Consumer credit application evaluation system and realizing method thereof

An evaluation system and implementation method technology, applied in data processing applications, instruments, finance, etc., can solve the problems of deviating from the development purpose of personal credit business and restricting the development of personal credit business, so as to improve the efficiency of credit approval, achieve good results, and overcome the standard inconsistent effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

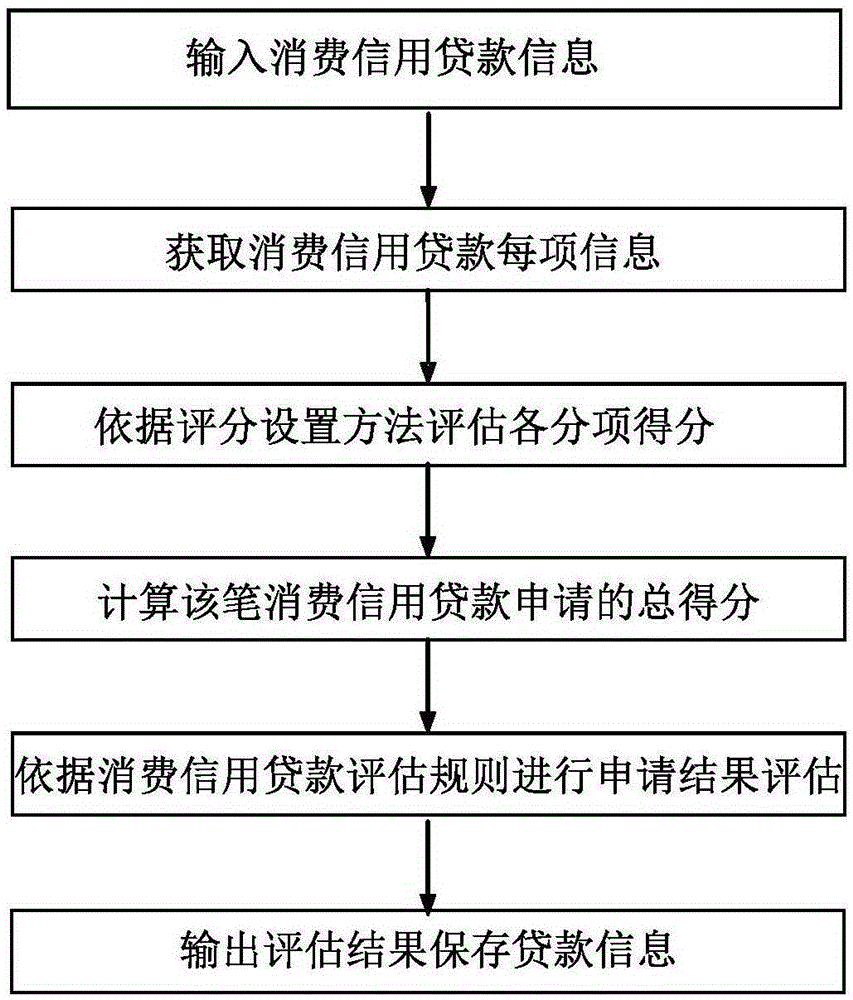

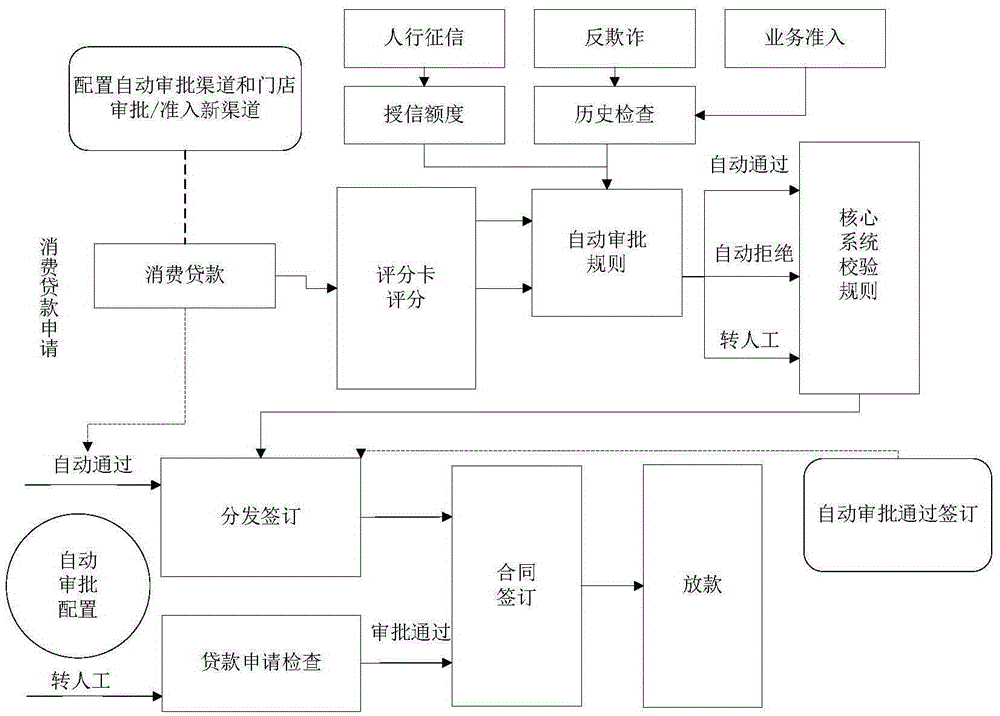

[0039] The specific implementation manners of the present invention will be further described in detail below in conjunction with the accompanying drawings and examples. Set the specific score of each information item for each consumer credit loan application information as follows:

[0040]

[0041]

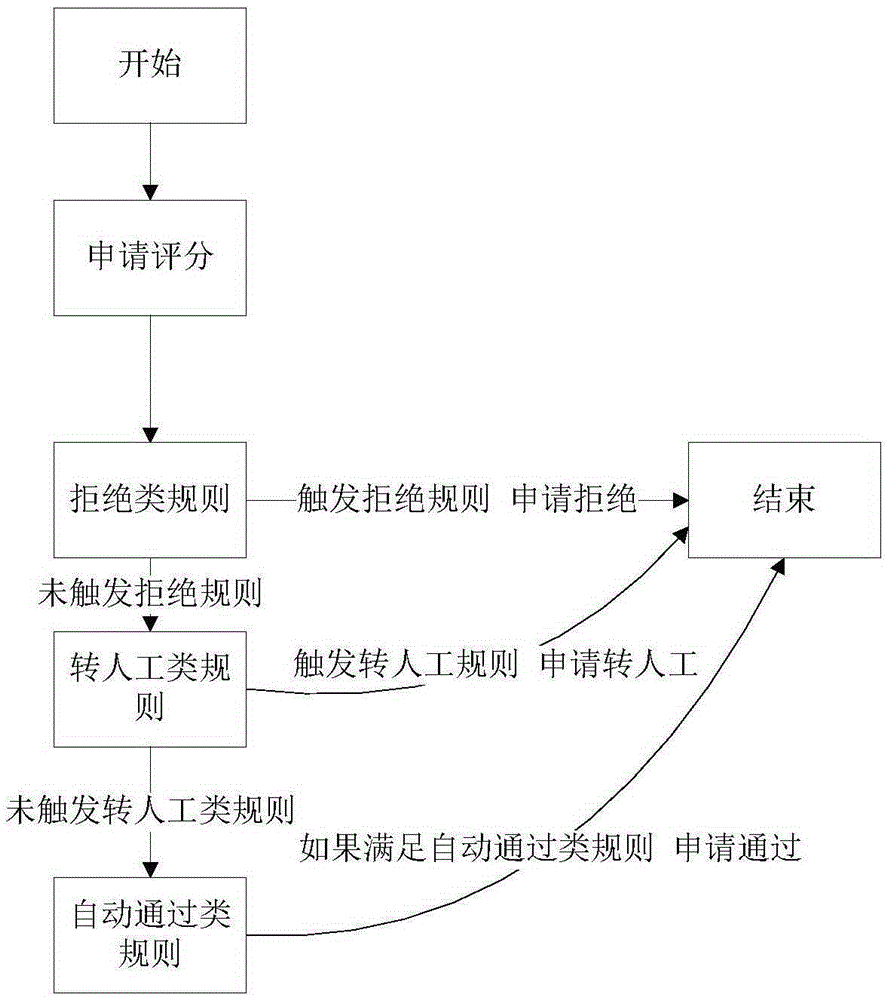

[0042] Set the reject threshold N to 484, and set the pass threshold M to 518.

[0043] Enter consumer credit loan information 1 as follows:

[0044] name

value

phone number

13811273633

education level

40 (high school and below)

62

gender

1(male)

57

ID card area

Jilin

57

marital status

10 (unmarried)

57

Enterprise size

0 (less than 20 people)

57

Number of credit card approval inquiries in the past 6 months

Missing query (no credit record)

50

The ratio of all accounts that have never expired to the total number of accounts

No cre...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com