Systems and methods for selectively delaying financial transactions

a technology of financial transactions and selective delay, applied in the field of financial transactions, can solve problems such as merchants being susceptible to risk, merchants losing revenue, and sometimes not paying the funds promised by check drafts

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

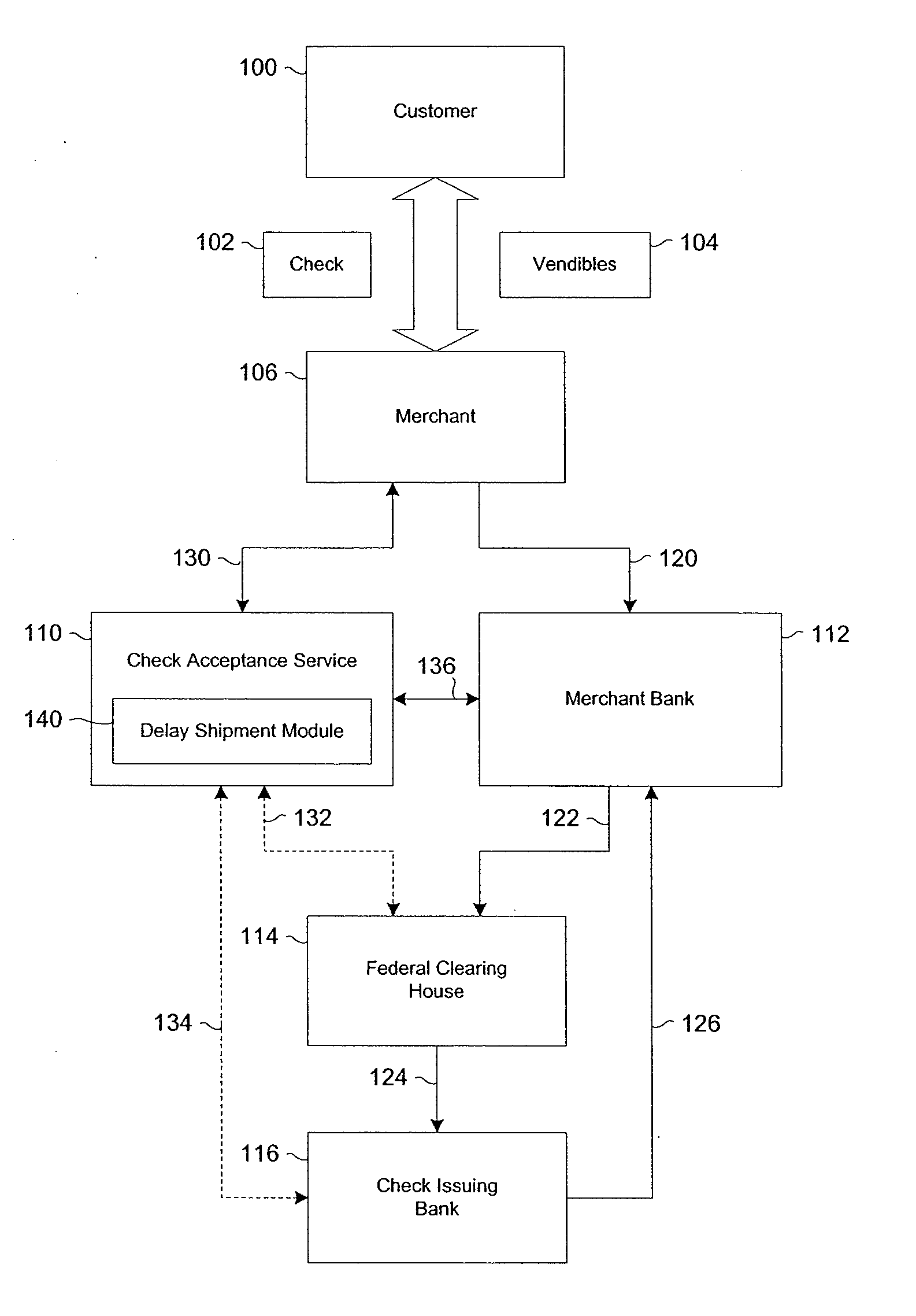

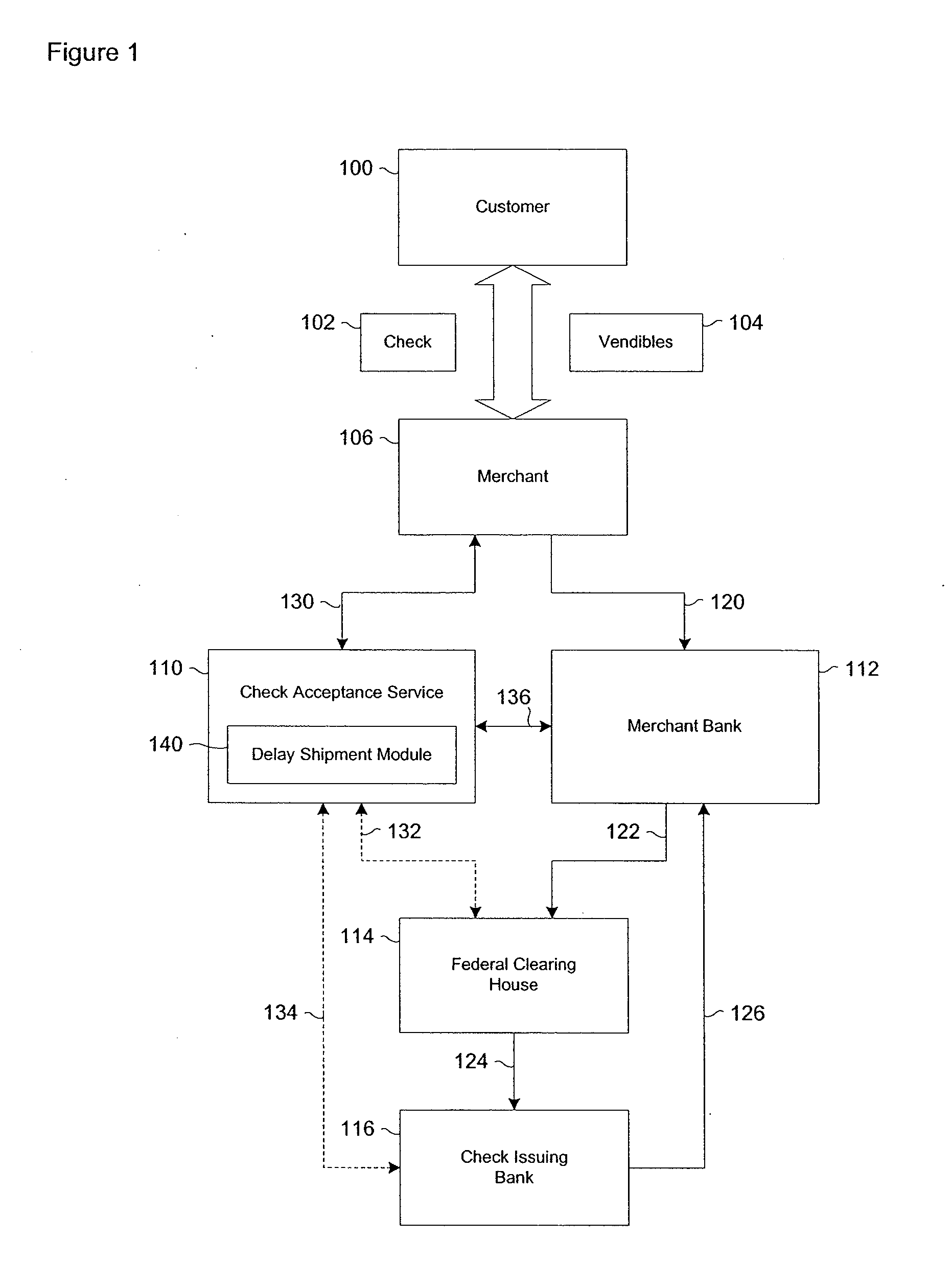

[0031] Reference will now be made to the drawings wherein like numerals refer to like parts throughout. FIG. 1 illustrates one embodiment of a financial transaction involving a promissory check draft. In this particular embodiment, a customer 100 provides the check draft 102 to a merchant 106 or service entity in exchange for vendibles 104, such as a service or merchandise. The check draft 102 may be accepted and deposited into a merchant bank 112 without receiving any external authorization as indicated by path 120.

[0032] In one aspect, the check draft 102 is electronically transferred through a clearing process, wherein the merchant bank 112 transfers the check draft 102 to a federal clearing house (FCH) 114 as indicated by path 122. In turn, the federal clearing house 114 transfers the check draft 102 to the check issuing bank 116 as indicated by path 124. In one aspect, if the check draft 102 is determined to be valid by the check issuing bank 116, then the check “clears” and t...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com