Method and system for facilitating opportunistic transactions

a technology of opportunistic transactions and auction systems, applied in the field of online opportunistic auction systems, can solve the problems of affecting the reliability of pricing information, and affecting the accuracy of opportunistic auctions

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

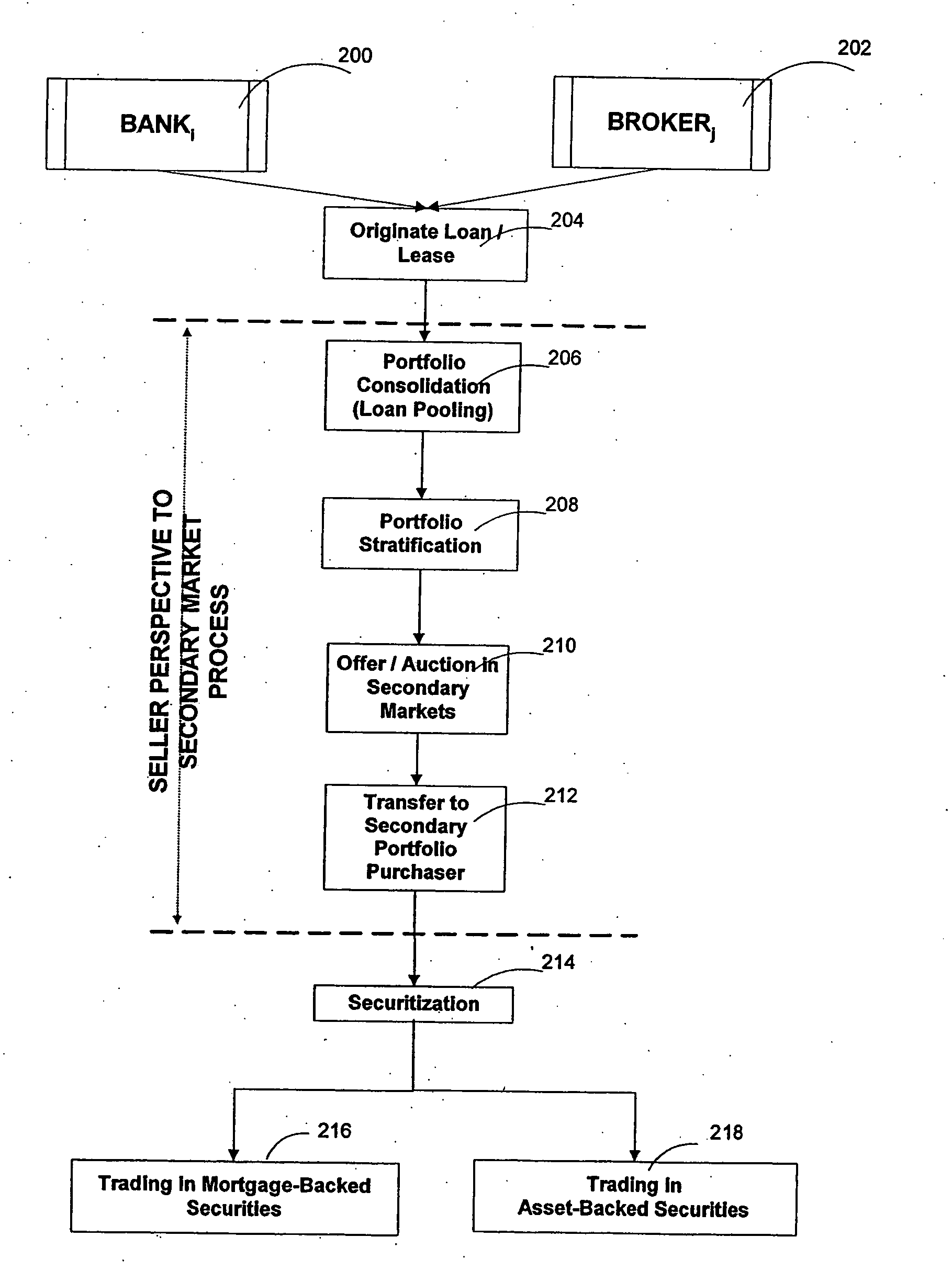

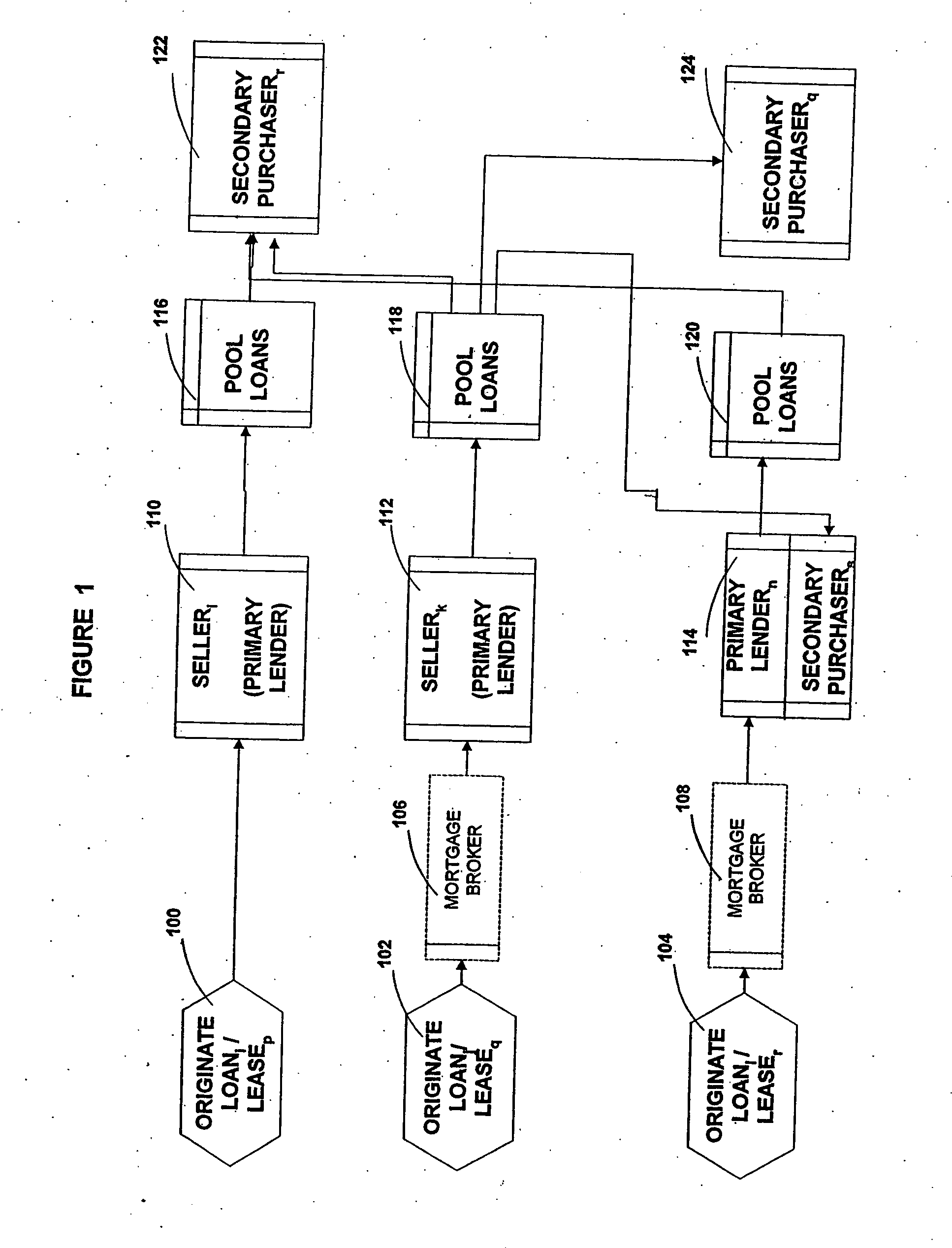

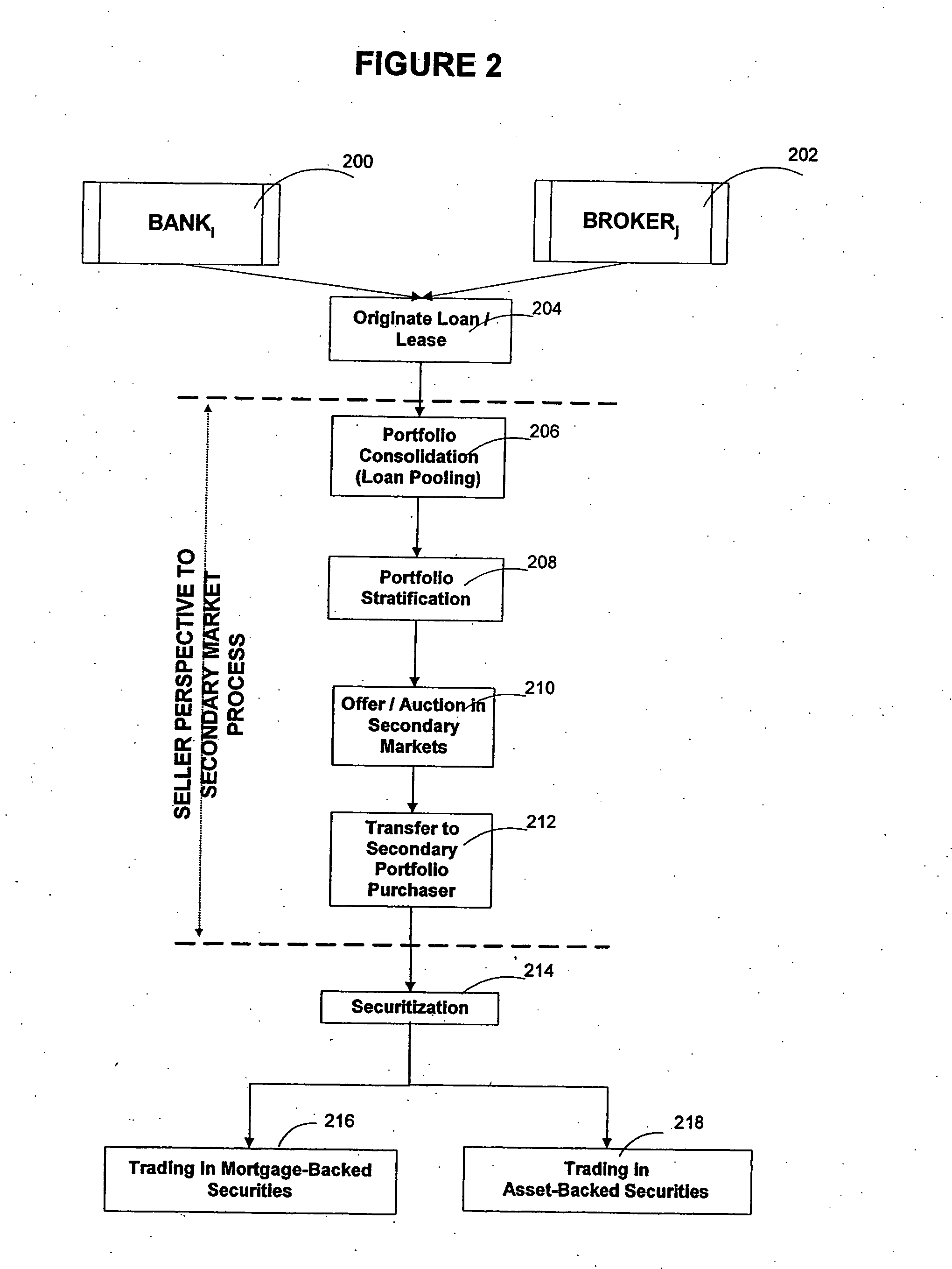

[0069] Exemplary embodiments of a secondary market object exchange of the invention will now be described with reference to the remaining Figures. The secondary market exchange utilizes a wide-area computer network such as the Internet which permits multiple remote users to access a central computer. All commands and requests sent to the exchange are handled by an automated computer based exchange manager, referred to interchangeably herein as the exchange, secondary exchange and the exchange manager.

[0070] FIG. 6 illustrates an exchange 604 which can independently or simultaneously be applied to numerous different secondary market objects including commercial real estate loans 608, automobile leases 610 (both individual 612 and corporate 614), consumer credit 616 (including direct financing and credit cards), home mortgages 618, equipment leasing 620, bad debt purchasing 626 (both individual and corporate 614), and student loans 628. As with mortgage bundles placed on the exchange,...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com