Loan product attribute determination method and server

A technology of product attributes and determination methods, applied in the field of information processing, can solve the problems of fixed attributes of loan products and inability to meet the loan needs of different customer groups, and achieve the effect of flexible configuration

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

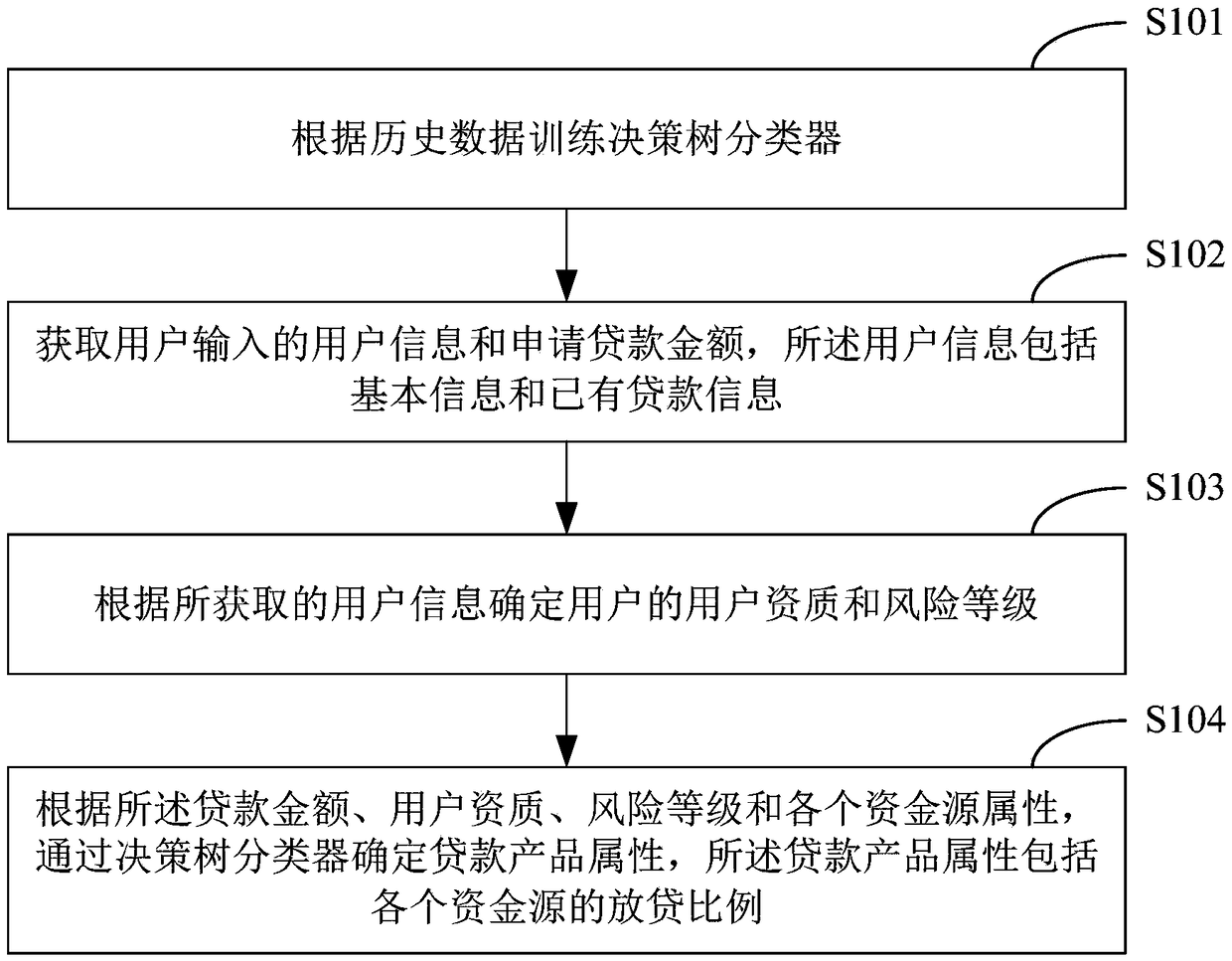

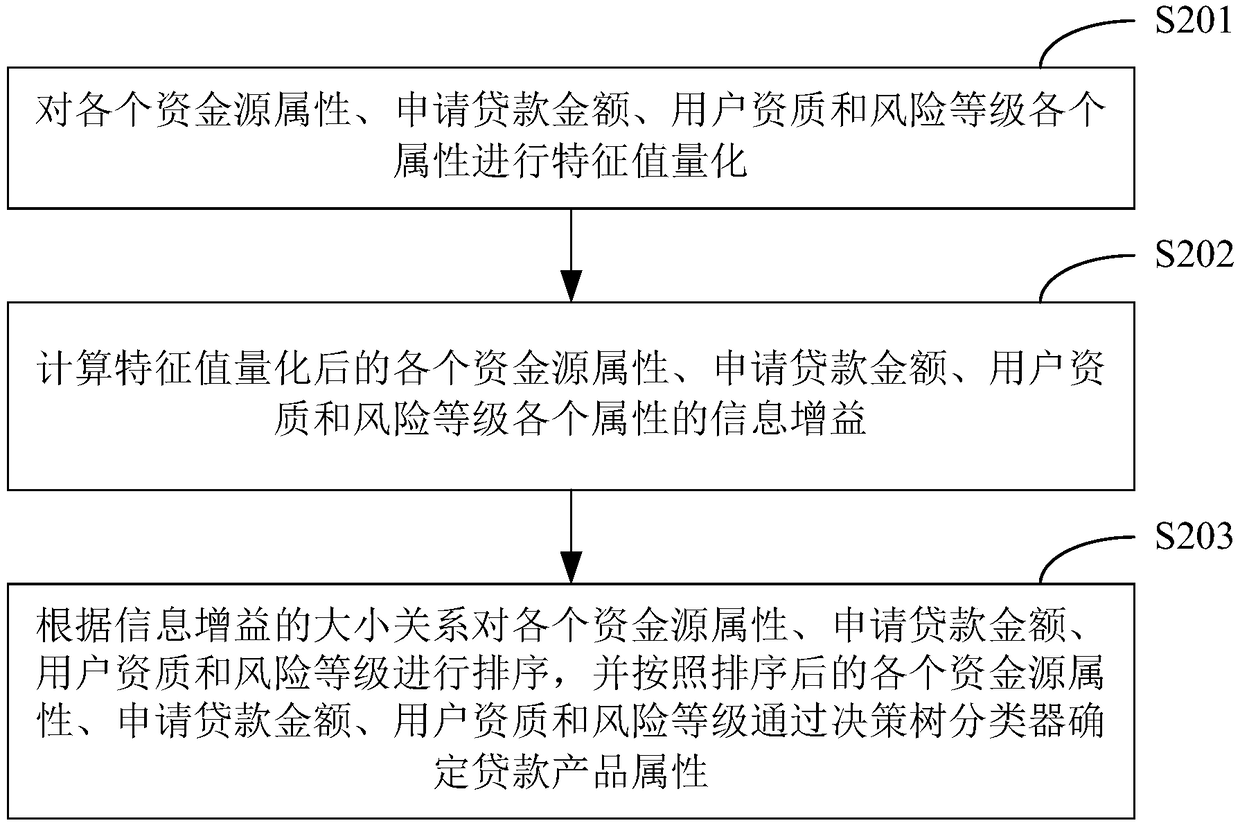

[0074] figure 1 The implementation process of the loan product attribute determination method provided by Embodiment 1 of the present invention is shown, and the details are as follows:

[0075] Step S101, training a decision tree classifier according to historical data.

[0076] Wherein, the historical data may be historically stored loan product attribute data. That is, the decision tree classifier can be trained through the correspondence between the previously stored application loan amount, user qualification, risk level, attributes of various fund sources and attributes of loan products. Optionally, the attributes of each funding source may be information such as the level of the available amount, the length of the loanable period, and the like.

[0077] In one embodiment, the training process of decision tree classifier according to historical data is:

[0078] Calculate the information gain of each attribute according to the training sample data set;

[0079] Takin...

Embodiment 2

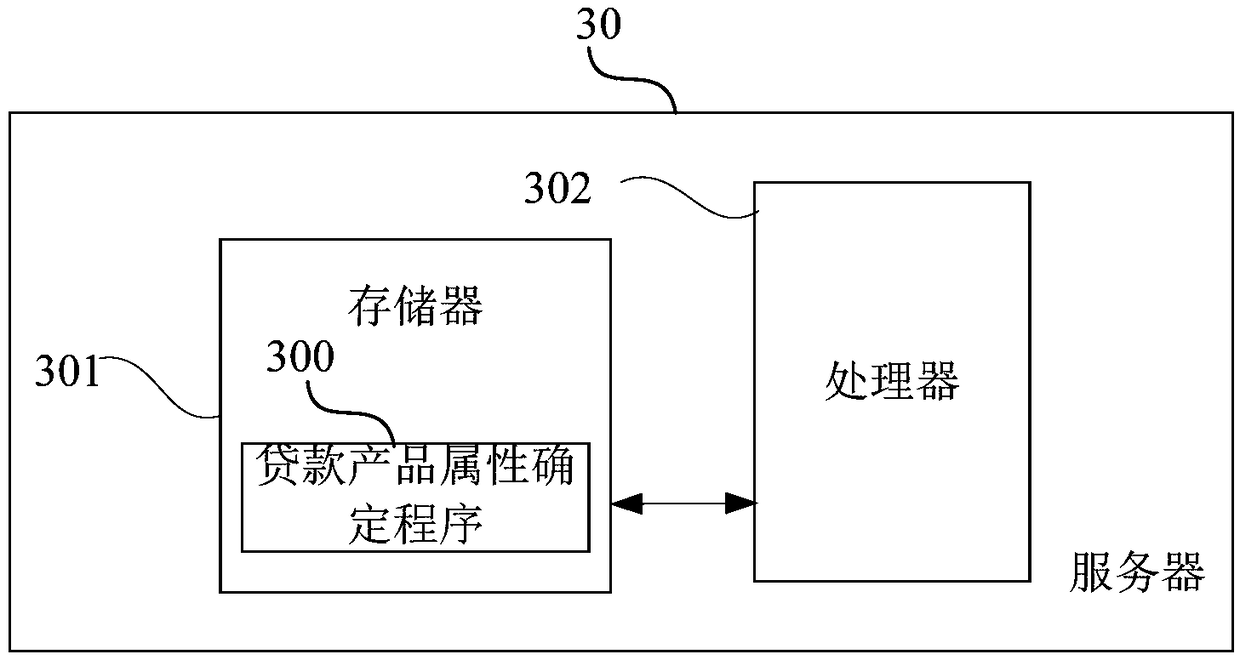

[0128] Corresponding to the loan product attribute determination method described in the above embodiment, image 3 A schematic diagram of the operating environment of the loan product attribute determination program provided by the embodiment of the present invention is shown. For ease of description, only the parts related to this embodiment are shown.

[0129] In this embodiment, the loan product attribute determination program 300 is installed and run on the server 30 . The server 30 may include, but not limited to, a memory 301 and a processor 302 . image 3 Only server 30 is shown with components 301-302, but it should be understood that implementing all of the illustrated components is not a requirement and that more or fewer components may instead be implemented.

[0130] The storage 301 may be an internal storage unit of the server 30 in some embodiments, such as a hard disk or memory of the server 30 . The memory 301 may also be an external storage device of the s...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com