Borrowing and loan matchmaking system and method capable of realizing risk control based on network platform moments credit extension

A network platform and friends' technology, applied in the field of loan matching system, can solve the problems of high review cost, high bad debt rate, acquaintances may not have funds, etc., to save manual steps, reduce investors' losses, and low-cost risk assessment Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0035] The present invention will be described in detail below in conjunction with the embodiments and the accompanying drawings. It should be noted that the described embodiments are only intended to facilitate the understanding of the present invention, rather than limiting it in any way.

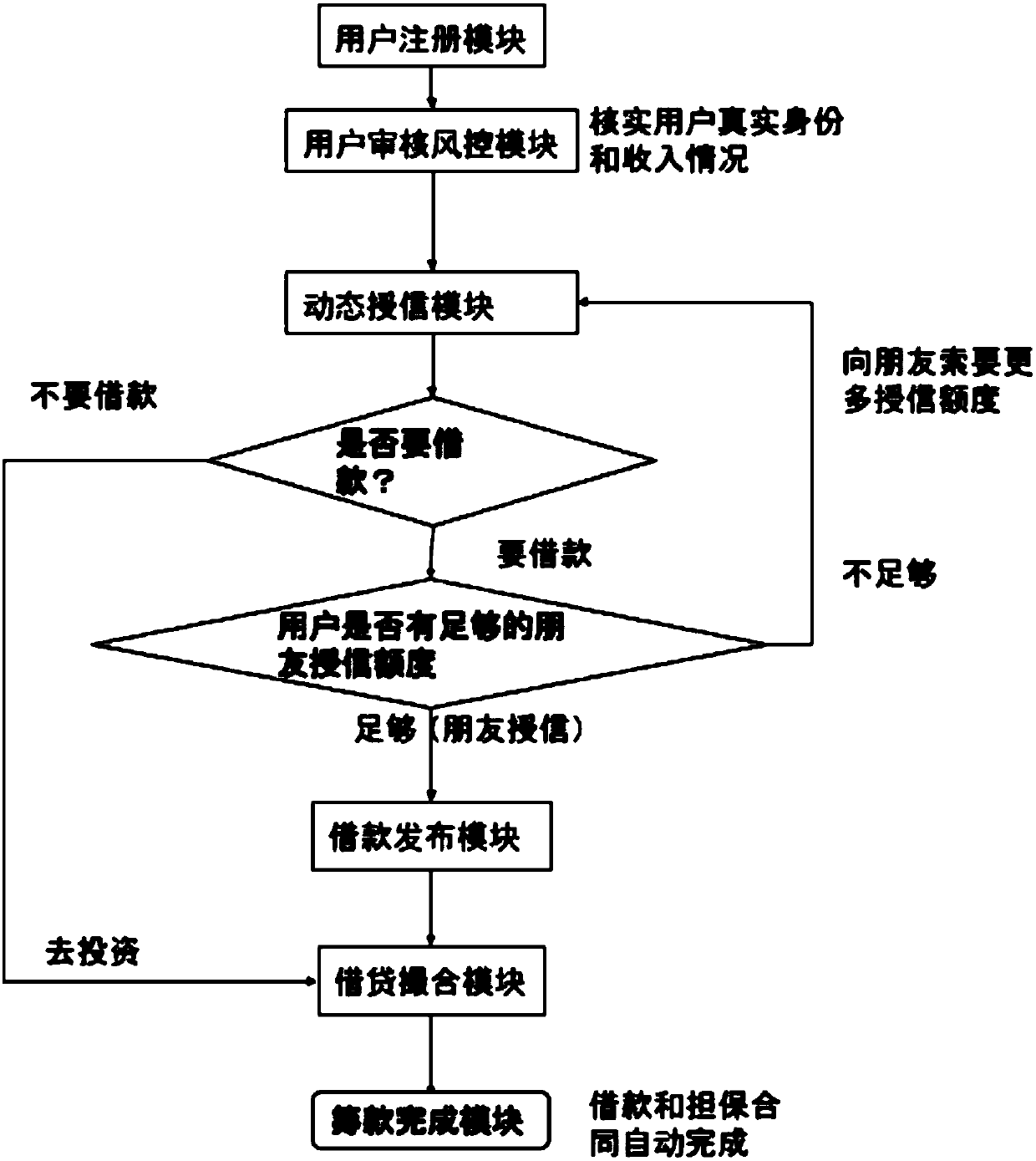

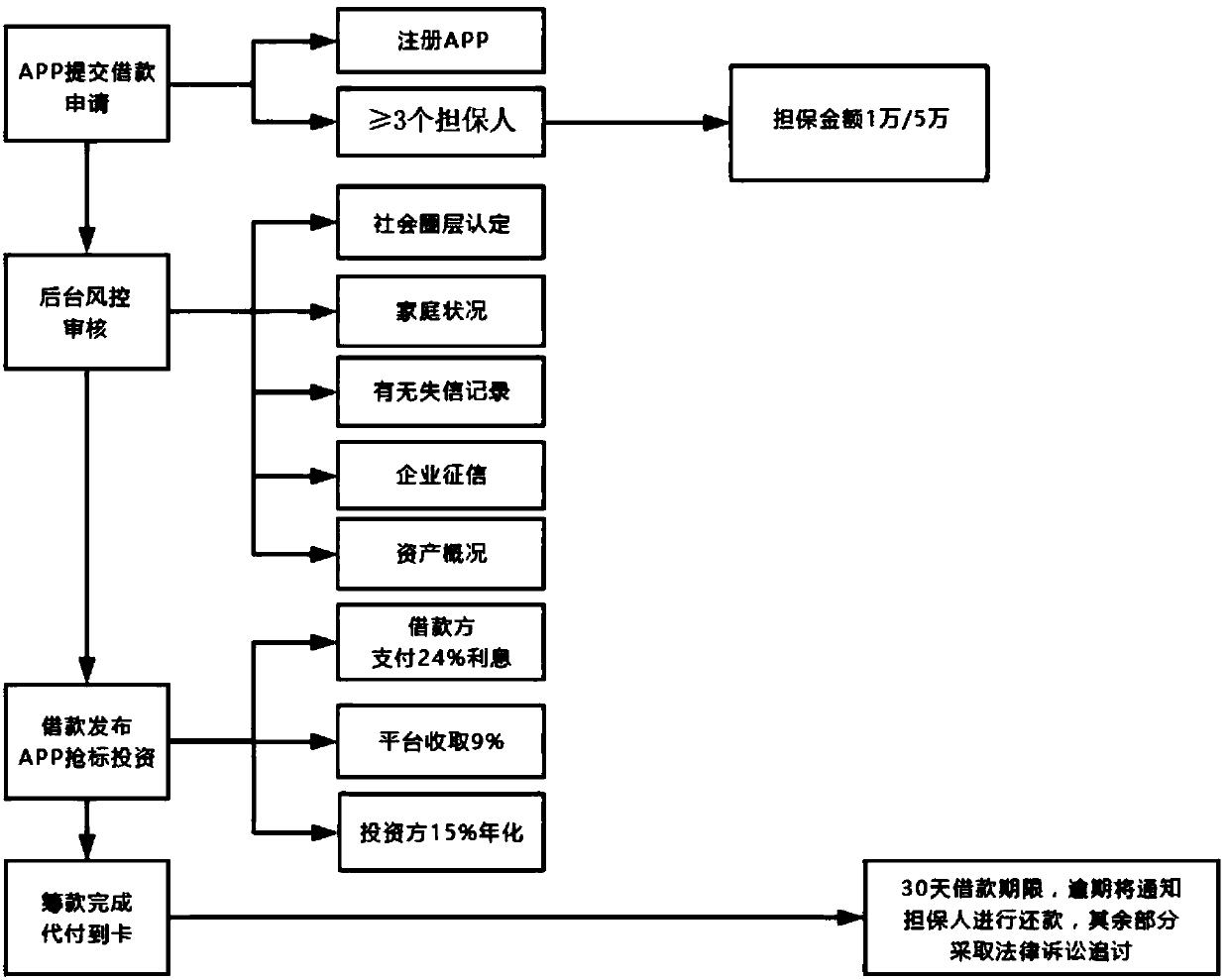

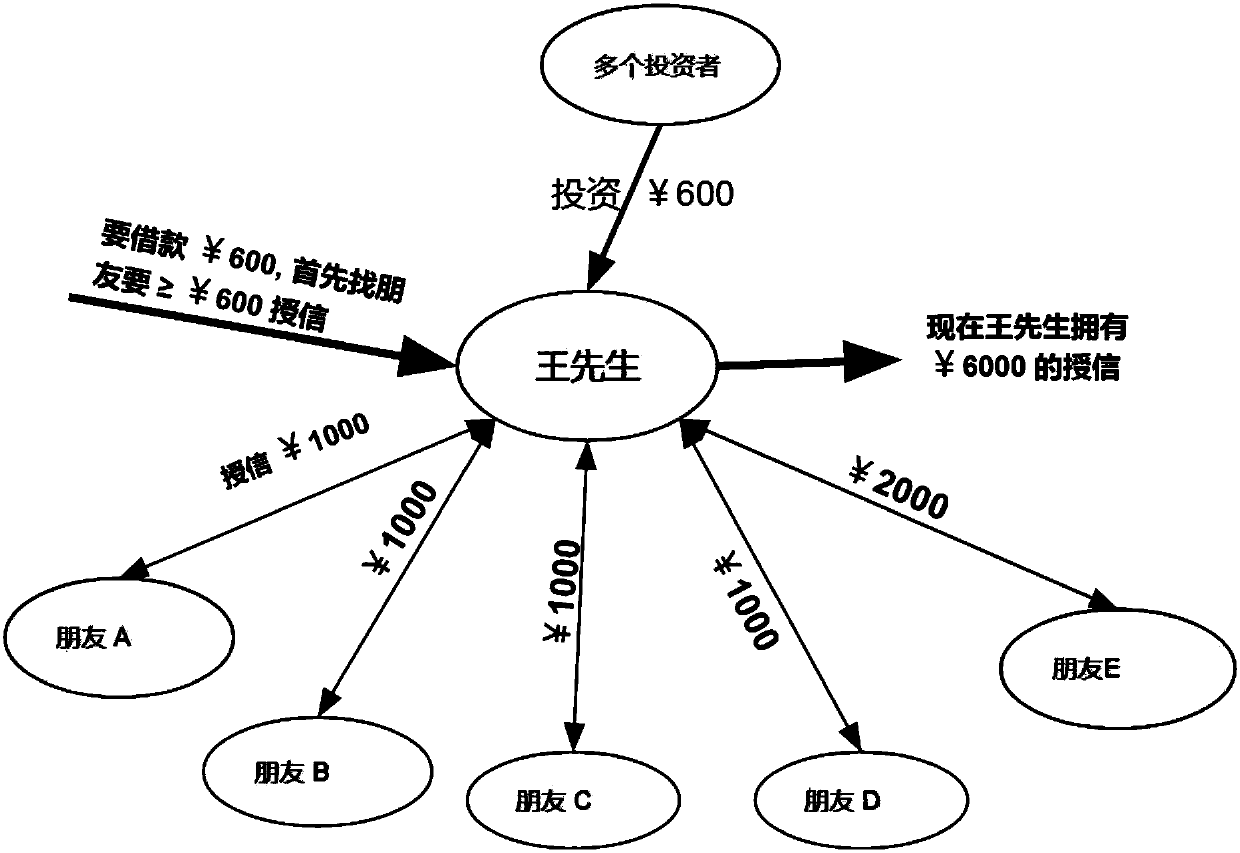

[0036] The loan matching system of this embodiment is based on the credit of the circle of friends on the network platform to achieve risk control, especially suitable for the field of small loans. The circle of friends refers to a group of users who have registered on the network platform and become friends with each other. see figure 1As shown, the matching system includes: user registration module, user audit risk control module, dynamic credit module, loan release module, loan matching module and fundraising completion module. Users who already have a predetermined number of circle of friends credit users can issue loan applications through the loan release module as borrowers (i.e. V...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com