Credit granting method and device, terminal device and storage medium

A credit line and credit technology, applied in the field of credit, can solve the problem that low-income groups cannot obtain credit

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

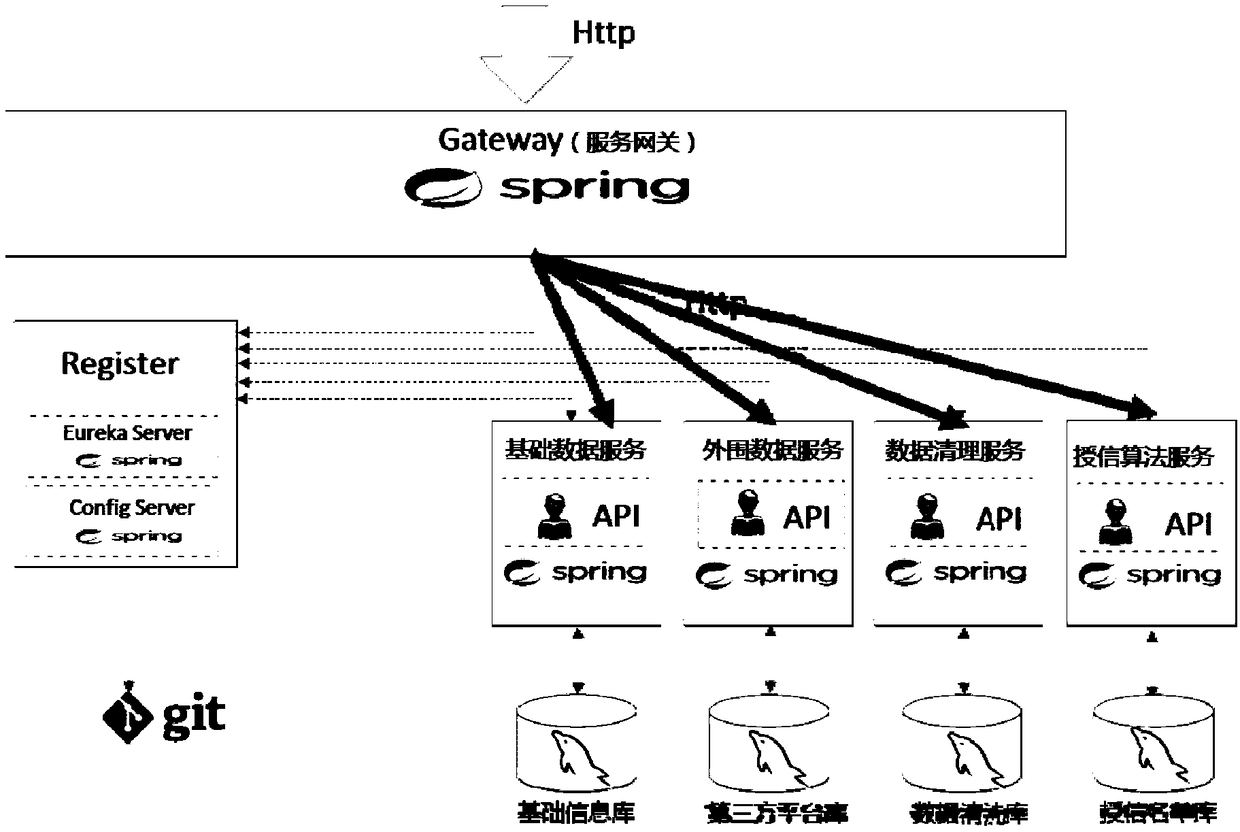

[0057] The credit granting method provided in this embodiment can be applied to an e-commerce service platform, and the e-commerce server platform is a platform that adopts a micro-service architecture. The entire application program of the e-commerce service platform will be split into subsystems with independent functions, which will run independently, and the system and the system can communicate through the RPC interface. After the micro-server architecture is adopted, the coupling degree between the subsystems of the e-commerce service platform is greatly reduced, the system will be very easy to expand, and the collaboration efficiency will be greatly improved.

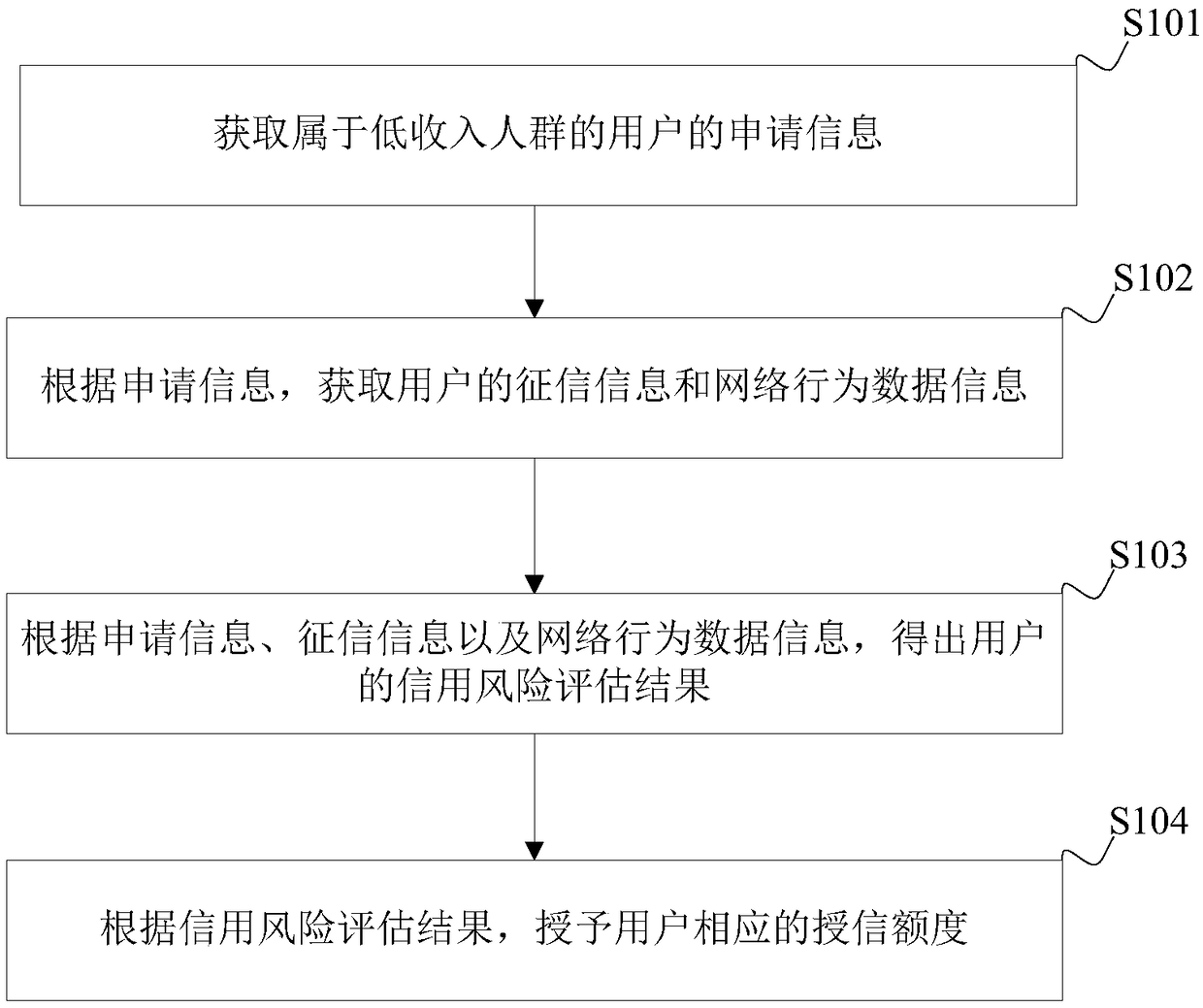

[0058] See figure 1 , a schematic block diagram of a process of a credit granting method provided in the embodiment of the present application, the method may include the following steps:

[0059] Step S101: Obtain application information of users belonging to low-income groups, where low-income groups are groups ...

Embodiment 2

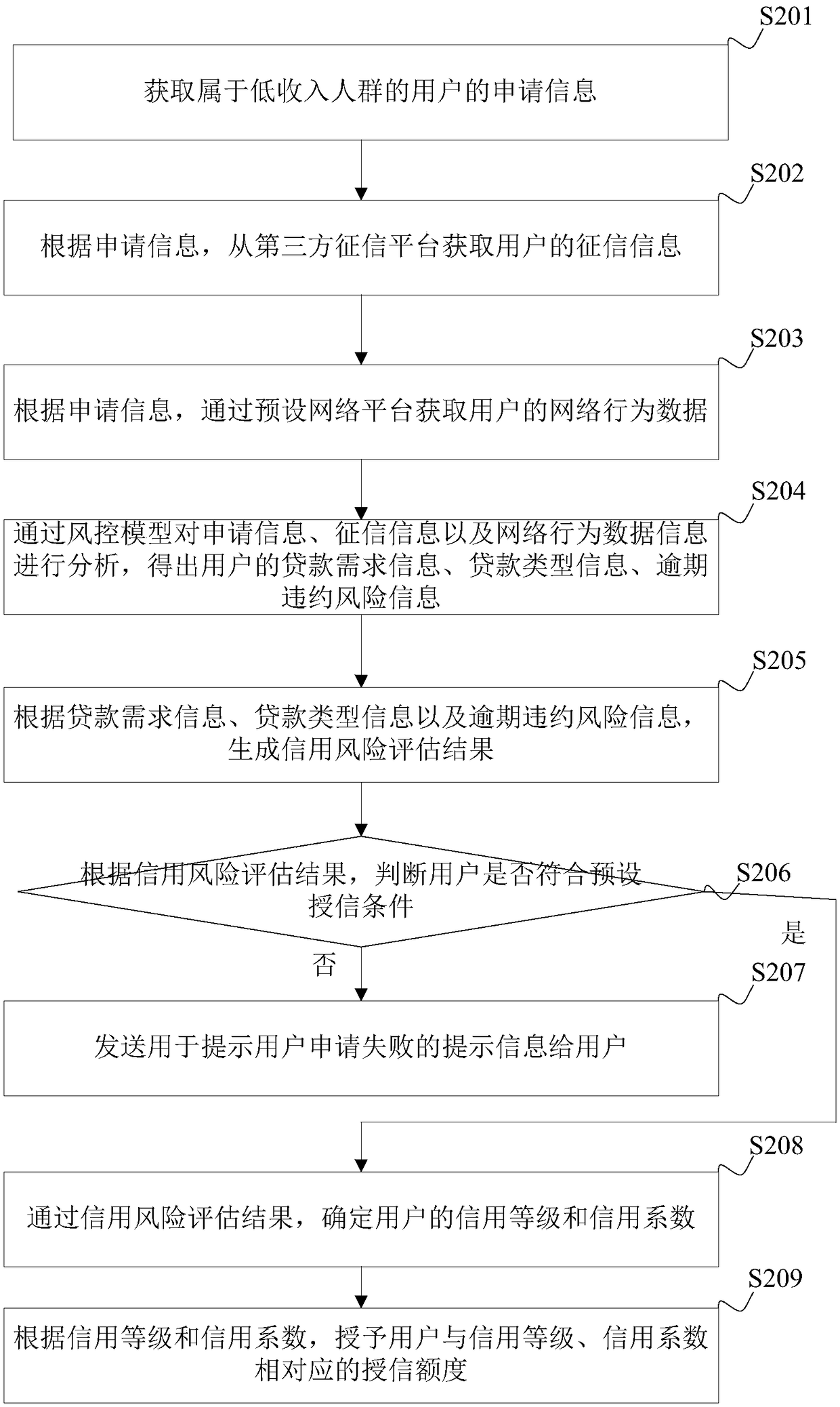

[0075] See figure 2 , another schematic flowchart of a credit granting method provided in the embodiment of the present application, the method may include the following steps:

[0076] Step S201: Obtain application information of users belonging to low-income groups.

[0077] Step S202: Acquire the user's credit information from a third-party credit information platform according to the application information. Among them, the third-party credit reporting platform is, for example, Sesame Credit, Credit Bureau, etc.

[0078] Step S203: Acquire the user's network behavior data through a preset network platform according to the application information.

[0079] It may include but is not limited to user basic attribute information, user behavior information, user online shopping, user APP behavior, social circle information, etc. For example, online payment behavior data, online consumption behavior data, online financial behavior data, social behavior data, etc. These netwo...

Embodiment 3

[0094] See Figure 5 , a schematic block diagram of the structure of a credit device provided in an embodiment of the present application, which is applied to an e-commerce service platform, and the e-commerce server platform is a platform using a micro-service architecture. The credit device includes:

[0095] The first obtaining module 51 is configured to obtain application information of users belonging to low-income groups, where low-income groups are groups whose income is lower than a preset value;

[0096] The second obtaining module 52 is configured to obtain the user's credit information and network behavior data information according to the application information;

[0097] The evaluation module 53 is used to obtain the user's credit risk evaluation result according to the application information, credit information and network behavior data information;

[0098] The credit extension module 54 is used for granting a corresponding credit line to the user according t...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com