Method of capital creation for tax-exempt organizations

a technology of capital creation and tax exemption, applied in the field of method of capital creation for tax exempt organizations, can solve problems such as imposing limitations on the dollar amoun

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

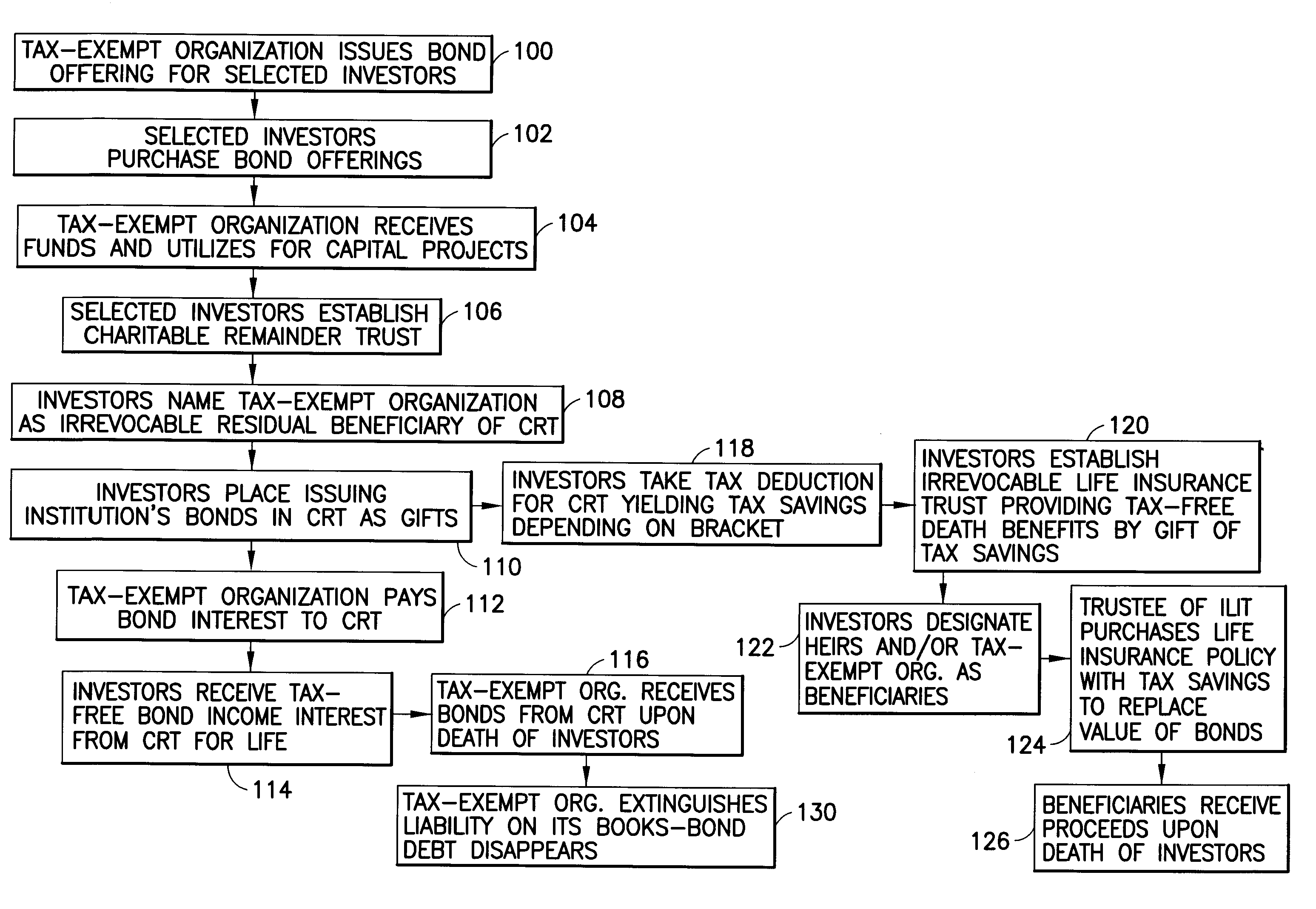

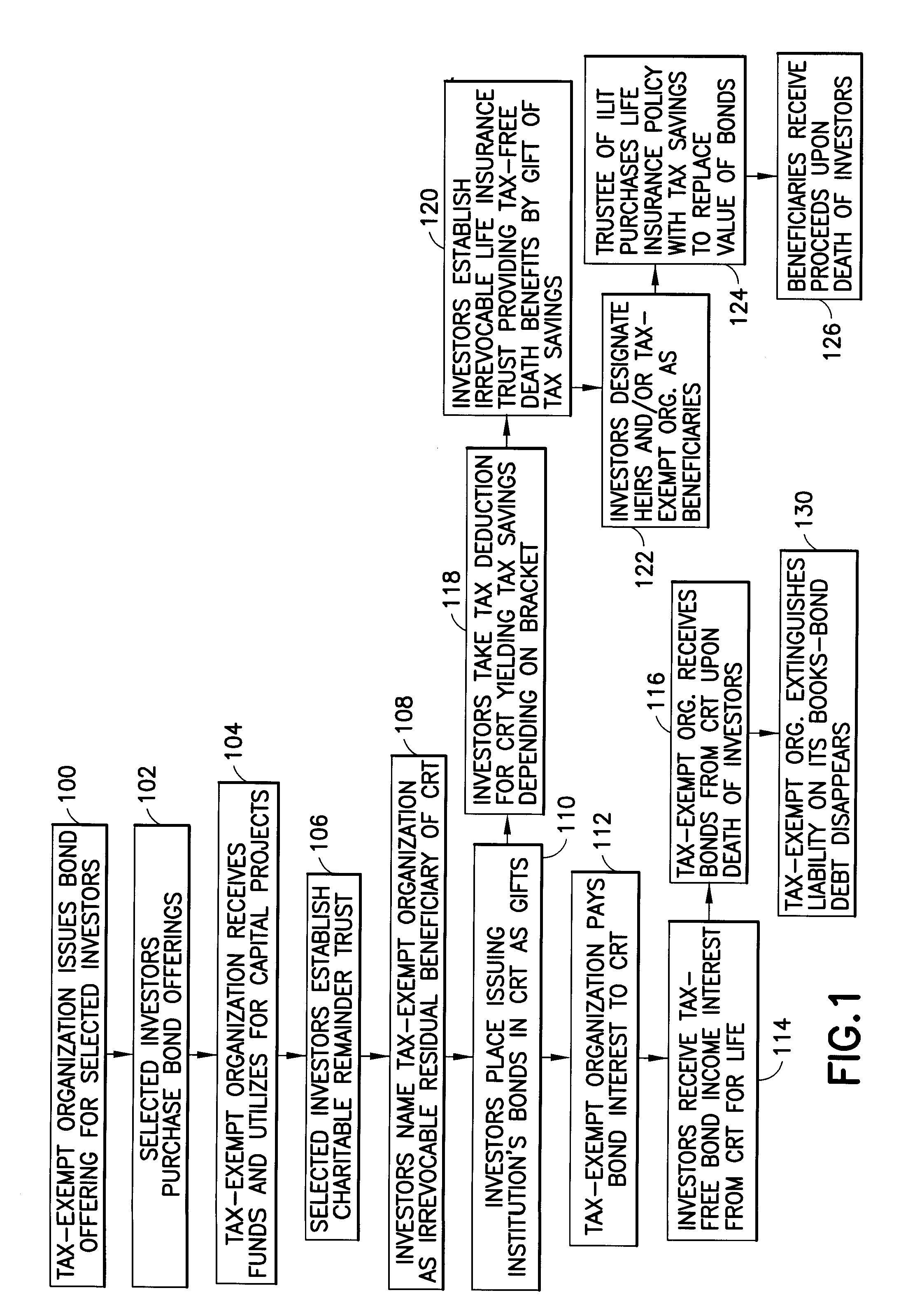

[0032]The capital creation process of the present invention makes use of several basic financial planning tools that are provided for in the Internal Revenue Code (IRC). The capital creation process utilizes the following elements as part of the method.

[0033]1. Tax-exempt financing authority issues tax-exempt bonds for qualifying institutions, organizations, and municipalities as detailed in the IRC §§ 141-150.

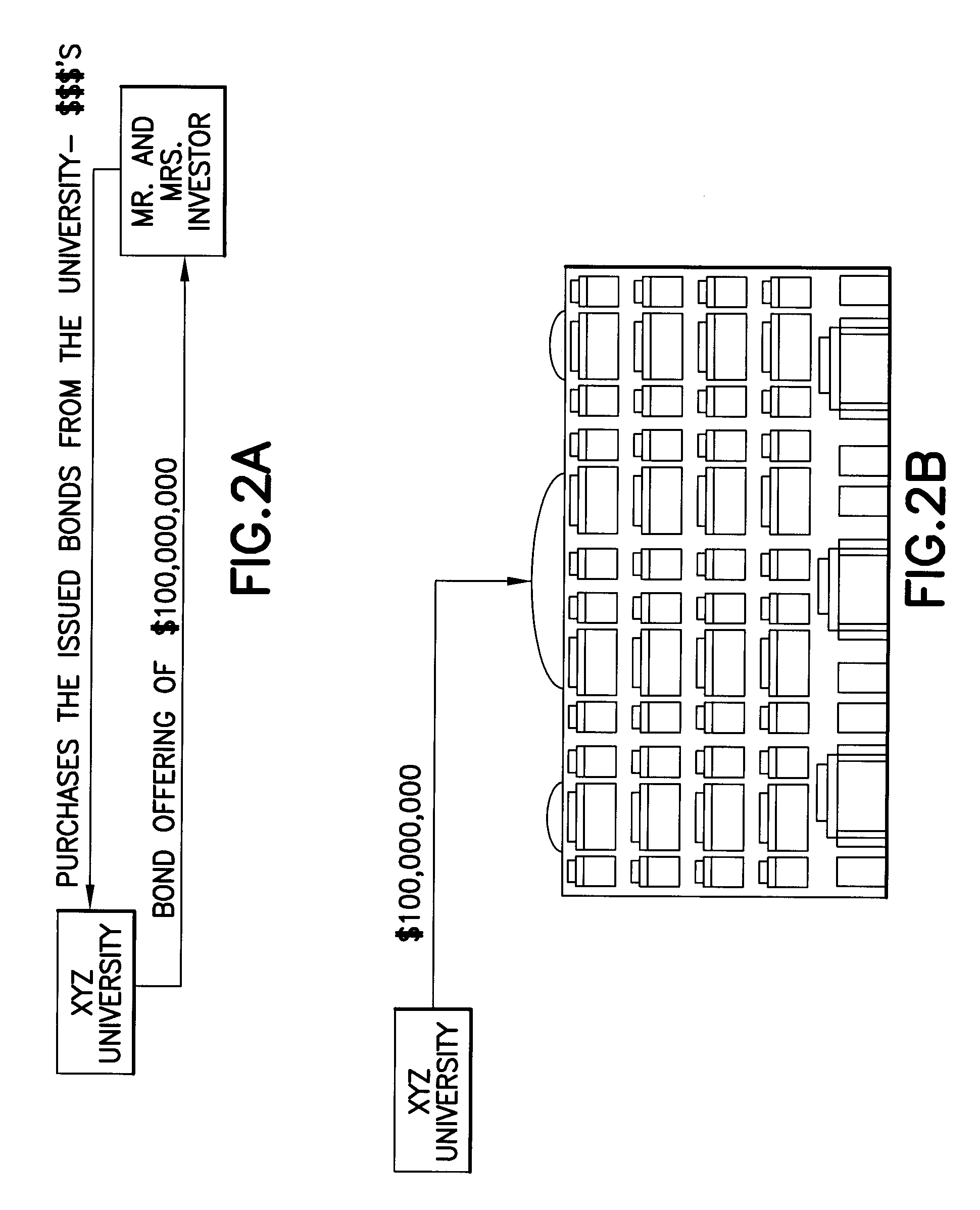

[0034]2. Older, wealthy individuals invest a significant portion of their assets in tax-exempt income producing opportunities. The age 65 and over demographic segment is growing disproportionally larger than other demographic age groups and offers the prospect of more and more large net worth investors purchasing investment grade, tax-exempt bonds for their portfolios.

[0035]3. The subsequent incentive and opportunity for such investors who are financial supporters of one or more charitable organization to commit to certain of their assets, on a deferred basis, to their selecte...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com