Small and medium-sized enterprise credit risk assessment platform based on online supply chain finance

A technology for small and medium-sized enterprises and risk assessment, applied in finance, data processing applications, instruments, etc., can solve the problems of consuming a lot of manpower and material resources and time, fraudulent qualifications, high costs, etc., and achieve the effect of reducing the burden of manpower and material resources and improving work efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0026] The technical solution protected by the present invention will be described in detail below with reference to the accompanying drawings.

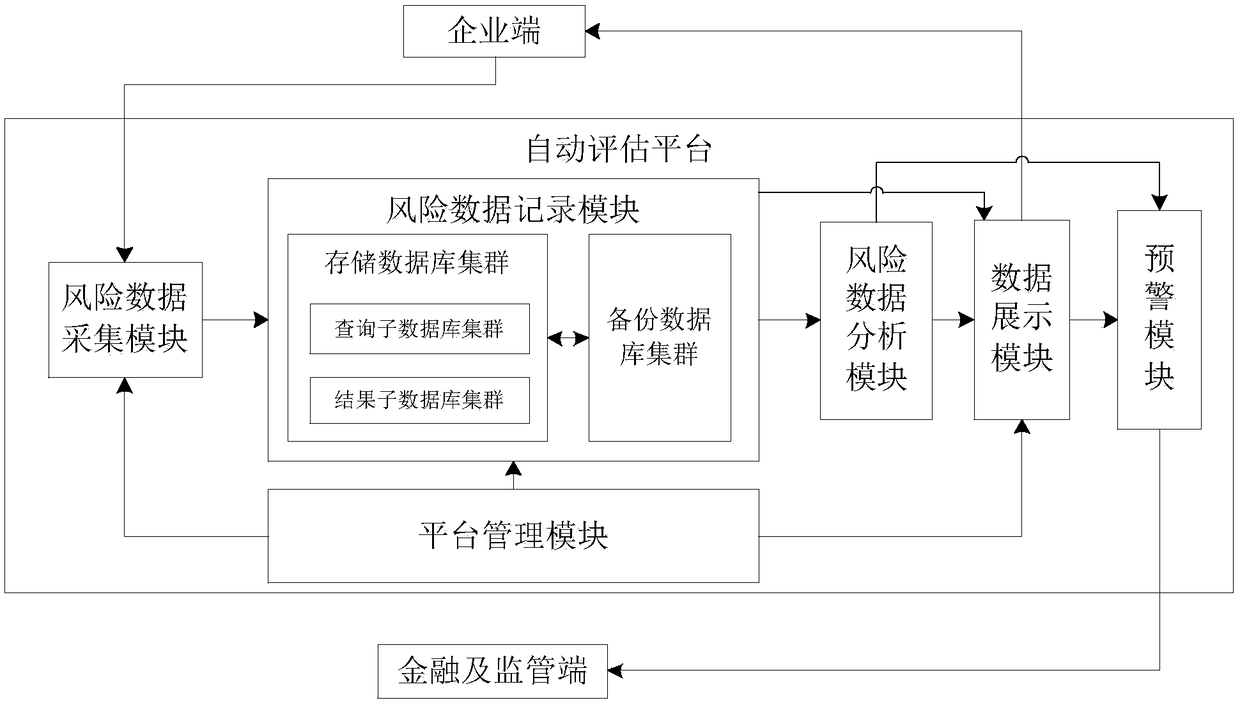

[0027] Please refer to figure 1 . The credit risk assessment platform for small and medium-sized enterprises based on online supply chain finance proposed by the present invention includes an automatic assessment platform and an enterprise end and a financial and regulatory end connected to the automatic assessment platform. The enterprise end connects to the automatic assessment platform. The platform can view its own credit risk status in real time, and can make a defense against dissenting risk assessments; and the financial and regulatory end can view and supervise the enterprise access to the platform in real time by accessing the automatic evaluation platform. The risk assessment situation, and the assessment rules can be configured to obtain the risk abnormal data in time.

[0028] Specifically, the automatic evaluation platform ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com