A value-added tax invoice storage cabinet and storage method

A value-added tax and storage cabinet technology, which is applied in invoicing/invoicing, instruments, and coin-accepting devices, etc., can solve problems such as poor self-service in business handling, low efficiency in business handling between business halls and customers, and no VAT invoices.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

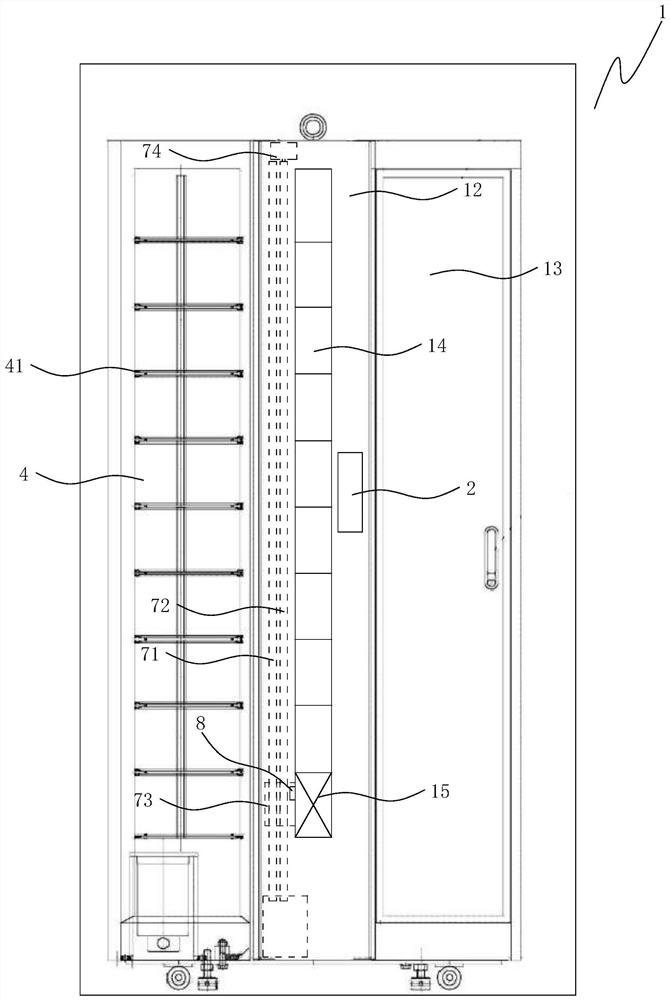

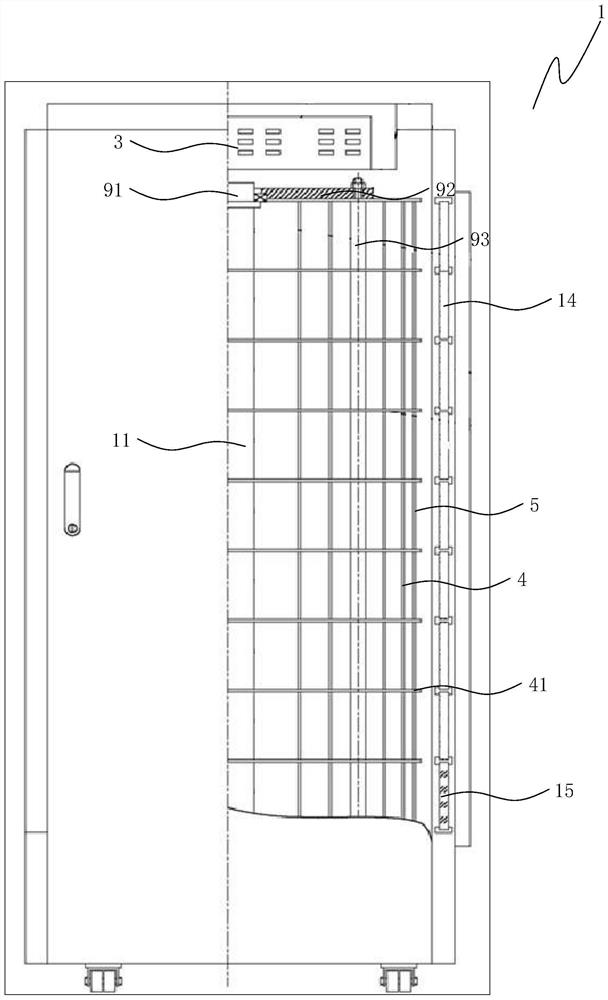

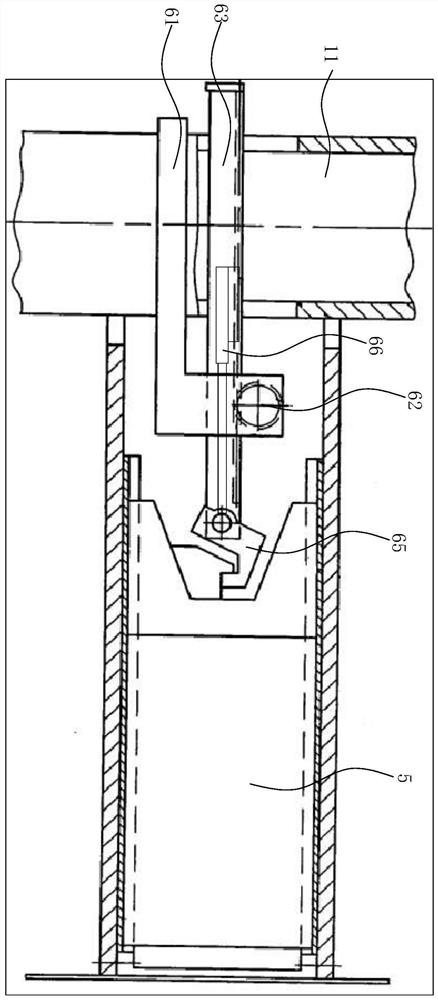

[0031] Such as Figure 1 to Figure 4 As shown, the value-added tax invoice storage cabinet is used to store value-added tax invoices. The value-added tax invoice has a two-dimensional code. The storage cabinet includes a cabinet body 1, a human-computer interaction device 2 installed on the cabinet body 1, and a The inner central shaft 11 and the control device 3, the multi-layer deposit layer 4 vertically and simultaneously rotatably arranged on the central shaft 11, the driving mechanism that drives each deposit layer 4 to rotate simultaneously, and the circumference is closely arranged on the deposit A plurality of invoice boxes 5 in the layer 4, a plurality of outlets 14 vertically arranged on the cabinet body 1 and corresponding to each deposit layer 4, arranged on the central axis 11 and corresponding to each outlet 14 to push out or A plurality of push-pull devices 6 that pull back the invoice box 5 inwards, a sliding door 15 and a first detection device 8 that can move...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com