Liquid insurance contracts

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

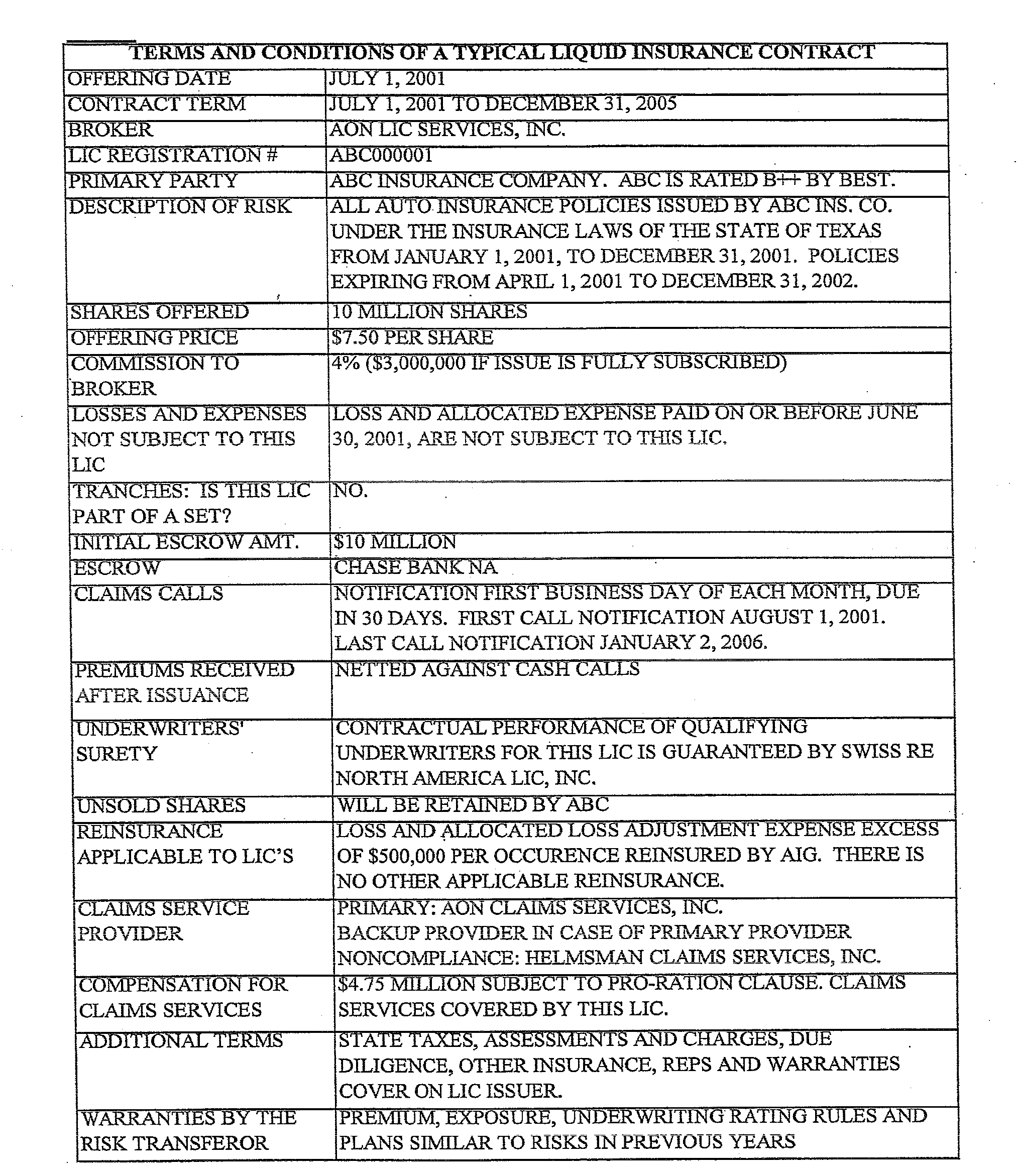

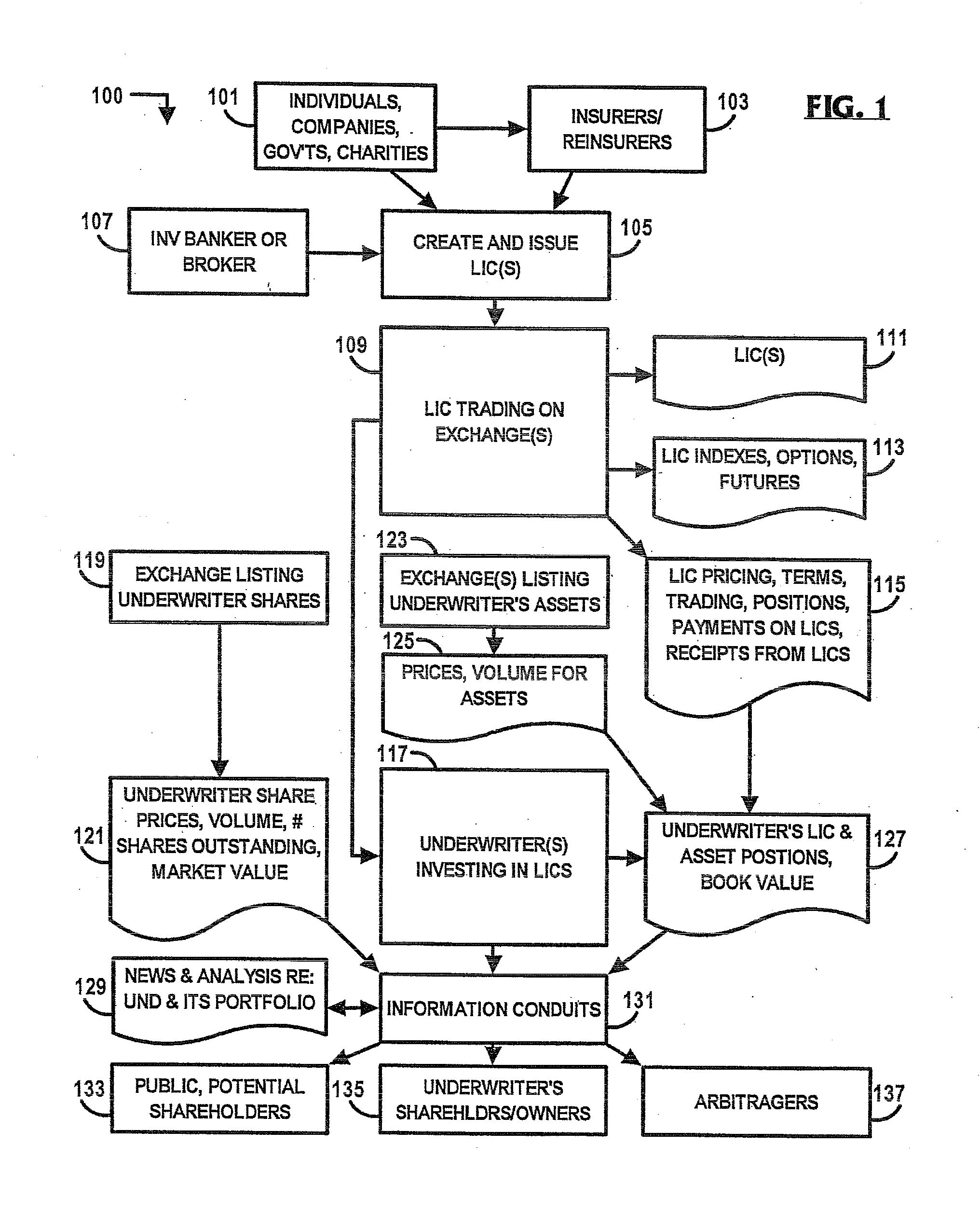

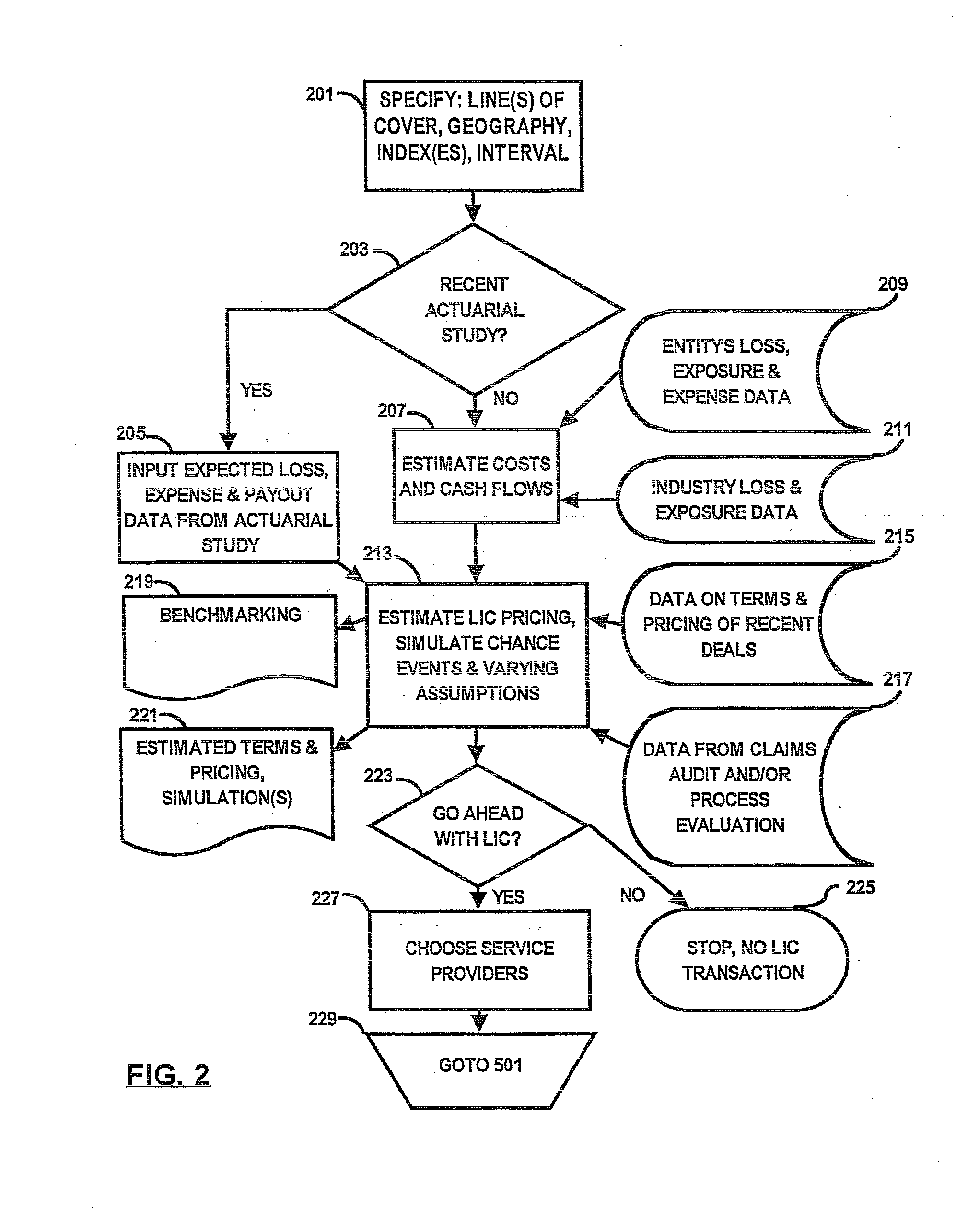

[0058]In the following description, the topics outlined below will be keyed to the drawings indicated.[0059]I. Overview Of An LIC System—FIG. 1[0060]II. Preparation For An LIC Issued By The Company Originally Bearing The Risk(s)—FIG. 2[0061]III. Bundling Of Insurance Or Reinsurance Policies For An LIC—FIG. 3[0062]IV. Creation Of LICs Based On Indexes—FIG. 4[0063]V. Creation Of LICs—FIG. 5[0064]VI. LIC Initial Offerings—FIG. 6[0065]VII. Auction Of Shares—FIG. 7[0066]VIII. LICs With Detachable Provisions, LIC Options Or LIC Futures—FIG. 8[0067]IX. Bond With Detachable LIC—FIG. 9[0068]X. Creation Of Exchange Traded Futures And Options—FIG. 10[0069]XI. Operation Of An LIC Exchange—FIG. 11[0070]XII. Operation Of An LIC Underwriter—FIG. 12[0071]XIII. Surety And Collateral Arrangements For LICs—FIG. 13[0072]XIV. Calculation Of Surety Or Collateral Amounts For Exchange-Traded LIC Contracts—FIG. 14[0073]XV. Creating One Or More Derivatives From A Single Existing LIC—FIG. 15[0074]XVI. Creatin...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com