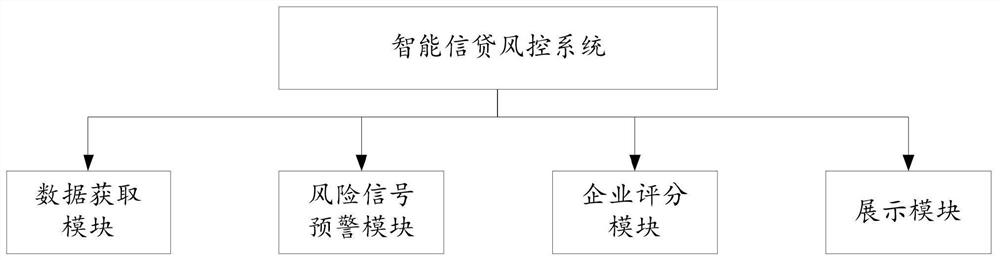

Intelligent credit risk control system based on multi-dimensional big data analysis

A big data and credit technology, applied in the field of credit risk control, can solve the problems of lack of risk prediction, inability to respond to enterprises and intuitive judgment, and achieve the effect of reducing the non-performing loan rate

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

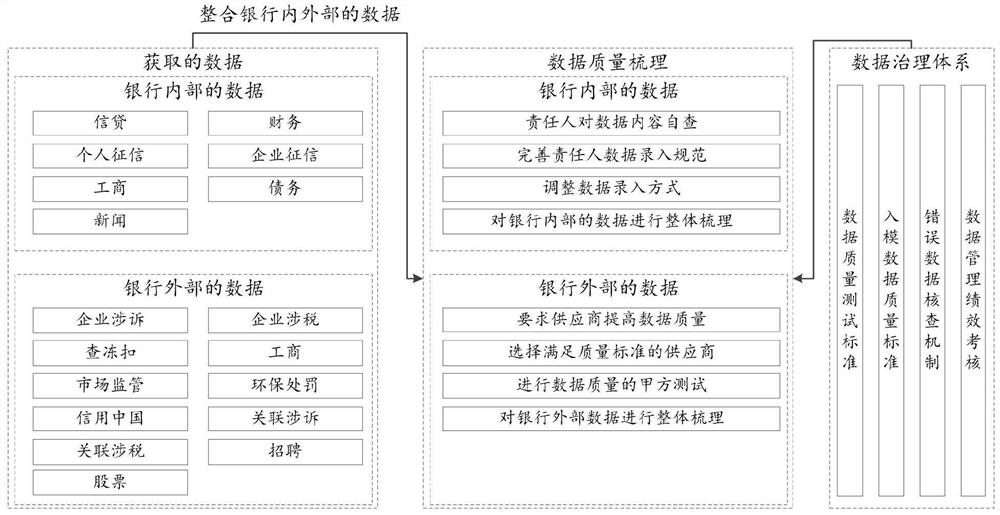

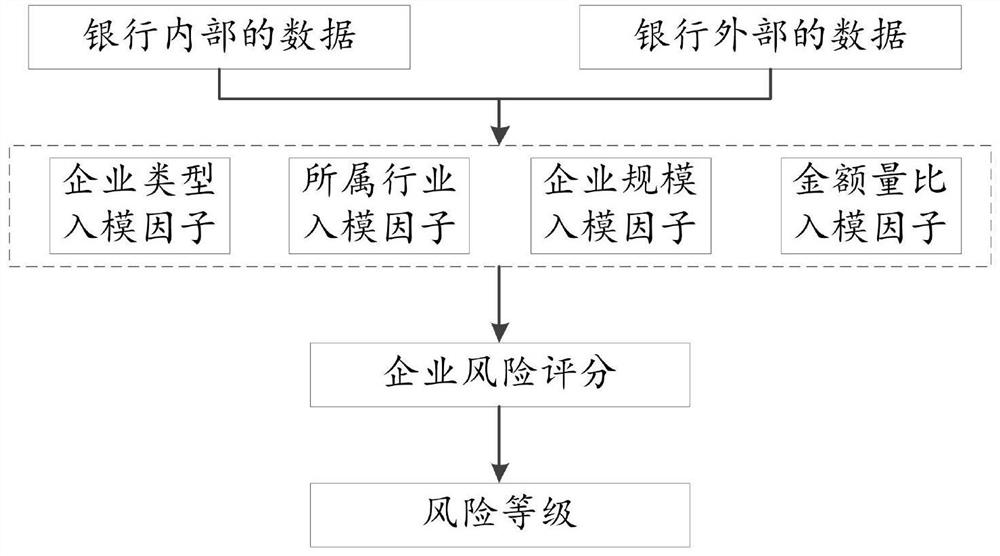

Method used

Image

Examples

Embodiment Construction

[0037] The specific implementation manner of the present invention will be described in more detail below with reference to schematic diagrams. The advantages and features of the present invention will be more apparent from the following description. It should be noted that all the drawings are in a very simplified form and use imprecise scales, and are only used to facilitate and clearly assist the purpose of illustrating the embodiments of the present invention.

[0038] In the following, if the methods described herein comprise a series of steps, the order of these steps presented herein is not necessarily the only order in which these steps can be performed, and some of the described steps may be omitted and / or some not described herein. Additional steps can be added to the method.

[0039] In the existing assessment methods, the risk assessment is generally based on the financial overdue behavior of individuals and enterprises that need credit and the collateral that can...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com