Land increment tax automatic accounting method and system

A land value-added tax and automatic technology, applied in the field of tax accounting, can solve problems such as easy to generate errors, difficult to do one-time sorting, difficult to quickly provide tax bureau certification materials, etc., to ensure accuracy, convenient and quick query and Batch adjustment tools to realize the effect of tax calculation automation

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0049] The implementation of the present invention is described below through specific examples and in conjunction with the accompanying drawings, and those skilled in the art can easily understand other advantages and effects of the present invention from the content disclosed in this specification. The present invention can also be implemented or applied through other different specific examples, and various modifications and changes can be made to the details in this specification based on different viewpoints and applications without departing from the spirit of the present invention.

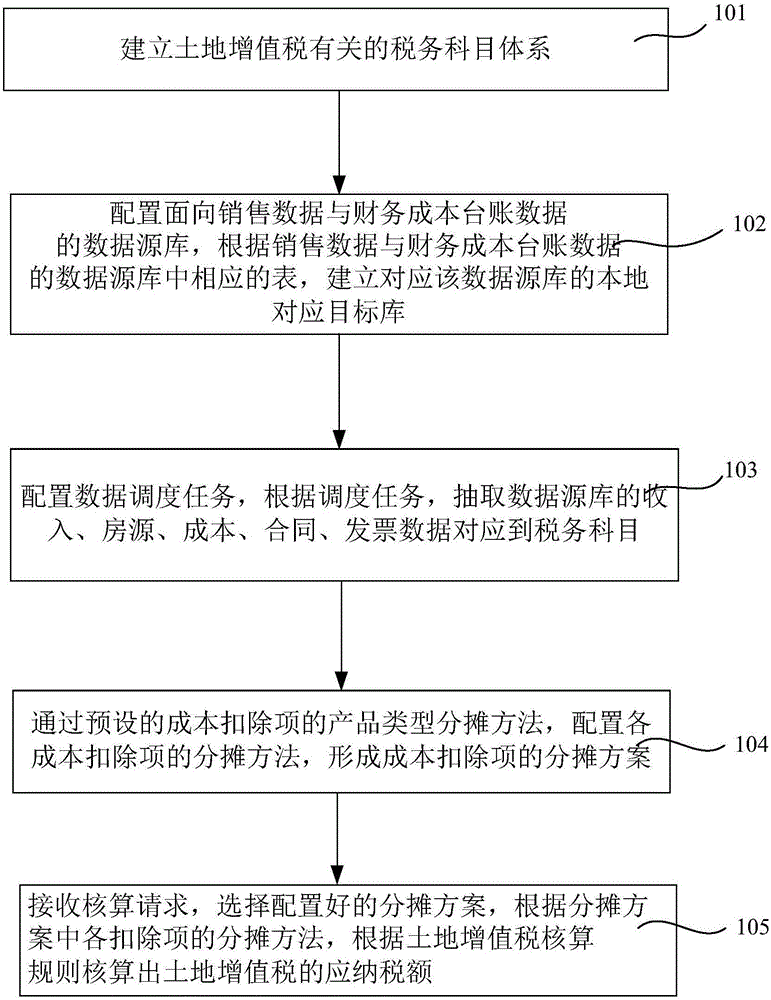

[0050] figure 1 It is a flow chart of steps of a preferred embodiment of an automatic accounting method for land value-added tax in the present invention. like figure 1 Shown, the automatic accounting method of a kind of land value-added tax of the present invention comprises the following steps:

[0051] Step 101, establish the tax subject system related to land value-added tax, for exam...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com