Method for providing insurance protection against the loss of group health insurance coverage in the event of a disability of a plan participant

a group health insurance and disability insurance technology, applied in the field of group health insurance protection, can solve the problems of reducing the net amount available to employees, materially affecting a significant portion of the american populace, and affecting etc., to solve the substantial cost problems and losses, and improve the ability of disabled participants to maintain cobra coverage. , the effect of increasing the price of healthcar

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

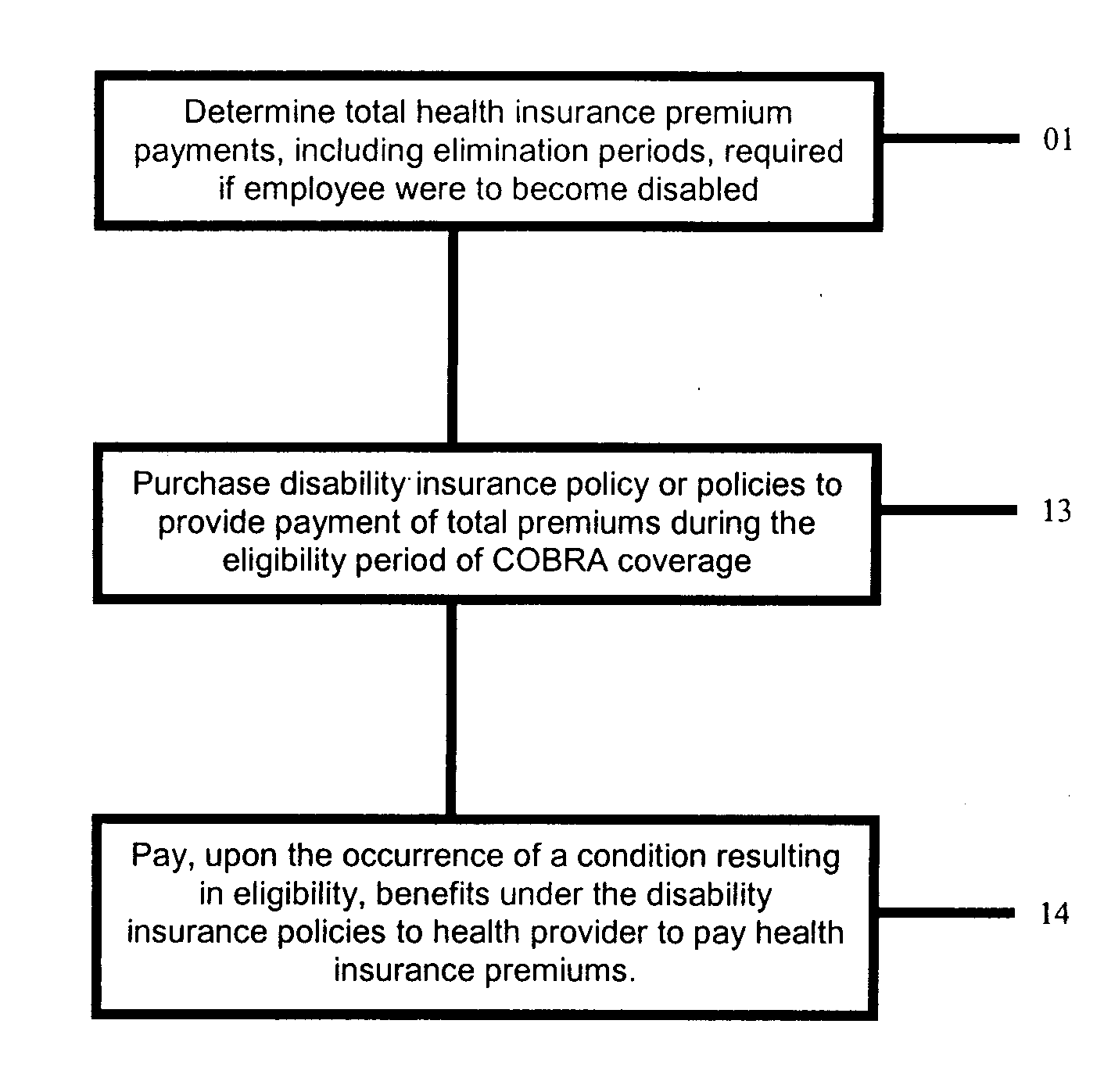

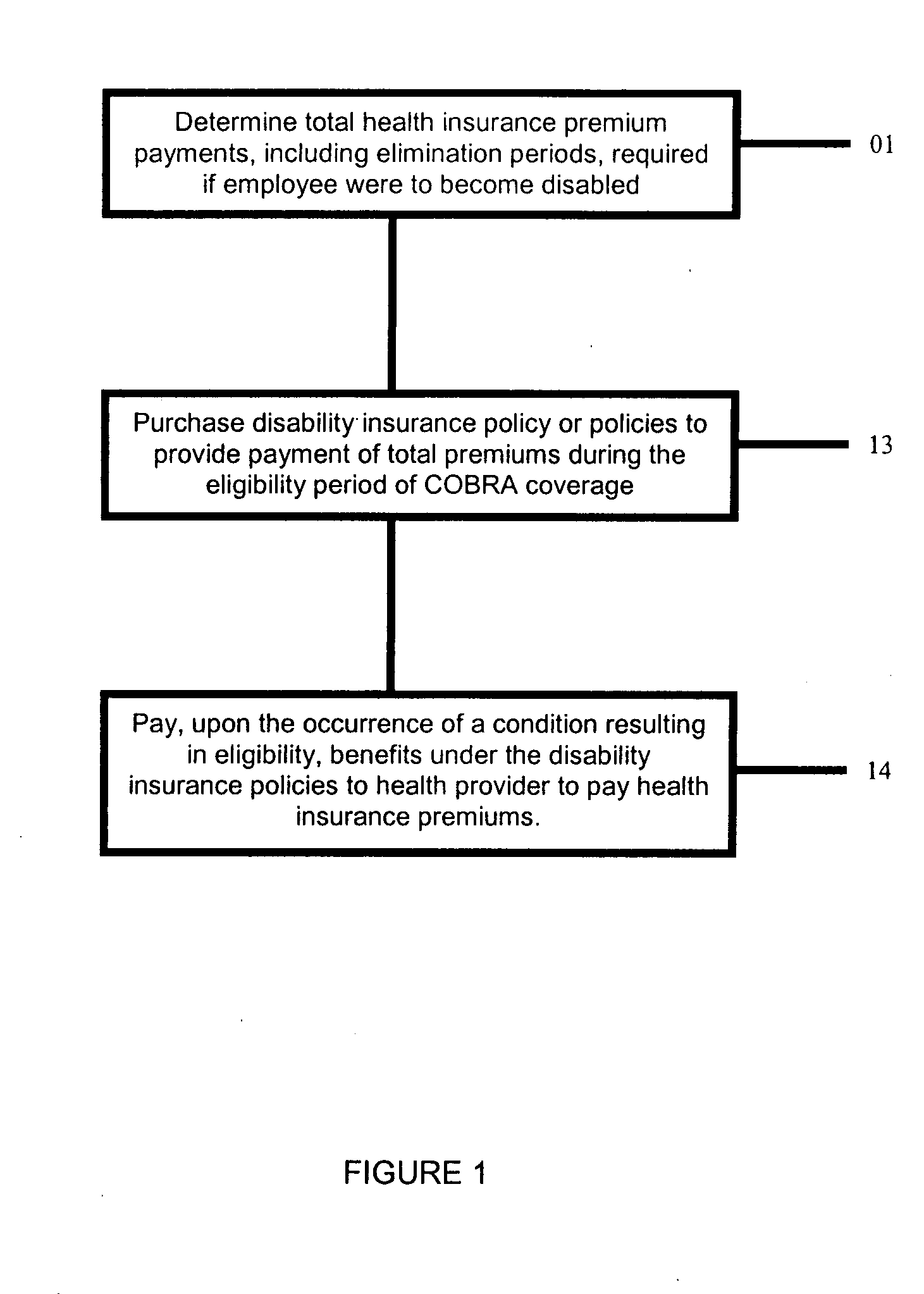

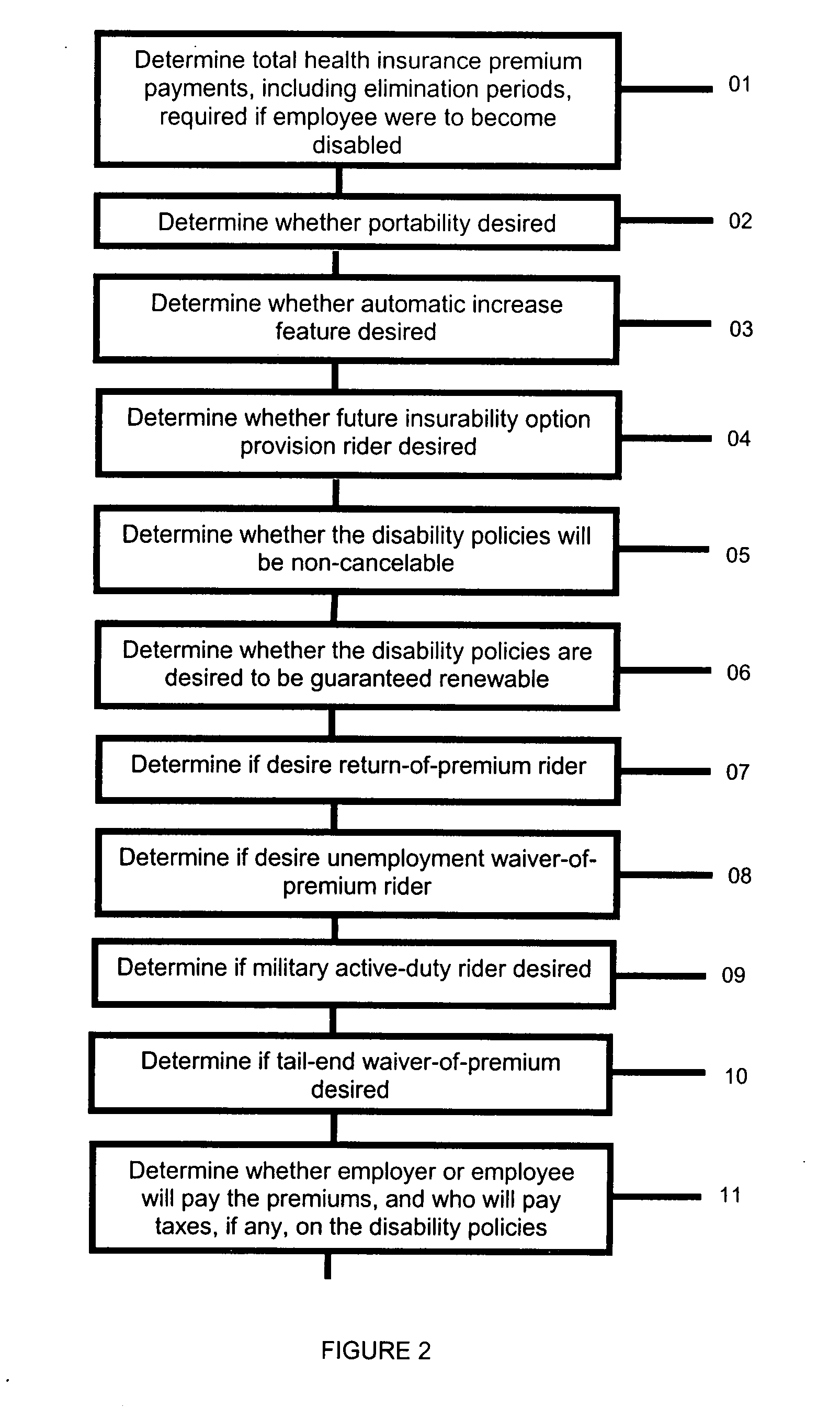

[0028]The method provides for the making of substitute continuing periodic payments of premiums to the health insurance provider for an employer-sponsored group health insurance policy under COBRA during a period in which the participant is disabled. The method comprises the steps of: (i) determining the amount of the total periodic premiums required to pay for continuing coverage of said employer-sponsored group health insurance policy if a participant becomes eligible under COBRA due to disability, taking into account elimination periods; (ii) purchasing, with funds paid periodically by the employer or the participant, or a combination of both, one or a plurality of disability insurance policies that will provide continuing substitute payment of the health insurance premiums during the eligibility period for COBRA coverage; and (iii) paying, upon the occurrence of a condition resulting in eligibility under the specifications of the disability insurance policy or policies, benefits...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com