Stock prediction method introducing investor preferences

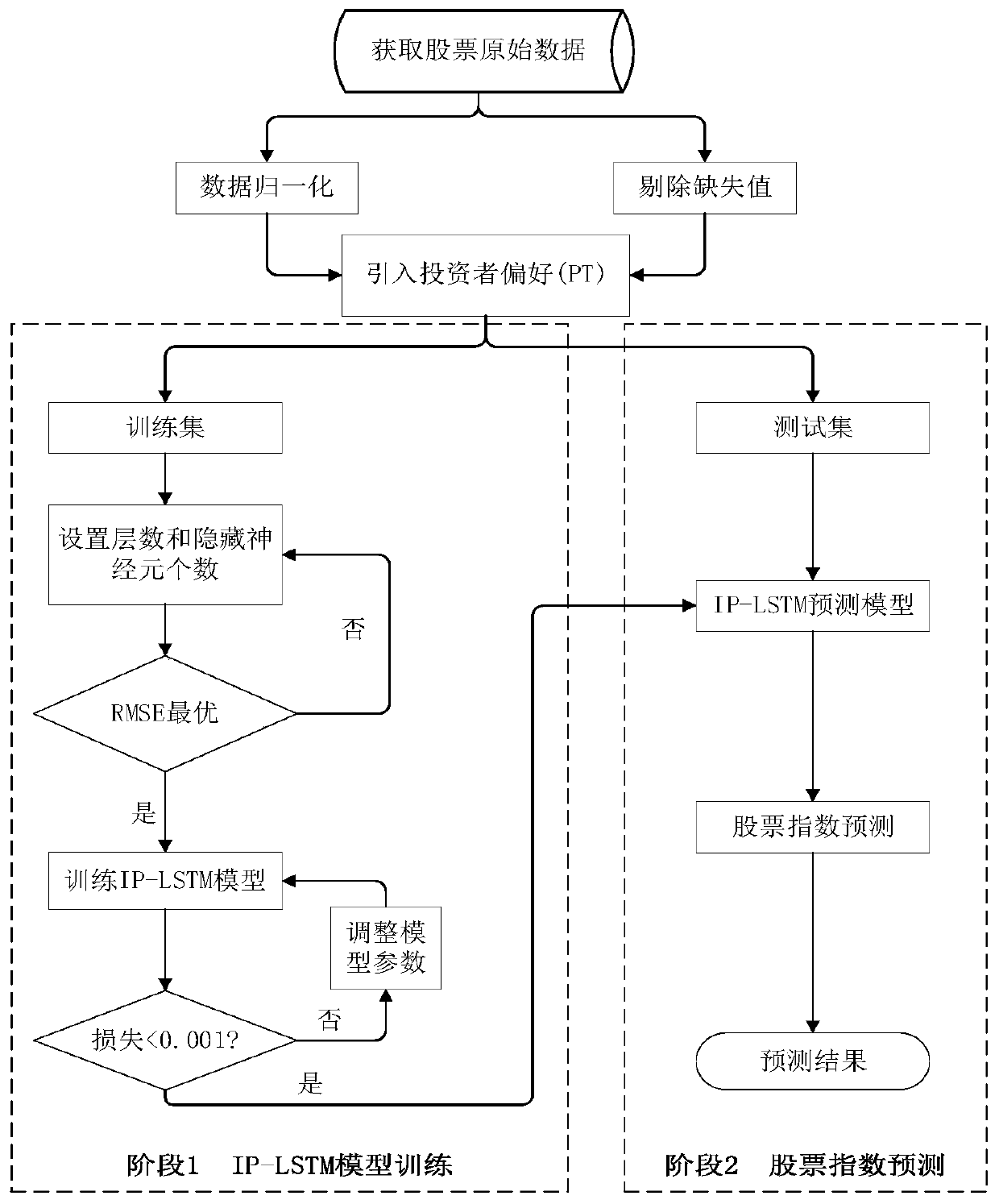

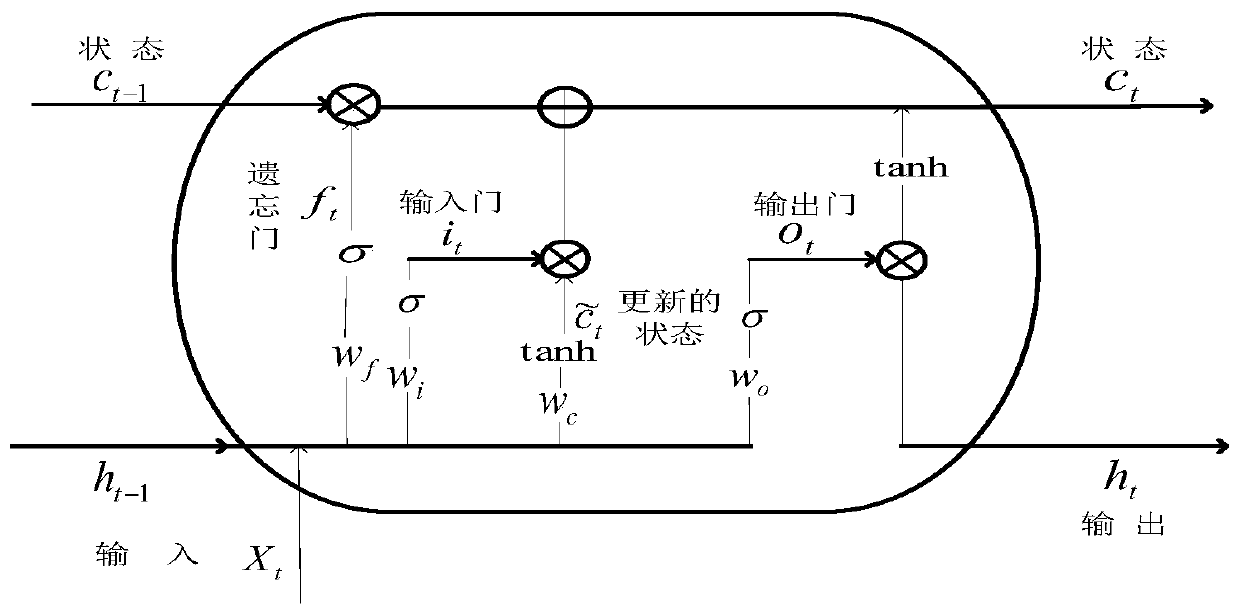

A forecasting method and investor's technology, applied in the field of stock investment, to avoid the problem of gradient disappearance and reduce computational complexity

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

[0044] Barberis pointed out that prospect theory plays an important role in analyzing the overall return rate of the stock market and explaining the trading behavior of financial assets. More and more research results show that prospect theory can better describe investor preferences and predict investor behavior. In view of this, the present invention is based on the prospect theory, and uses the value of the prospect theory to quantitatively describe the behavior preference of investors. Assume that investors assess the risk of stocks based on prospect theory and value stocks based on their past performance. Therefore, the value of prospect theory can be calculated based on the historical stock return rate, and this index can be used as a measure of investor behavior preference and used in the forecast of stock expected return.

[0045] S1. Calculate the theoretical value of the prospect by using the historical rate of return data of the stock;

[0046] The specific steps ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com