Investment advice systems and methods

a technology of investment advice and system, applied in the field of investment advice systems, can solve the problems of requiring time and limited financial advice systems, and achieve the effect of reducing the difficulty of reading and comprehending, and reducing the difficulty of current electronic security research reports

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

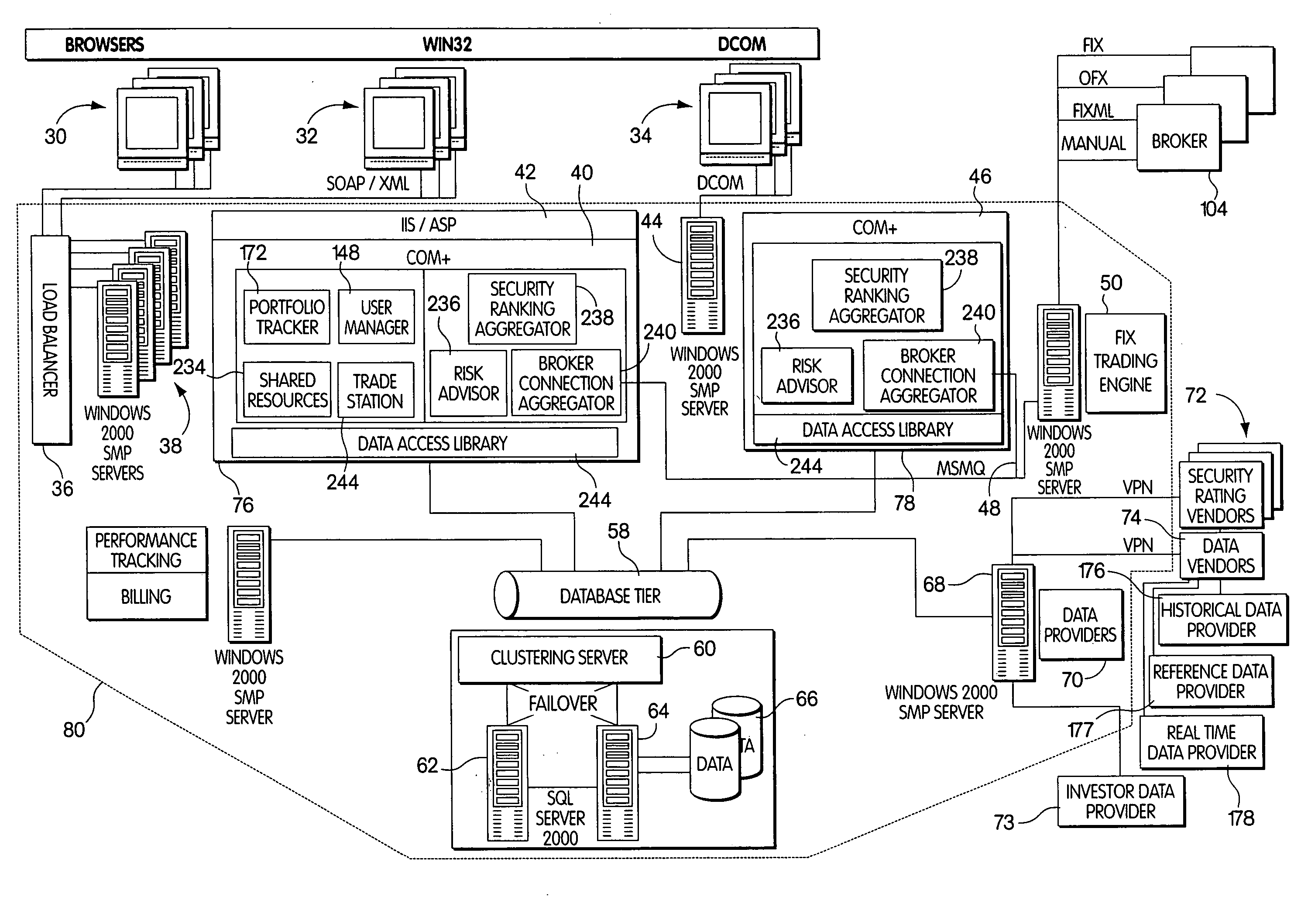

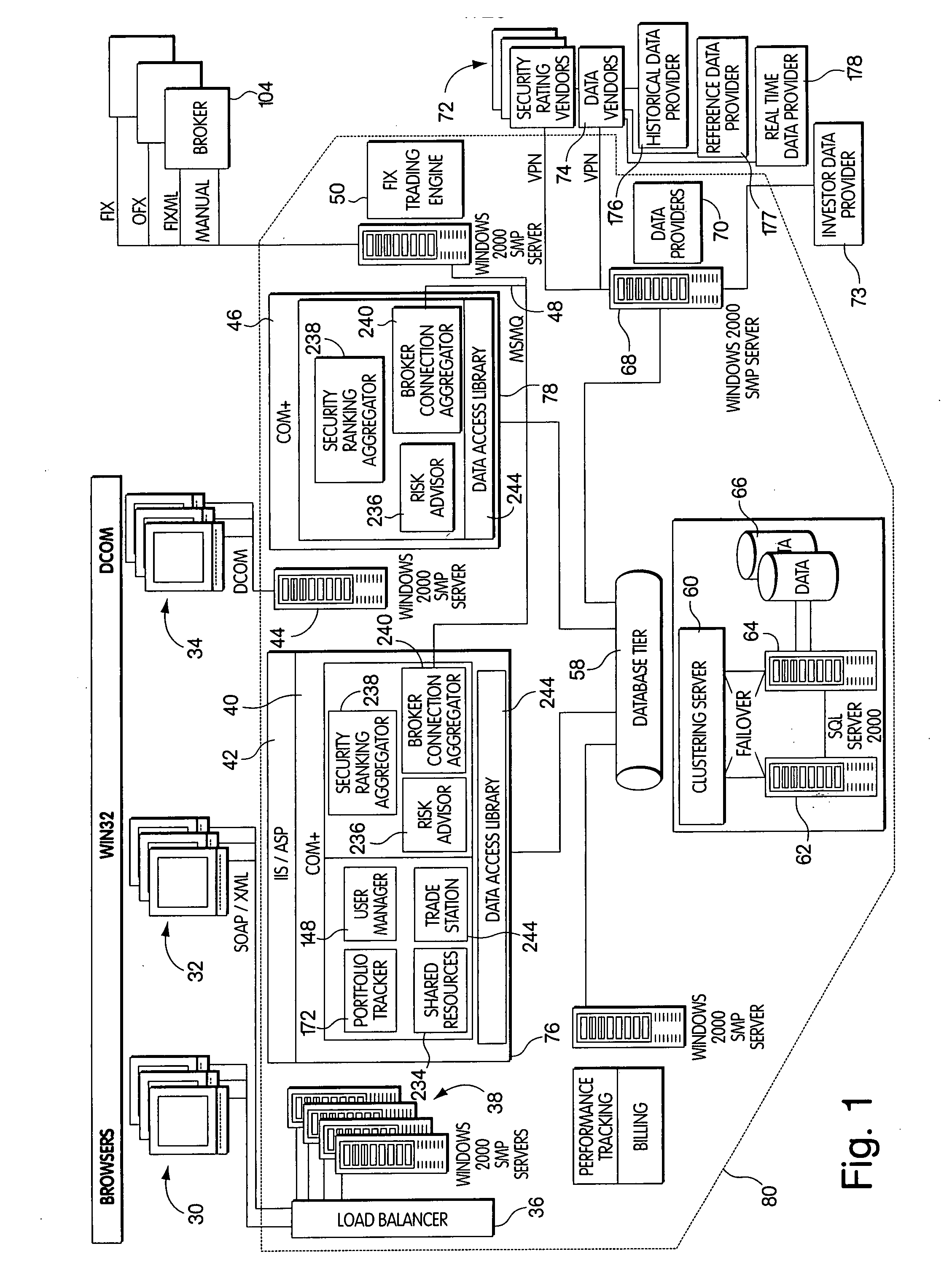

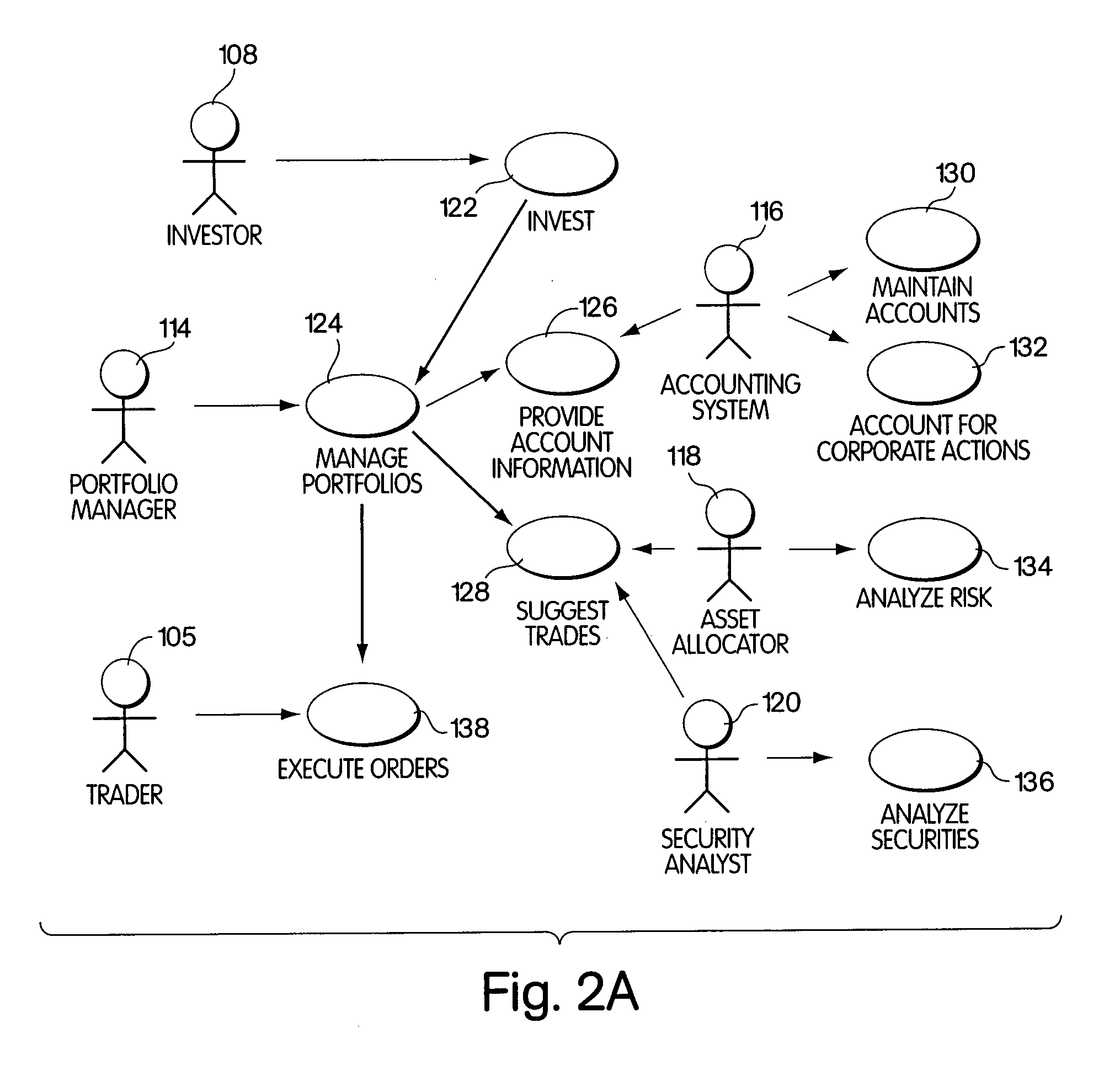

Method used

Image

Examples

Embodiment Construction

[0054] To achieve the goal of providing point-of-sale advice the invention encapsulates client risk information with the concept of a Benchmark Portfolio. Clients can chose to use benchmarks such as the S&P500 or the Wilshire 5000. In one embodiment, a client can also establish a customized benchmark that meets the client's risk / return objectives. The system then compares client portfolios against the selected standard in terms of diversification, factor exposure, the value-weighted average ranking and performance. A client portfolio generally consists of approximately 20 securities or more, selected from among the best securities as ranked by the advisor(s) picked by, or for, the client, bearing in mind the client's current holdings and tax position.

Regarding Expert Advise

[0055] In one embodiment, the invention presents stock recommendations from multiple sources. Each source supplies recommendations about future stock returns on a wide universe of stocks. The recommendations ar...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com