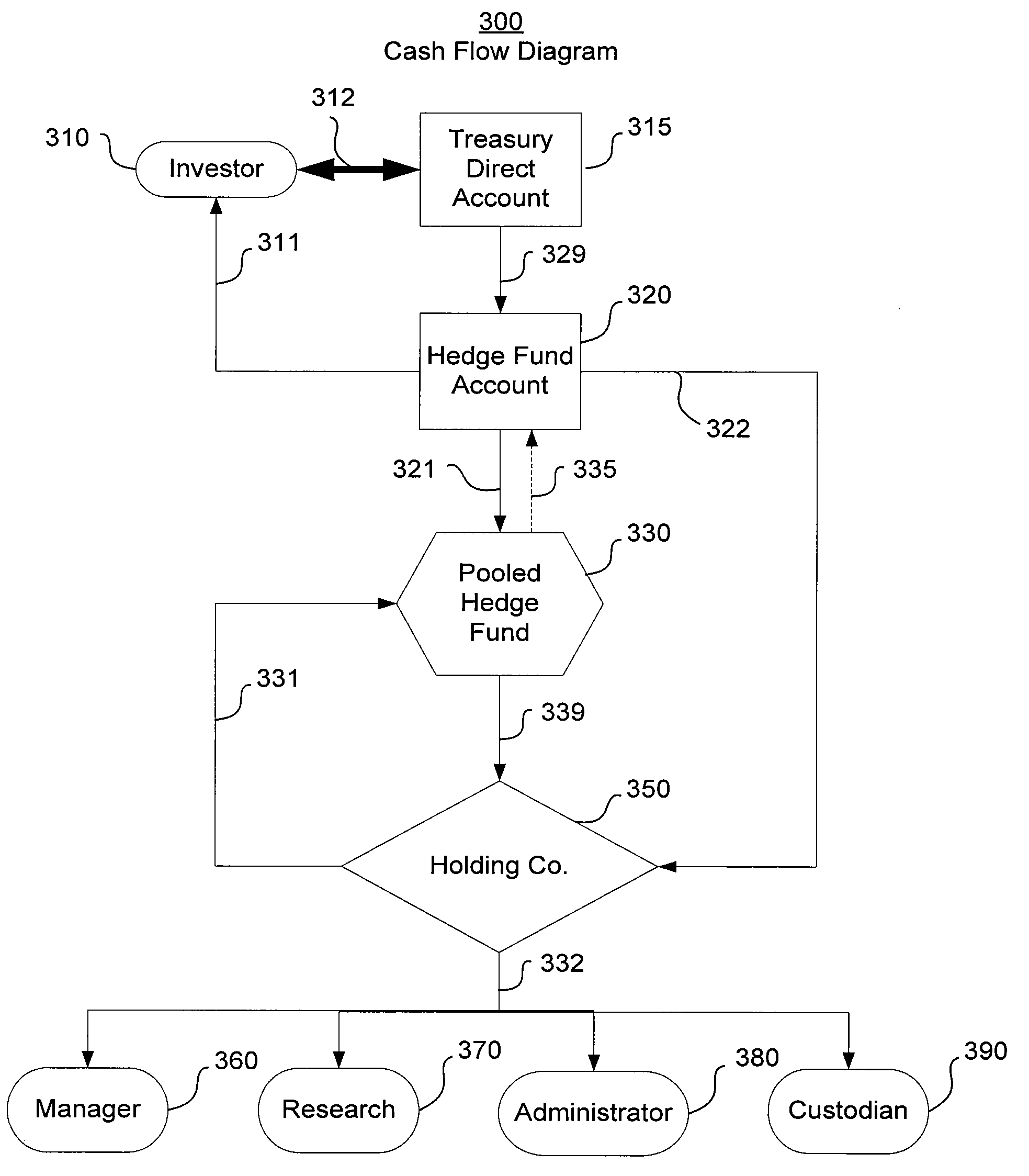

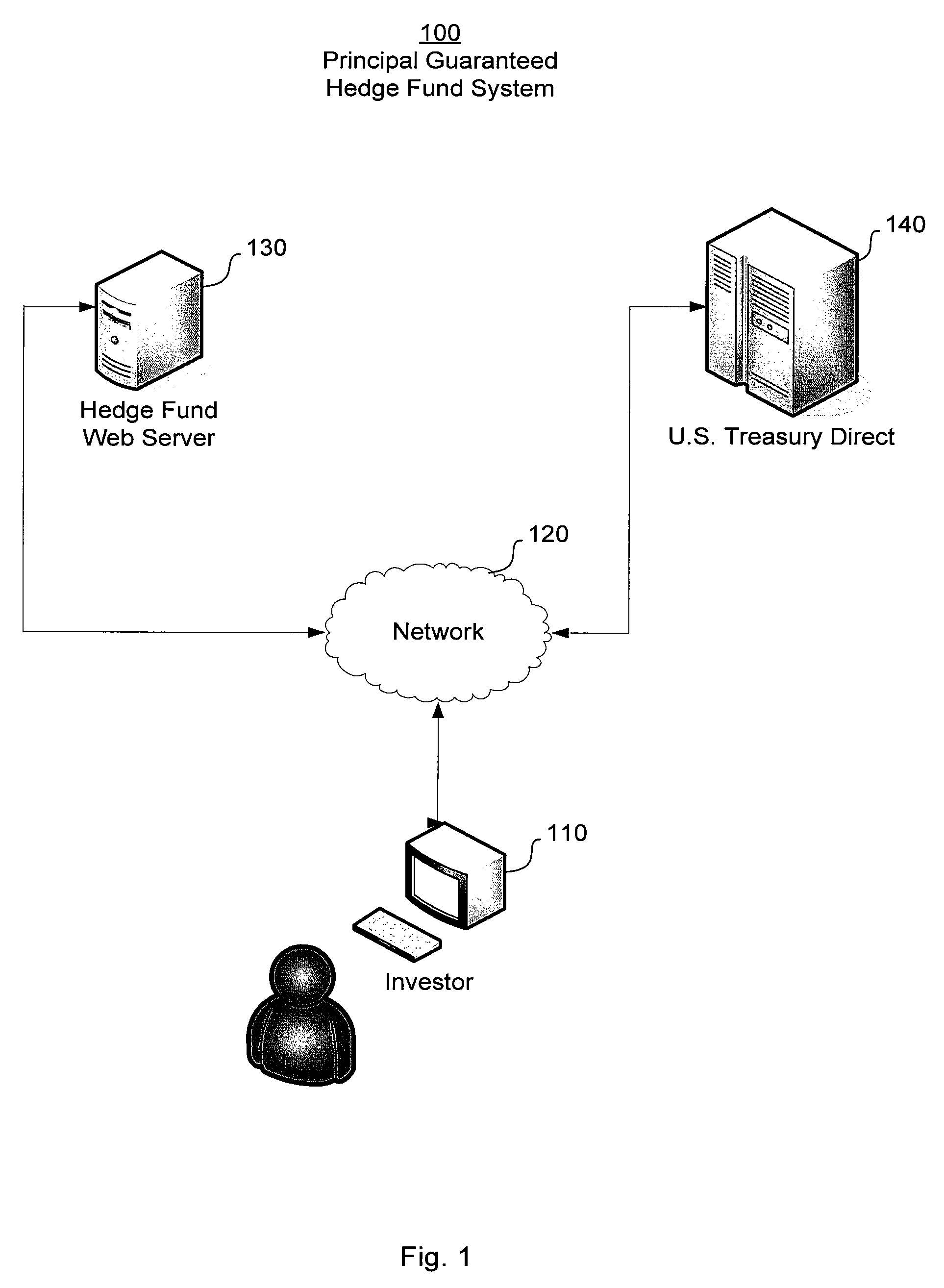

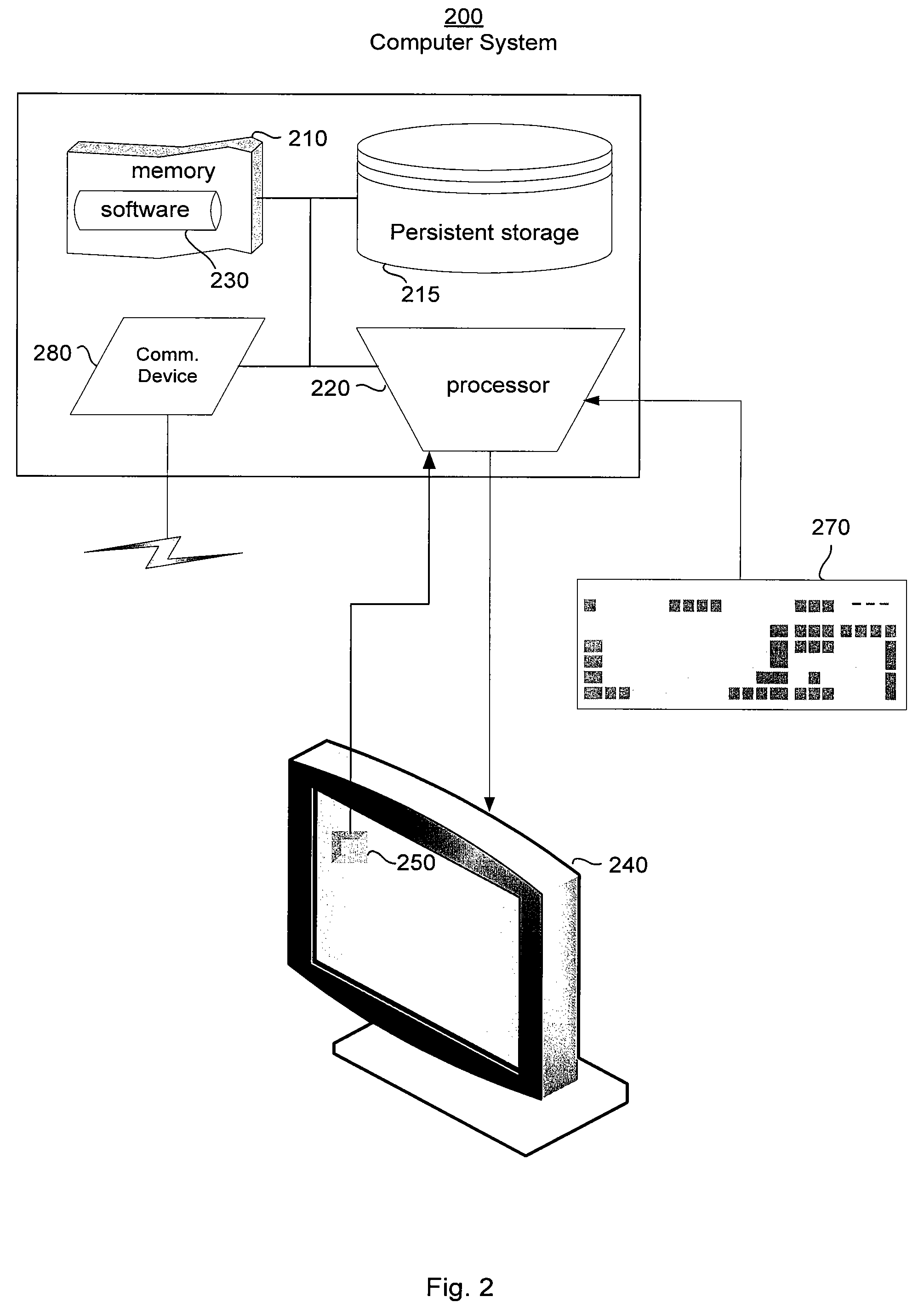

[0038]The present invention comprises a system and method for implementing a hedge fund business model. The system and methods are preferably implemented by computer software stored and executed on a general purpose computer. This computer provides the Investor with the ability to direct the operation of the computer to invest in a hedge fund.

[0039]Additionally, the present invention may be described herein in terms of functional block components, code listings, optional selections and various processing steps. It should be appreciated that such functional blocks may be realized by any number of hardware and / or software components configured to perform the specified functions. For example, the present invention may employ various integrated circuit components, e.g., memory elements, processing elements, logic elements, look-up tables, and the like, which may carry out a variety of functions under the control of one or more microprocessors or other control devices.

[0040]Similarly, th...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com