Scoring card modeling method

A modeling method and scorecard technology, applied in character and pattern recognition, instruments, finance, etc., can solve problems such as inability to adapt to external market changes, poor modeling model effect, and long scorecard time, and reduce manual modeling. Possibility of error, prevention of downtime, accurate scoring effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0019] Below in conjunction with specific embodiment and accompanying drawing, the present invention is further elaborated and illustrated:

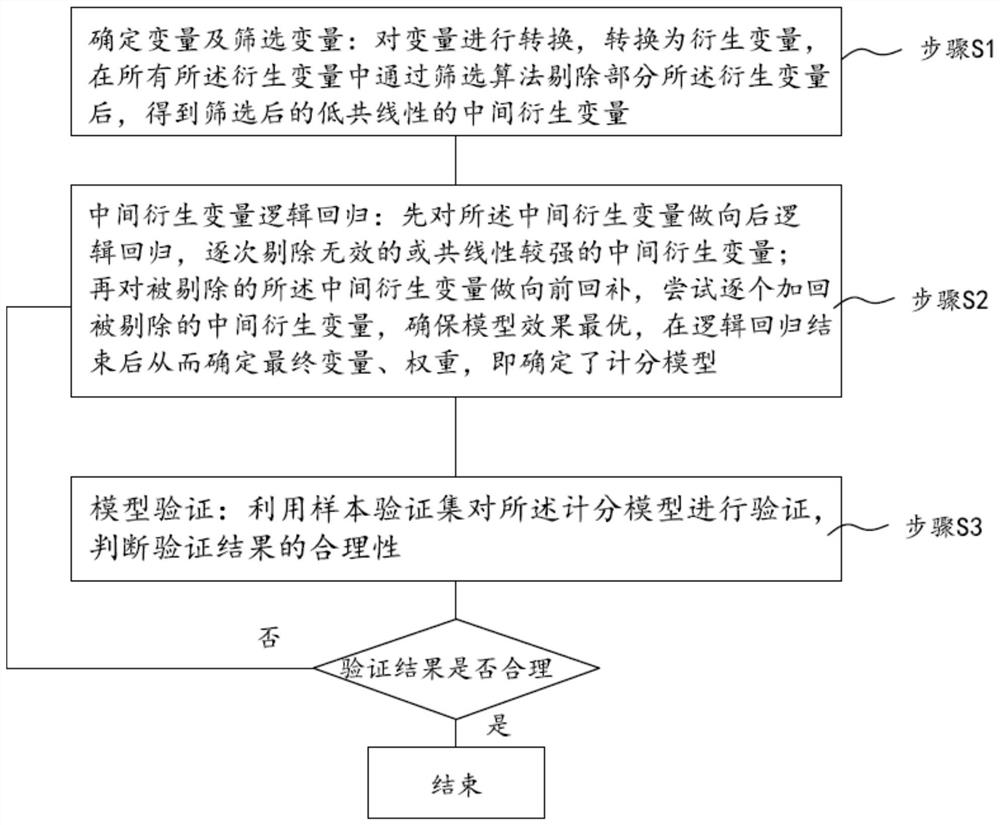

[0020] Please refer to figure 1 , a scoring card modeling method disclosed in the present invention. Its method is mainly used for assessing customers' consumption and credit repayment ability for banking financial institutions, and for risk assessment of credit financial institutions.

[0021] The specific scoring card modeling method includes:

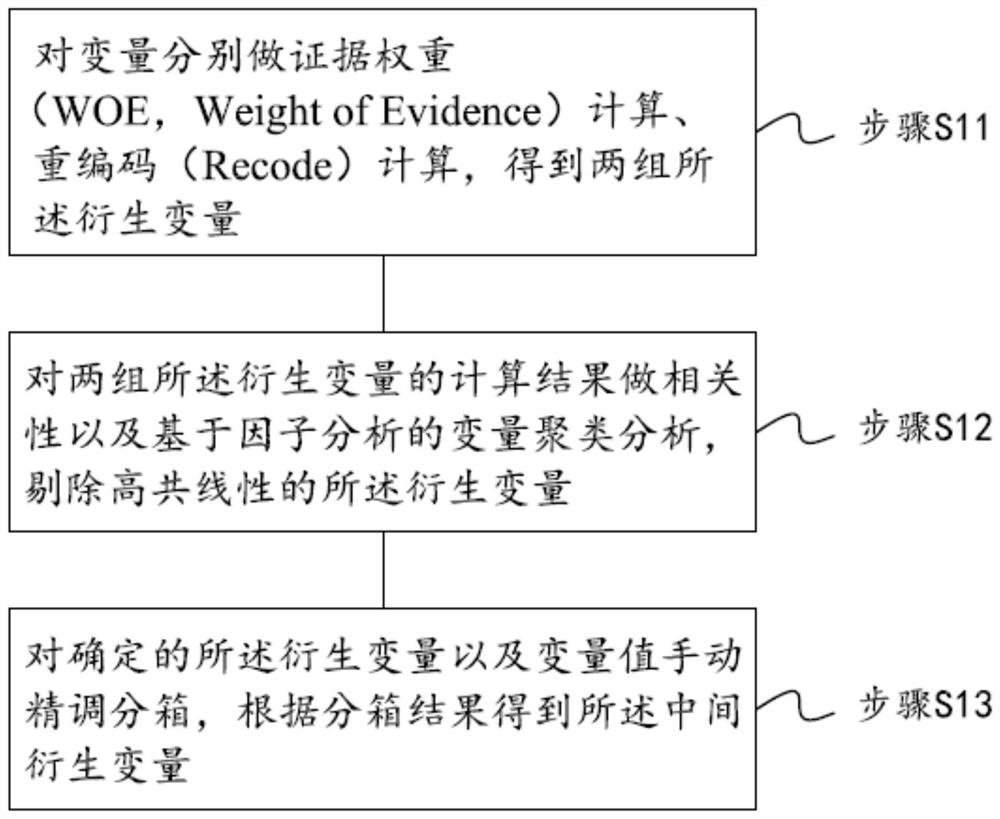

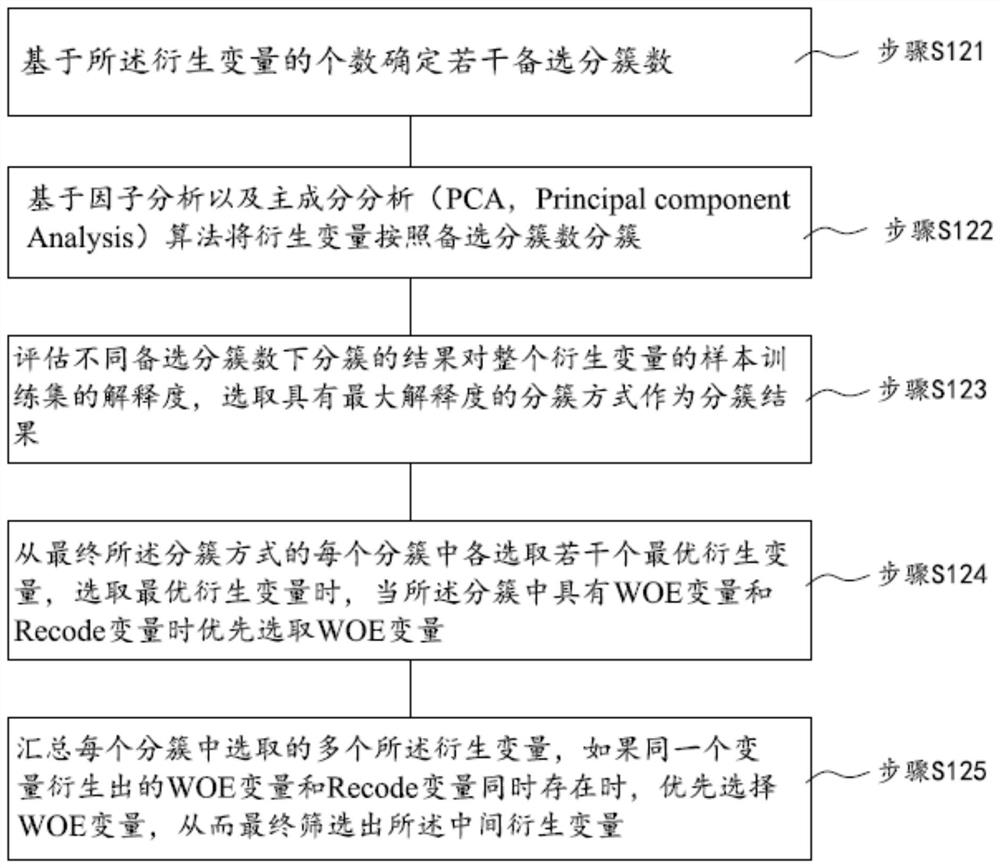

[0022] Step S1, determining variables and screening variables: transforming the variables into derived variables, and removing some of the derived variables from all the derived variables through a screening algorithm to obtain intermediate derivatives with high interpretability and low collinearity after screening. variable.

[0023] In this step, it is first necessary to explore and correct the data: count the sample training data, determine the variable types and distributions required in...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com