Patents

Literature

33 results about "Insurability" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Insurability can mean either whether a particular type of loss (risk) can be insured in theory, or whether a particular client is insurable for by a particular company because of particular circumstance and the quality assigned by an insurance provider pertaining to the risk that a given client would have.

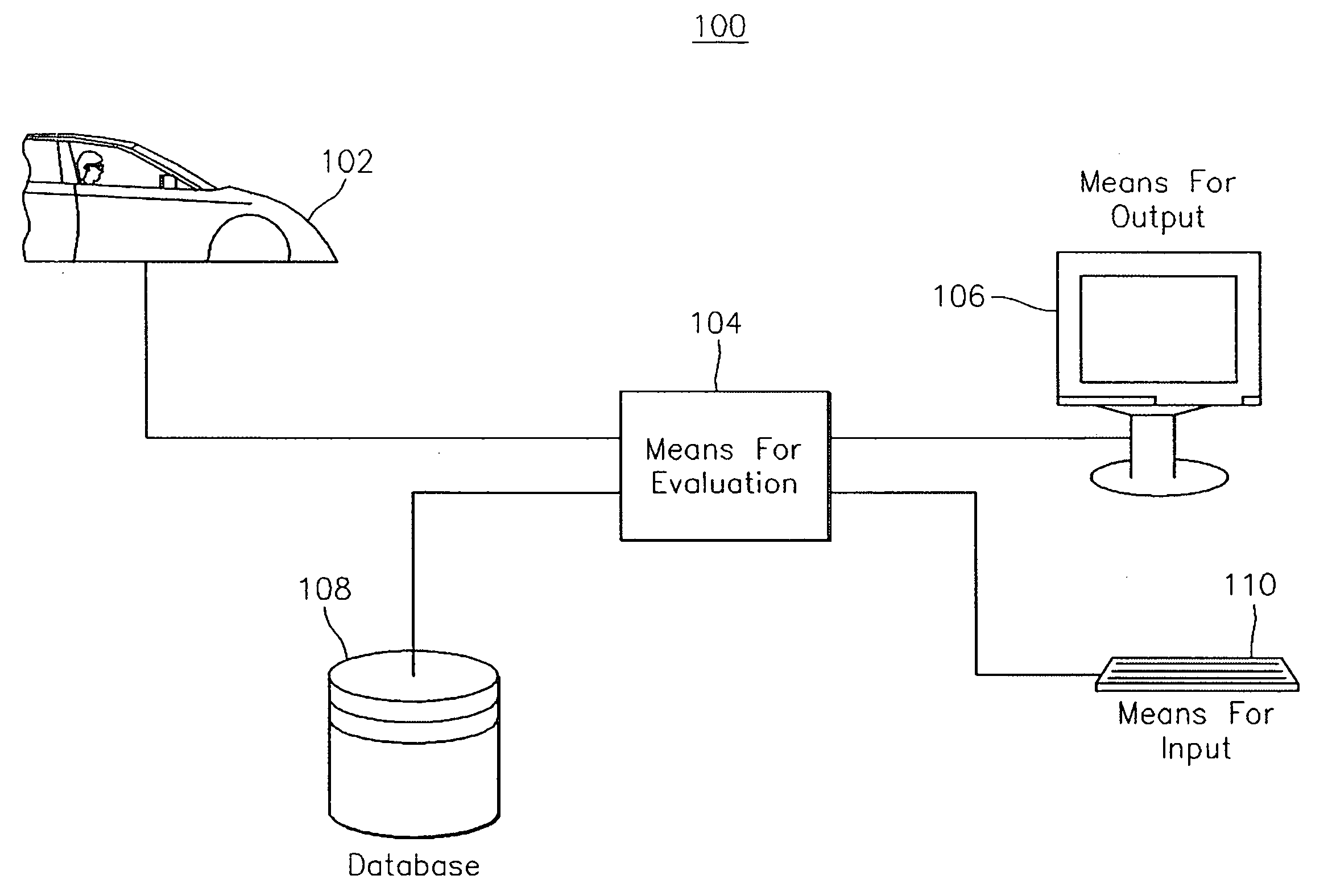

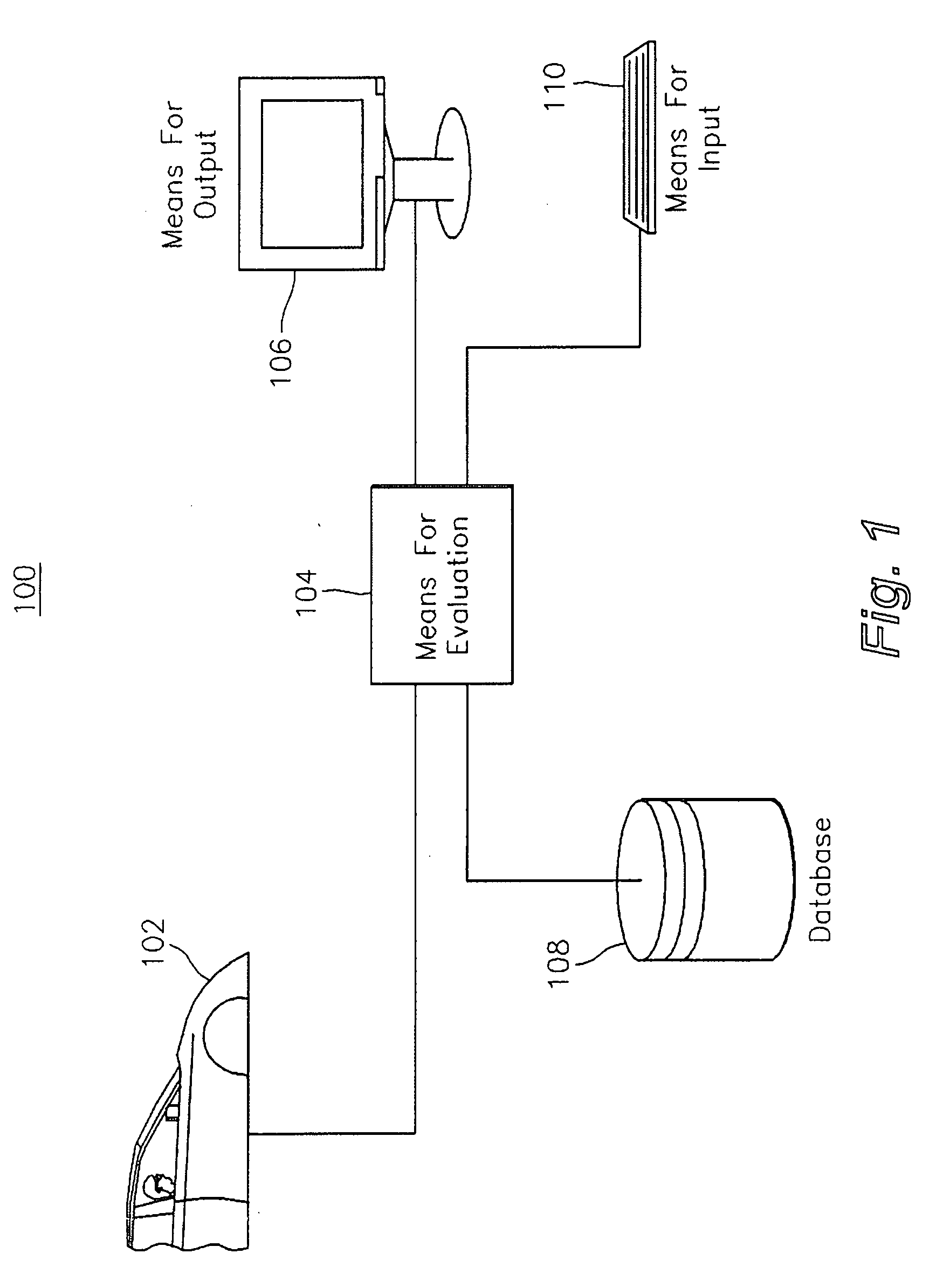

Driving simulator and method of evaluation of driver competency

A method determines insurability of drivers. The method includes simulating a driving experience for a driver in an interactive driving simulator. Performance of the driver in the simulated driving experience is evaluated to generate a driving proficiency score for the driver. The method also includes evaluating insurability of the driver based on the driving proficiency score. A system also determines insurability of drivers.

Owner:BURCH LEON A

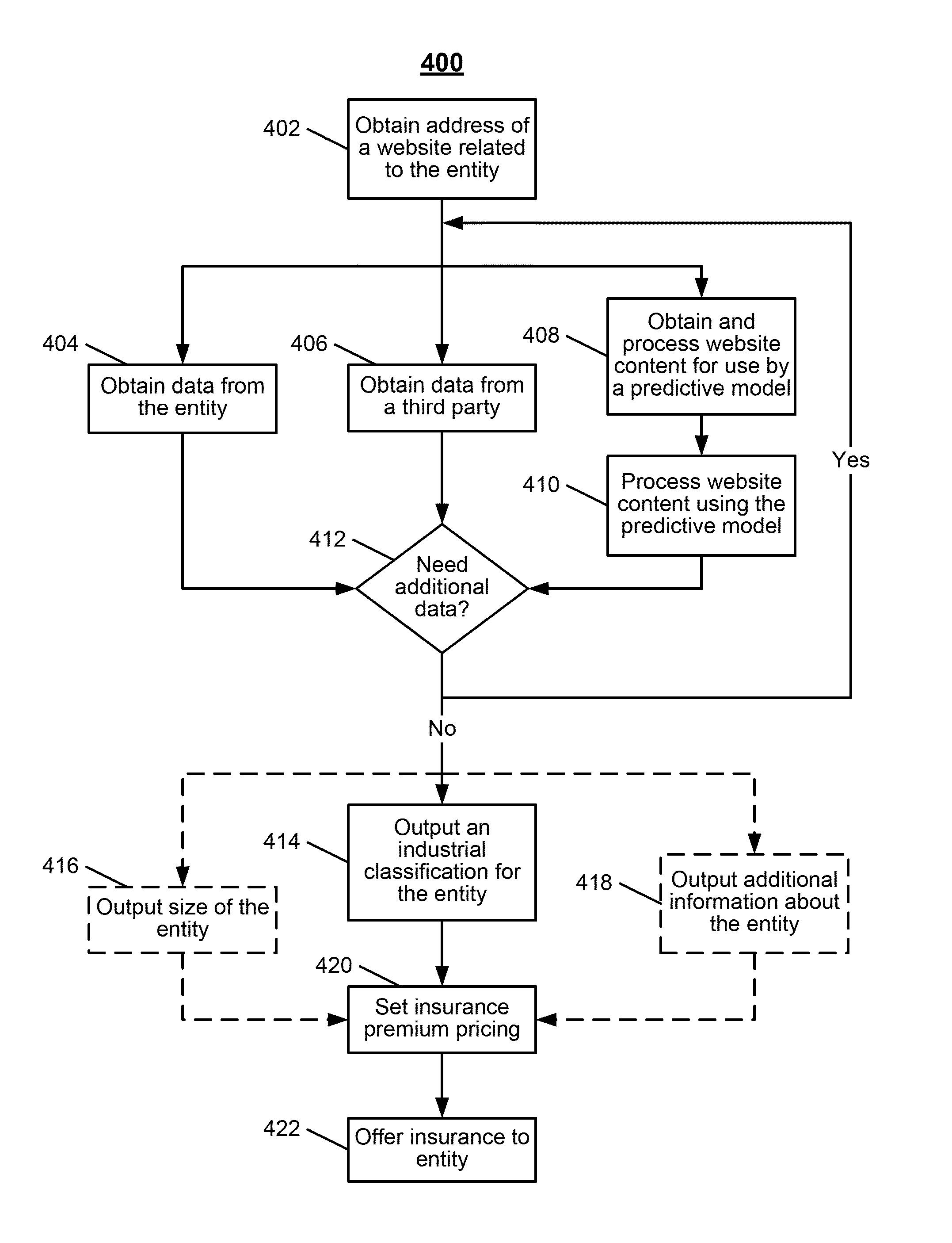

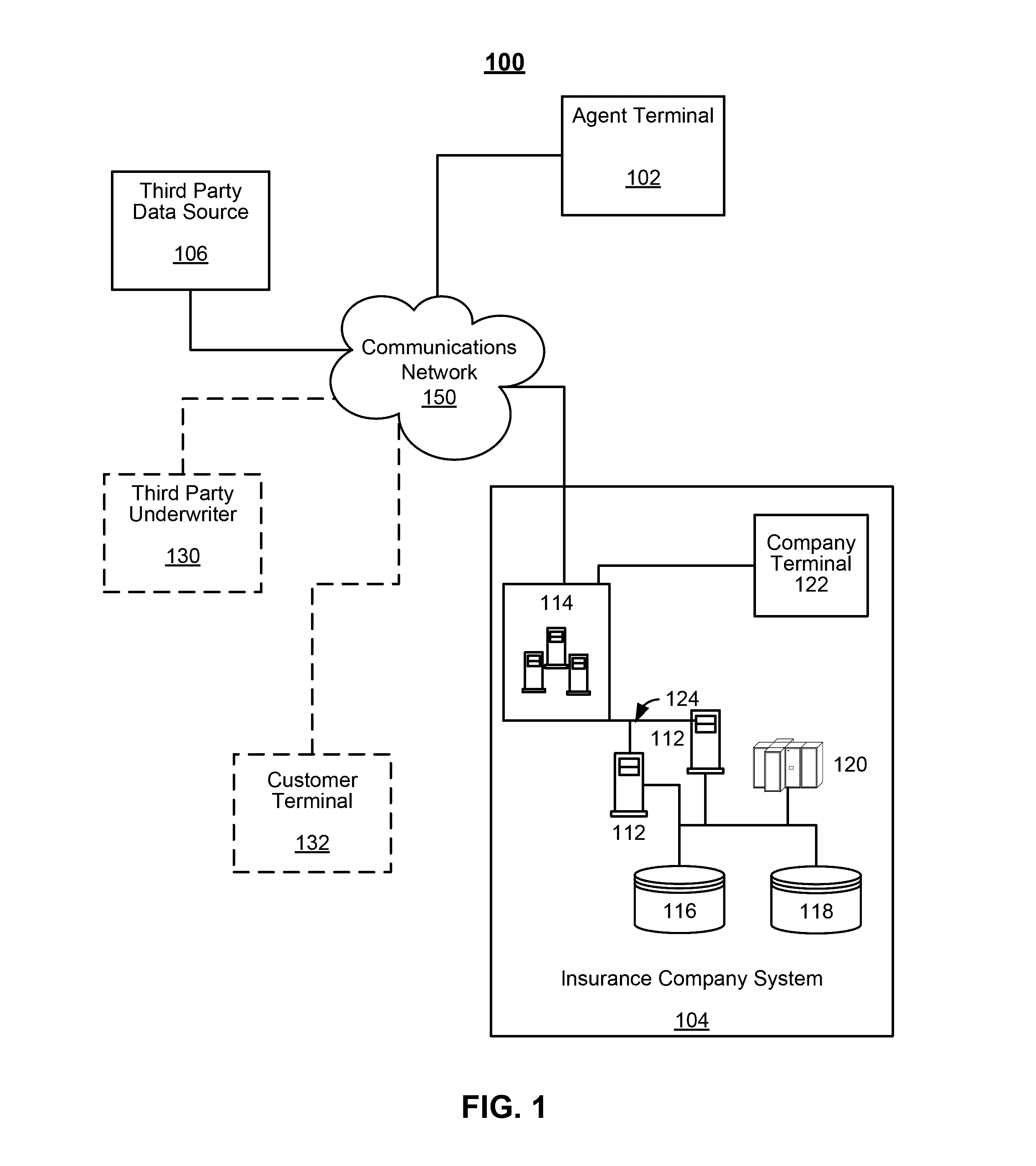

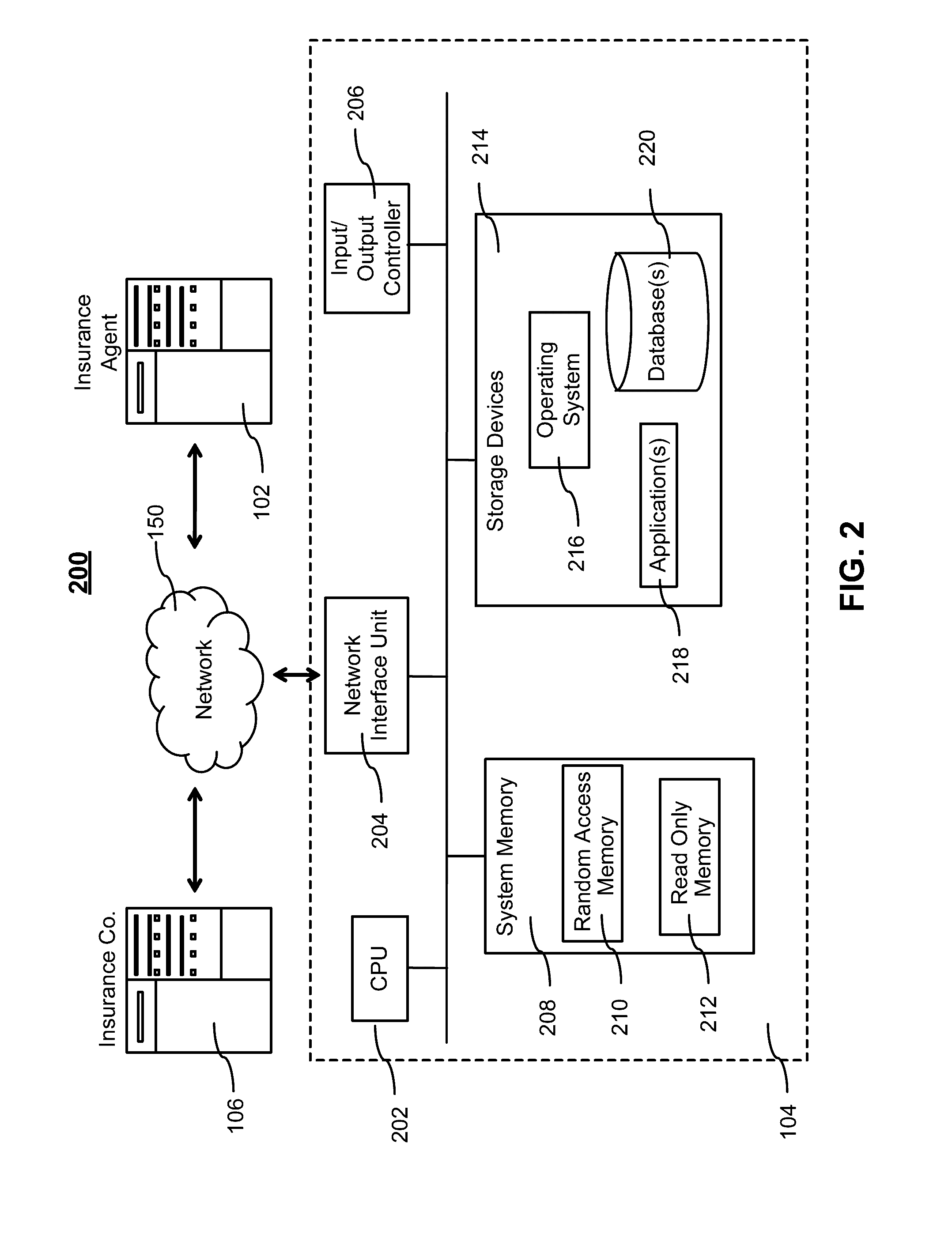

System and method for determination of insurance classification of entities

ActiveUS20140129261A1Accurately determineSolve the real problemFinanceEnsemble learningInsurabilityData science

Systems and methods are disclosed herein for determining an insurance evaluation based on an industrial classification. The system may be configured to receive an electronic resource address relating to an entity, access data relating to the entity using the electronic resource address, tokenize the data, generate token counts based on the tokenized data; and apply at least one computerized predictive model to the token counts to determine one or more classifications associated with the entity. The system may further be configured to conduct evaluations of insurability, fraud determinations and other processes using the determined classification(s).

Owner:HARTFORD FIRE INSURANCE

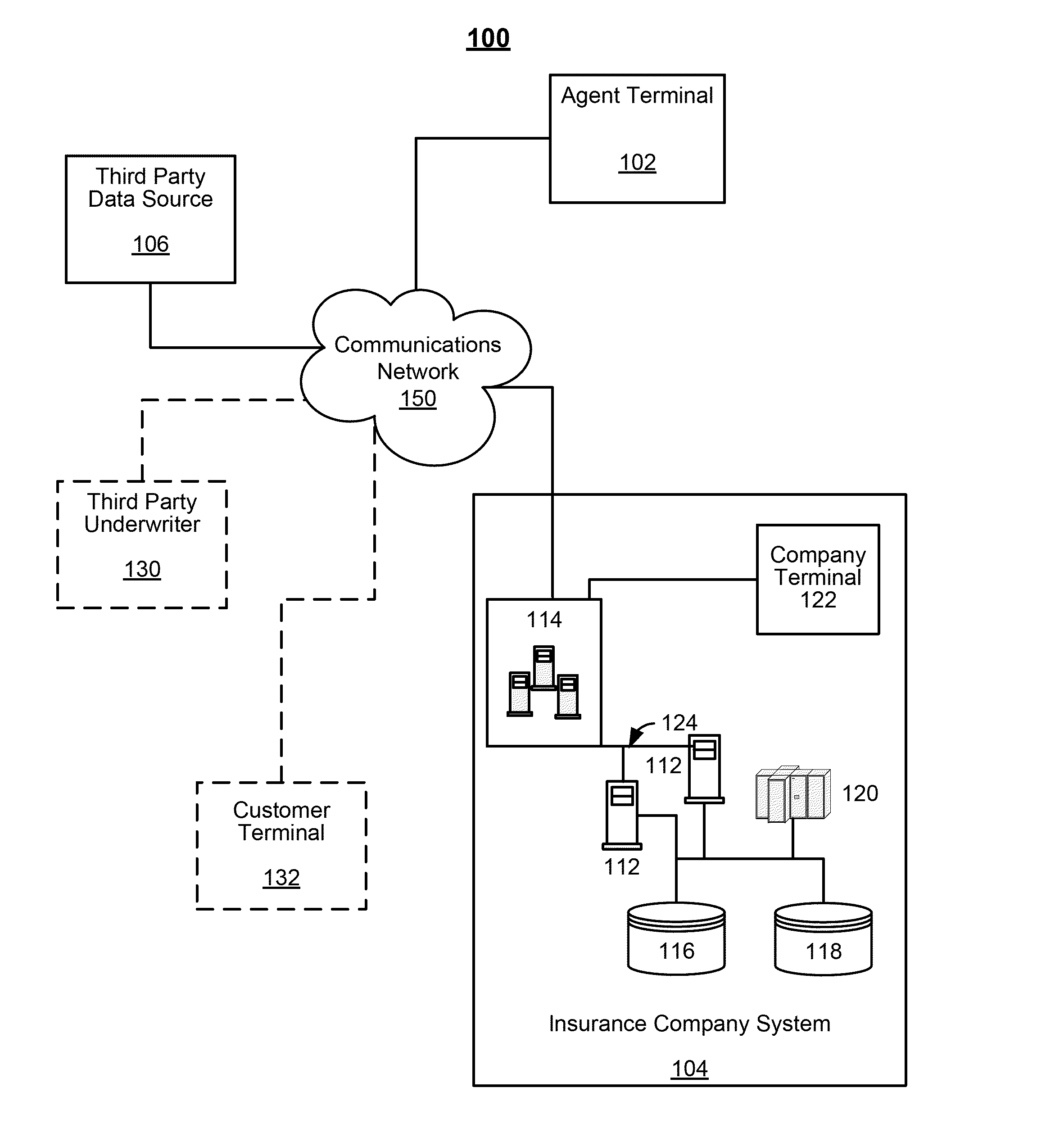

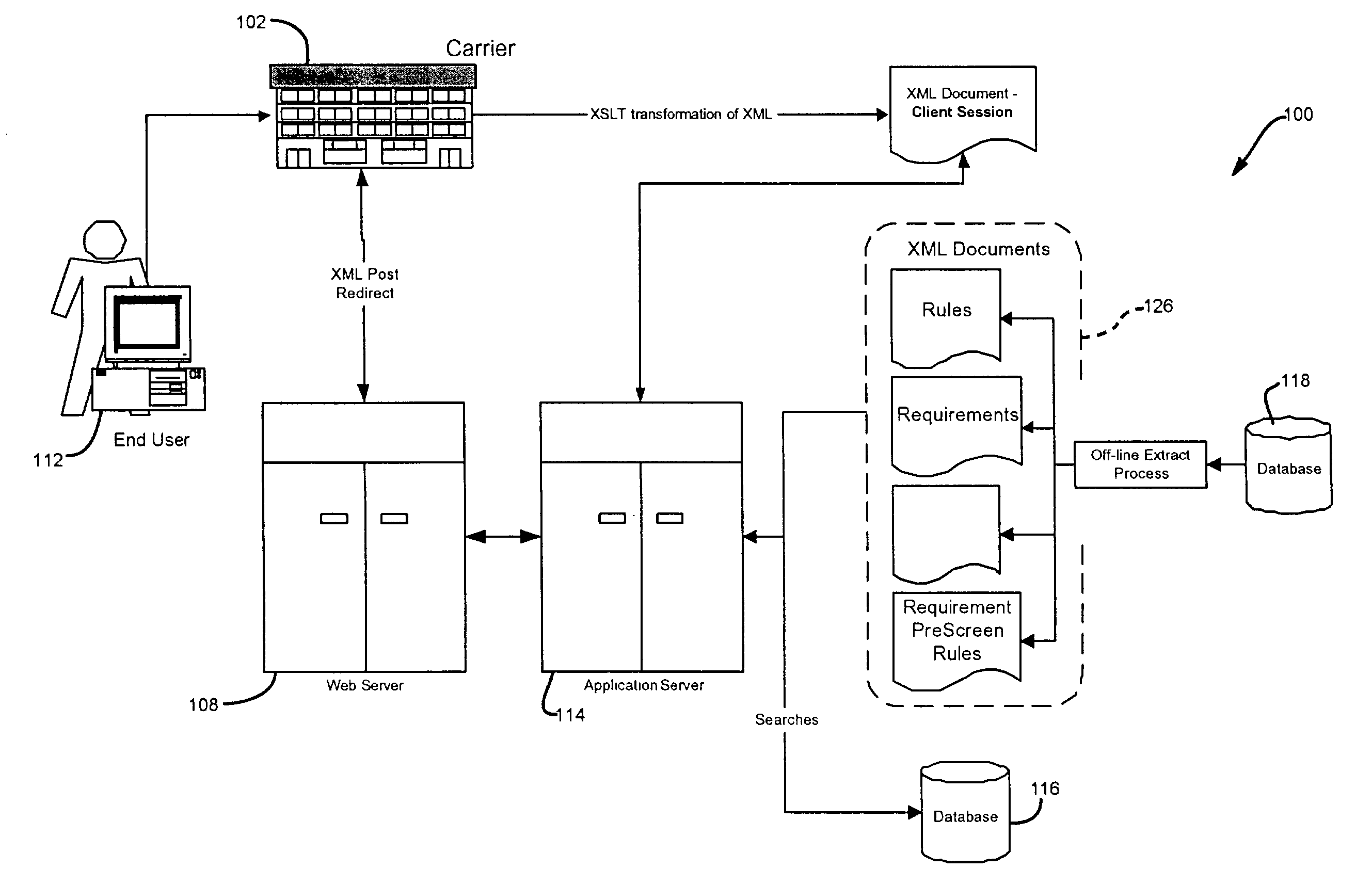

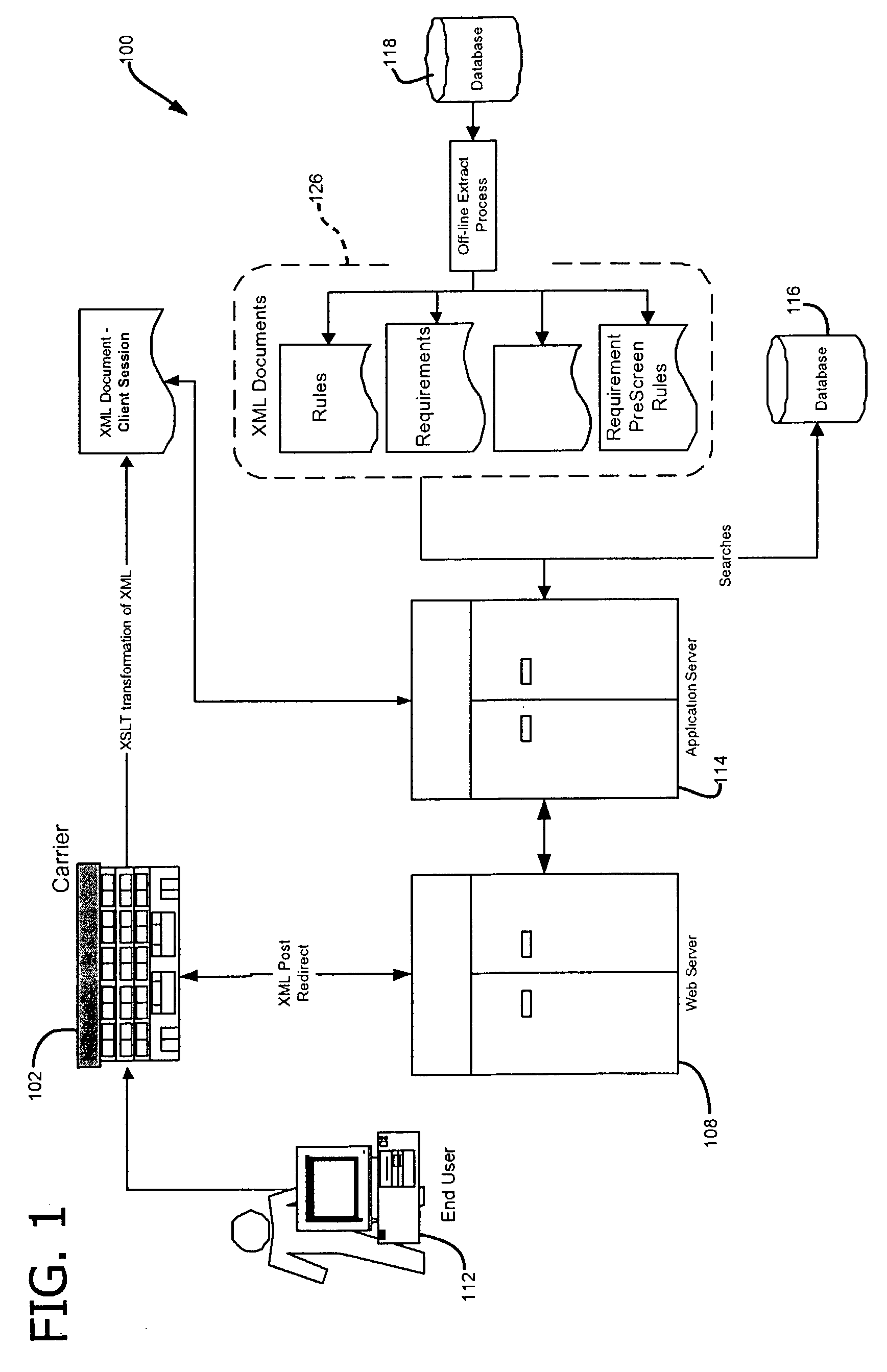

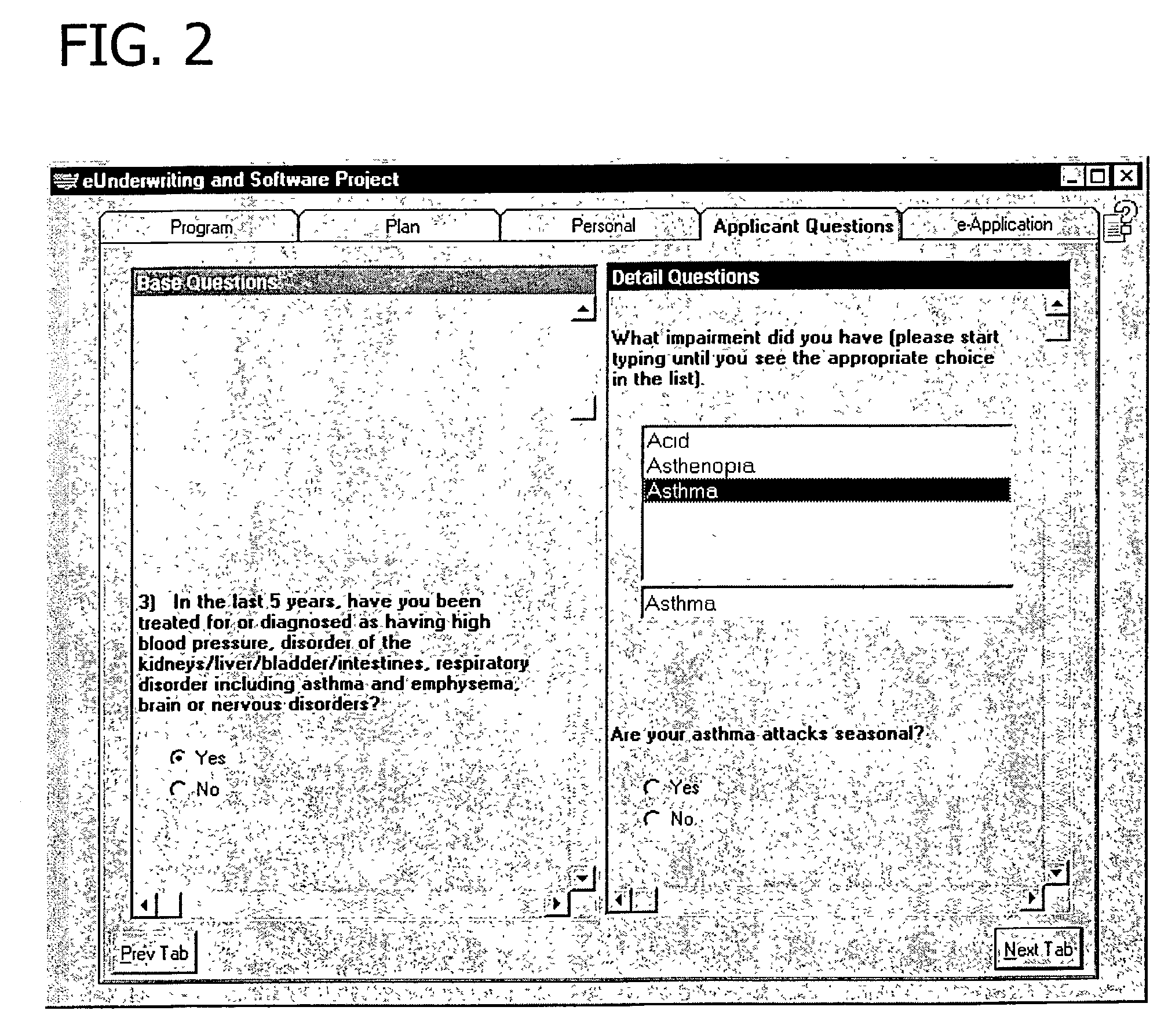

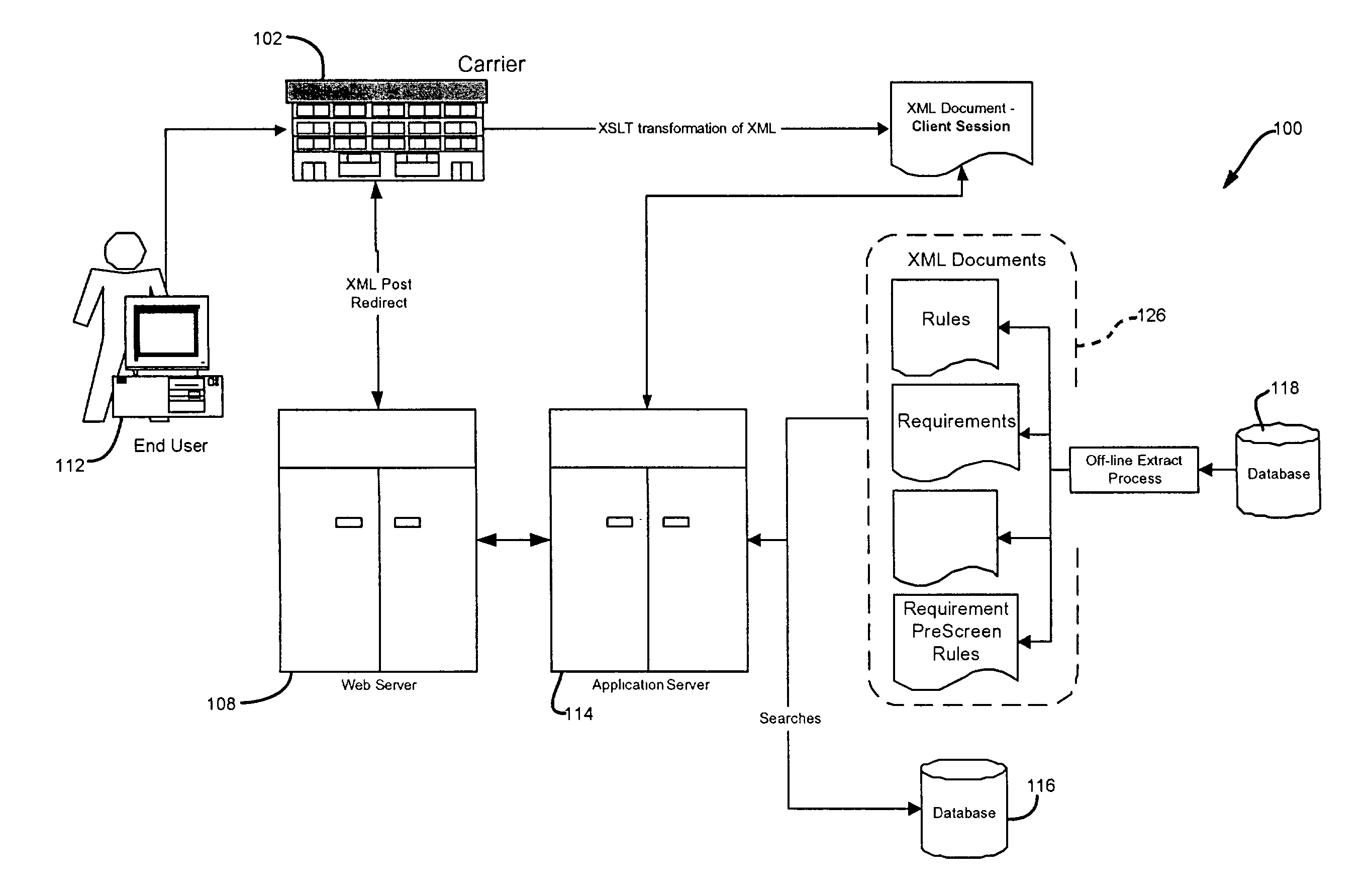

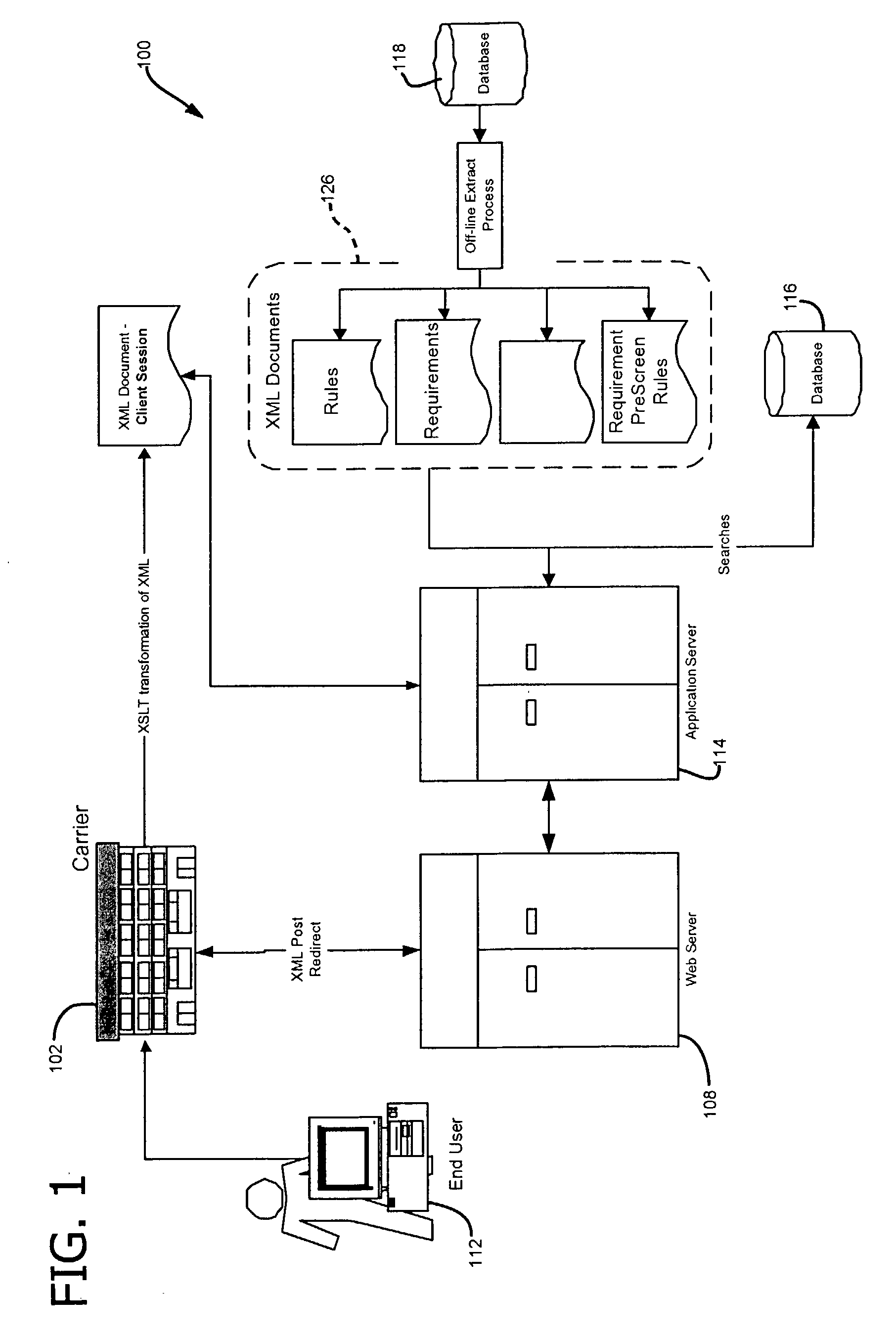

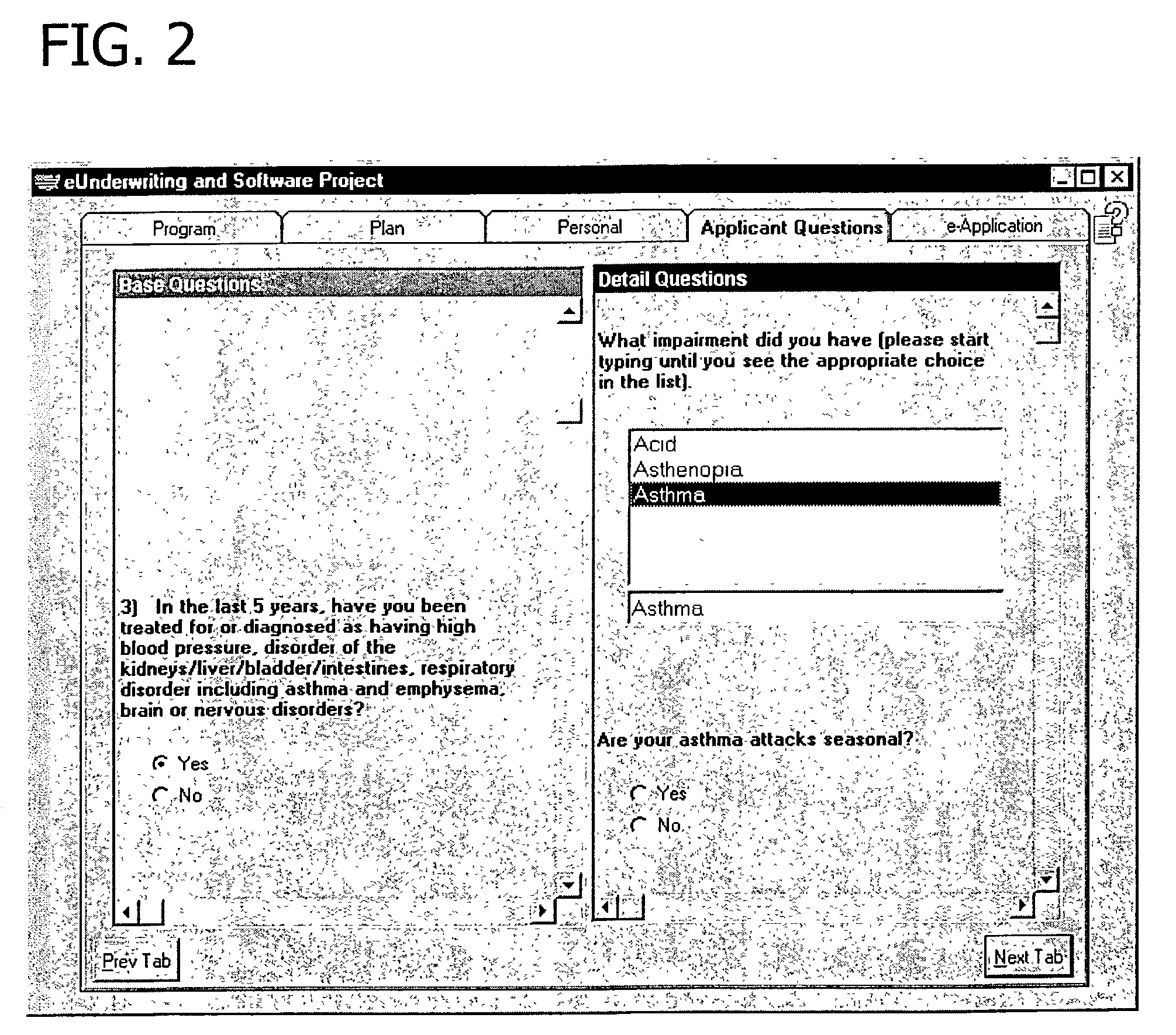

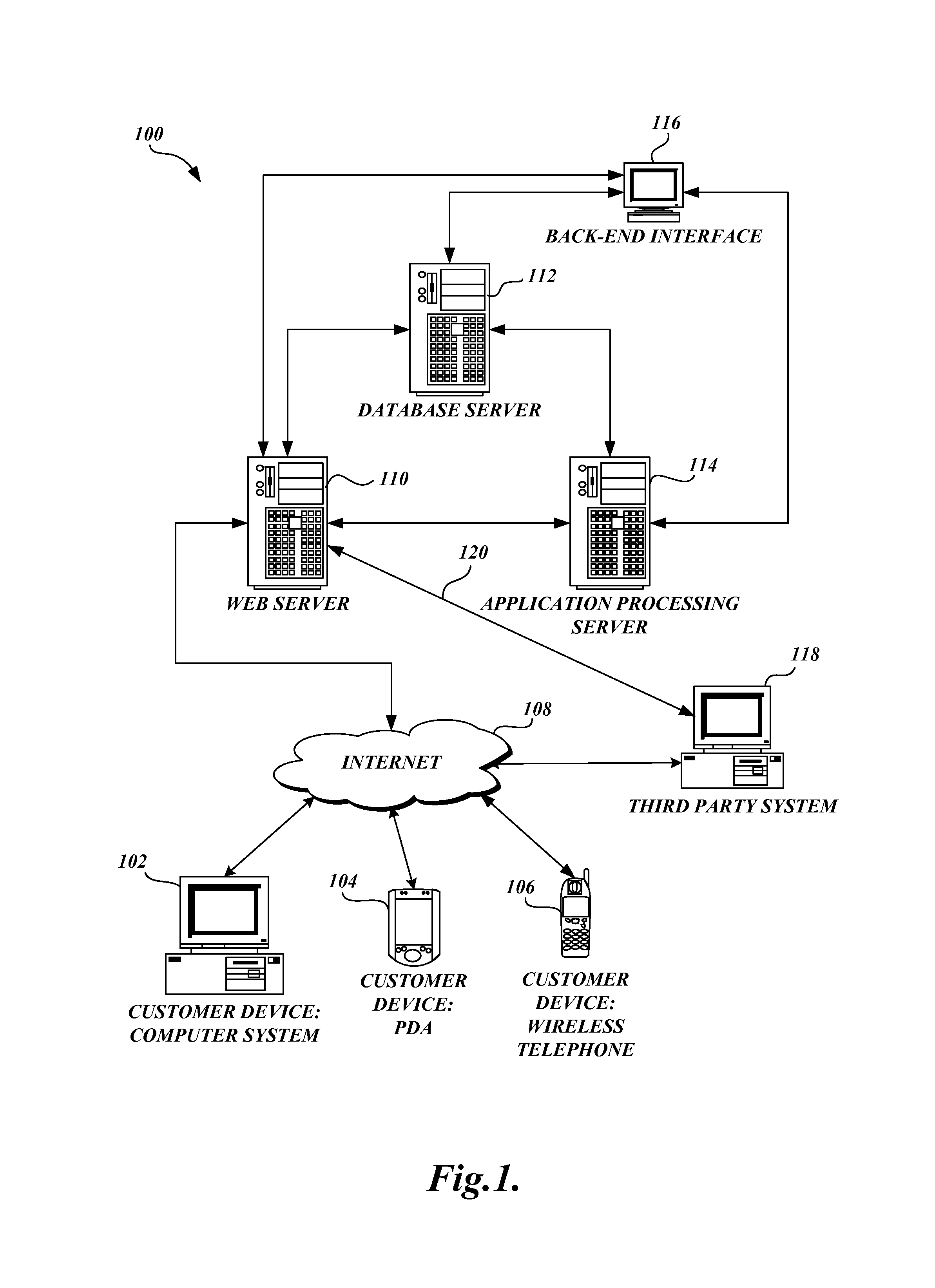

Computerized system and method of performing insurability analysis

InactiveUS20030233260A1Ensure effective implementationQuickly and efficiently handlesFinanceOffice automationComputerized systemClient-side

A method and system for evaluating insurability of an applicant for insurance from a carrier. A server, receiving and responsive to communications from a client computer, renders a contemporaneous insurability decision. The communications from the client computer include responses to an interactive questionnaire presented via a browser. A database associated with the server stores a comprehensive set of questions for collecting underwriting information and the server executes processing rules to determine which questions to present in the questionnaire. The questionnaire includes base questions and detail questions. The detail questions are each related to at least one of the base questions for collecting further information related to the respective base question. The server renders the insurability decision and exports a summary file to the carrier. The summary file includes the questions and responses thereto as well as the insurability decision.

Owner:REINSURANCE GROUP OF AMERICA CORP +1

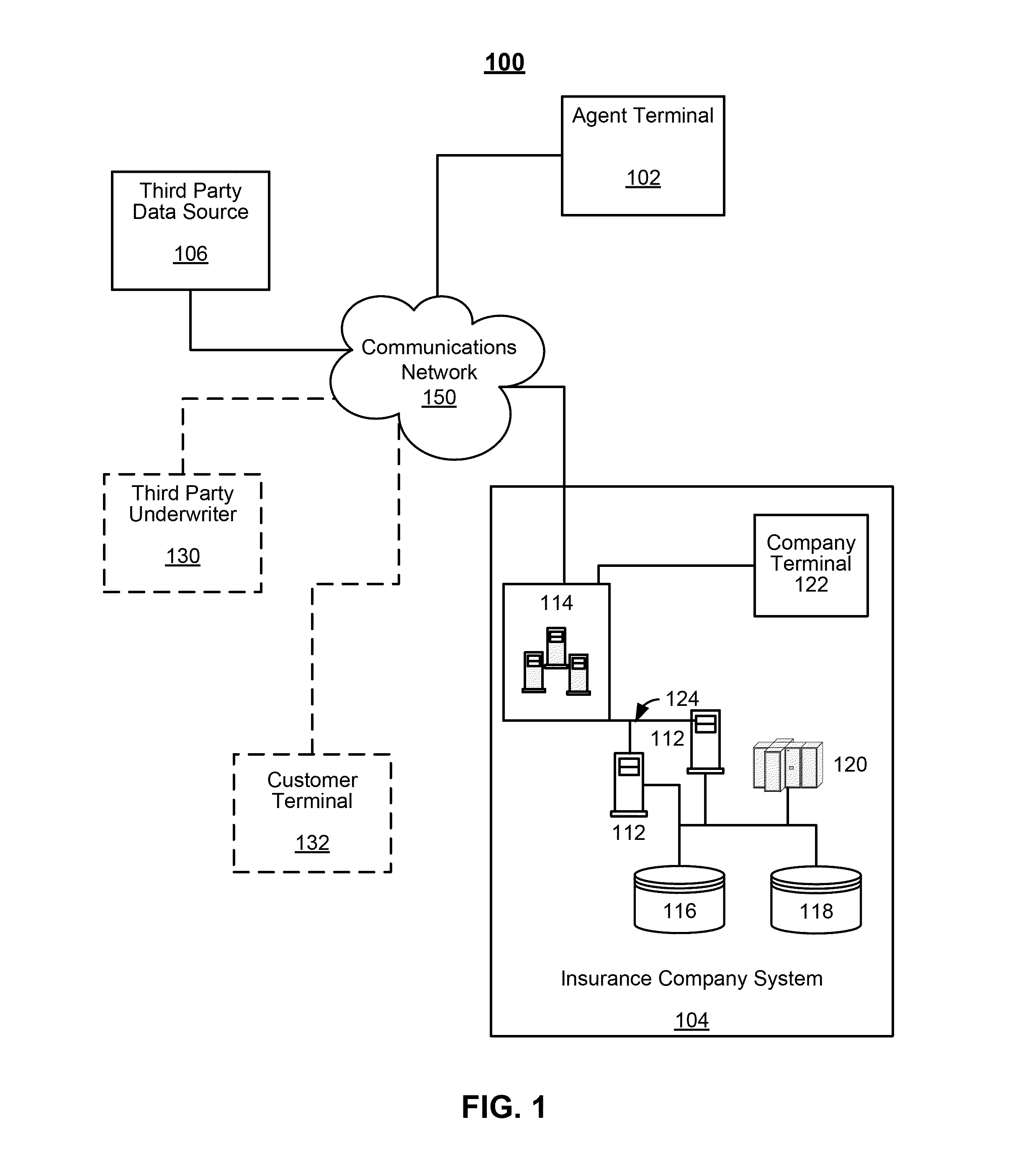

Computerized system and method of performing insurability analysis

InactiveUS20040181435A9Quickly and efficiently handlesFast and easy changeFinanceOffice automationComputerized systemClient-side

A method and system for evaluating insurability of an applicant for insurance from a carrier. A server, receiving and responsive to communications from a client computer, renders a contemporaneous insurability decision. The communications from the client computer include responses to an interactive questionnaire presented via a browser. A database associated with the server stores a comprehensive set of questions for collecting underwriting information and the server executes processing rules to determine which questions to present in the questionnaire. The questionnaire includes base questions and detail questions. The detail questions are each related to at least one of the base questions for collecting further information related to the respective base question. The server renders the insurability decision and exports a summary file to the carrier. The summary file includes the questions and responses thereto as well as the insurability decision.

Owner:REINSURANCE GROUP OF AMERICA CORP +1

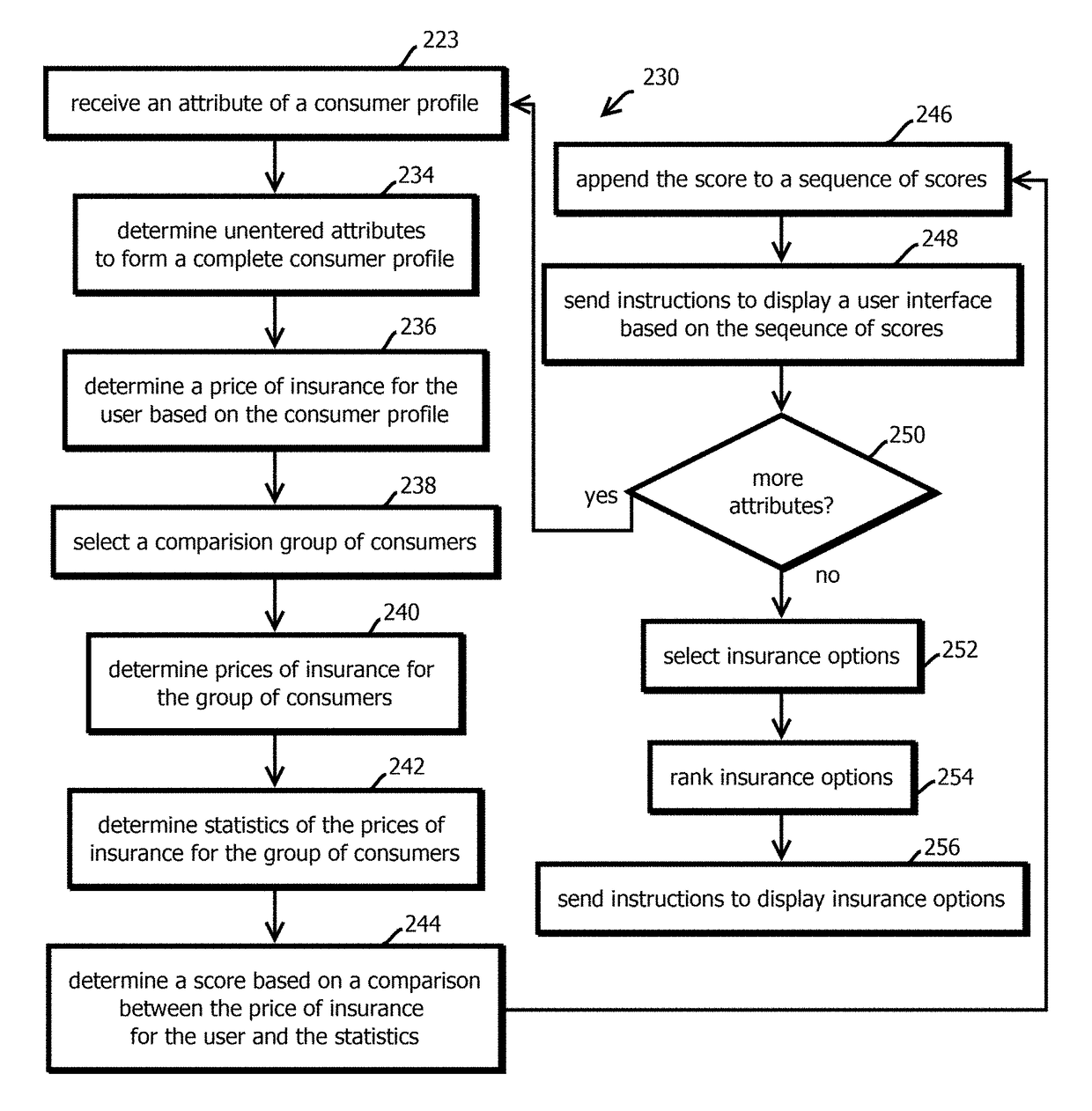

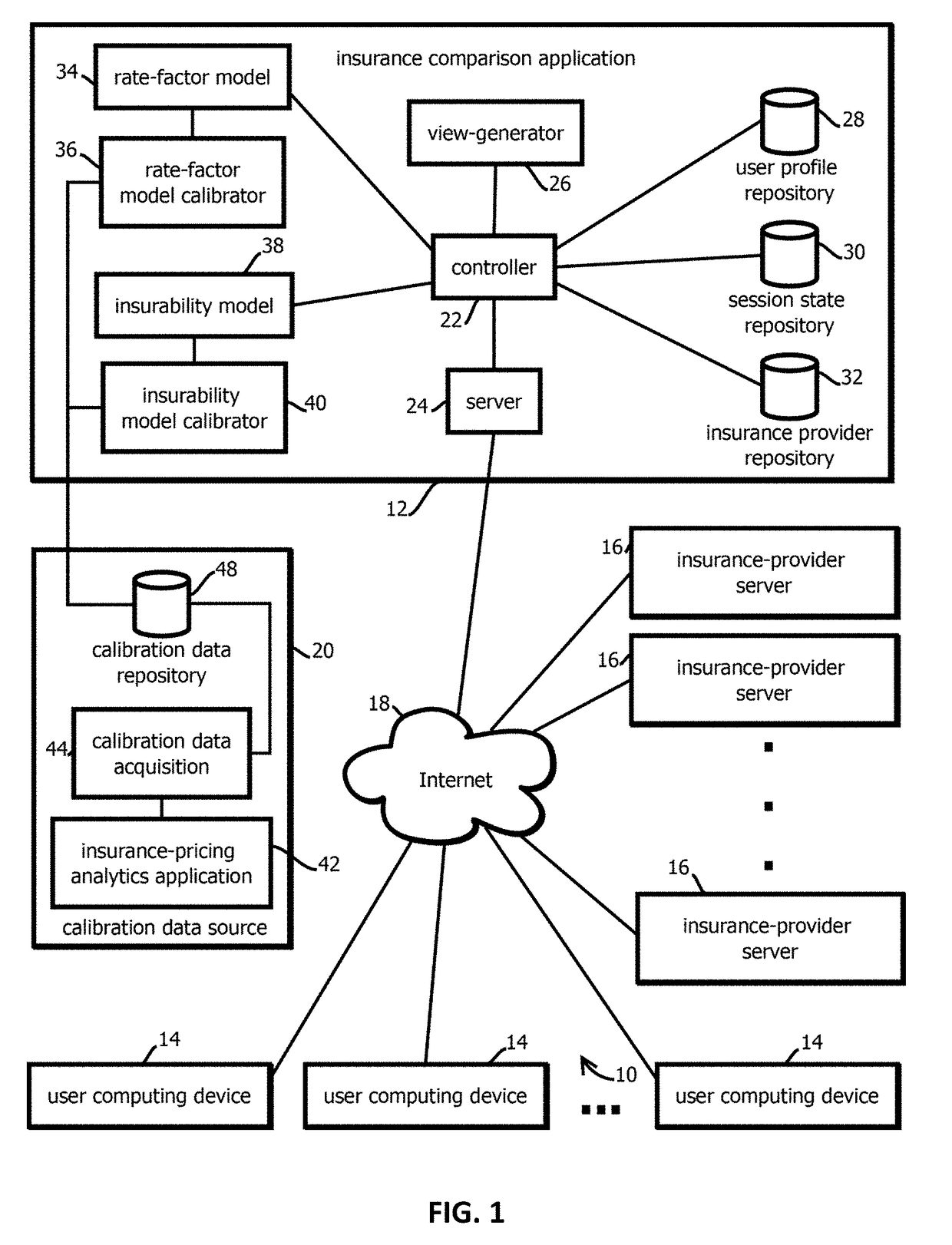

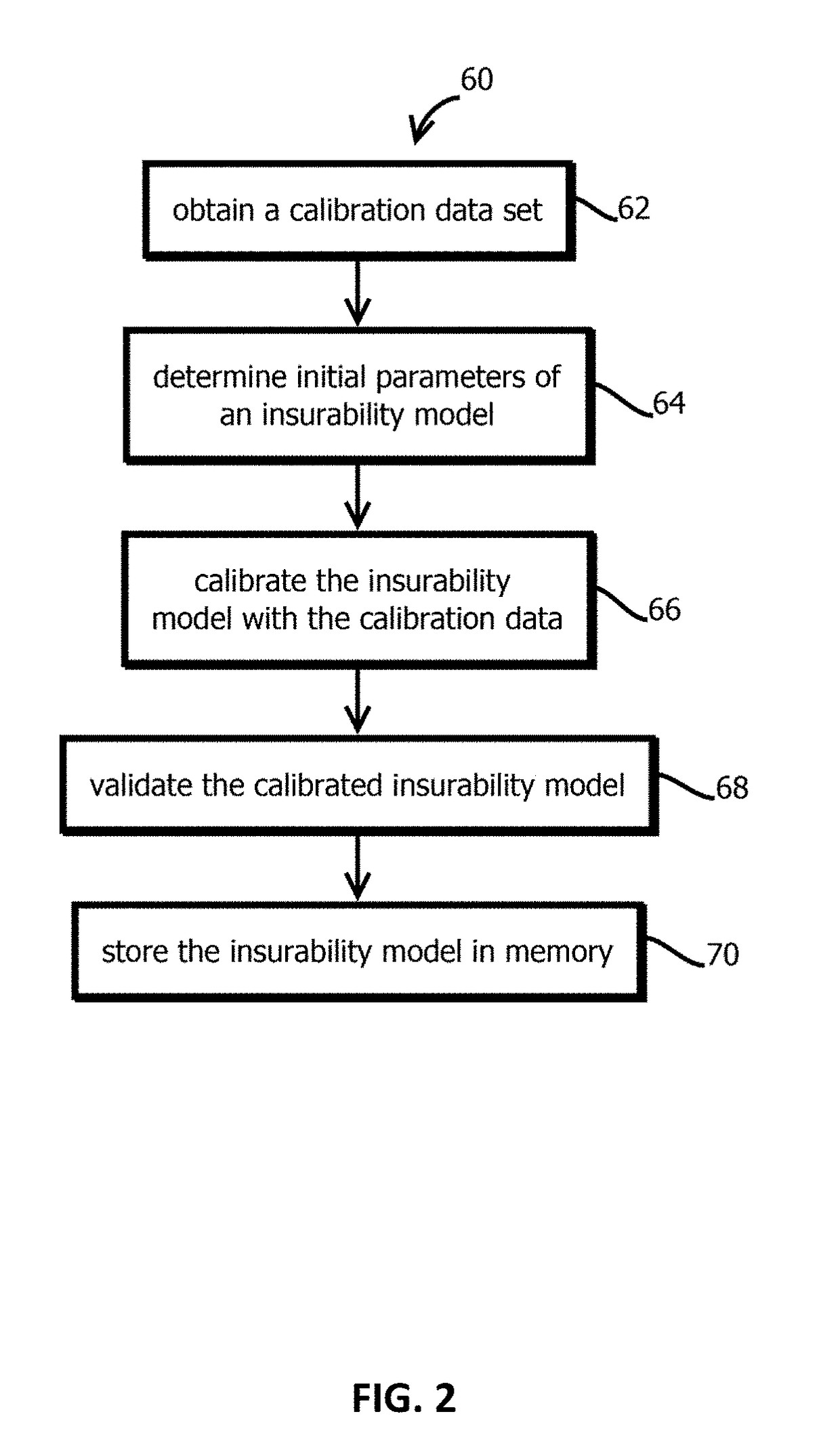

Dimensionality reduction of multi-attribute consumer profiles

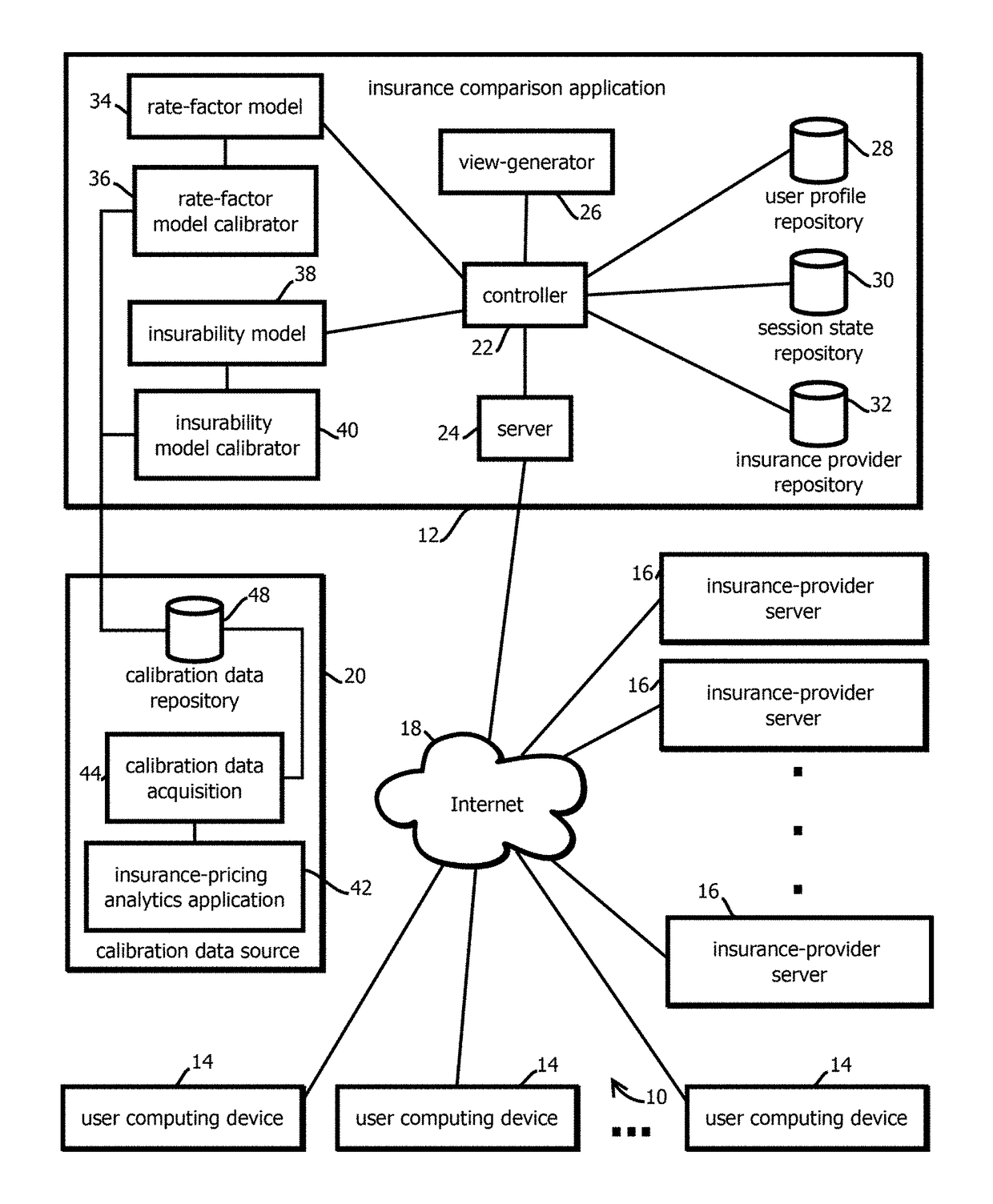

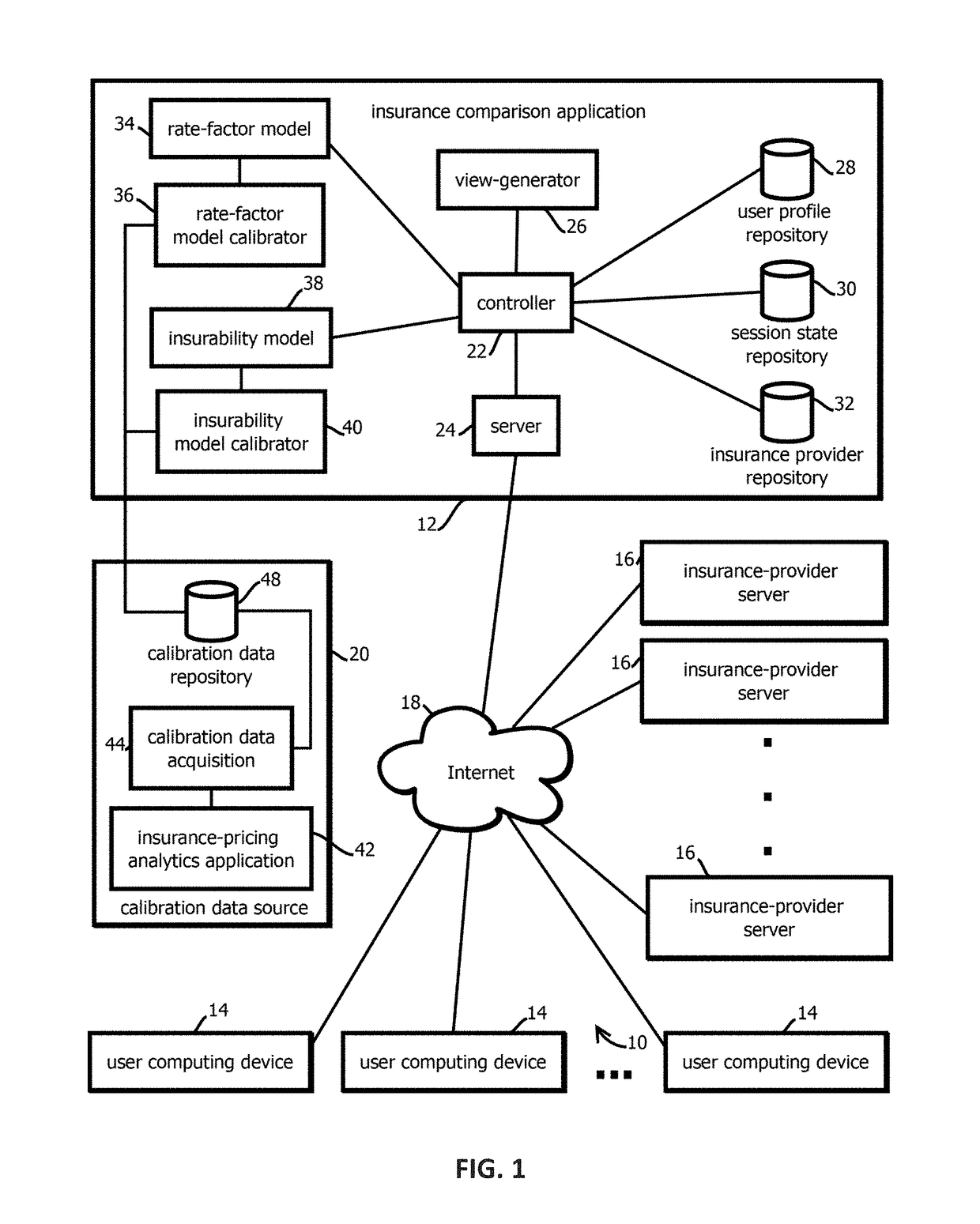

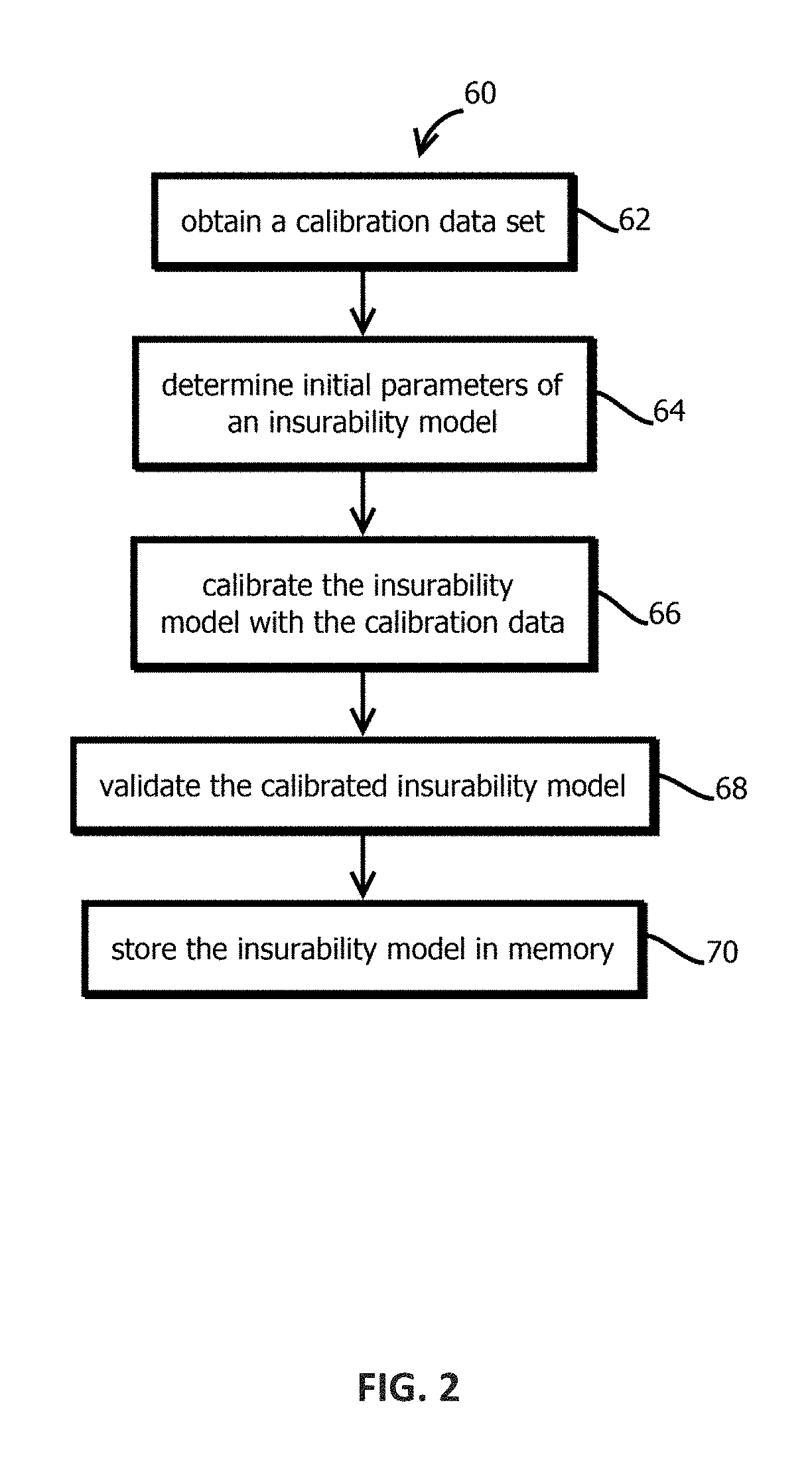

Provided is a process of inferring insurability scores, the process including: receiving a request for an insurance comparison webpage; sending instructions to present one or more webpages of a web site having a plurality of user inputs configured to receive a plurality of attributes of the user; receiving the attributes; determining an insurability score with an insurability model based on the received attributes of the user; and sending instructions to display a value indicative of the insurability score.

Owner:INSURANCE ZEBRA INC

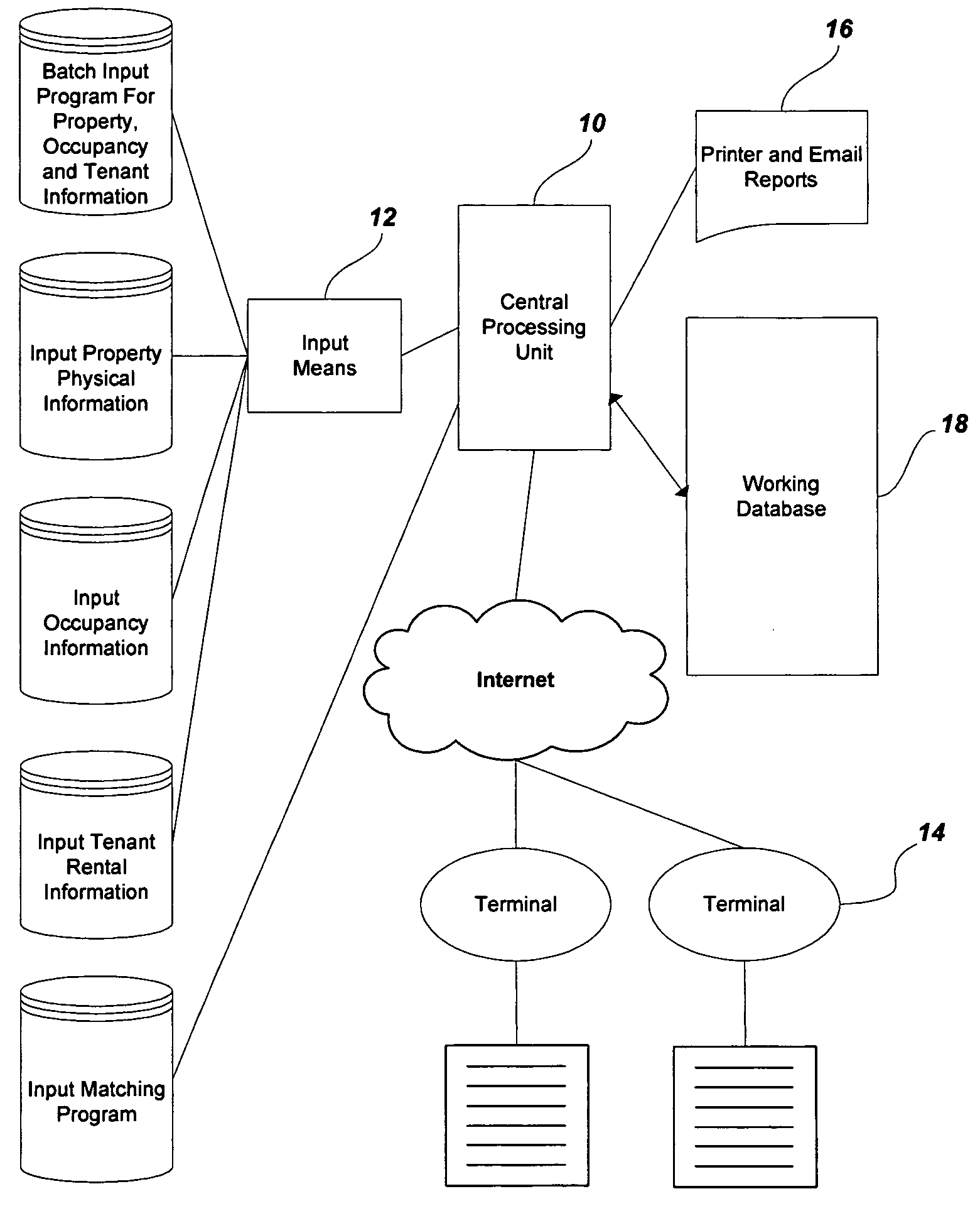

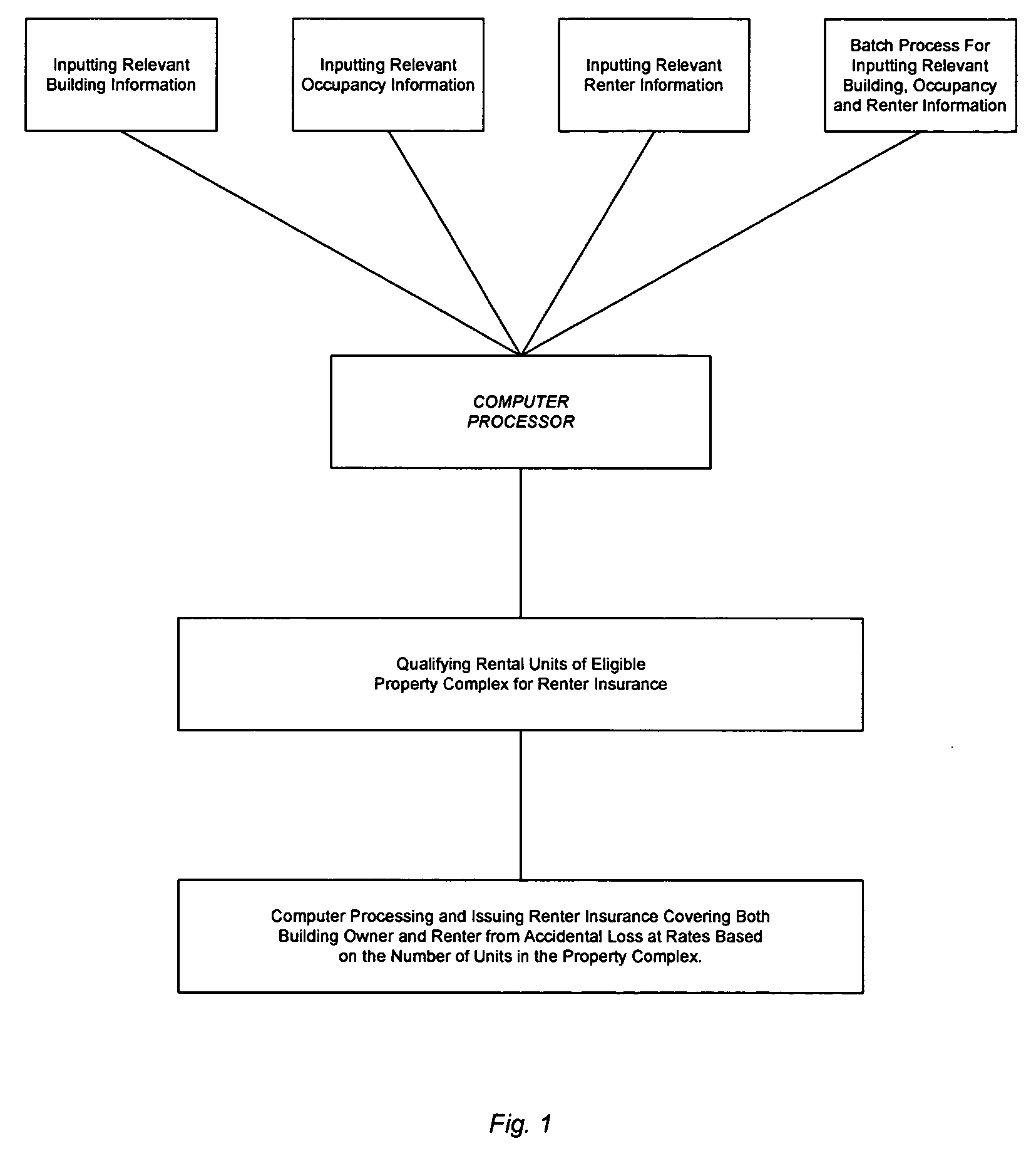

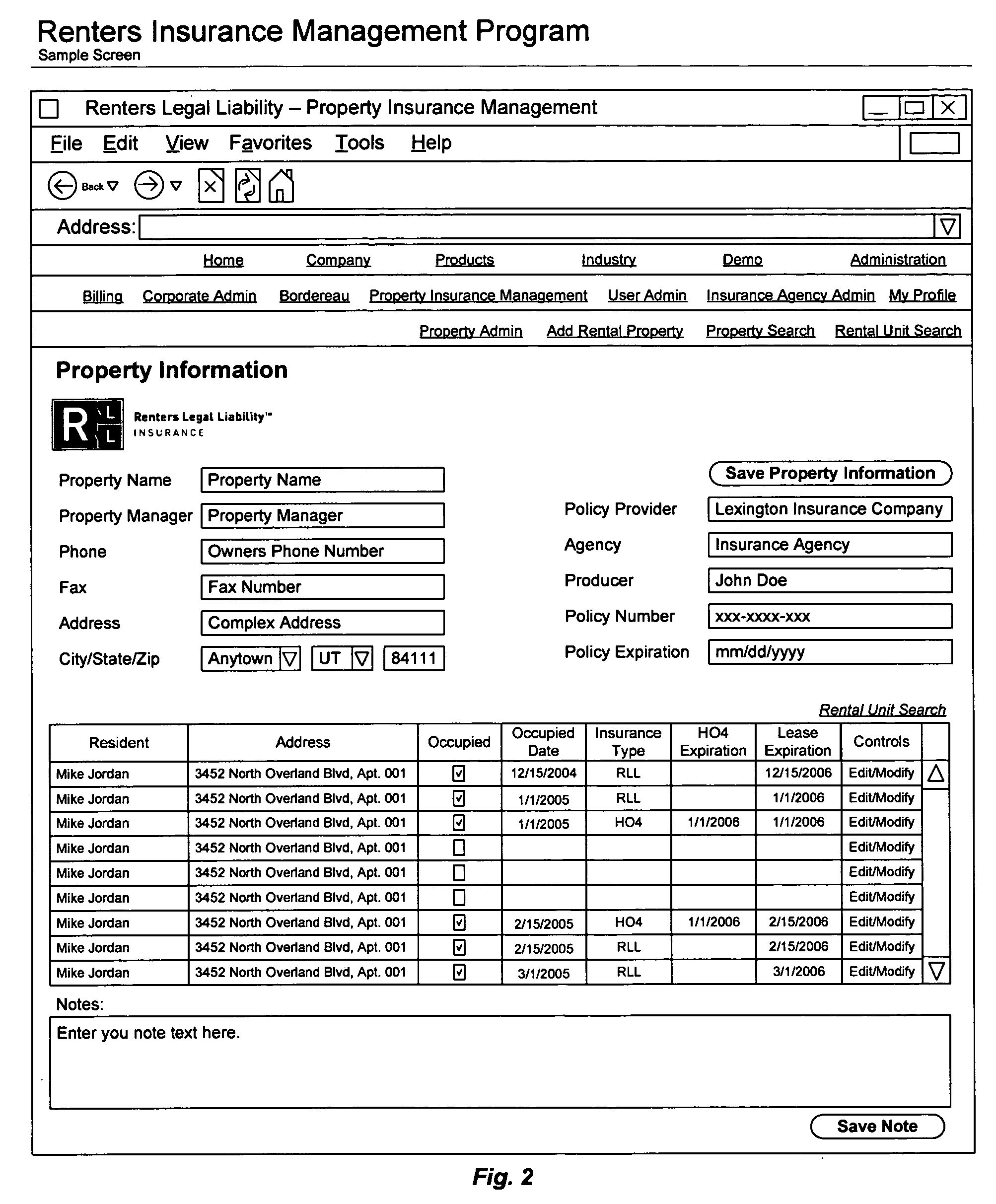

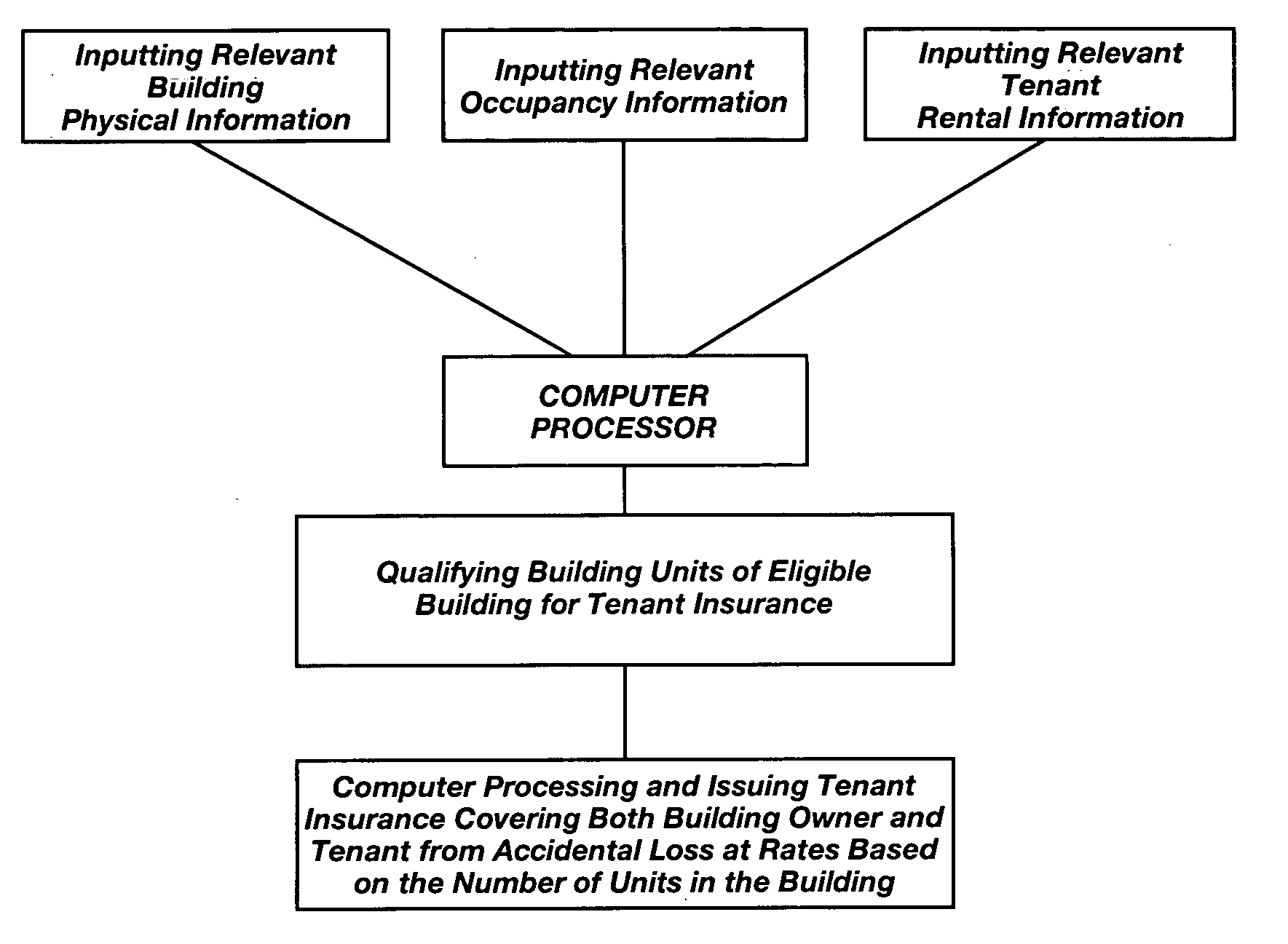

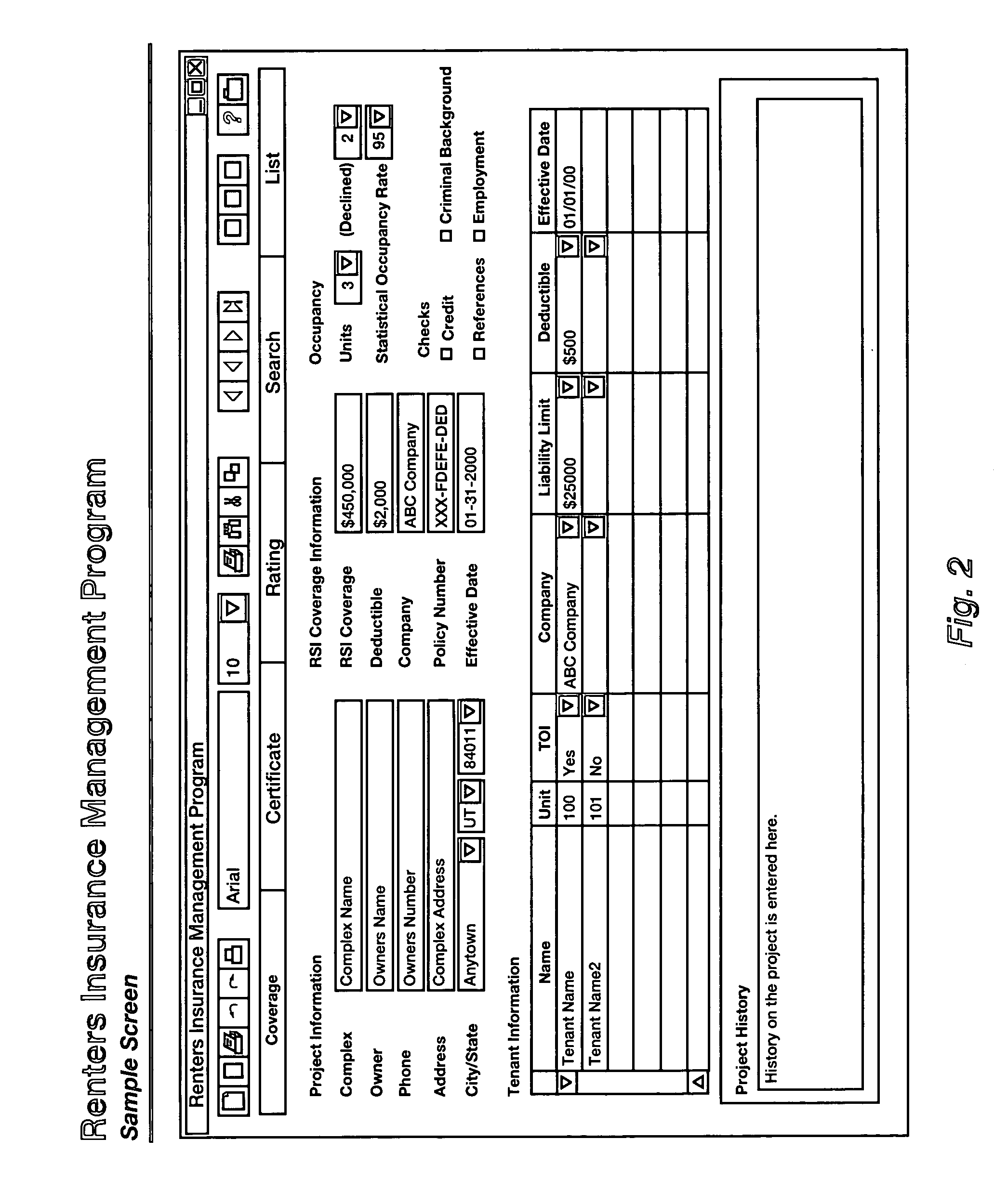

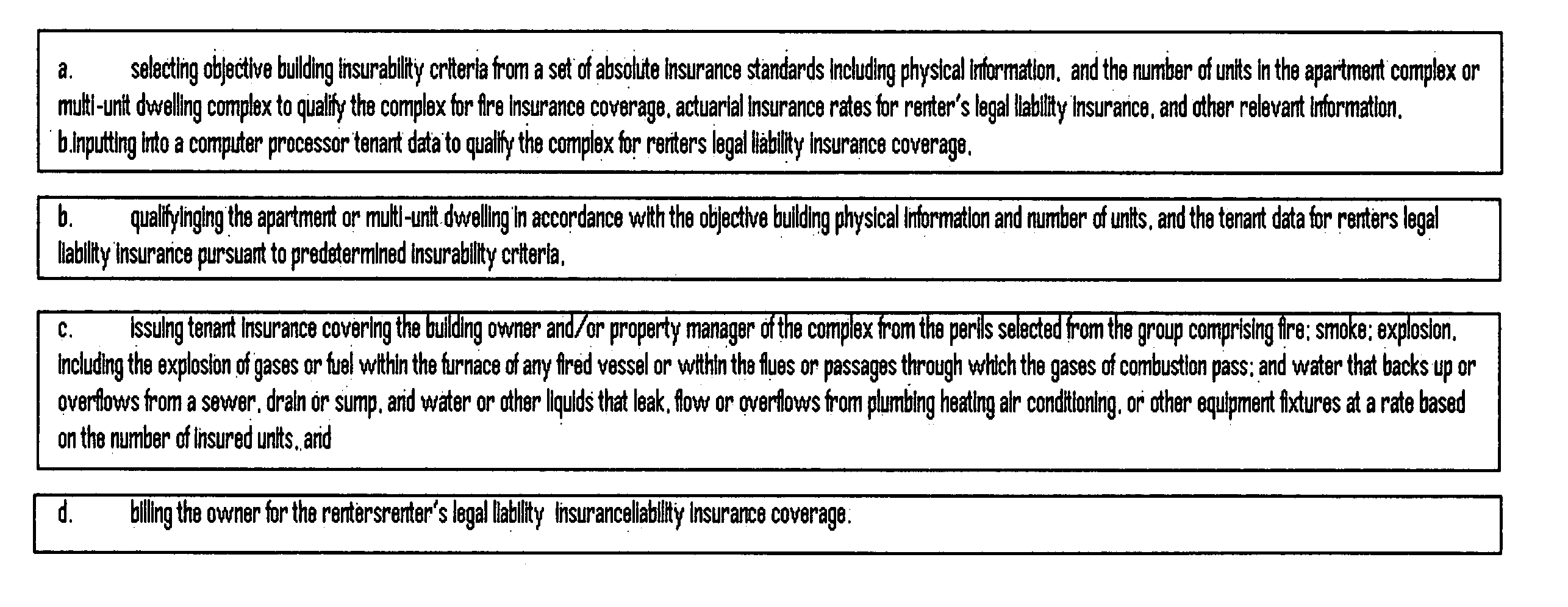

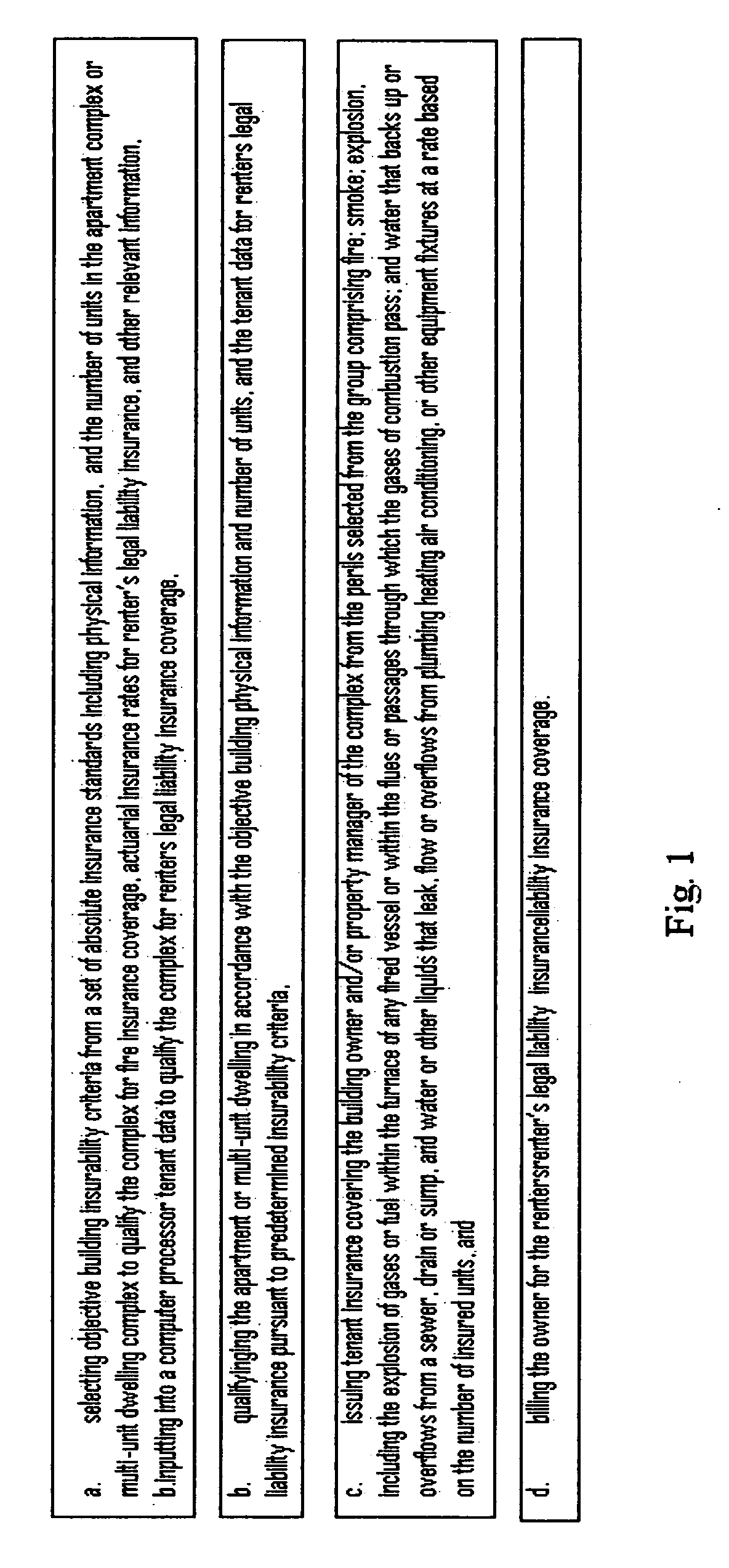

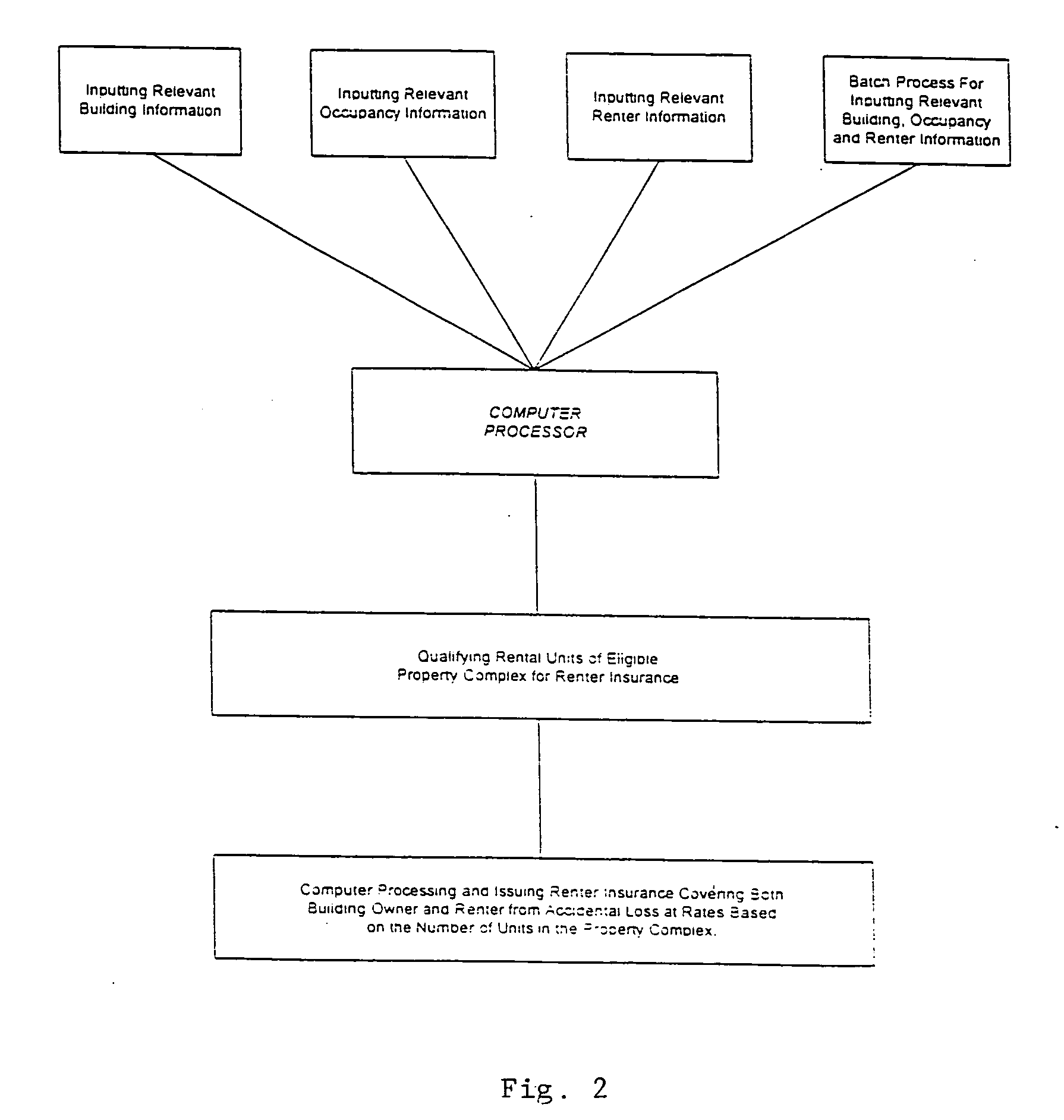

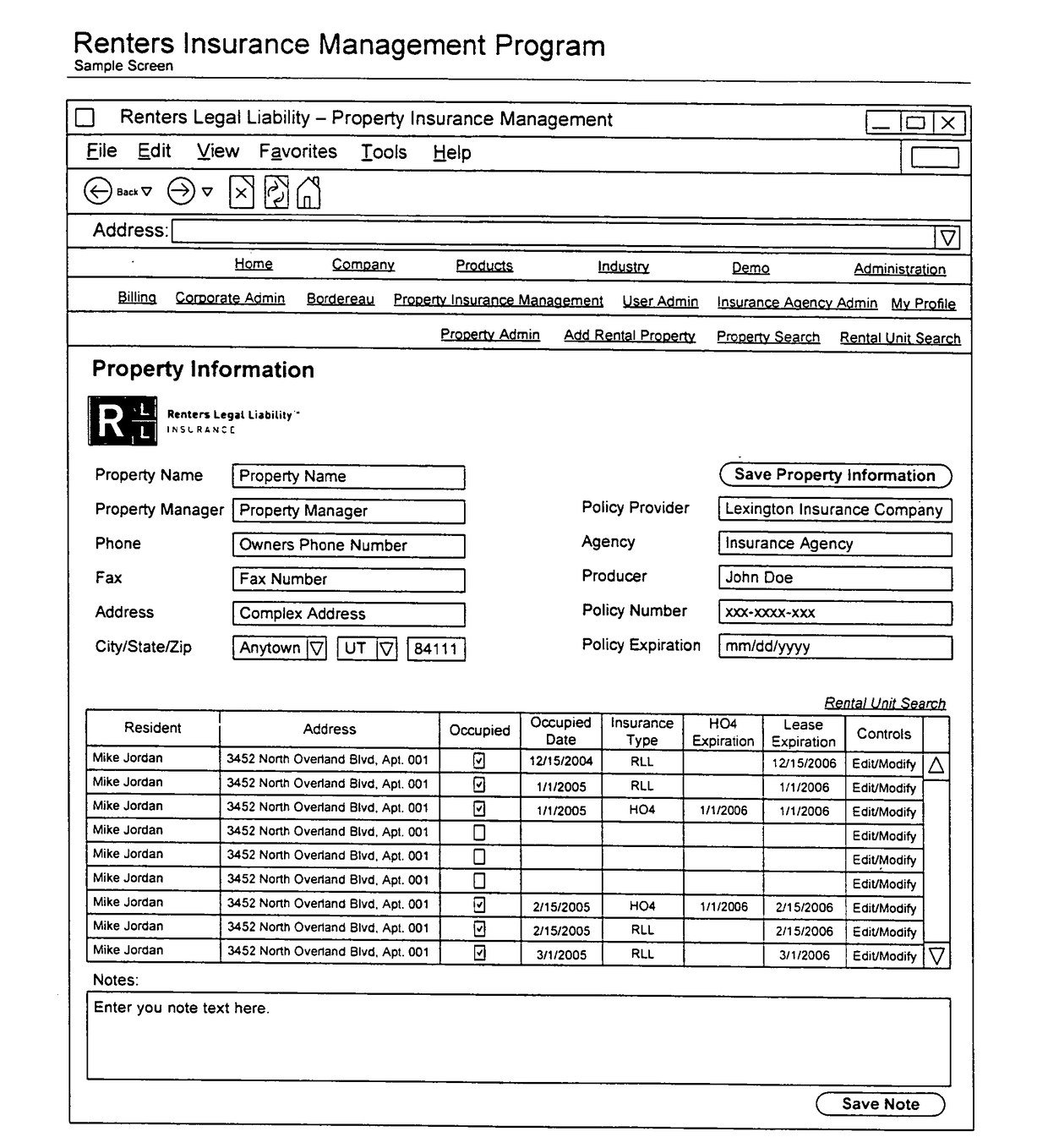

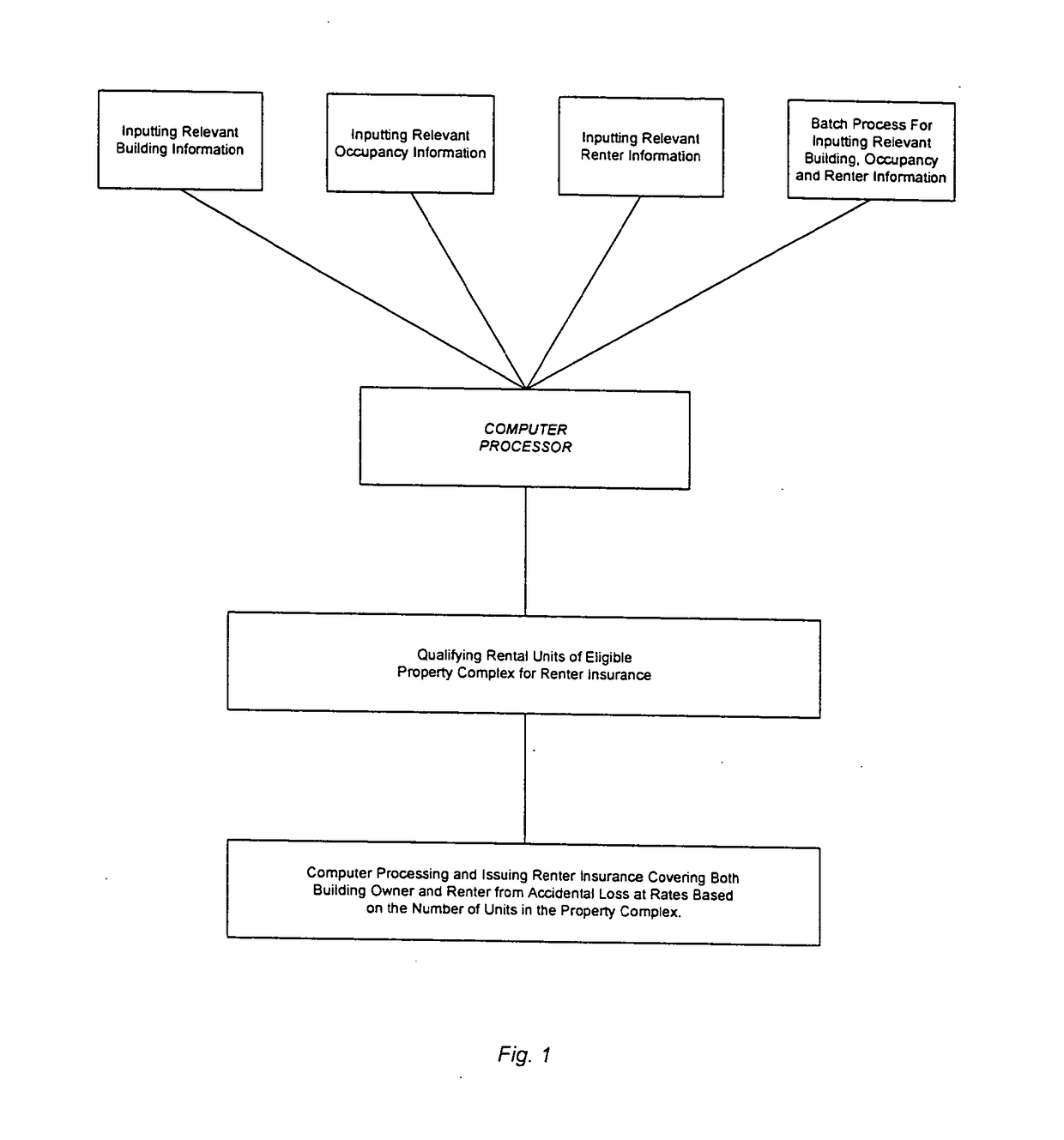

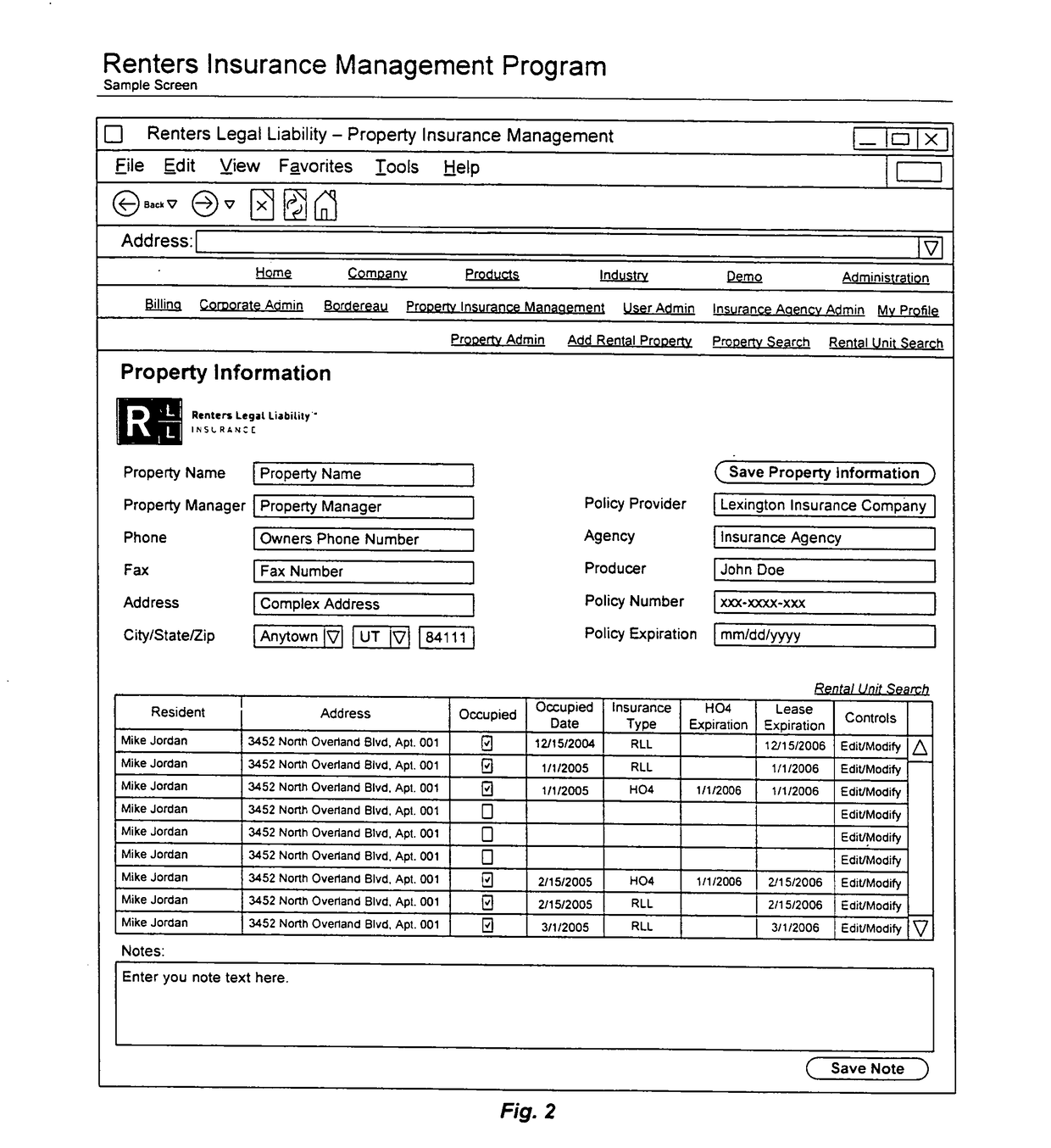

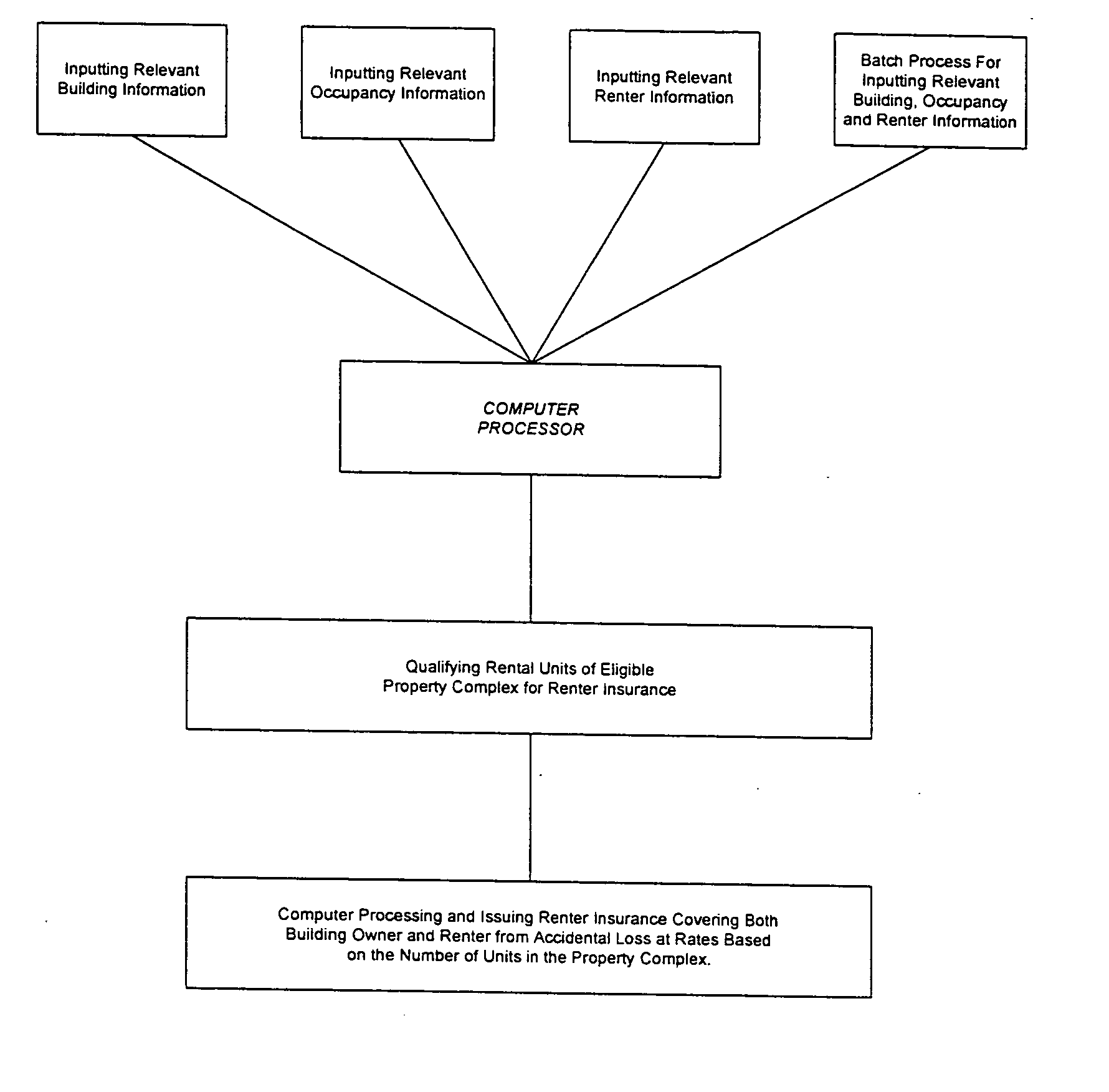

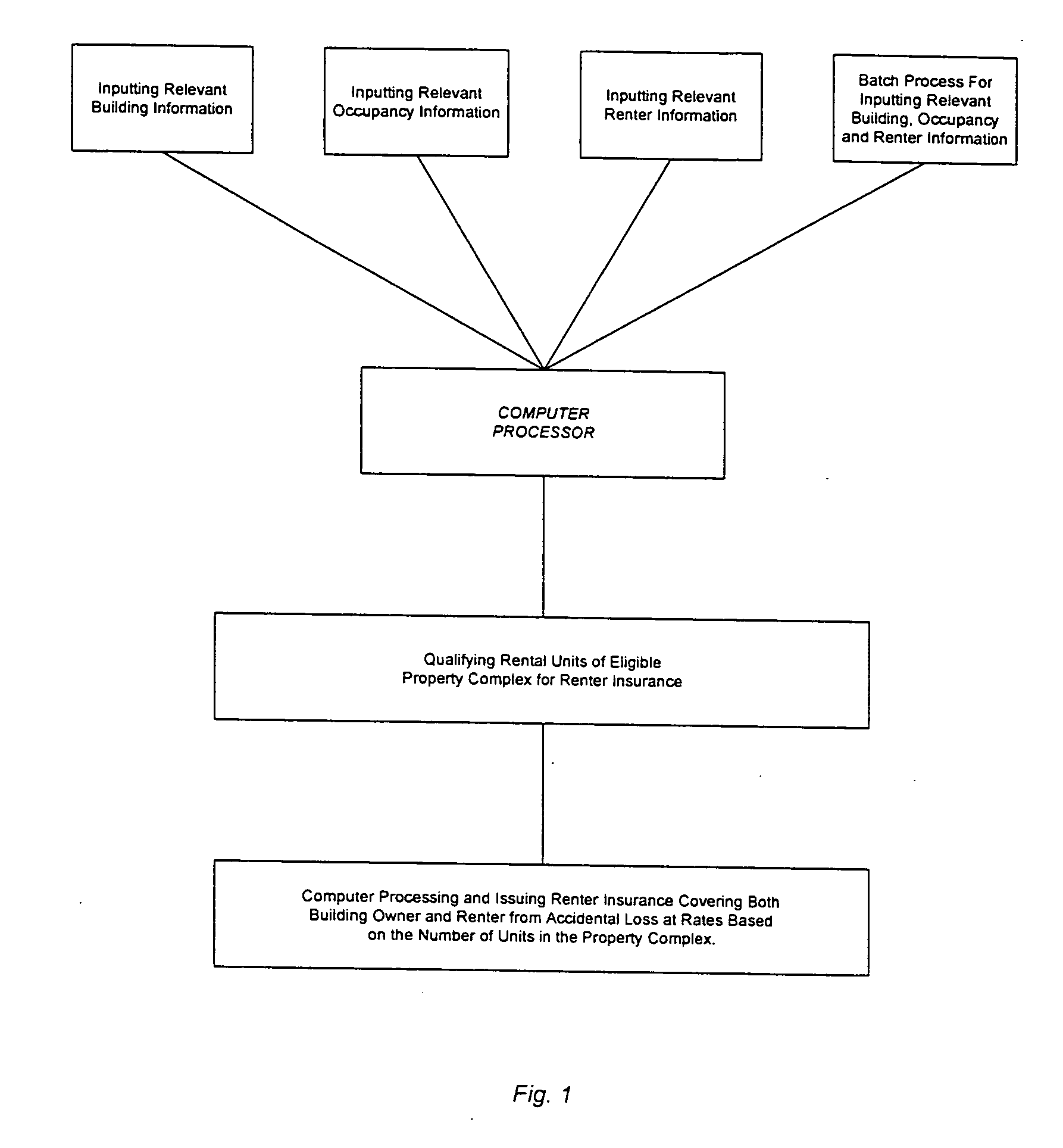

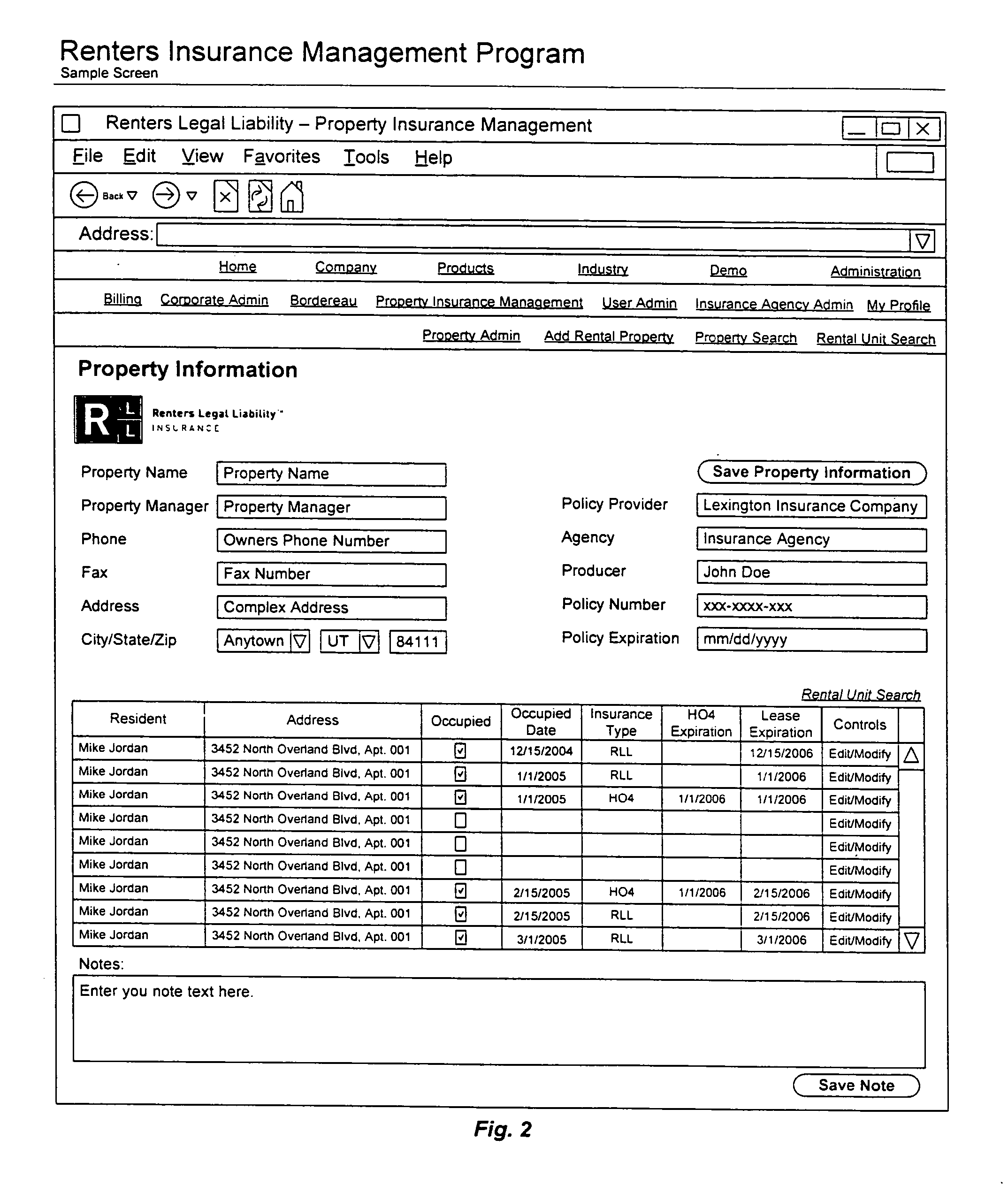

Method and apparatus for insuring multiple unit dwellings

A method and apparatus for insuring the owner of an apartment or multi-unit dwelling from damage to his building caused by his tenant's unintentional acts comprising: inputting into a computer processor a database of building physical information, occupancy information, and tenant rental information; inputting into the computer processor an insurance qualification program for renters legal liability insurance covering the building owner from unintentional damage caused by the tenant from fire, smoke, explosions, water damage, or negligence injuries by the tenant caused to third parties pursuant to predetermined insurability criteria; qualifying the building for renters legal liability insurance, and computer translating and generating insurance coverage for the building owner based on the number of units in the building and insurance coverage limits desired, and billing the owner for renter's legal liability insurance.

Owner:RENTERS LEGAL LIABILITY A LIABILITY OF THE STATE OF UTAH

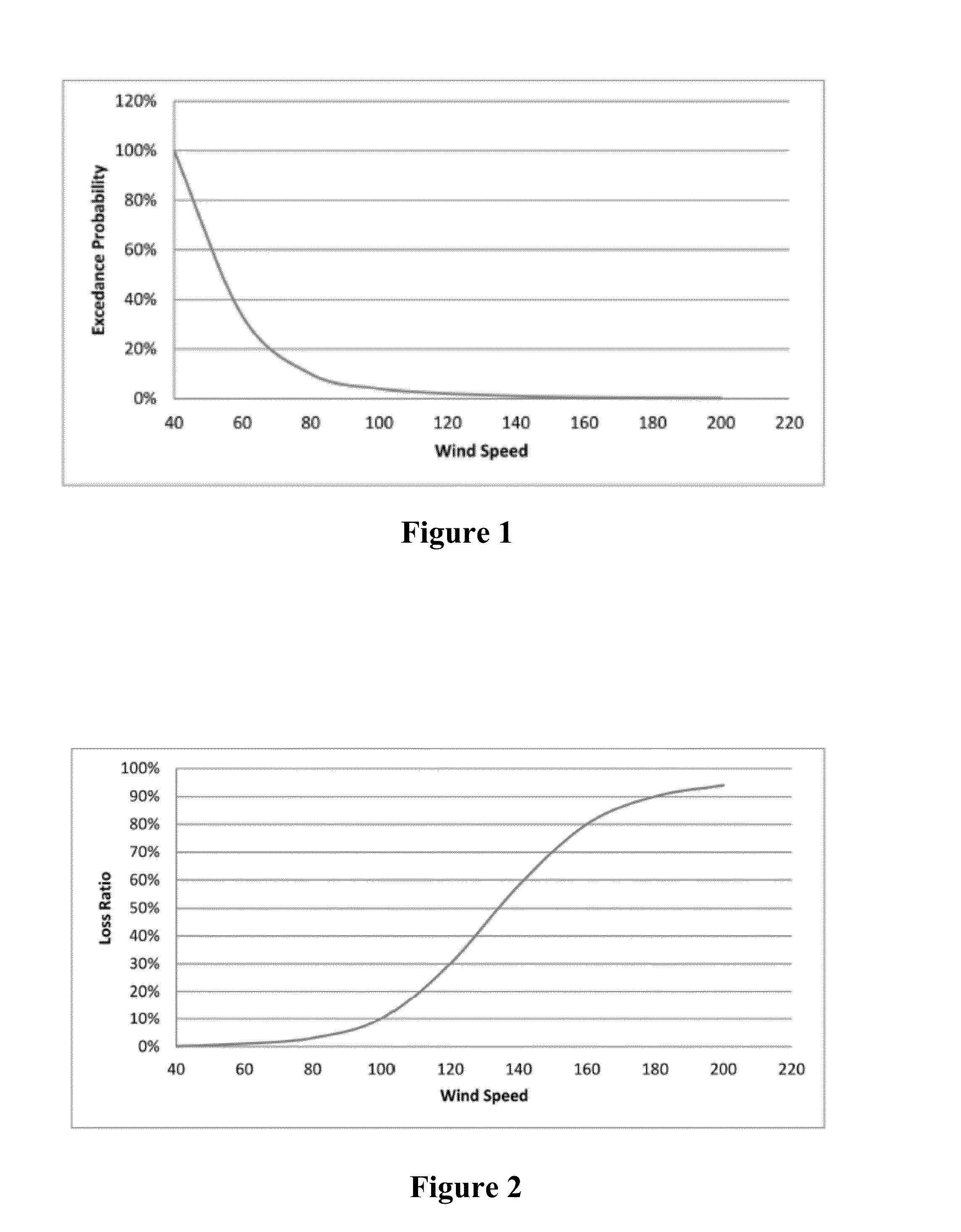

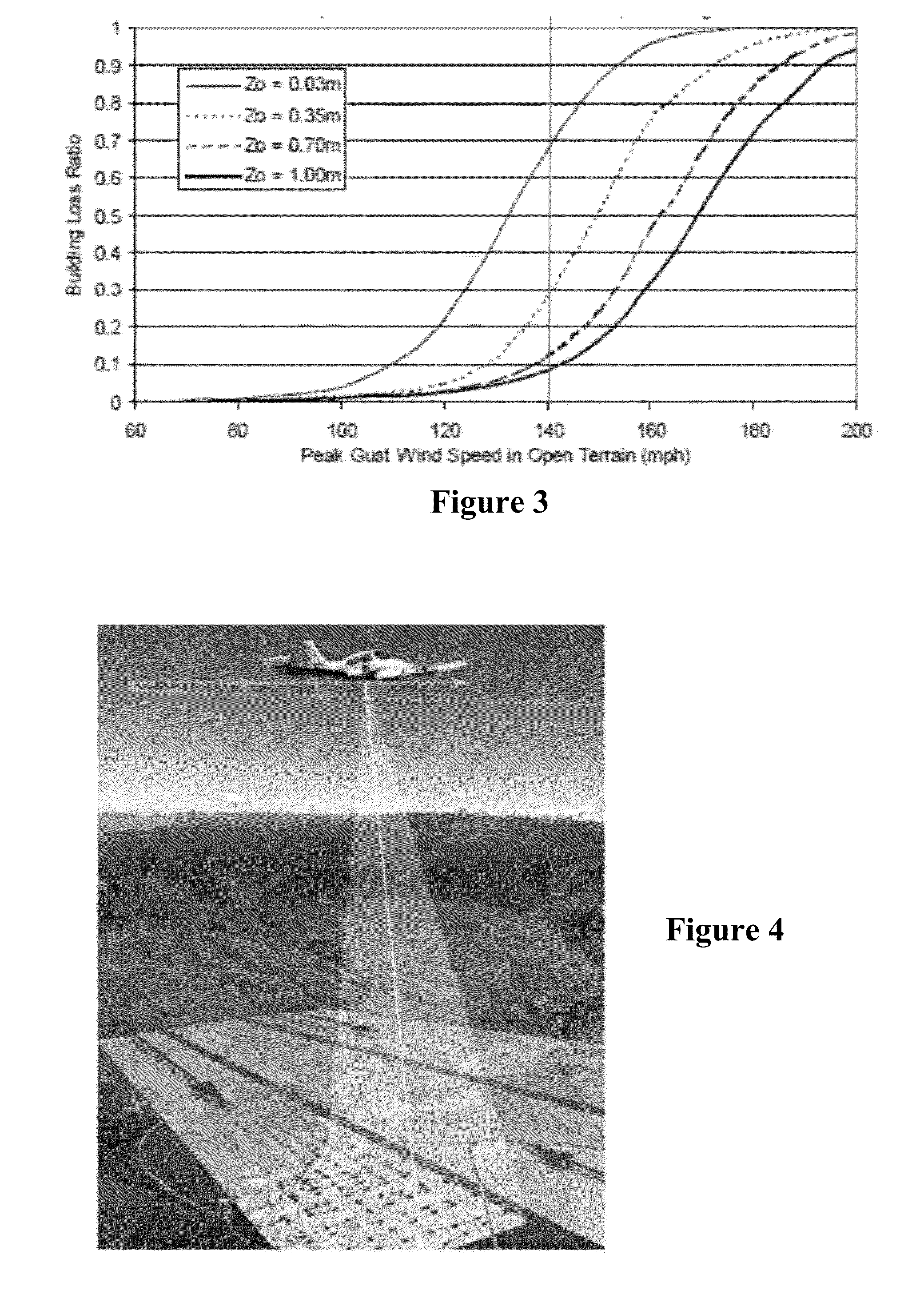

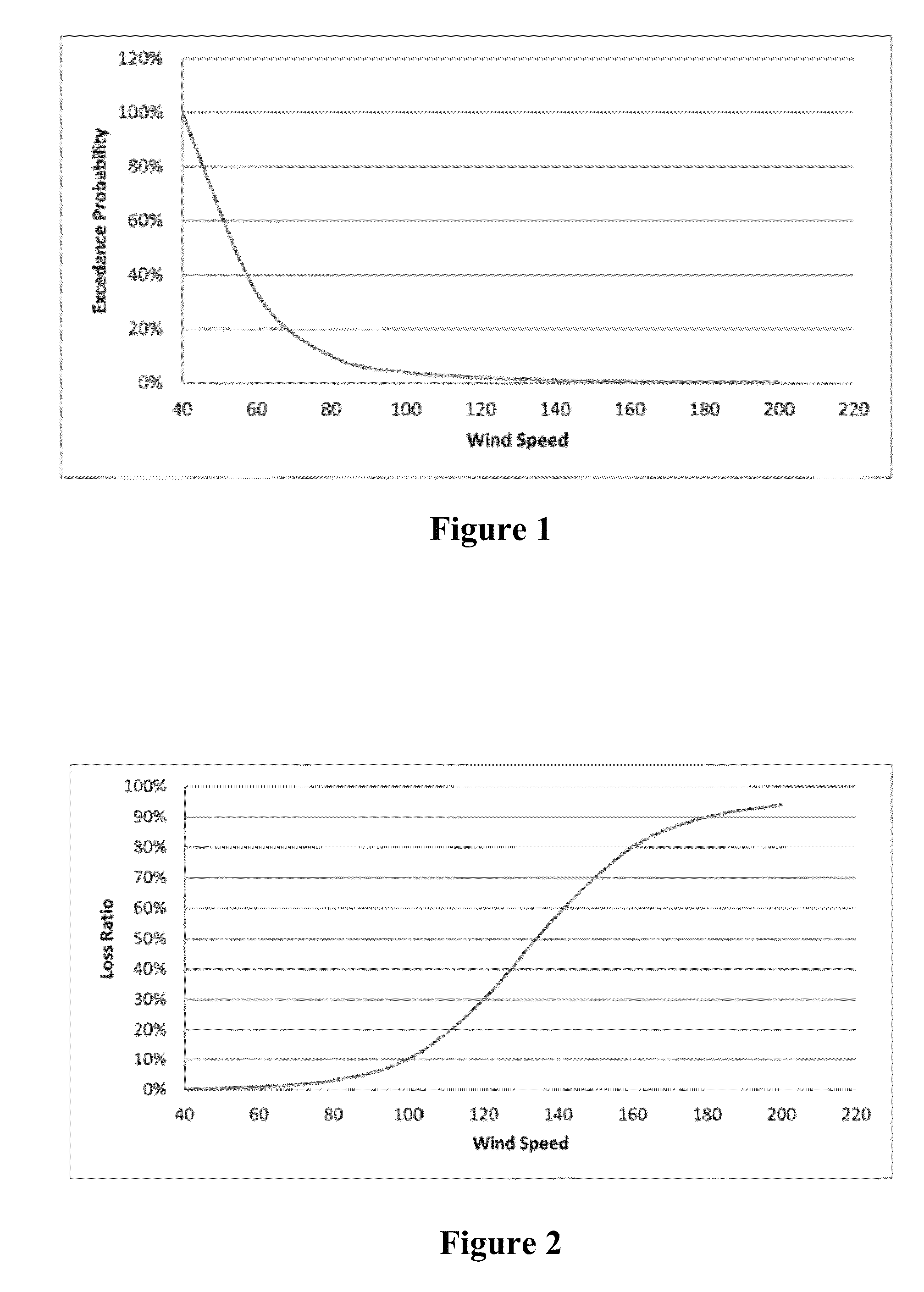

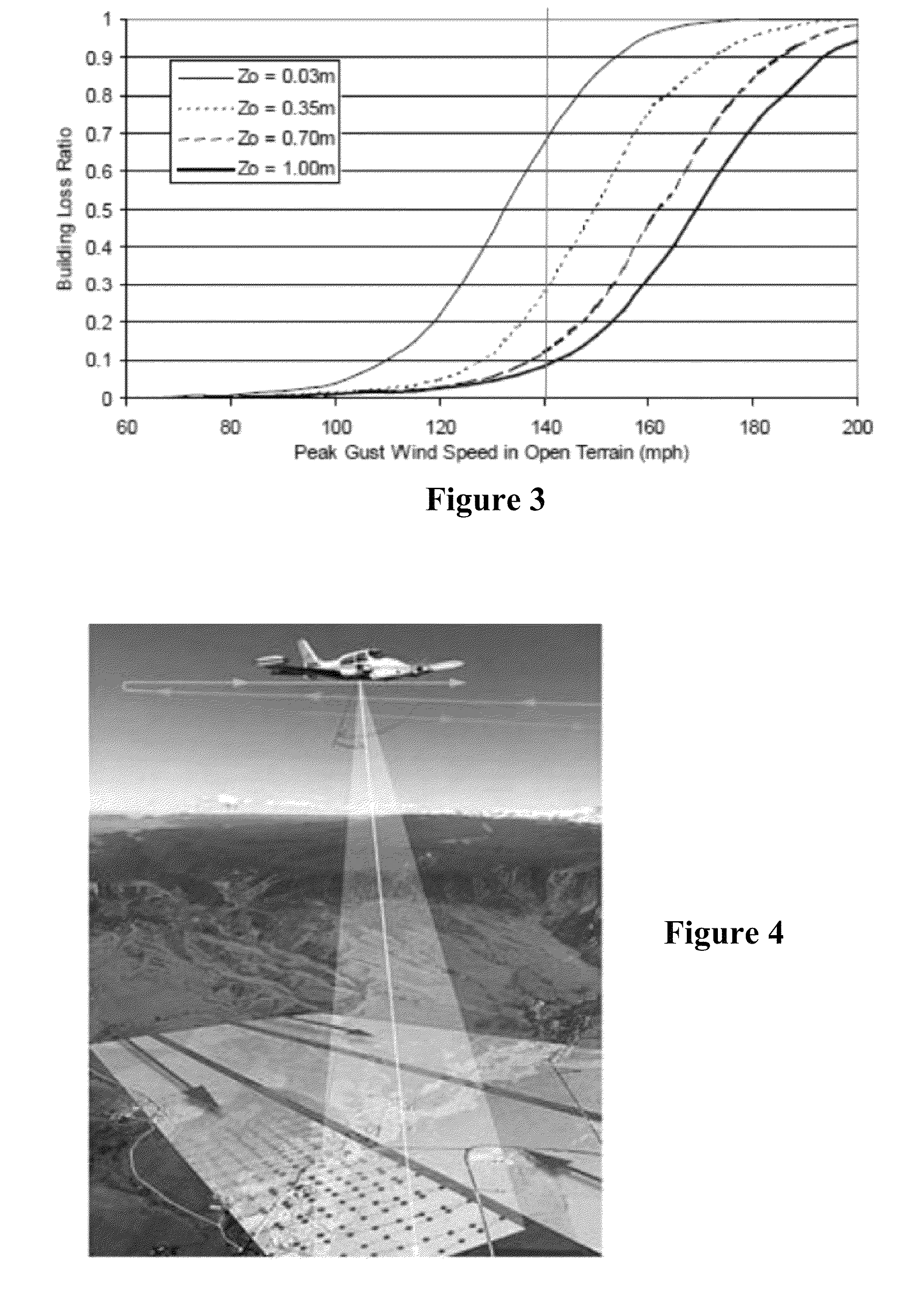

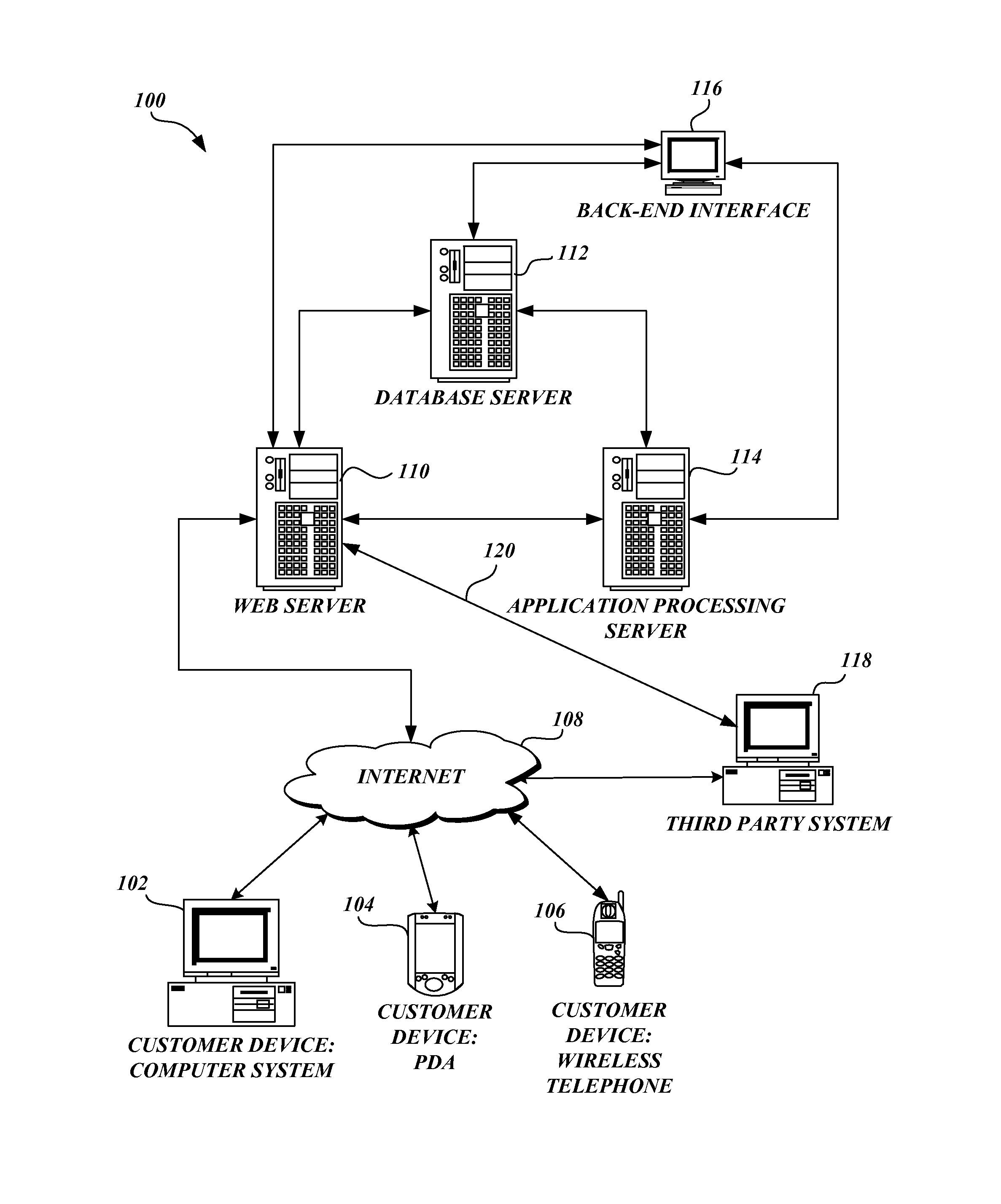

Method and system for estimating economic losses from wind storms

The present invention relates to systems and methods for estimating economic losses from wind storms. Accordingly, provided herein are methods estimating roughness length of an area surrounding a structure, methods calculating local wind speed at a structure, methods of estimating wind pressure on a structure, and methods of calculating the insurability of a structure. Also provided are systems and computer-readable storage media configured for performing the disclosed methods.

Owner:CORE PROGRAMS

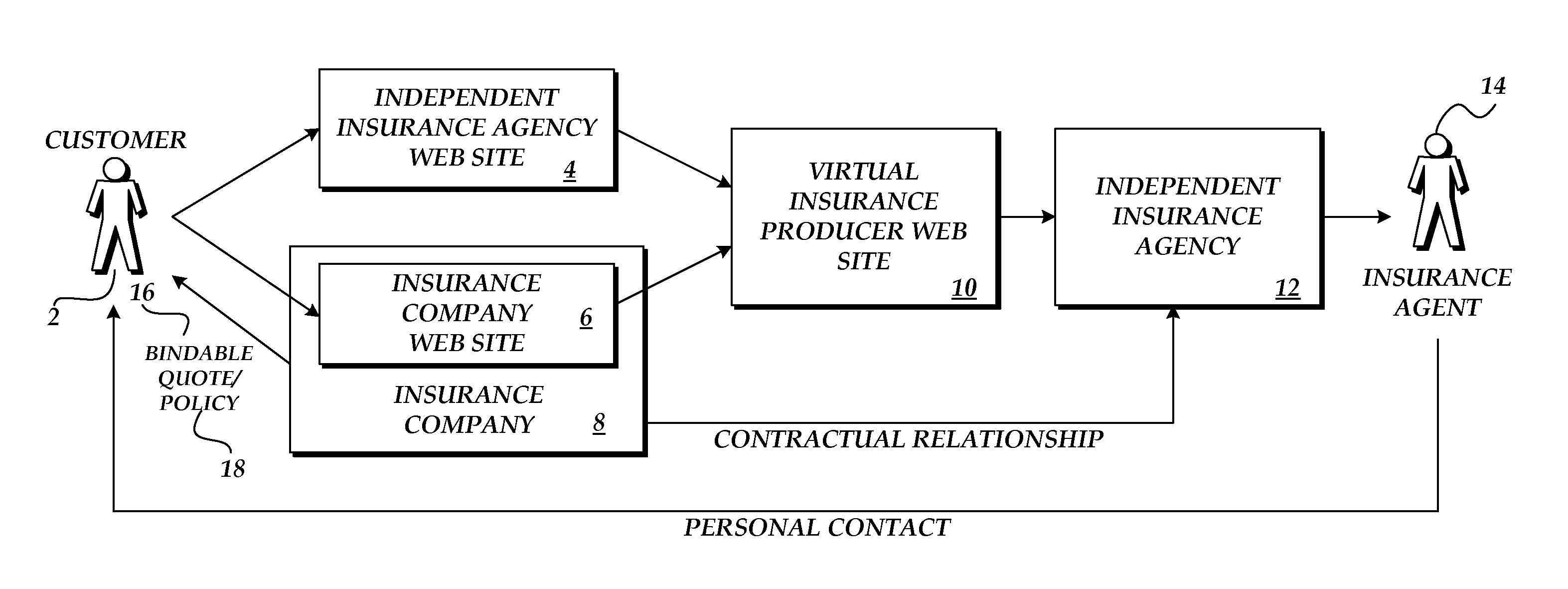

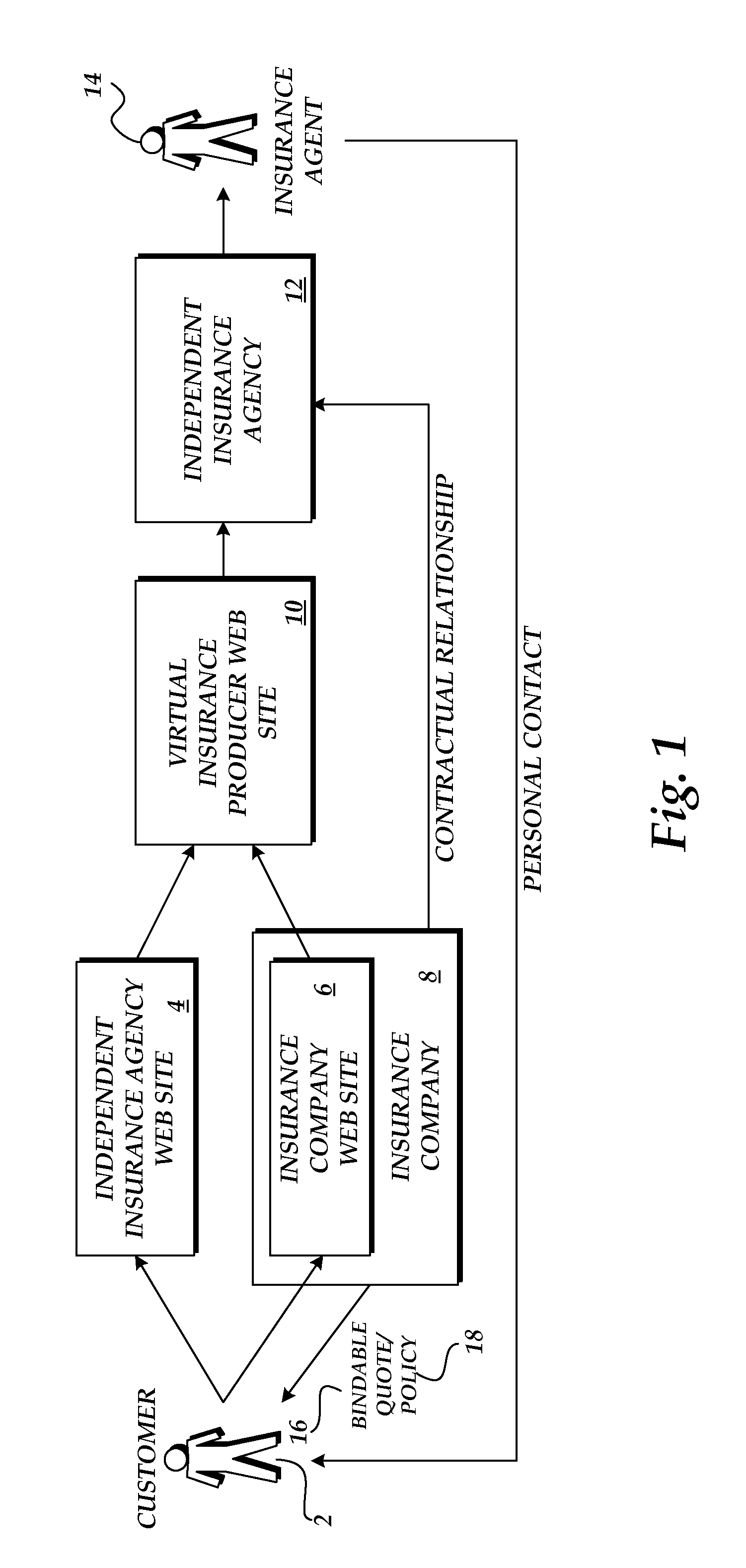

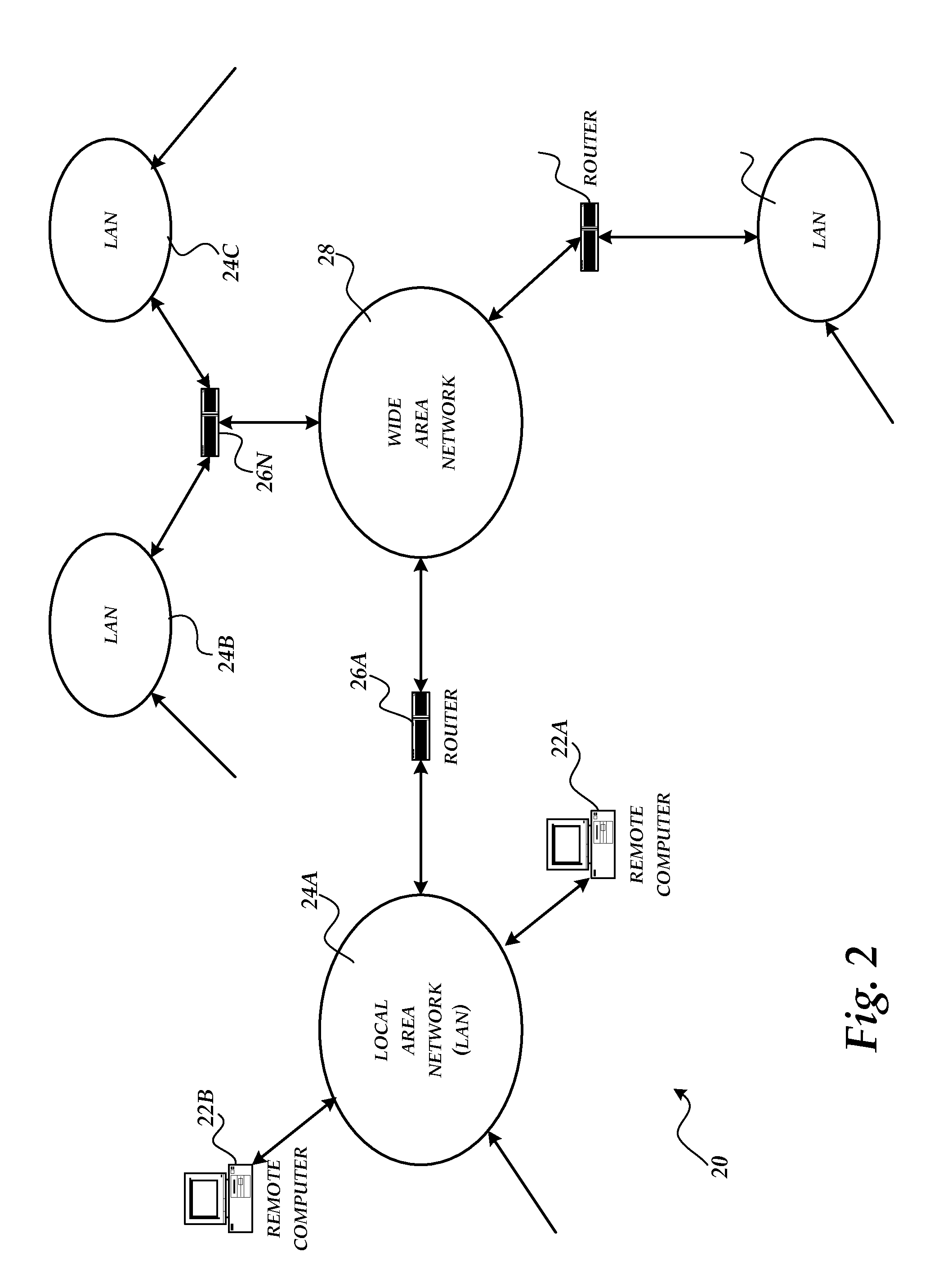

Method and system for providing insurance policies via a distributed computing network

InactiveUS20110166893A1Convenient electronic formatProvide goodFinanceOffice automationWeb siteElectronic form

A virtual insurance producer Web site is provided at which a prospective insurance customer may request a bindable premium quotation for an insurance policy. The prospective customer may be asked to provide information relating to the insurability of an individual to be insured by the insurance policy and information relating to the coverage to be provided by the insurance policy. The premium is displayed to the prospective customer as a bindable quotation that binds the insurance company providing the policy and that may be purchased on-line immediately. The prospective customer may purchase the insurance policy according to the provided bindable premium quotation through the virtual insurance producer Web site. If the prospective customer elects to purchase the policy, the virtual insurance producer Web site may re-intermediate an insurance agent into the sales process and transmit the insurance policy to the customer in electronic form.

Owner:SAFECO CORP

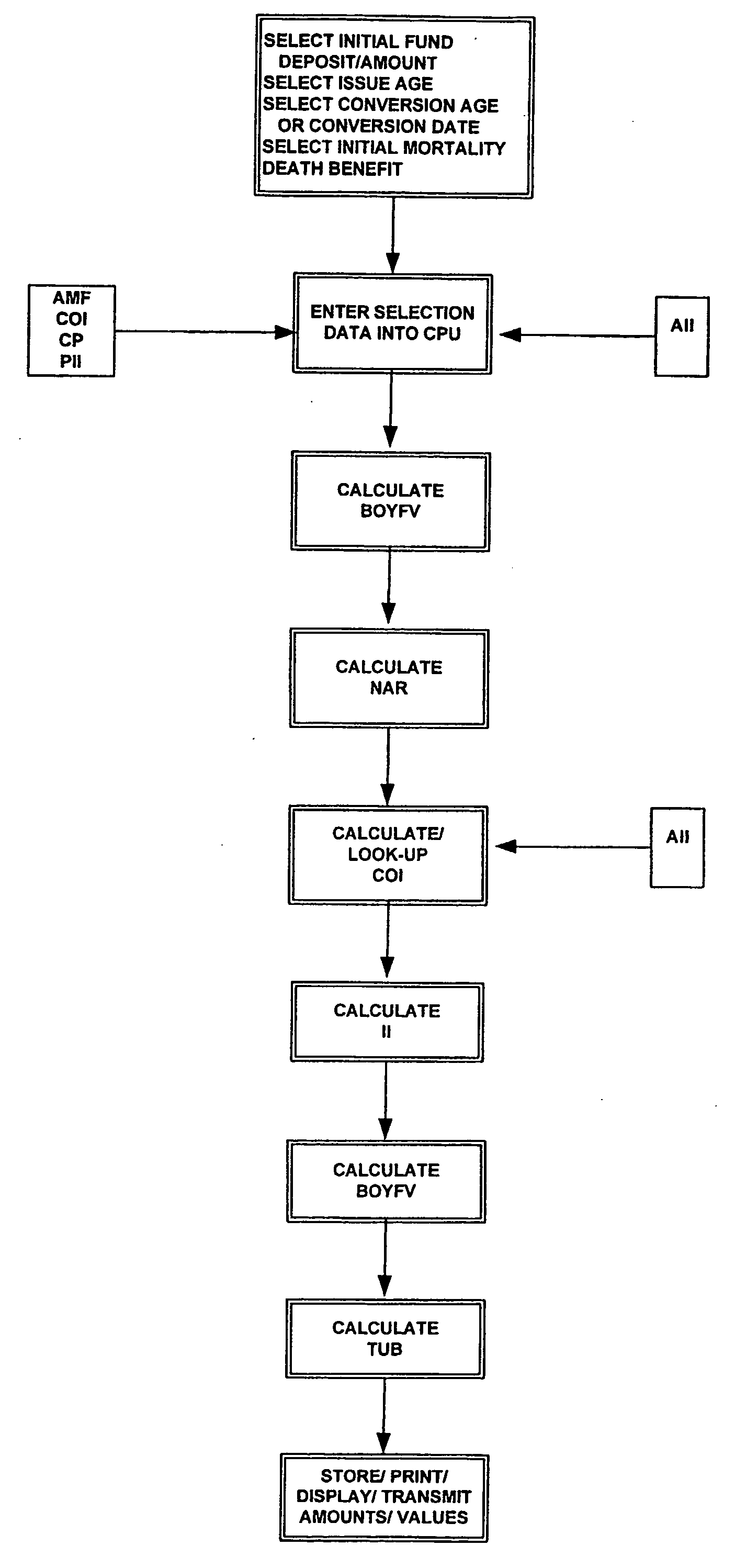

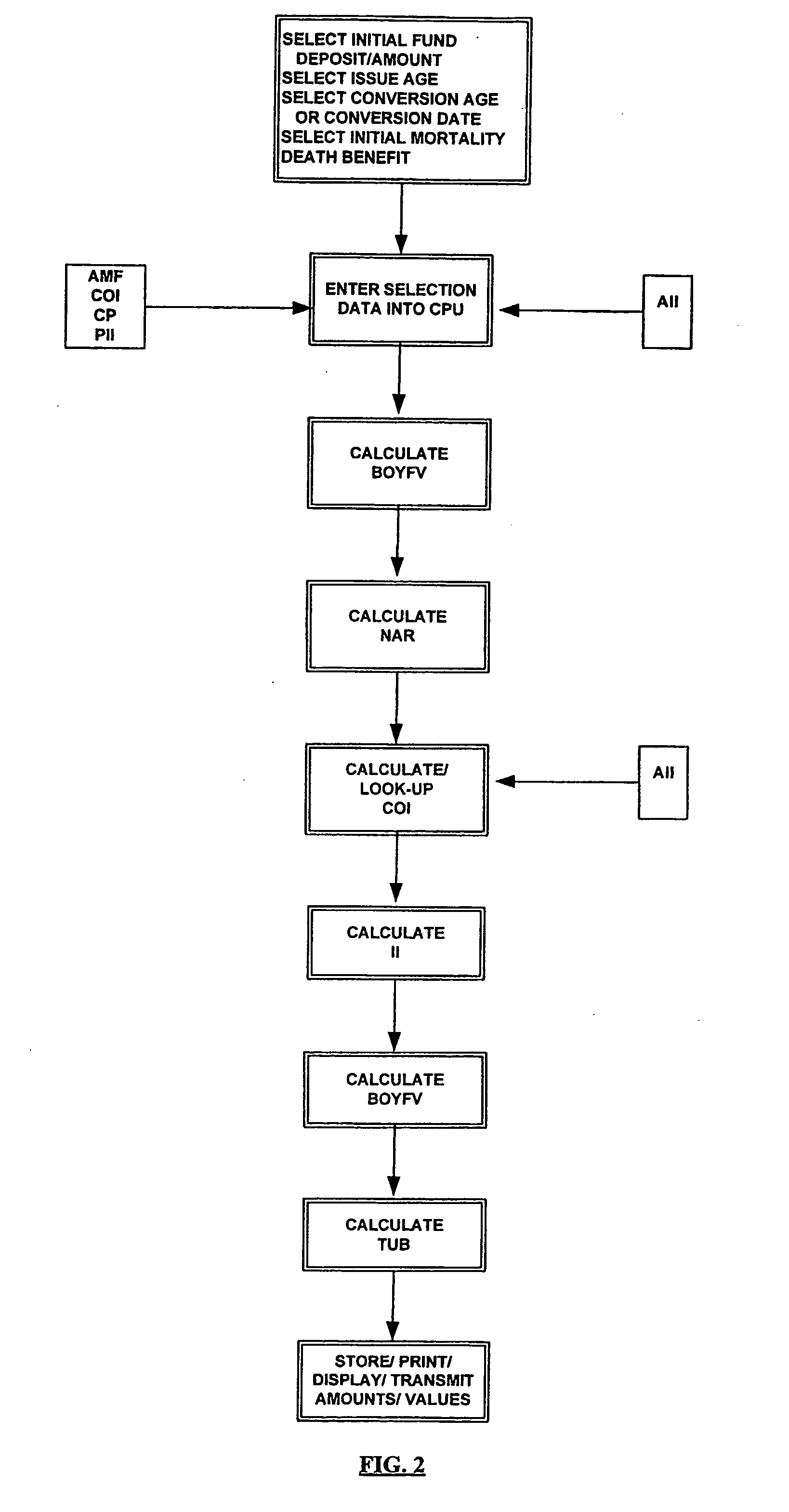

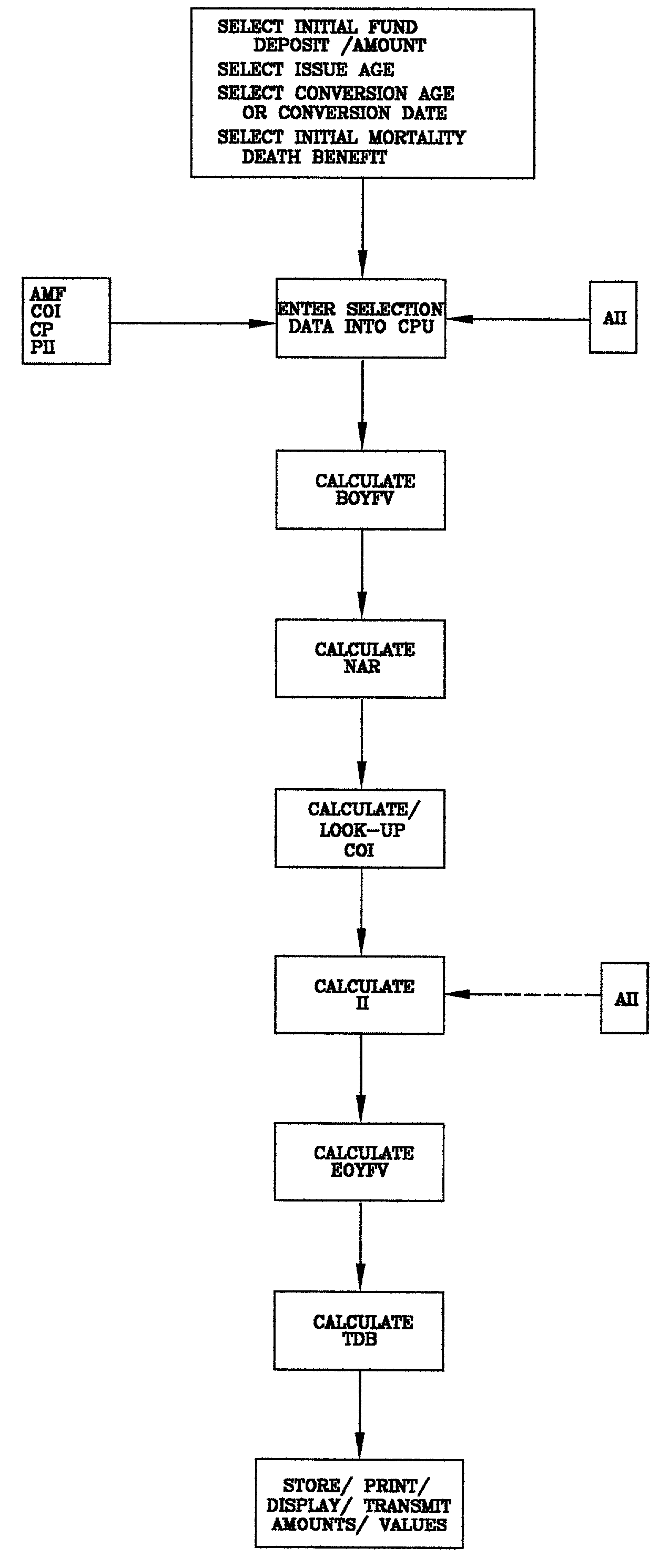

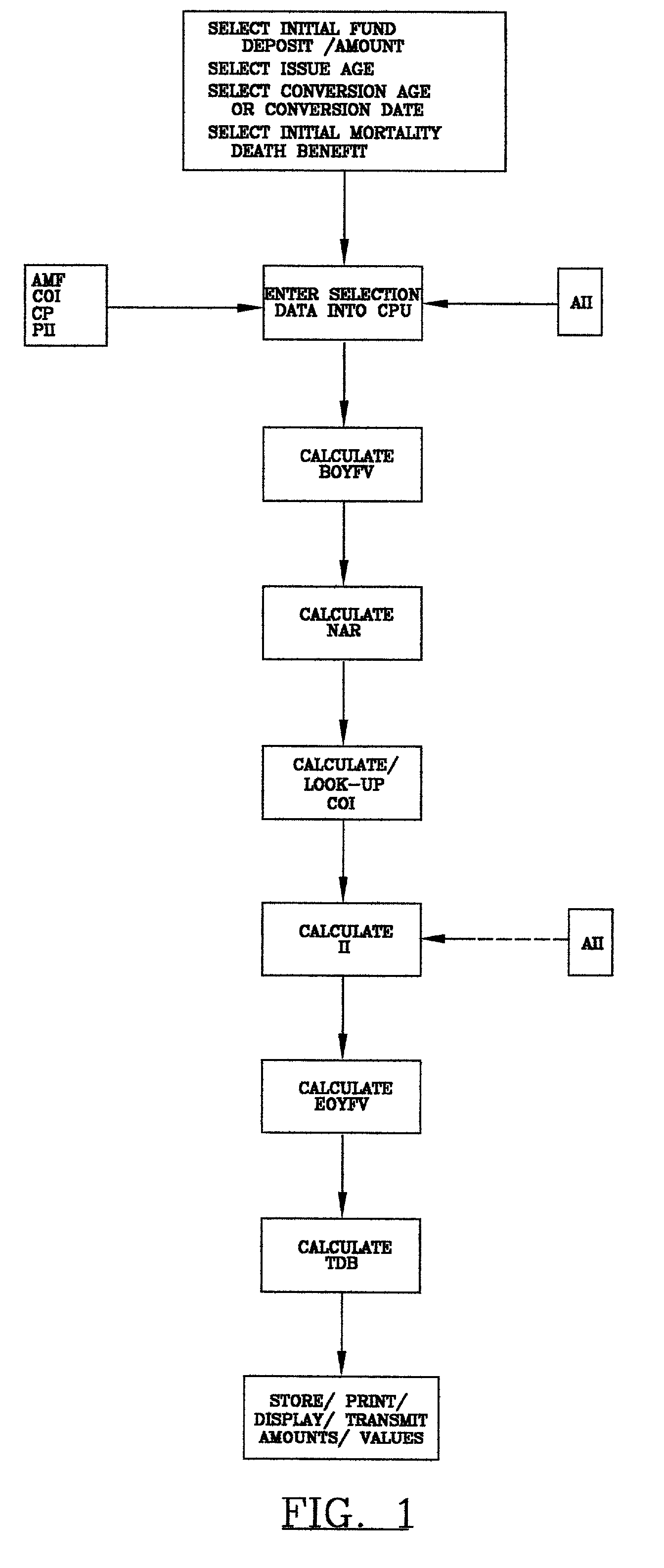

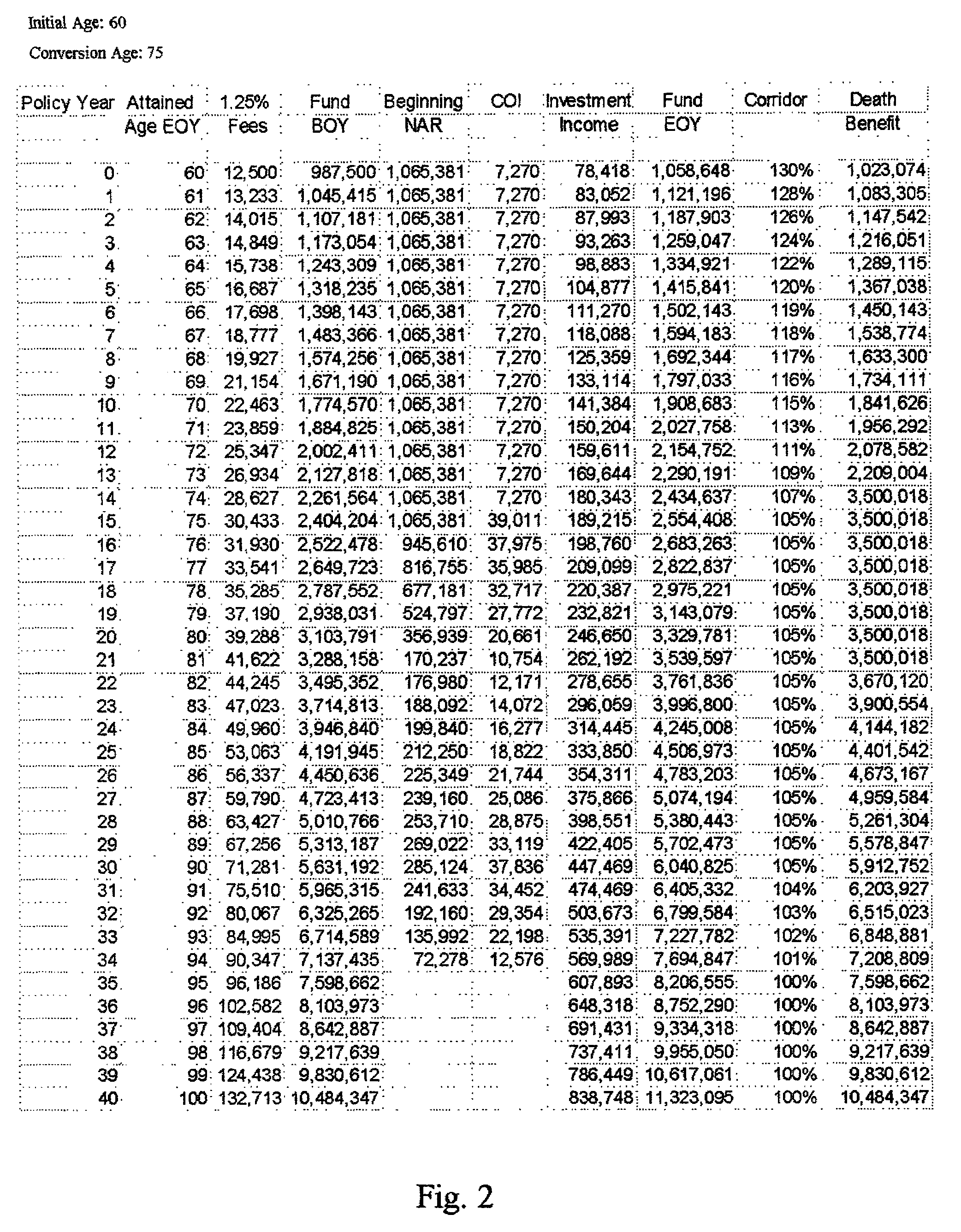

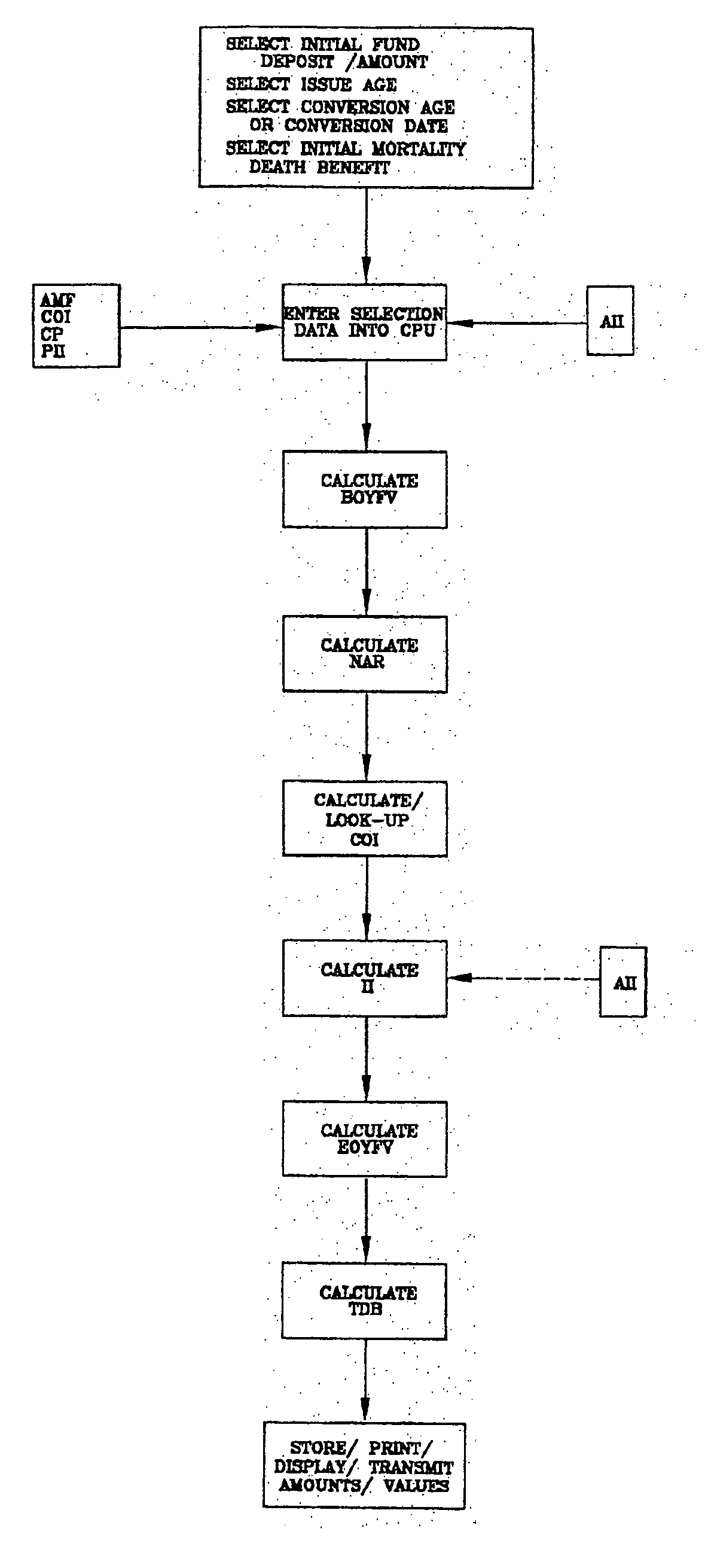

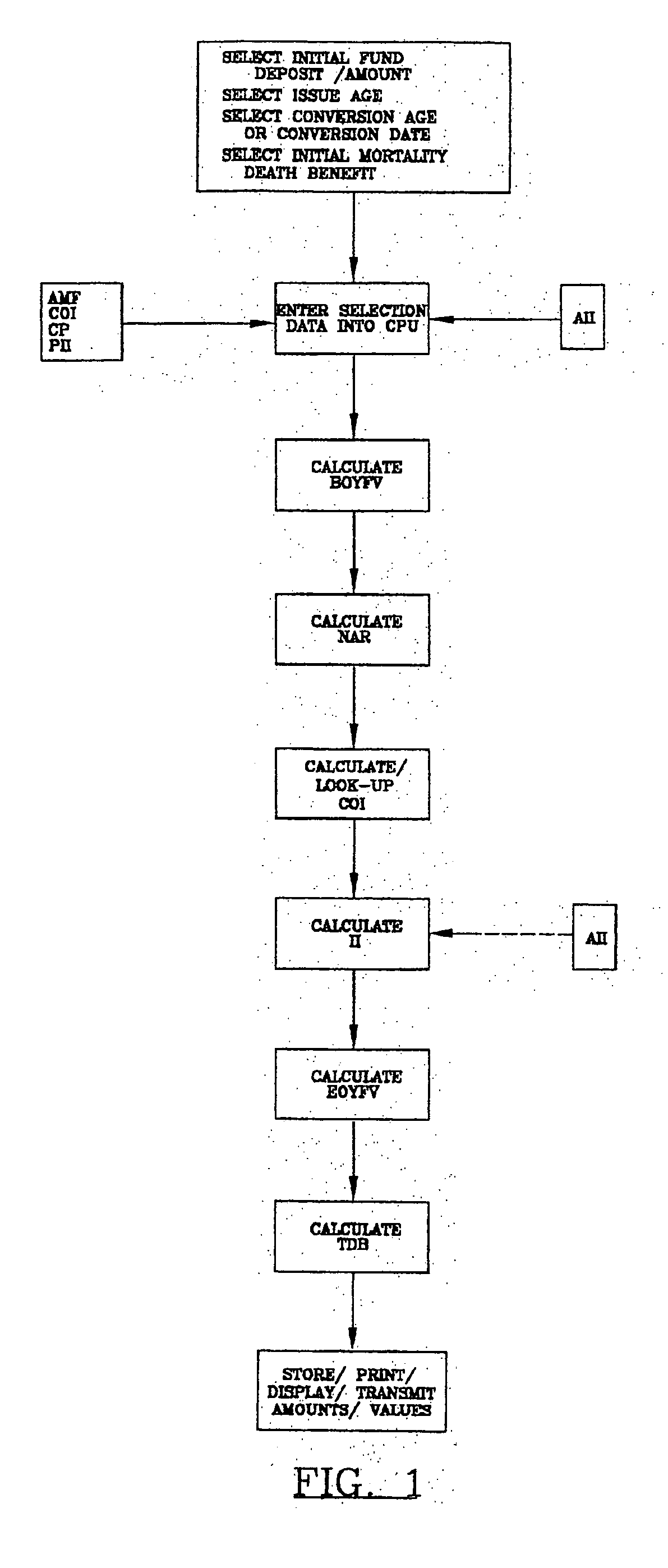

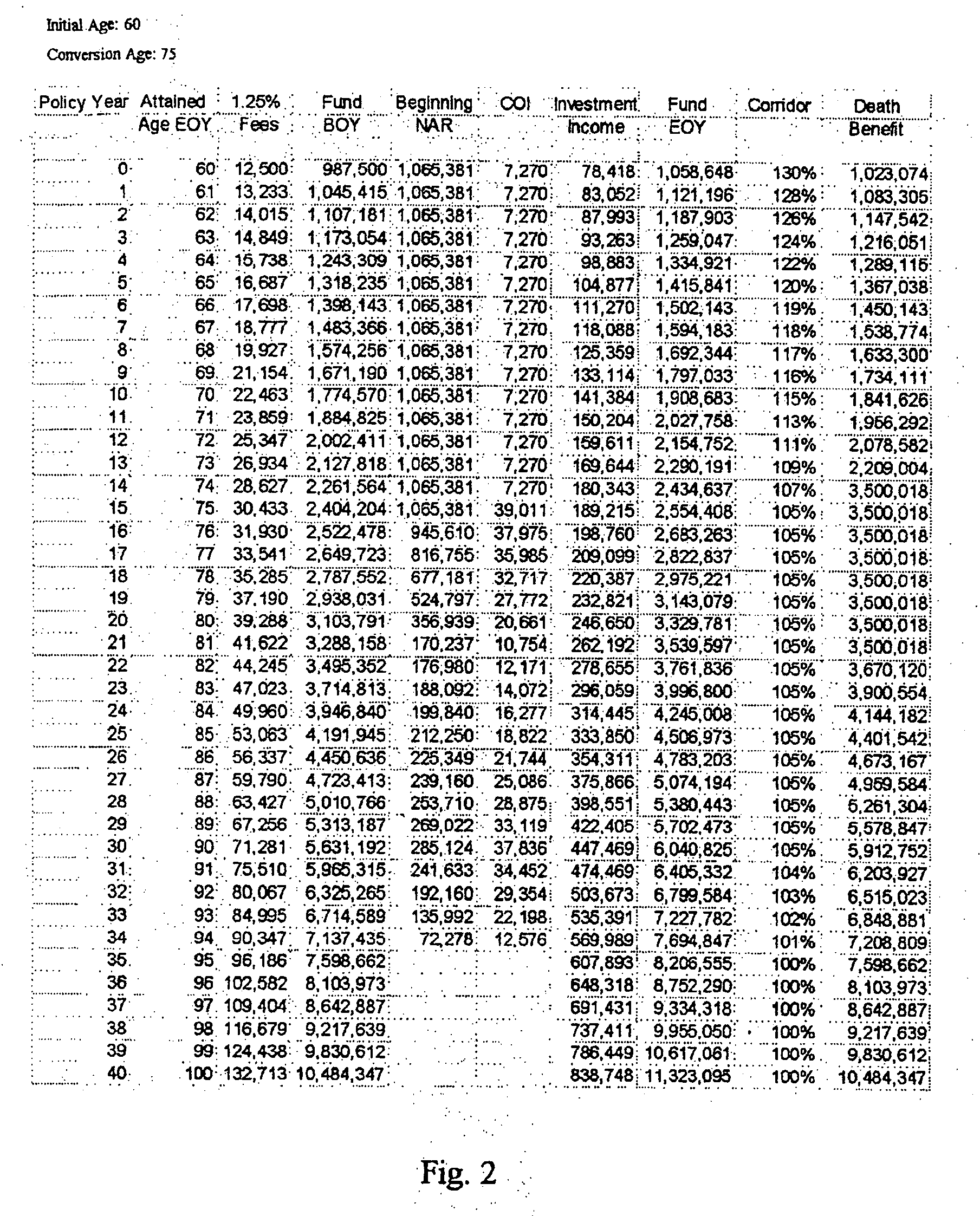

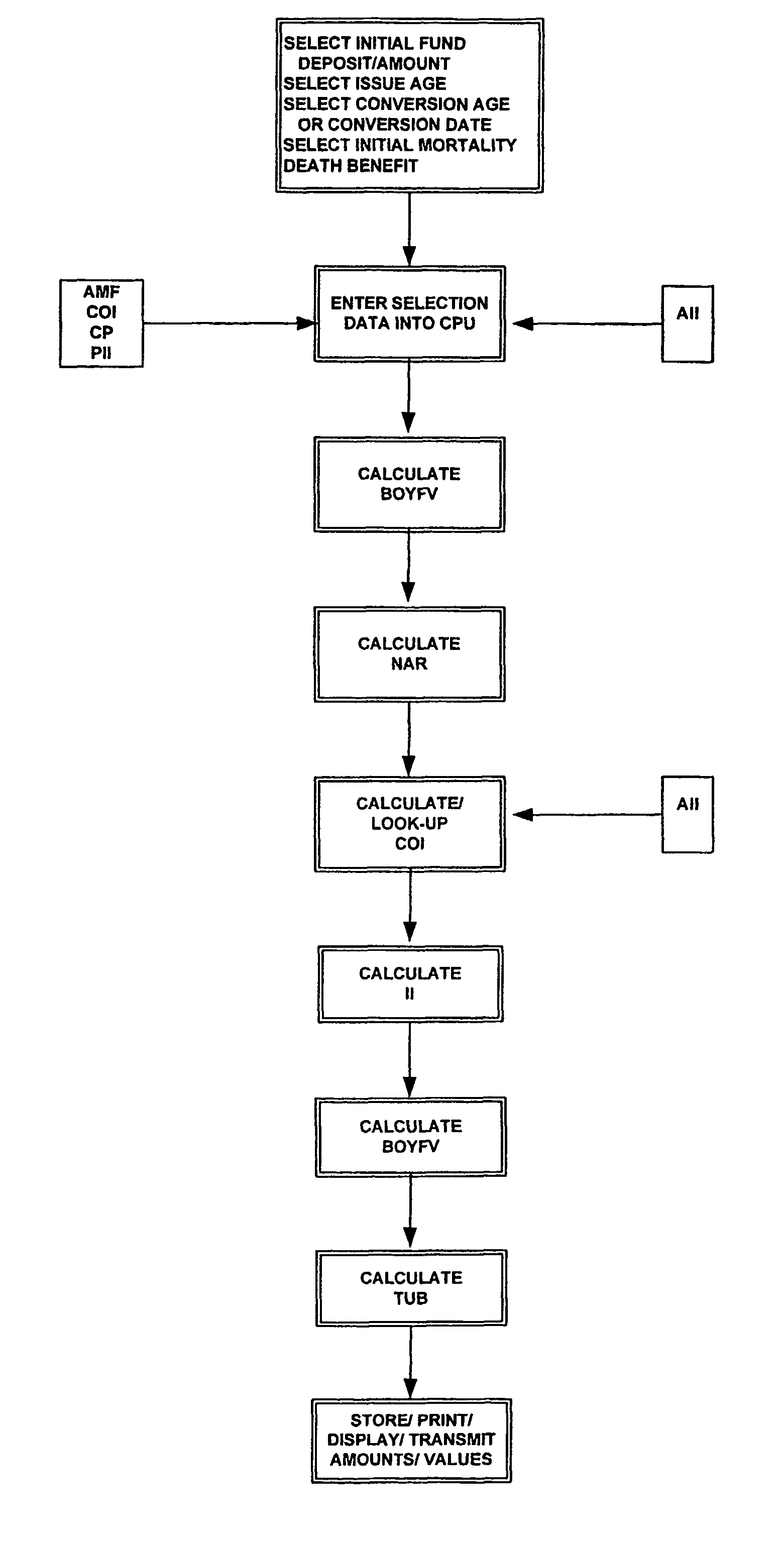

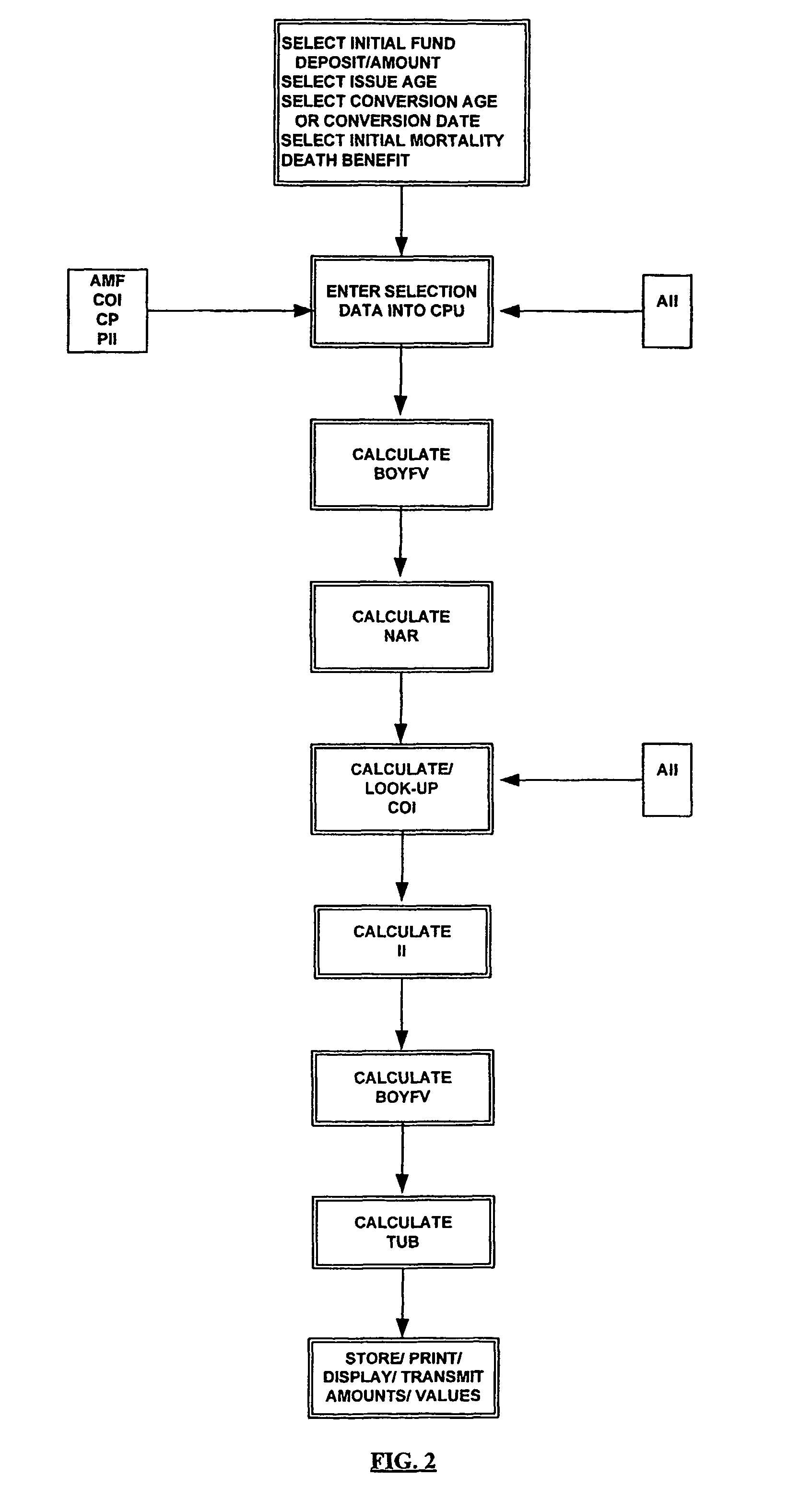

Method and system for converting an annuity fund to a life insurance policy

InactiveUS20090037231A1Least and reduced tax consequenceFinancePayment architectureInsurance lifeEngineering

A method and system for converting an annuity fund to a life insurance policy at a predetermined conversion date comprising the following steps: establishing an annuity fund of a predetermined value and purchasing a fixed or variable annuity for the annuity fund, establishing an irrevocable life insurance conversion plan including selecting the predetermined conversion date, selecting a predetermined mortality death benefit at the predetermined conversion date and purchasing a guaranteed insurability option to guarantee the availability of the predetermined mortality death benefit at the predetermined conversion date, accruing investment income within the annuity fund on a tax deferred basis until the predetermined conversion date, converting the annuity fund to the life insurance policy with the predetermined mortality death benefit at the predetermined conversion date, accruing income within the life insurance policy until the death of the insured under the life insurance policy and disbursing the death benefit consisting of mortality insurance and accrued cash values to the beneficiary at the death of the insured under the life insurance policy.

Owner:BANKERS INSURANCE GROUP

Dimensionality reduction of multi-attribute consumer profiles

Provided is a process of inferring insurability scores, the process including: receiving a request for an insurance comparison webpage; sending instructions to present one or more webpages of a web site having a plurality of user inputs configured to receive a plurality of attributes of the user; receiving the attributes; determining an insurability score with an insurability model based on the received attributes of the user; and sending instructions to display a value indicative of the insurability score.

Owner:INSURANCE ZEBRA INC

Method and system for converting an annuity fund to a life insurance policy

InactiveUS7343333B2Least and reduced tax consequenceFinancePayment architectureInsurance lifeEngineering

A method and system for converting an annuity fund to a life insurance policy at a predetermined conversion date comprising the following steps: establishing an annuity fund including selecting an initial predetermined value and purchasing an annuity for the initial predetermined value, establishing an irrevocable life insurance conversion plan including selecting the predetermined conversion date, selecting a predetermined mortality death benefit at the predetermined conversion date and purchasing a guaranteed insurability option to guarantee the availability of the predetermined mortality death benefit at the predetermined conversion date, accruing investment income within the annuity fund on a tax deferred basis until the predetermined conversion date, converting the annuity fund to the life insurance policy with the predetermined mortality death benefit at the predetermined conversion date, accruing income within the life insurance policy until the death of the owner of the life insurance policy and disbursing the death benefit to the beneficiary at the death of the owner of the life insurance policy.

Owner:BANKERS INSURANCE GROUP

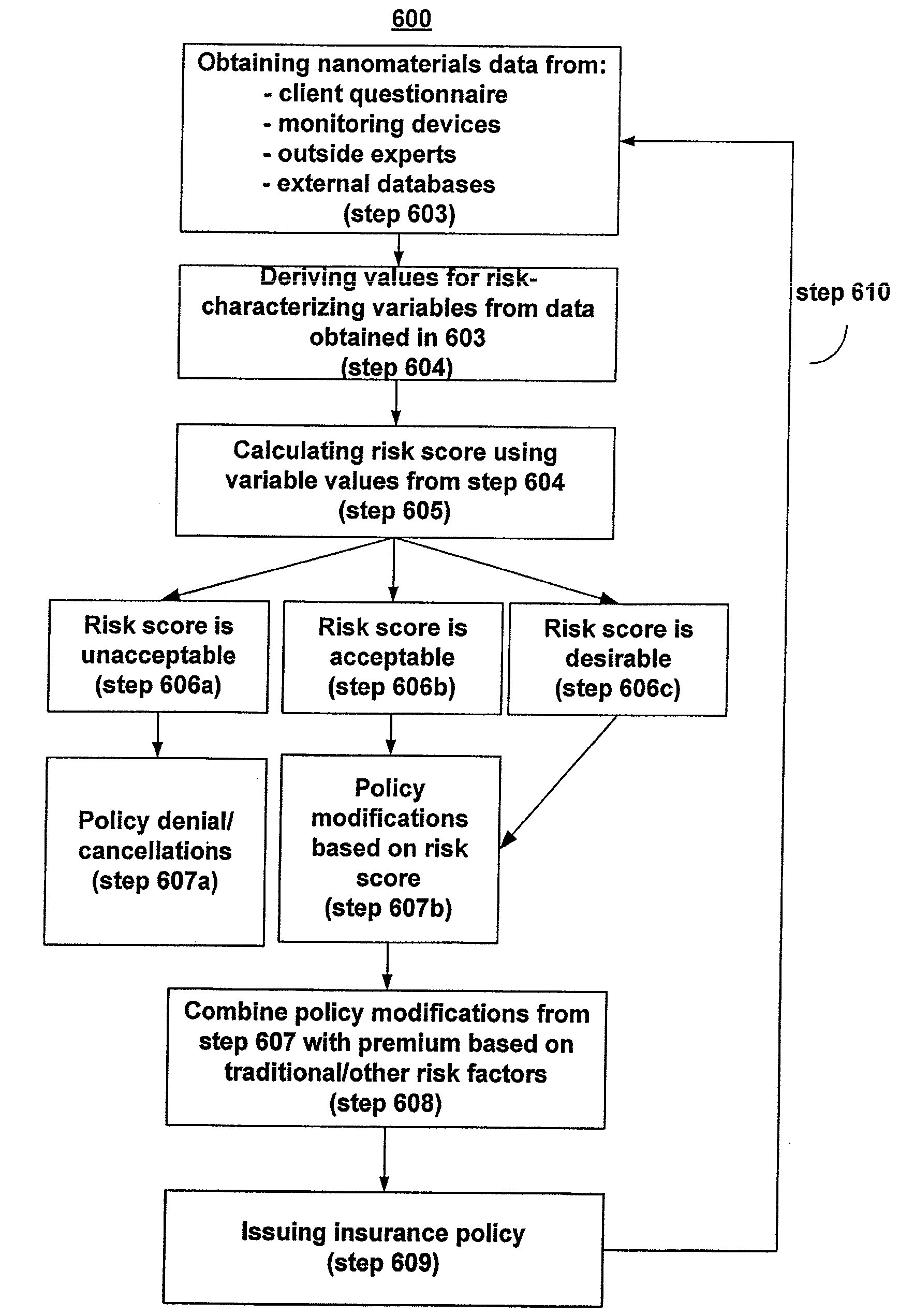

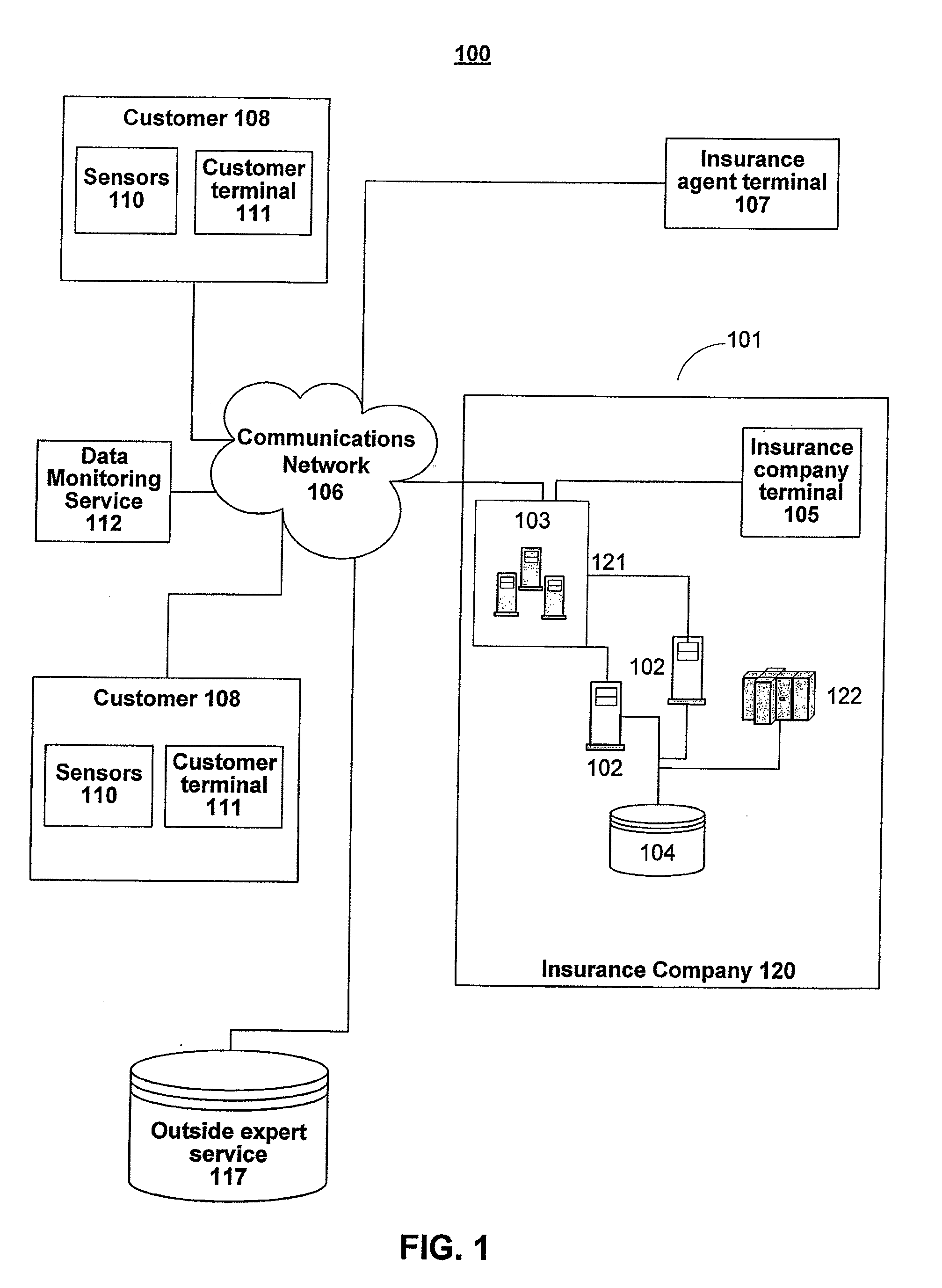

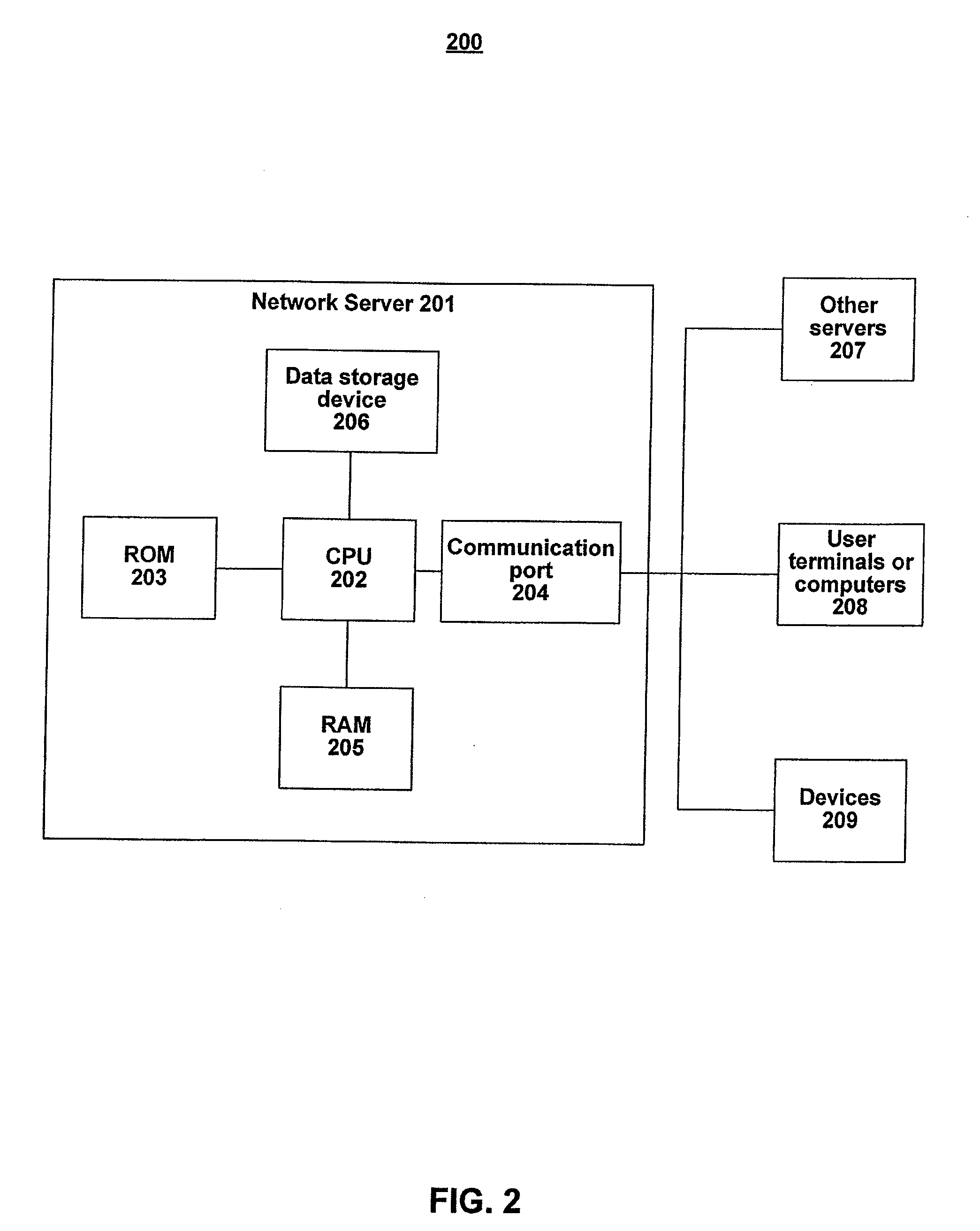

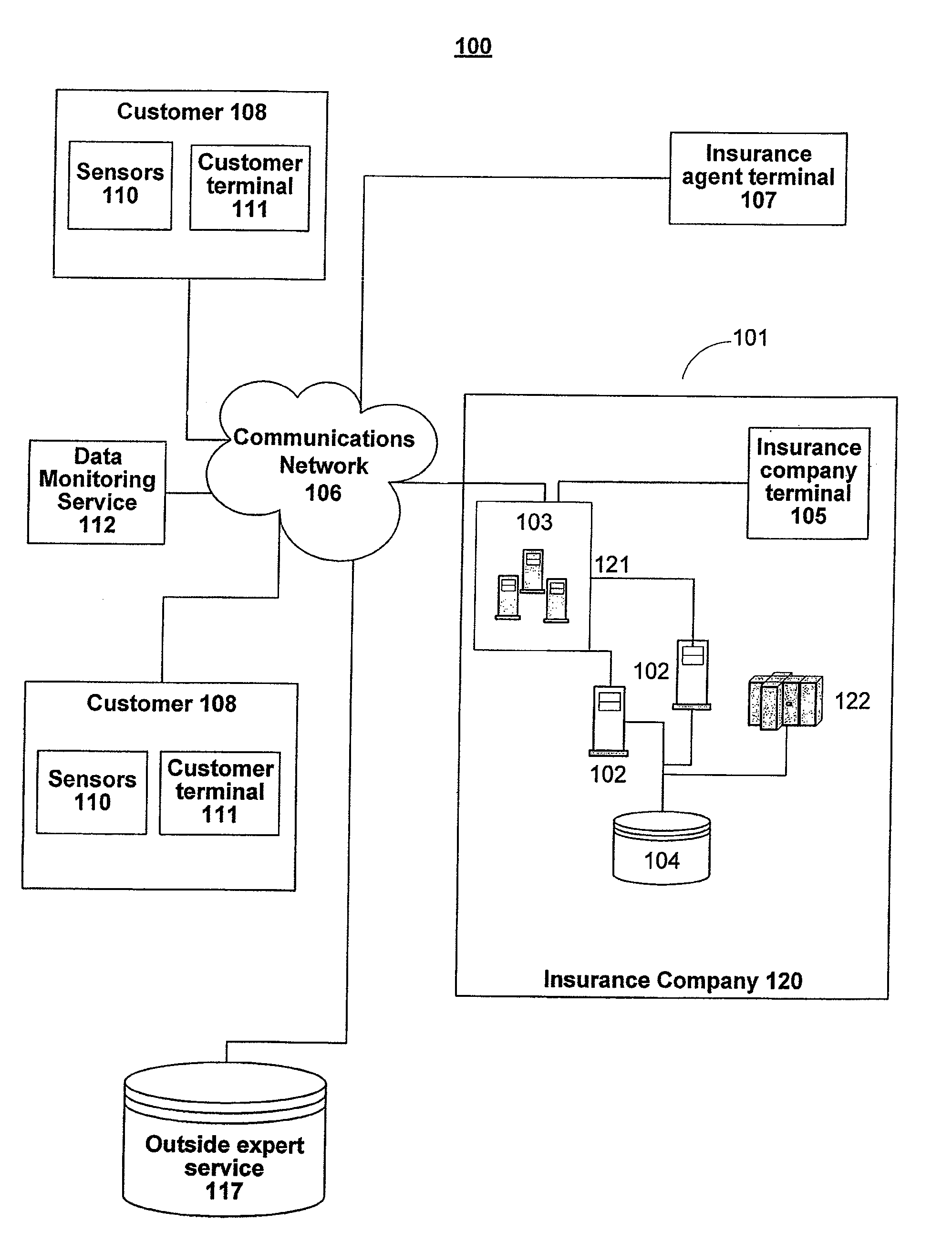

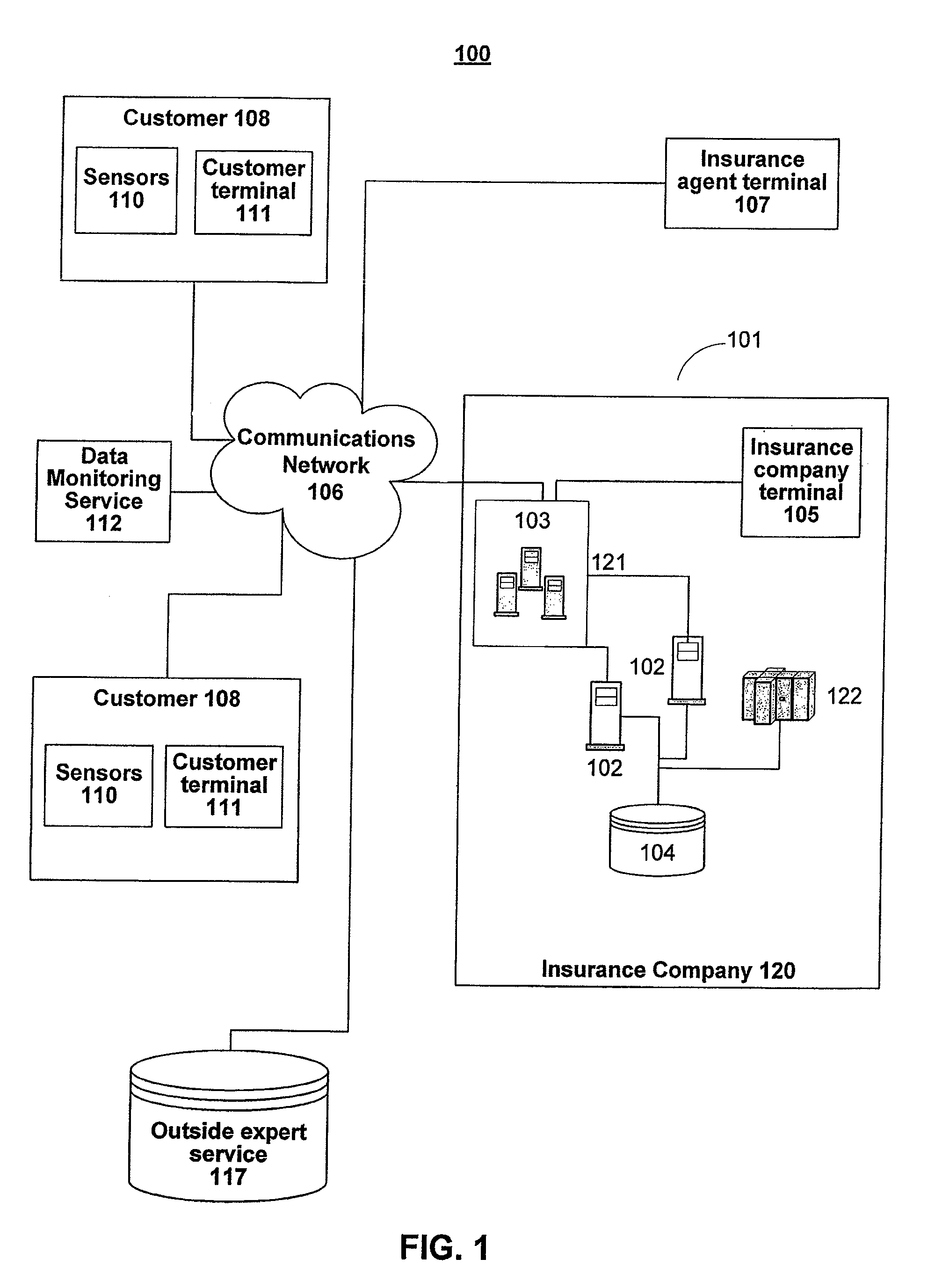

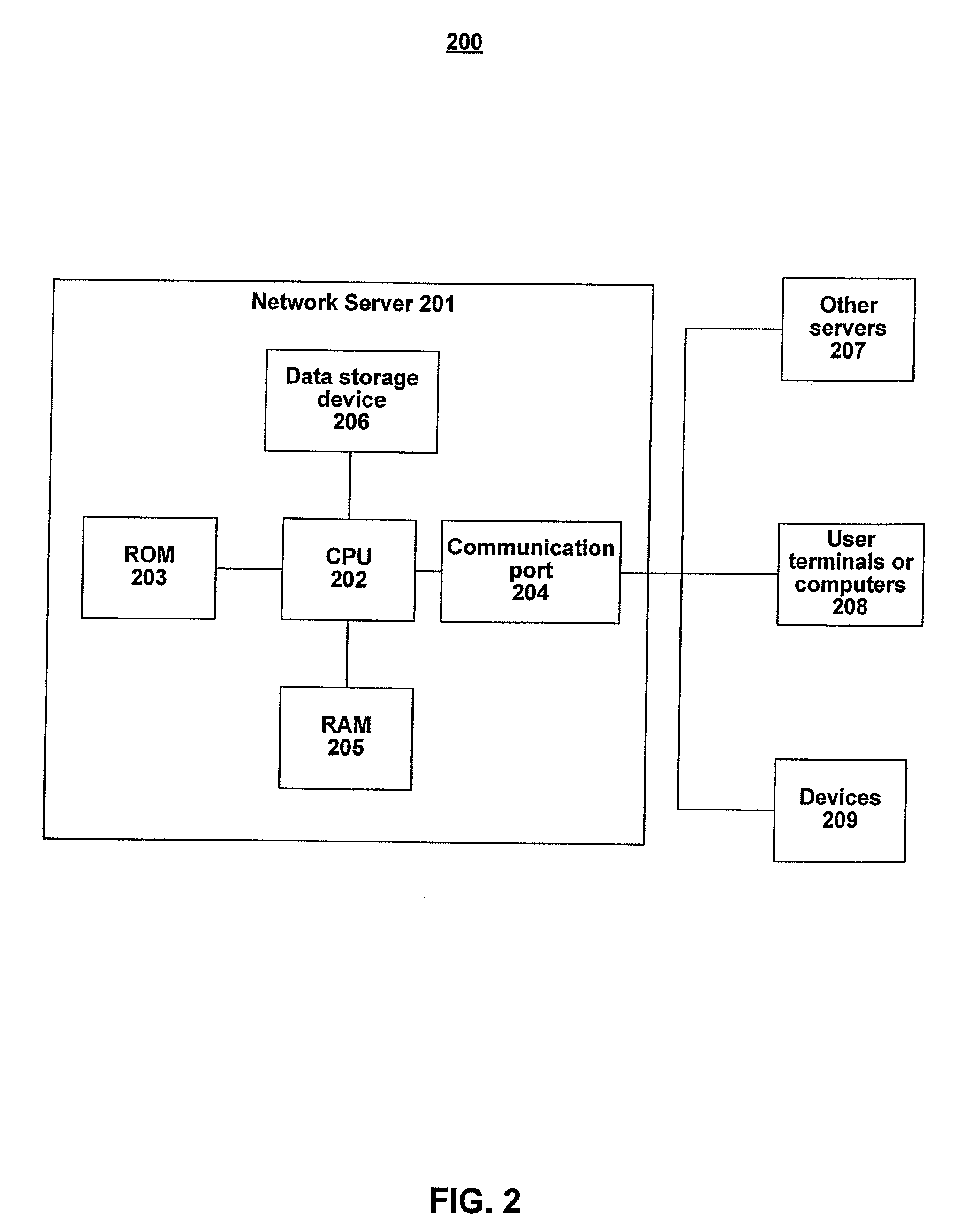

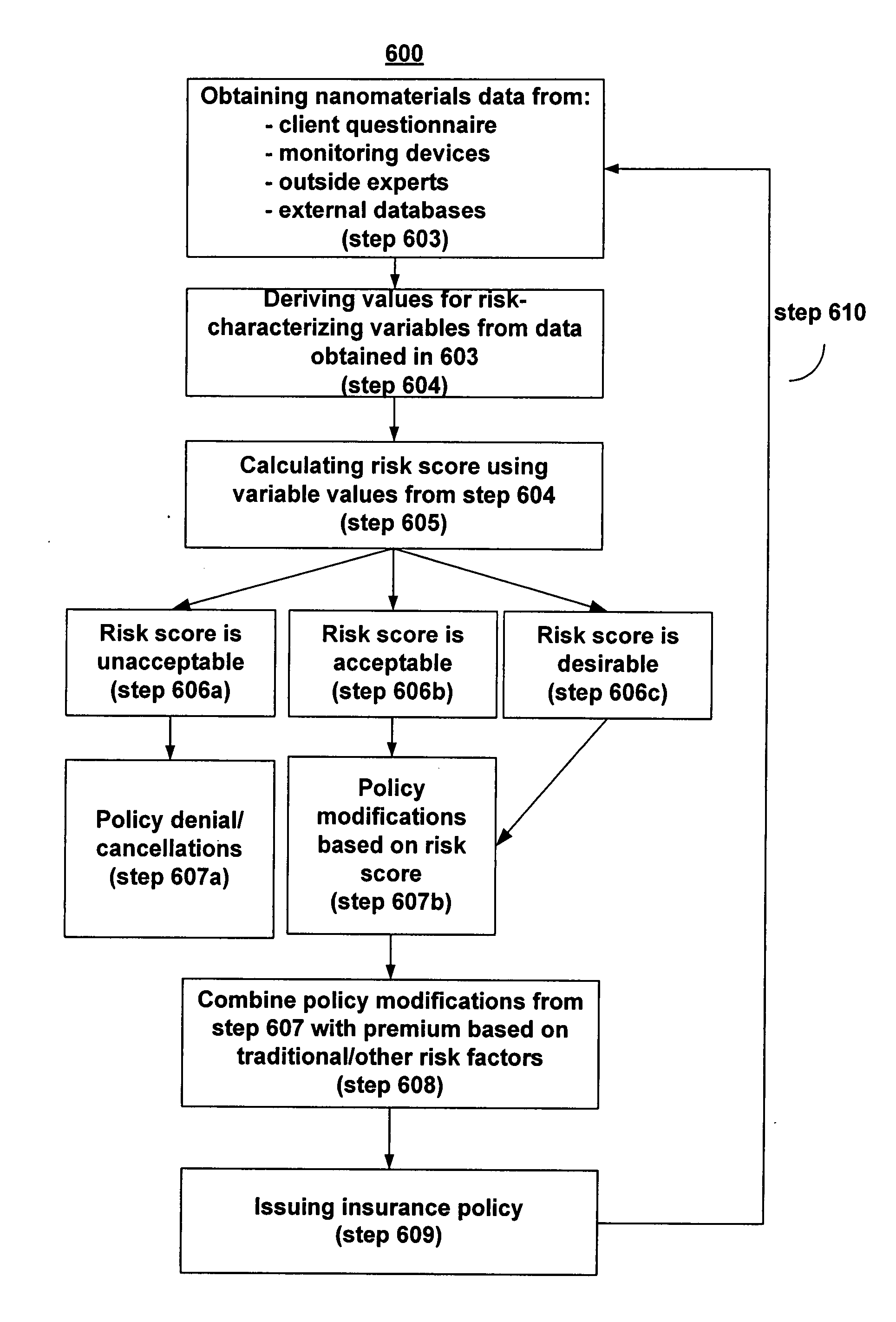

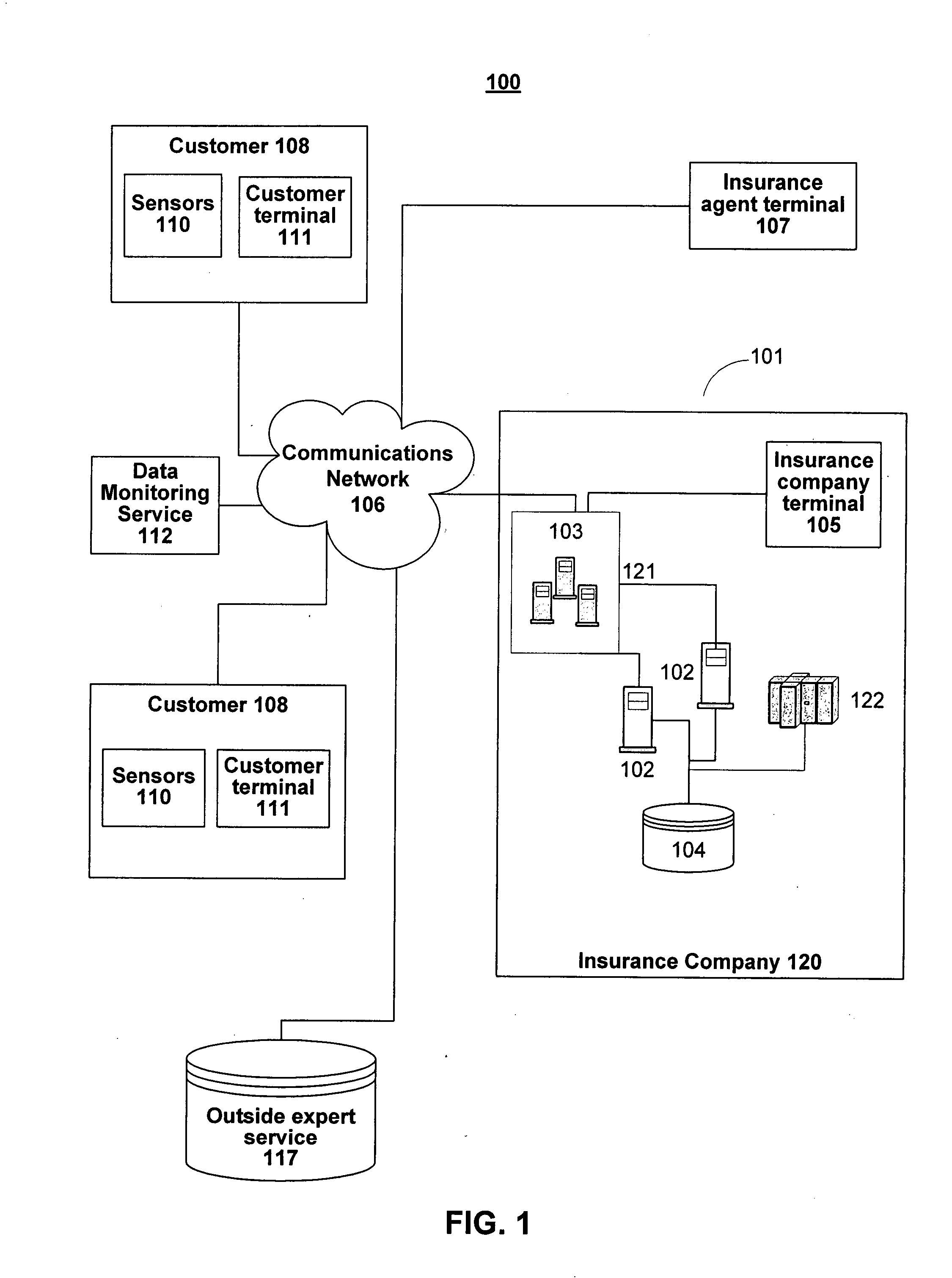

System and method for identifying and evaluating nanomaterial-related risk

A system, method, and processor-readable medium are provided for quantitatively evaluating risk associated with nanotechnology. An insurance company computing system obtains nanomaterial-related data from a variety of sources, including nanomaterial sensors such as differential mobility analyzers located on-site at an insured facility. The insurance computing system uses the obtained data and a computerized model to compute a risk score that is used in evaluating the insurability of the facility or the operating entity. An insurance policy or modifications to an existing insurance premium are subsequently produced based on the computed risk score.

Owner:HARTFORD FIRE INSURANCE

System and method for identifying and evaluating nanomaterial-related risk

A system, method, and processor-readable medium are provided for quantitatively evaluating risk associated with nanotechnology. An insurance company computing system obtains nanomaterial-related data from a variety of sources, including nanomaterial sensors such as differential mobility analyzers located on-site at an insured facility. The insurance computing system uses the obtained data and a computerized model to compute a risk score that is used in evaluating the insurability of the facility or the operating entity. An insurance policy or modifications to an existing insurance premium are subsequently produced based on the computed risk score.

Owner:HARTFORD FIRE INSURANCE

Method and apparatus for insuring multiple unit dwellings

A method and apparatus for insuring both the owner and tenants within an apartment or multi-unit dwelling comprising: inputting into a computer processor a database of building physical information, occupancy information, and tenant rental information; inputting into the computer processor an insurance qualification program for tenant insurance covering both the building owner and tenant from unintentional damage caused by the tenant from fire, smoke, explosions, water damage, or negligence injuries by the tenant caused to third parties pursuant to predetermined insurability criteria; qualifying the building for tenant and owner occupancy insurance, and computer translating and generating insurance coverage for the building owner based on the number of units in the building and insurance coverage limits desired, and billing the owner for renter's single interest insurance.

Owner:RENTERS LEGAL LIABILITY

Blanket insurance method and policy for insuring multiple unit dwellings

InactiveUS20060116915A1Reduce the cost of insuranceAvoid financial burdenFinanceOffice automationMulti unitThird party

A blanket insurance method and policy for insuring the owner of an apartment or multi-unit dwelling from damage to his building caused by his tenant's unintentional acts comprising: inputting into a computer processor a database of building physical information, occupancy information, and tenant rental information; inputting into the computer processor an insurance qualification program for renters legal liability insurance covering the building owner from unintentional damage caused by the tenant from fire, smoke, explosions, water damage, or negligence injuries by the tenant caused to third parties pursuant to predetermined insurability criteria; qualifying the building for renters legal liability insurance, and computer translating and generating insurance coverage for the building owner based on the number of units in the building and insurance coverage limits desired, and billing the owner for renter's legal liability insurance.

Owner:RENTERS LEGAL LIABILITY

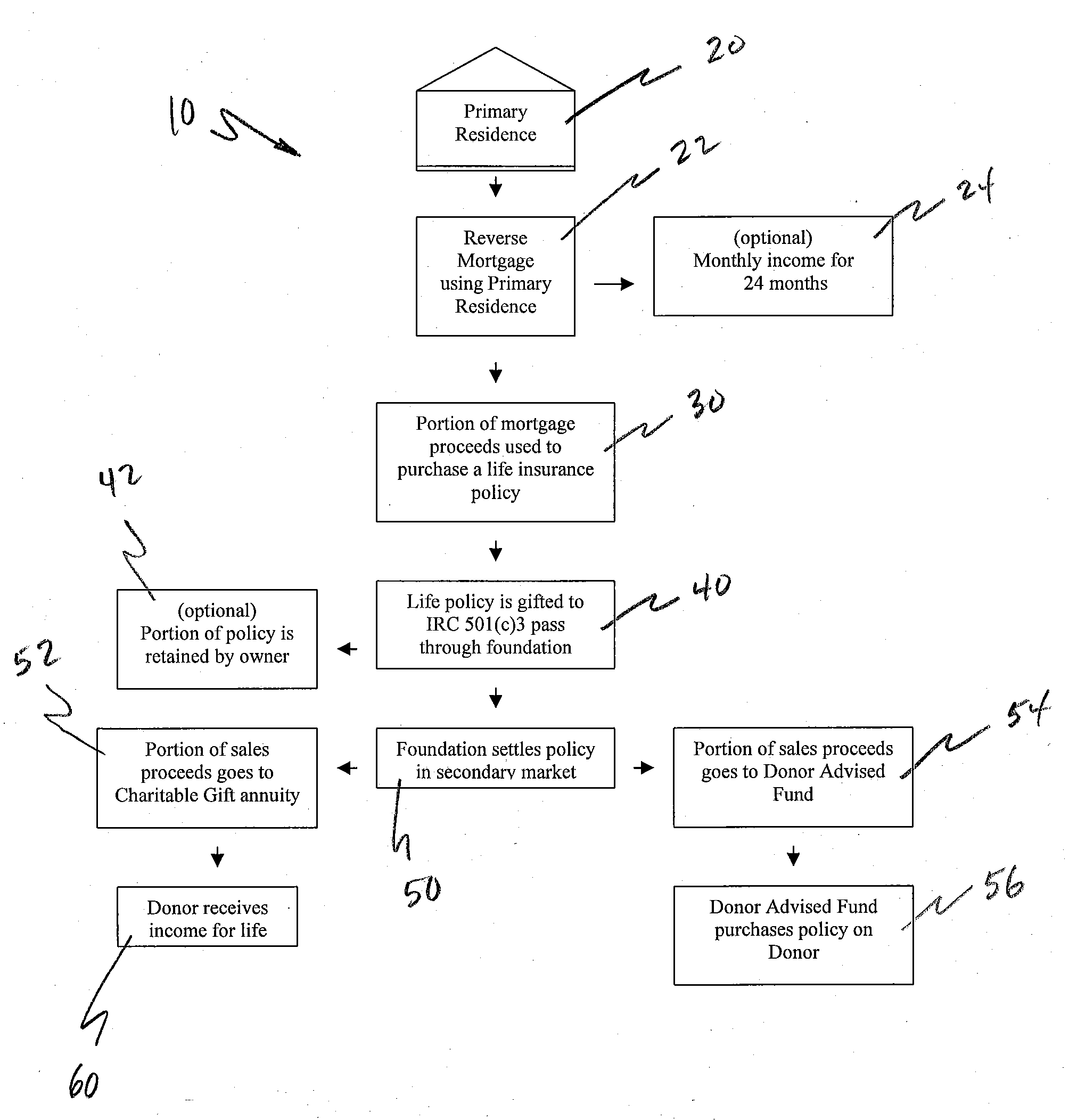

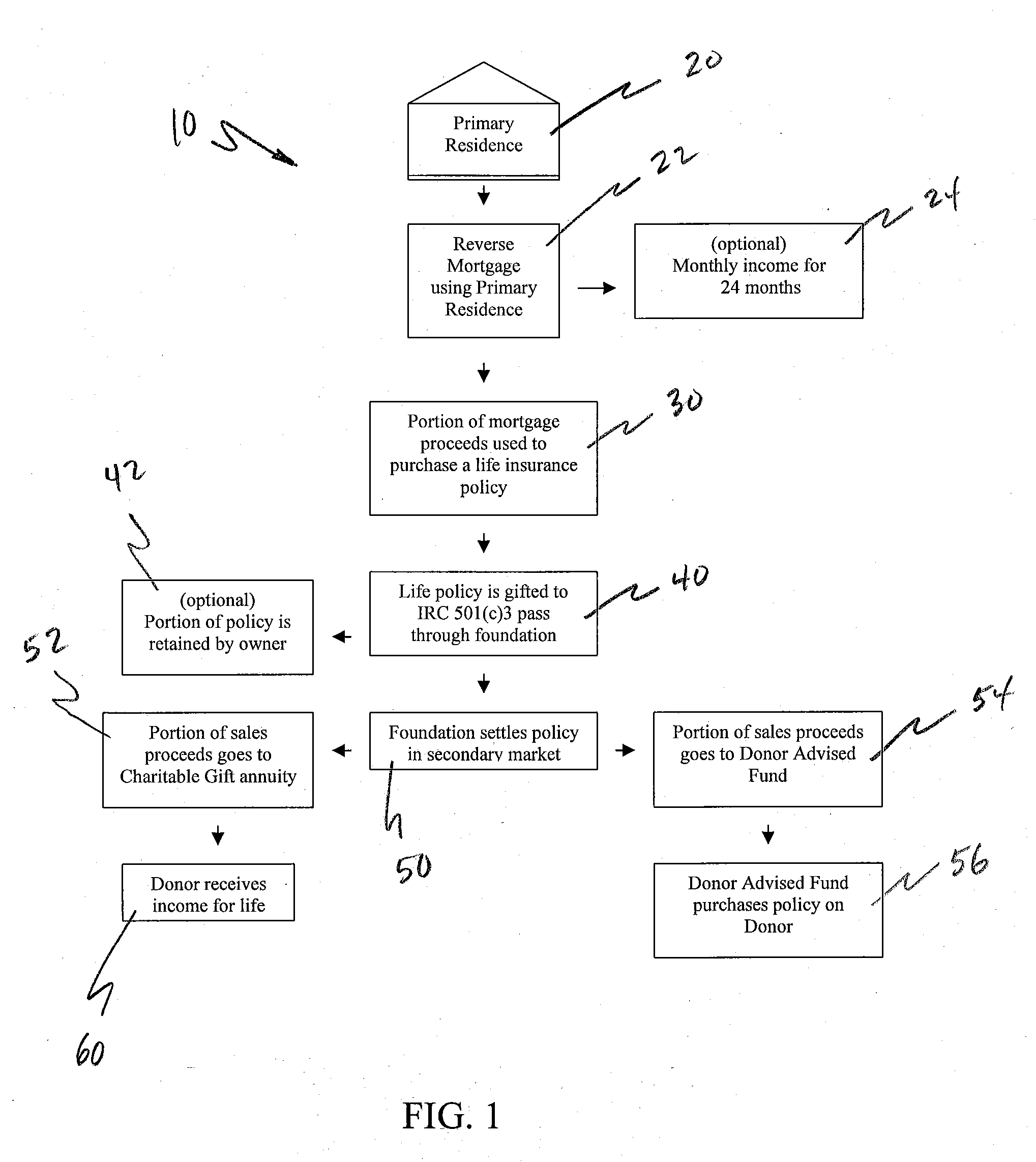

Method and system for increasing retirement income

A method and system for persons who are over the age of 62 to increase their retirement income by utilizing their insurability and real estate equity to fund the purchase of life insurance and / or annuities which are subsequently gifted to a donor advised fund, a charitable gift annuity, or a combination of both.

Owner:SANDERS GEORGE F +1

System and method for identifying and evaluating nanomaterial-related risk

A system, method, and processor-readable medium are provided for quantitatively evaluating risk associated with nanotechnology. An insurance company computing system obtains nanomaterial-related data from a variety of sources, including nanomaterial sensors such as differential mobility analyzers located on-site at an insured facility. The insurance computing system uses the obtained data and a computerized model to compute a risk score that is used in evaluating the insurability of the facility or the operating entity. An insurance policy or modifications to an existing insurance premium are subsequently produced based on the computed risk score.

Owner:HARTFORD FIRE INSURANCE

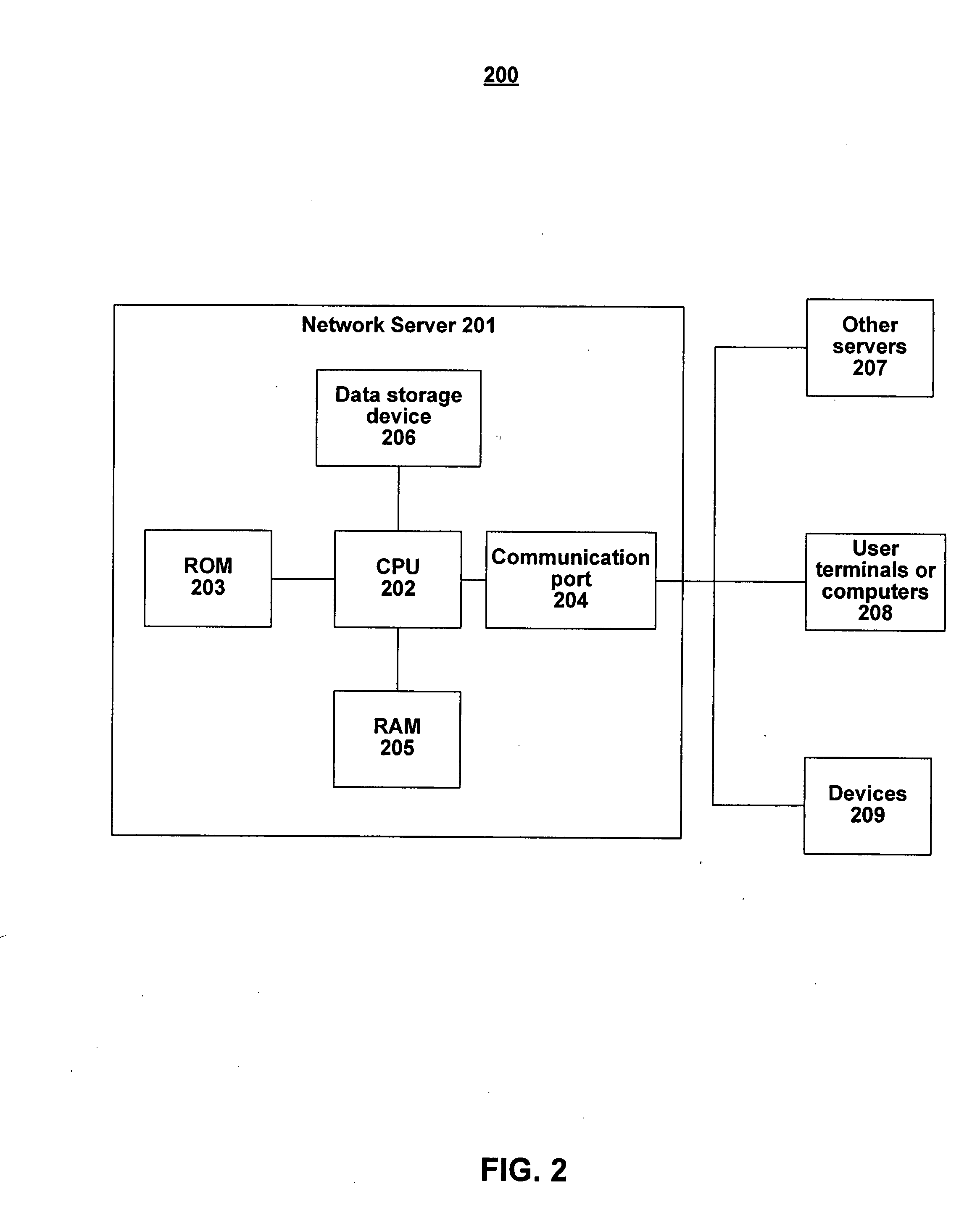

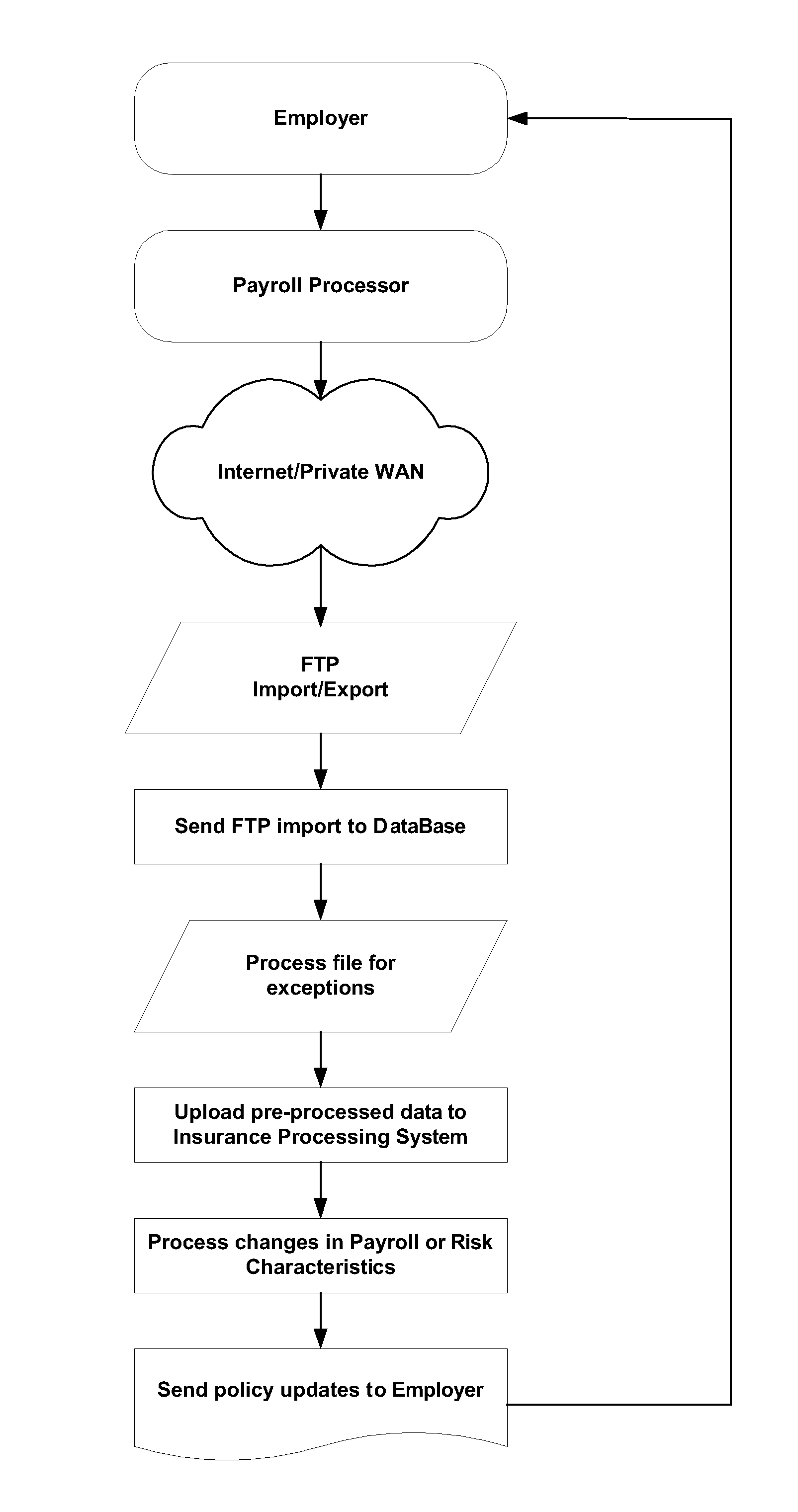

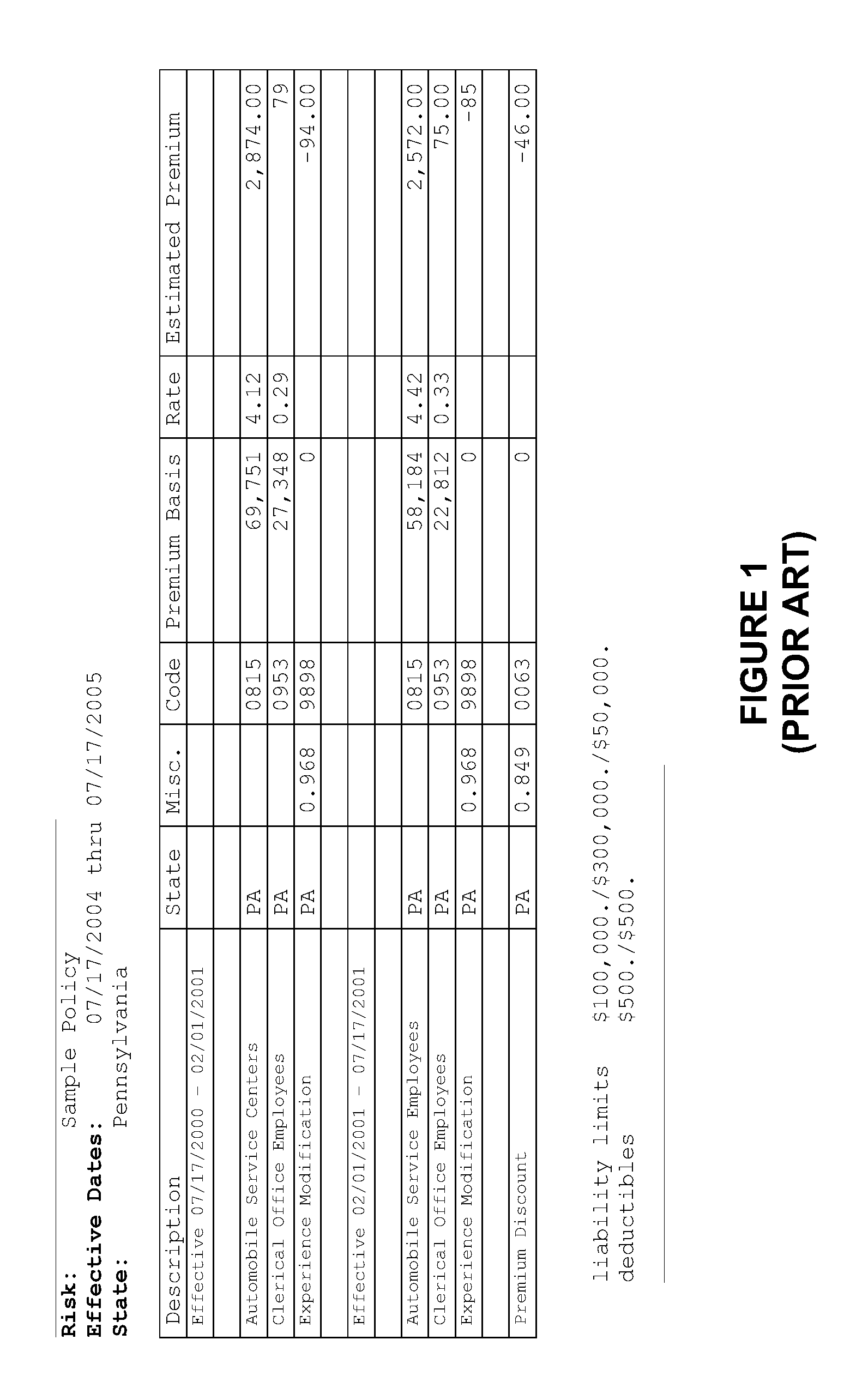

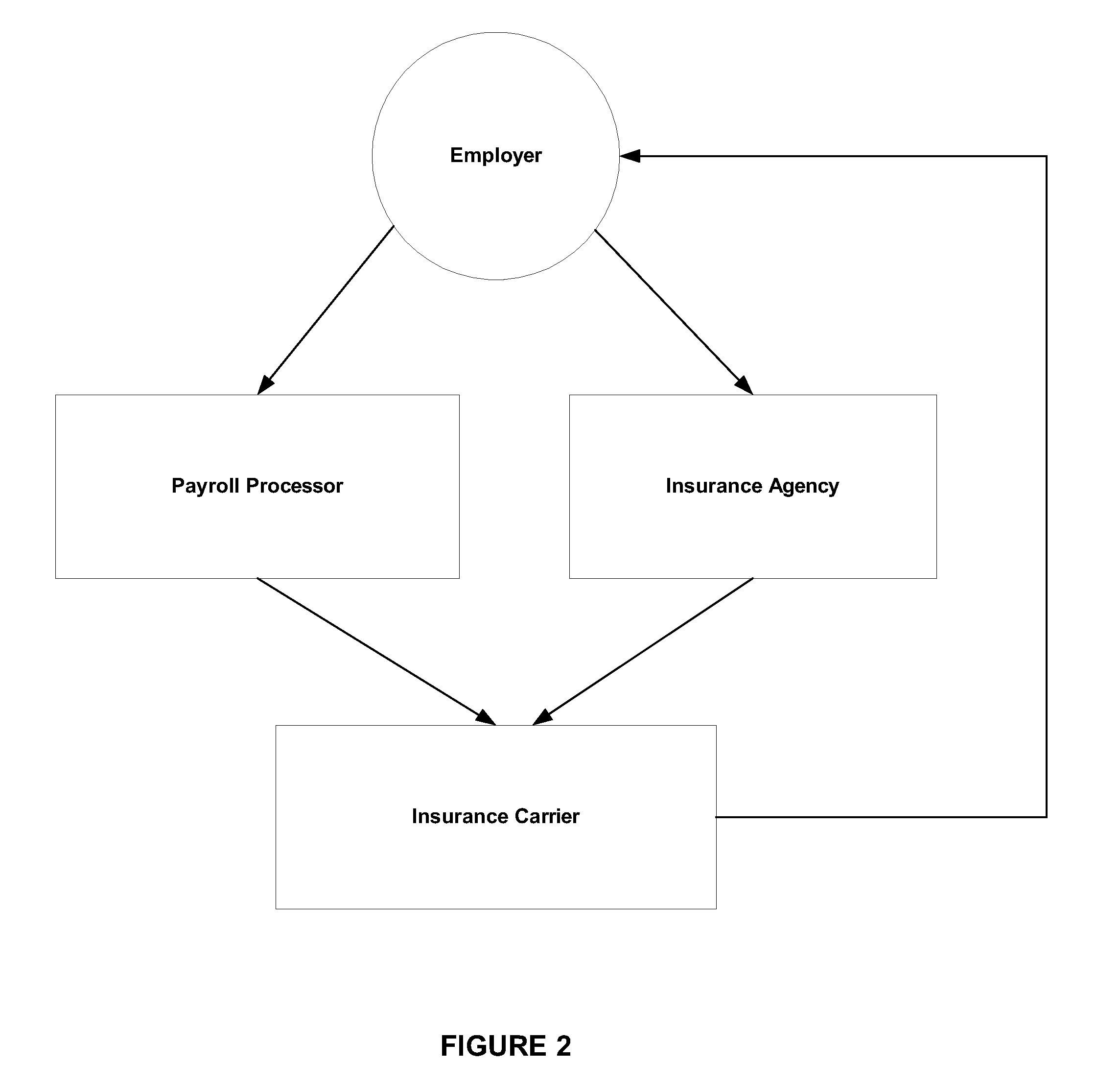

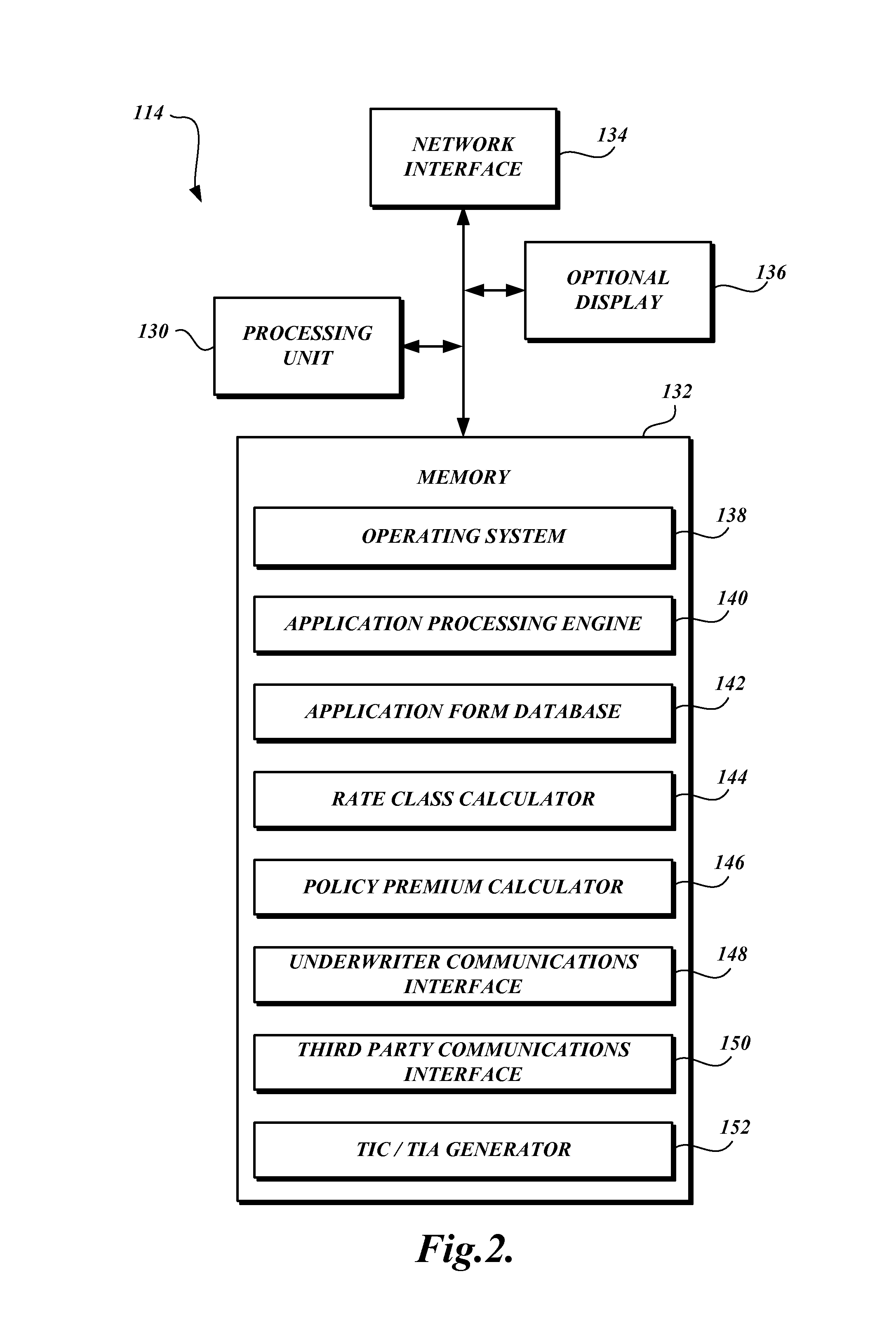

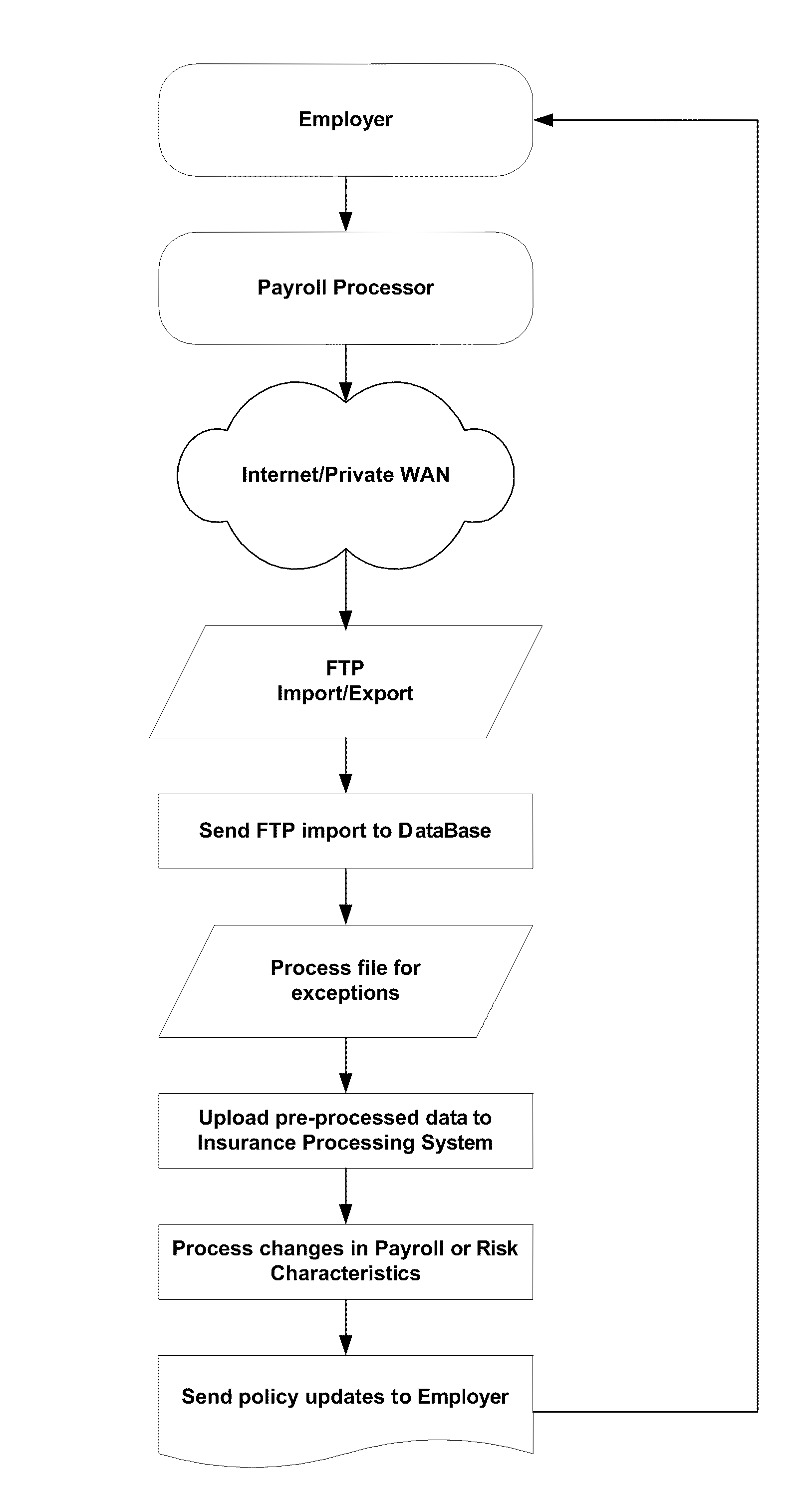

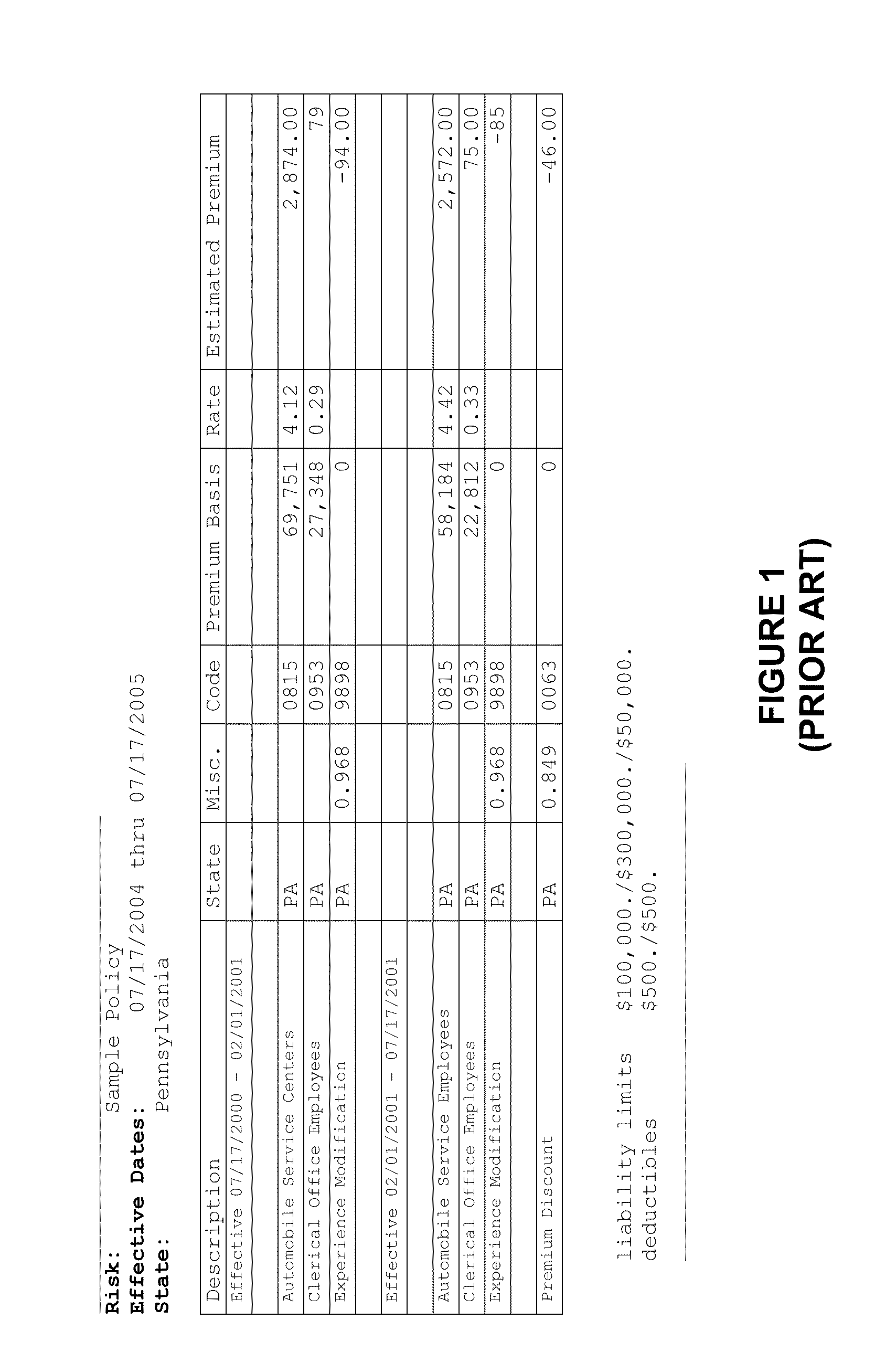

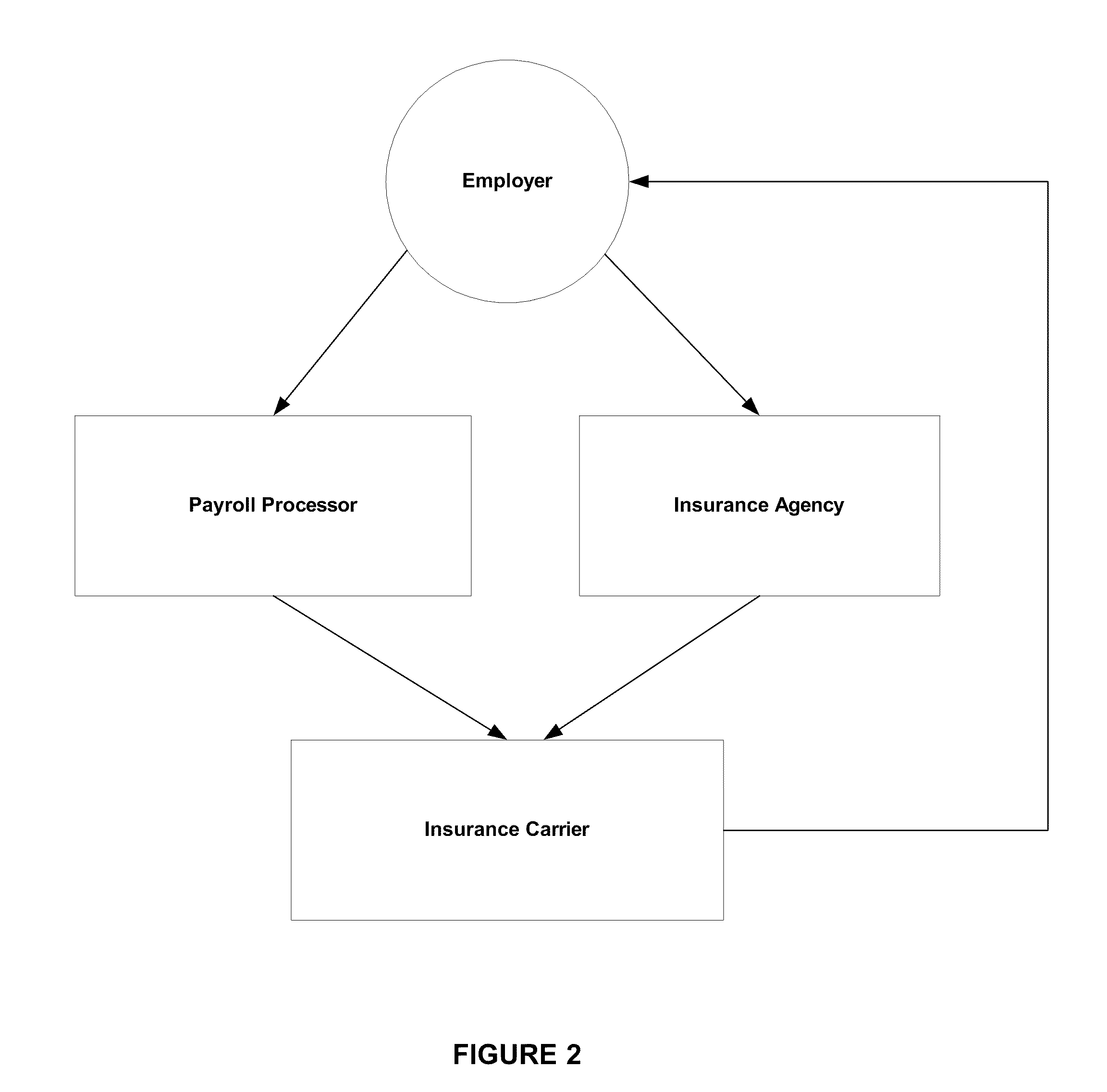

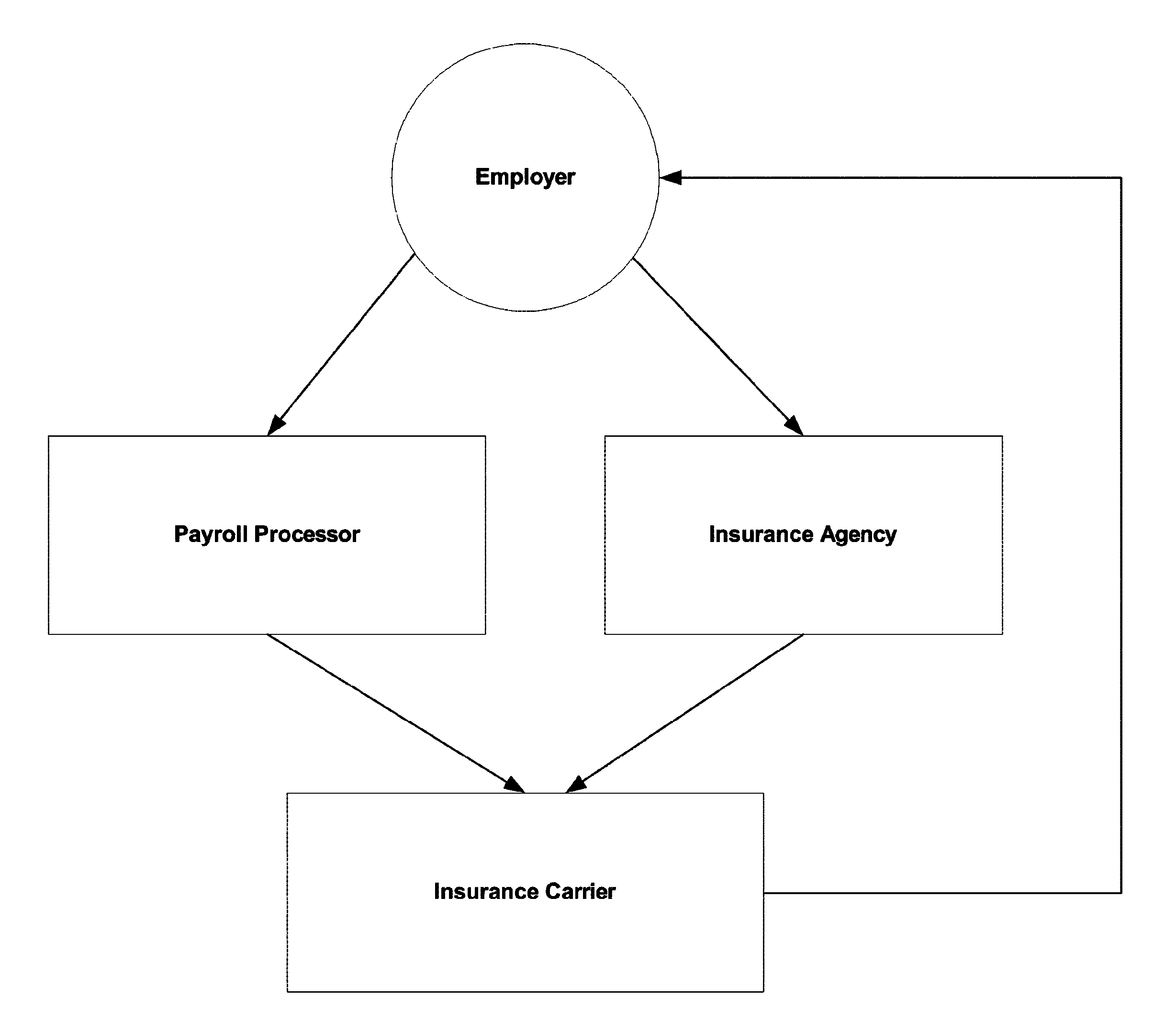

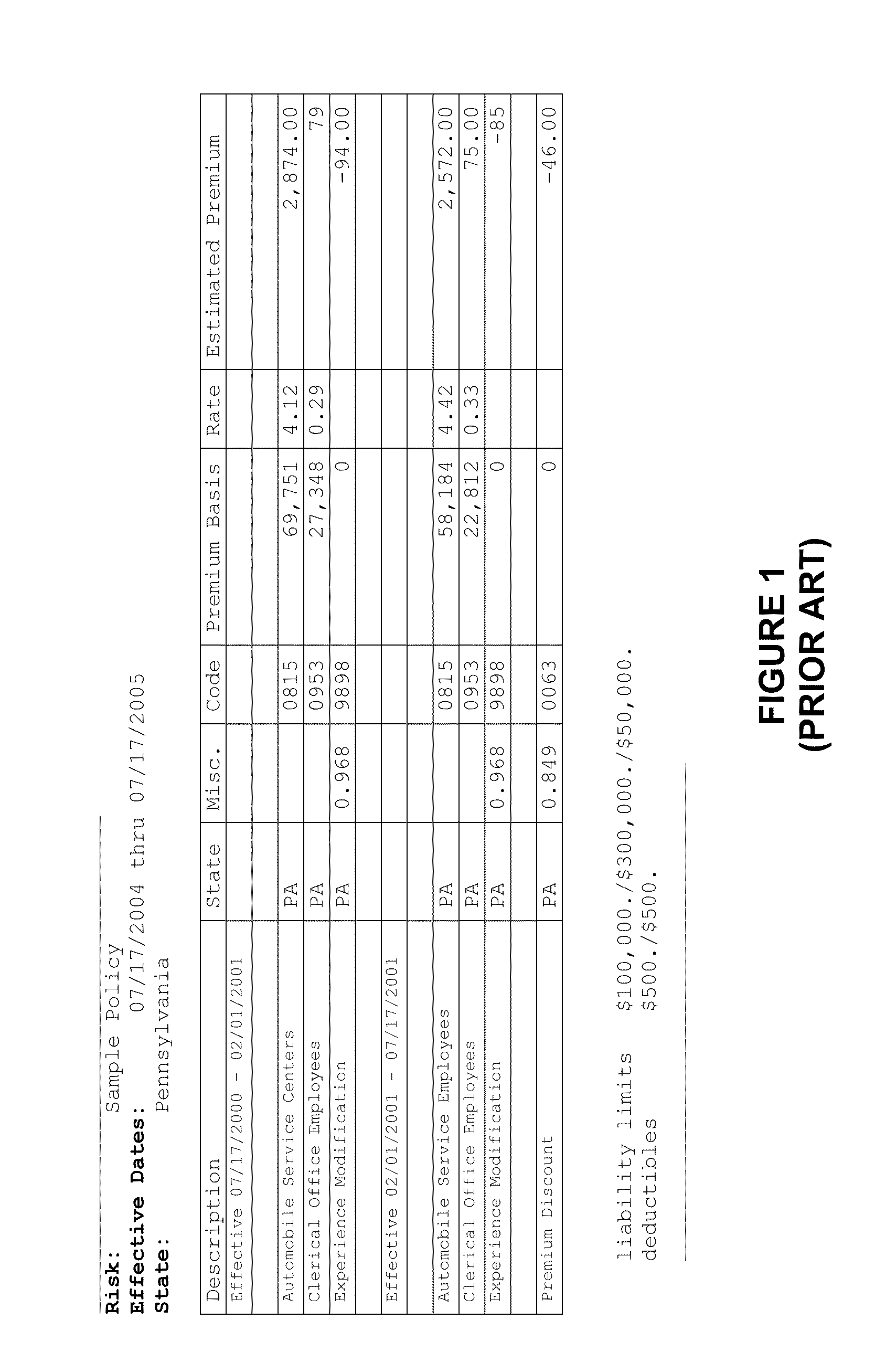

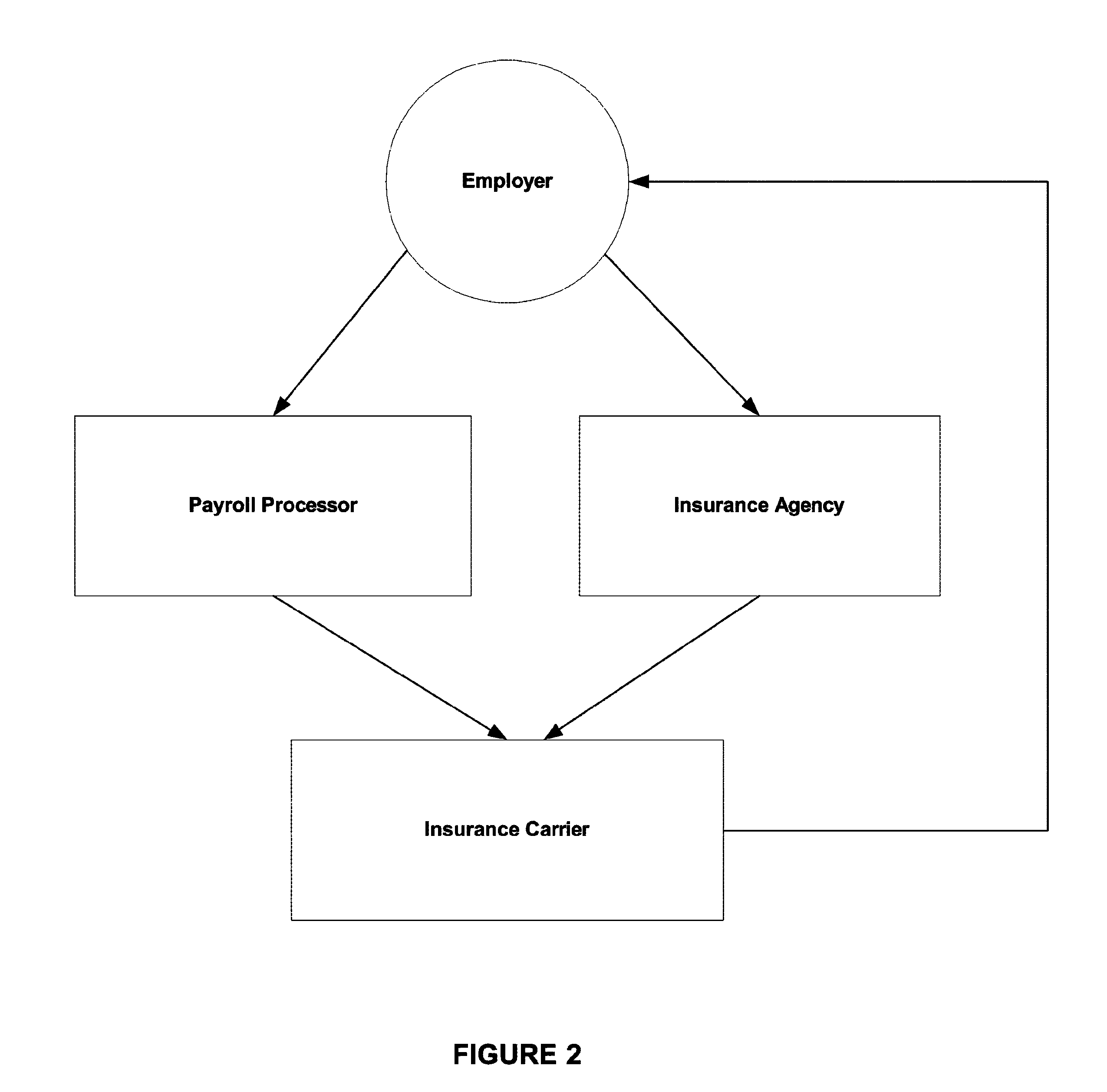

System and method for determining a cost of insurance based upon monitoring, collecting and communicating data representative of a risk's payroll characteristics

A system / method of determining a cost of workers compensation insurance for a selected period based upon monitoring, collecting and communicating data representative of a risk's payroll characteristics during said selected period, wherein the cost is adjustable by relating the payroll characteristics to predetermined actuarial rates. The system / method: determines an initial profile and a base cost of workers compensation insurance, monitors data elements representative of payroll and business status of a risk during the selected period; identifies and analyzes data elements that have a pre-identified relationship to the risk's insurability; consolidates the analyzed data elements for identifying a surcharge or discount to be applied to the base cost; and produces a final cost of workers compensation insurance for the selected period from the base cost.

Owner:WESTGUARD INSURANCE

System and method for determination of insurance classification of entities

Owner:HARTFORD FIRE INSURANCE

Method and system for estimating economic losses from wind storms

The present invention relates to systems and methods for estimating economic losses from wind storms. Accordingly, provided herein are methods estimating roughness length of an area surrounding a structure, methods calculating local wind speed at a structure, methods of estimating wind pressure on a structure, and methods of calculating the insurability of a structure. Also provided are systems and computer-readable storage media configured for performing the disclosed methods.

Owner:CORE PROGRAMS

Online system and method for processing life insurance applications

A method and system for online processing of life insurance applications includes receiving information that identifies an individual to be insured and describes the insurability of the individual. A certification may be received via an electronic data communications link confirming whether an illustration of a life insurance policy was delivered to the policy applicant. Furthermore, information may be received via an electronic data communications link from a third party confirming the identity of the individual to be insured. When a commitment to purchase the policy is received, a personalized temporary insurance certificate may be issued to the applicant, preferably accompanied by a temporary insurance agreement specifying the terms of temporary life insurance coverage extended to the individual. An authorization may also be received via an electronic data communications link authorizing immediate collection of medical history information from one or more third parties concerning the individual to be insured.

Owner:SYMETRA LIFE INSURANCE

Workers compensation system for determining a cost of insurance based on real-time payroll data

A system / method implemented at an insurance company estimates a final premium charge and more accurate real time estimate during the lifetime of the policy for workers compensation insurance associated with a risk based on: receiving real-time payroll data associated with the risk; monitoring the received real-time payroll data to identify and record raw data elements that have an identified relationship with any of, or a combination of, the following: the risk's business operation, insurability of the risk, character of the risk, or rating parameters associated with the risk's policy; and determining the final premium charge of workers compensation insurance for the risk based on a premium modification that increases or decreases a premium charge based on an evaluation of the recorded raw data elements.

Owner:WESTGUARD INSURANCE

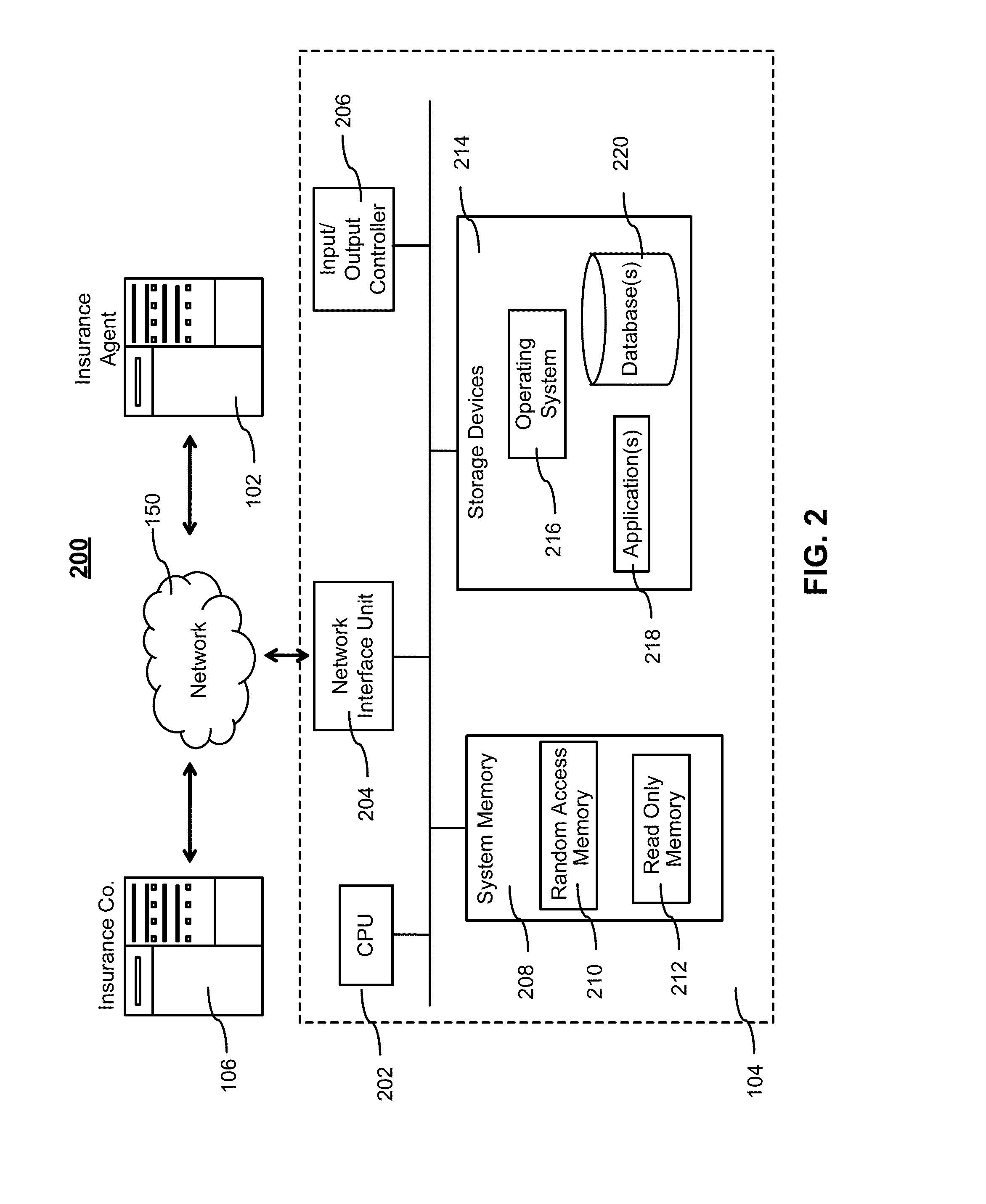

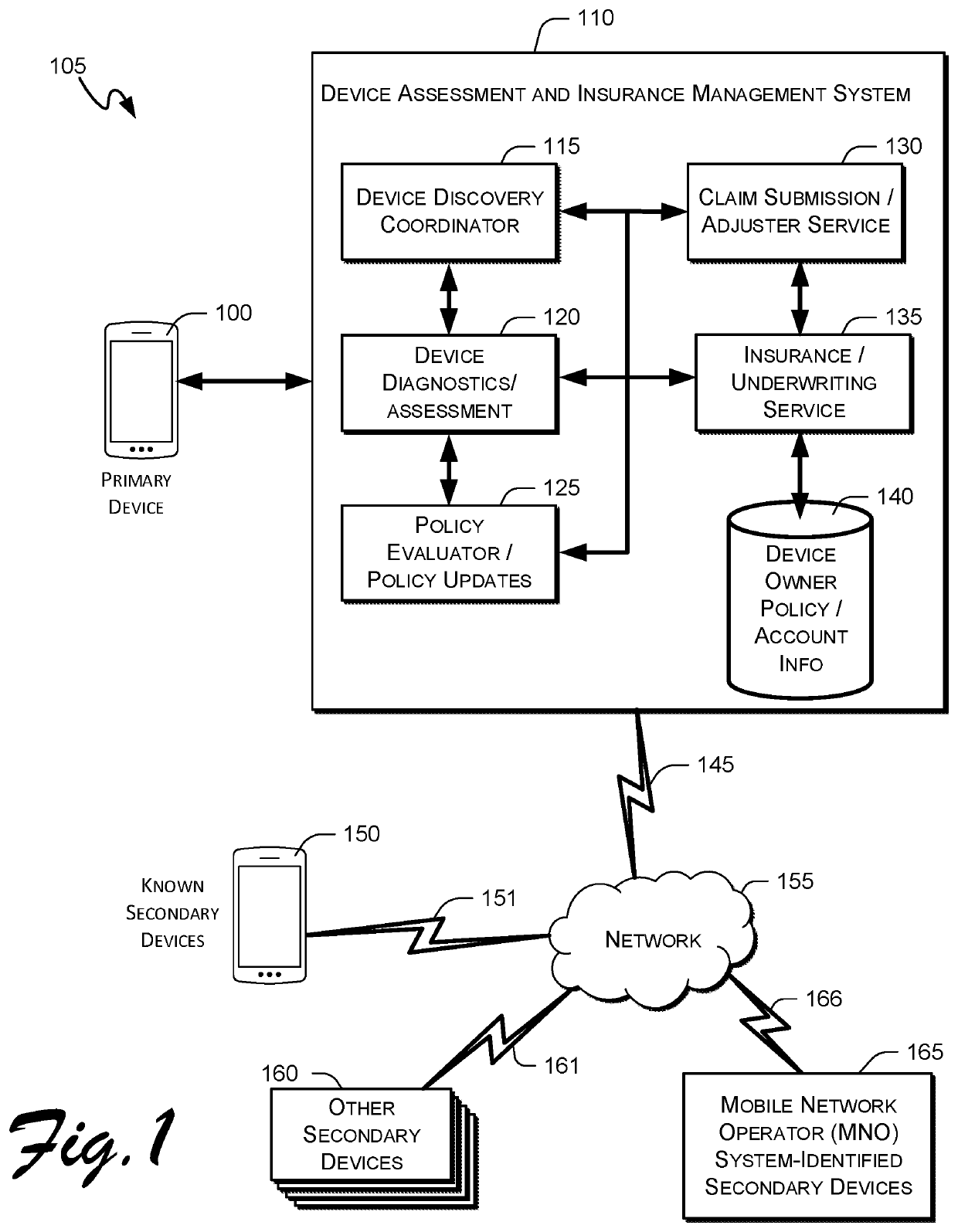

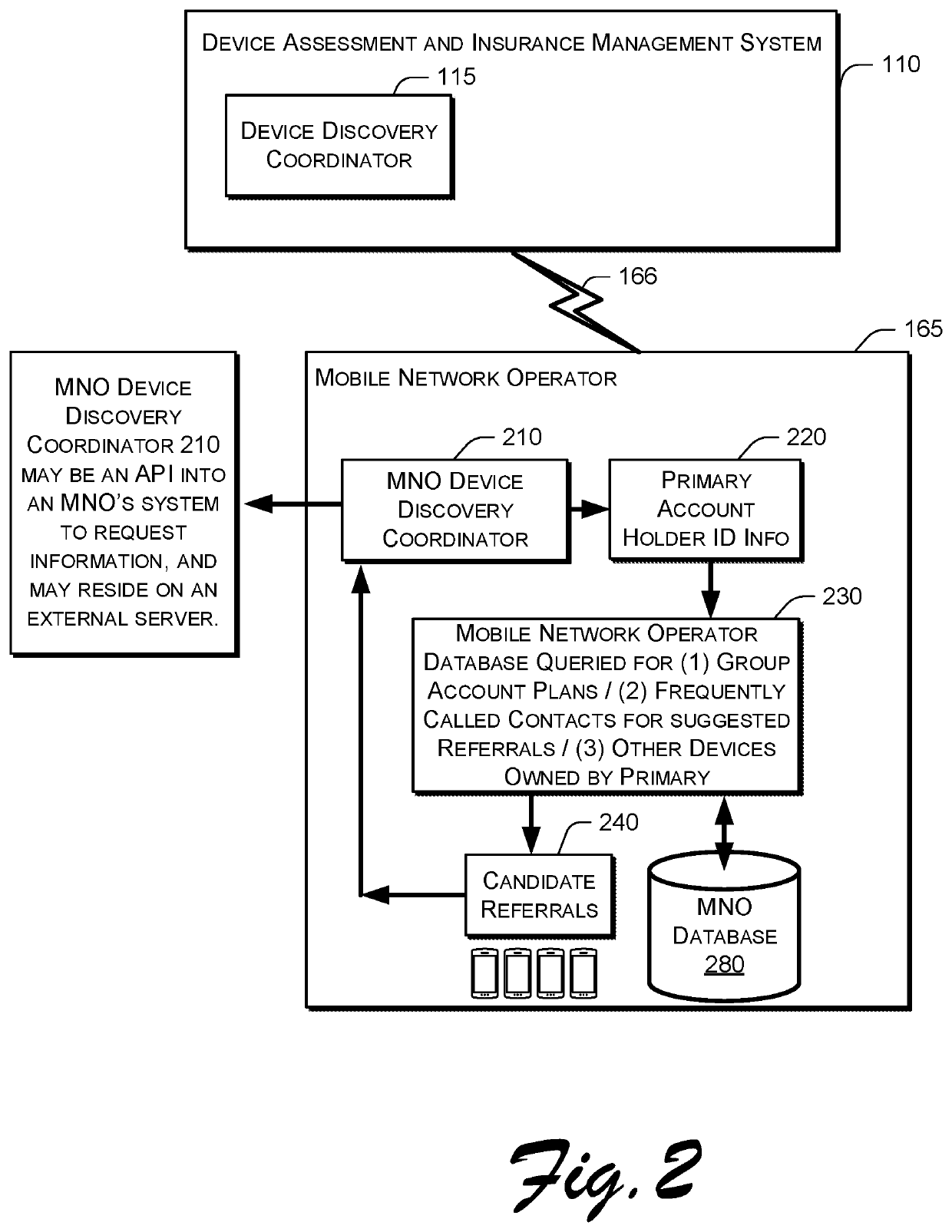

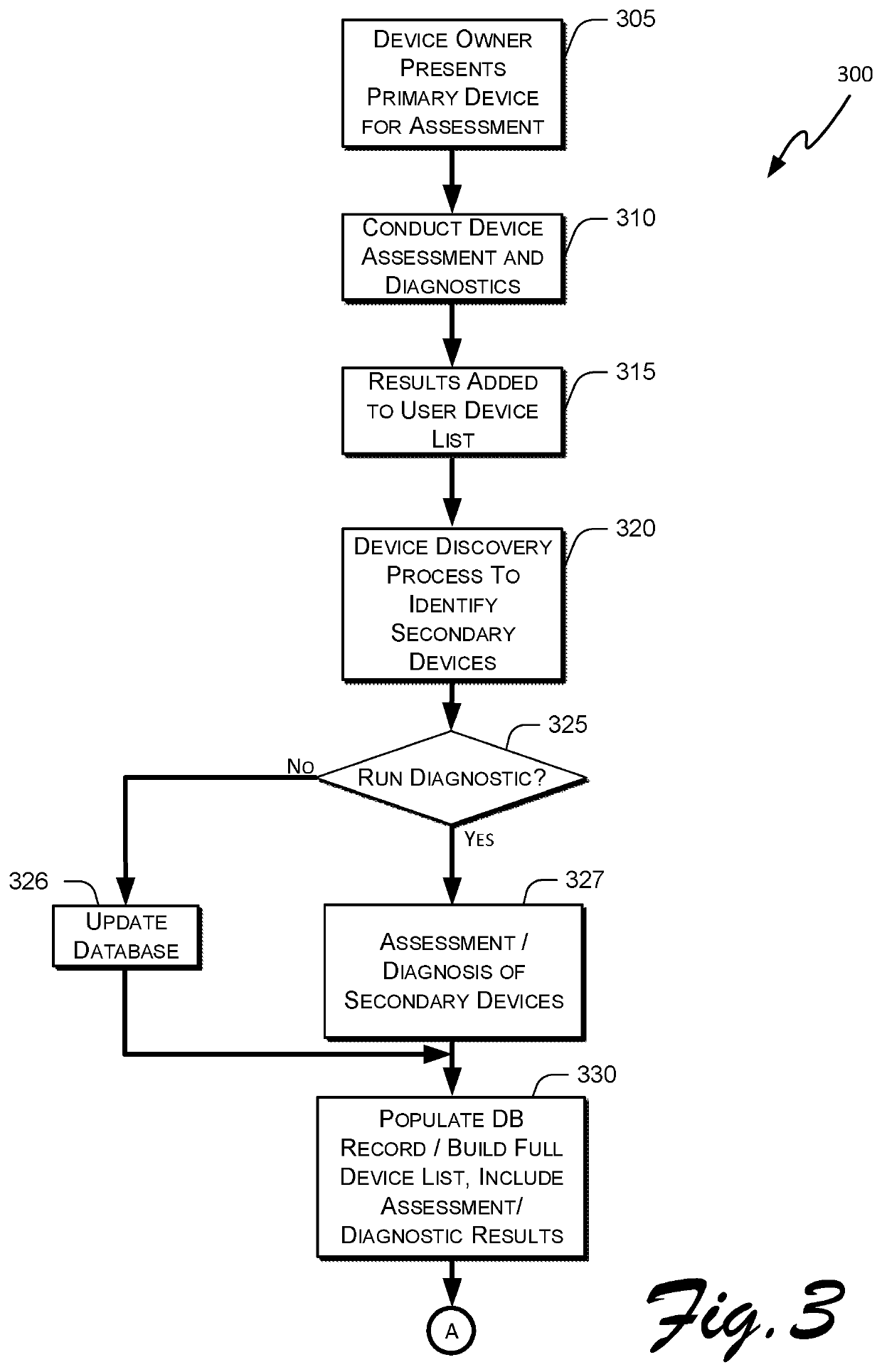

System and method for extensible device assessment and dynamic policy configuration

PendingUS20210407013A1High and lowReduce the valueCircuit monitoring/indicationFinanceCommunication interfaceInsurability

There are provided systems and methods for extensible device assessment and dynamic policy configuration, where a plurality of devices associated with a primary device owner can be covered in a dynamically adjustable insurance policy. In one embodiment, a primary device is tested and assessed for insurability, then additional related devices may be discovered devices through network connections established through communications interfaces with the primary device (as well as direct inputs from the device owner. Then once devices are discovered and more fully diagnosed for operational status, insurance / warranty options are assessed, and a list of devices, coverage options, and cost is provided to the device owner. As such, comprehensive insurance with known and manageable risk may be provided for a collection of devices, not all of which may be presented to an insurance agent in person.

Owner:BLANCCO TECH GRP IP OY

Method and system for converting an annuity fund to a life insurance policy

InactiveUS20080109264A1Good economic benefitsLeast and reduced tax consequenceFinancePayment architectureInsurance lifeEngineering

A method and system for converting an annuity fund to a life insurance policy at a predetermined conversion date comprising the following steps: establishing an annuity fund of a predetermined and purchasing a fixed annuity for the annuity fund, establishing an irrevocable life insurance conversion plan including selecting the predetermined conversion date, selecting a predetermined mortality death benefit at the predetermined conversion date and purchasing a guaranteed insurability option to guarantee the availability of the predetermined mortality death benefit at the predetermined conversion date, accruing fixed investment income within the annuity fund on a tax deferred basis until the predetermined conversion date, converting the annuity fund to the life insurance policy with the predetermined mortality death benefit at the predetermined conversion date, accruing income within the life insurance policy until the death of the insured under the life insurance policy and disbursing the death benefit consisting of mortality insurance and accrued cash values to the beneficiary at the death of the insured under the life insurance policy.

Owner:BANKERS INSURANCE GROUP

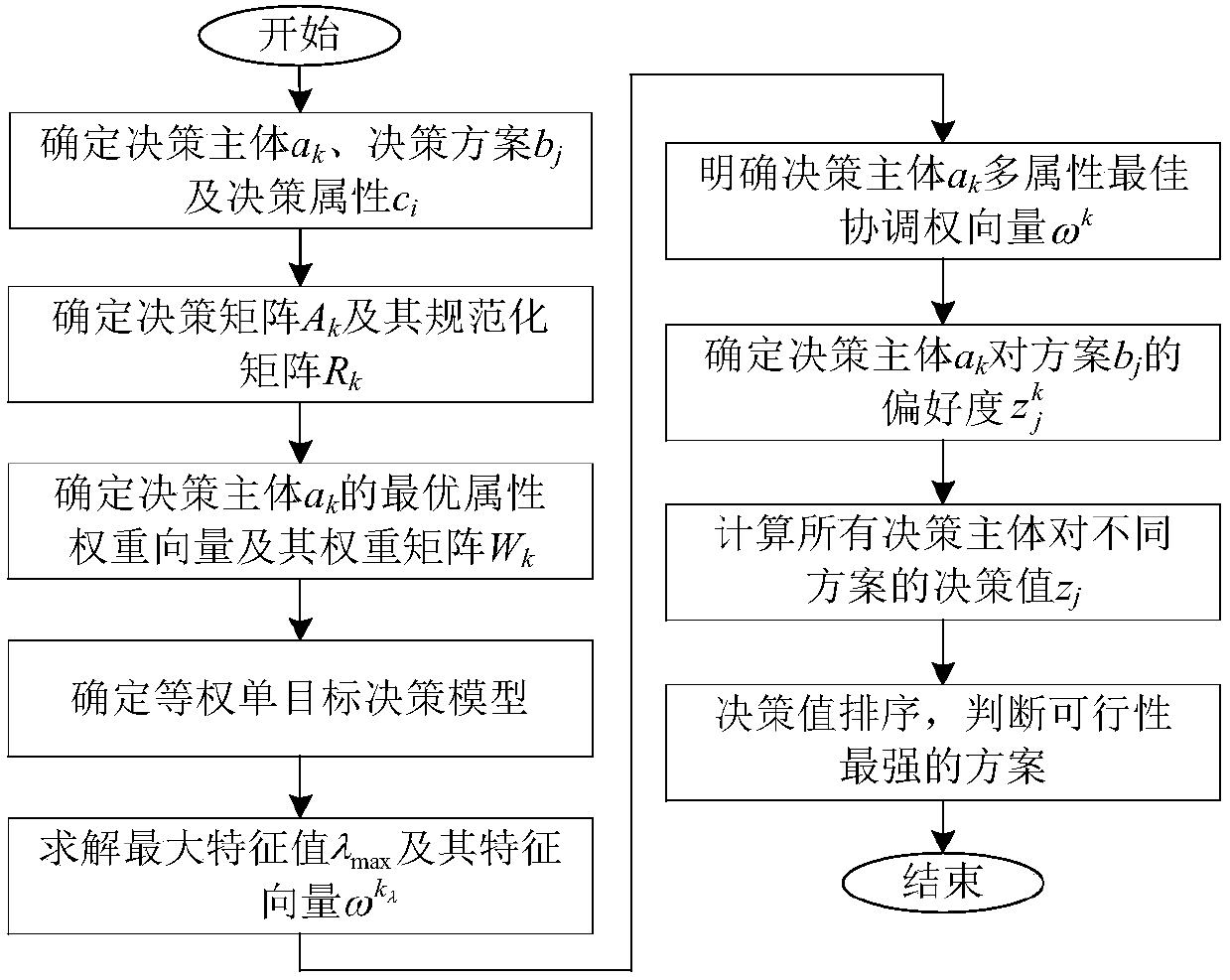

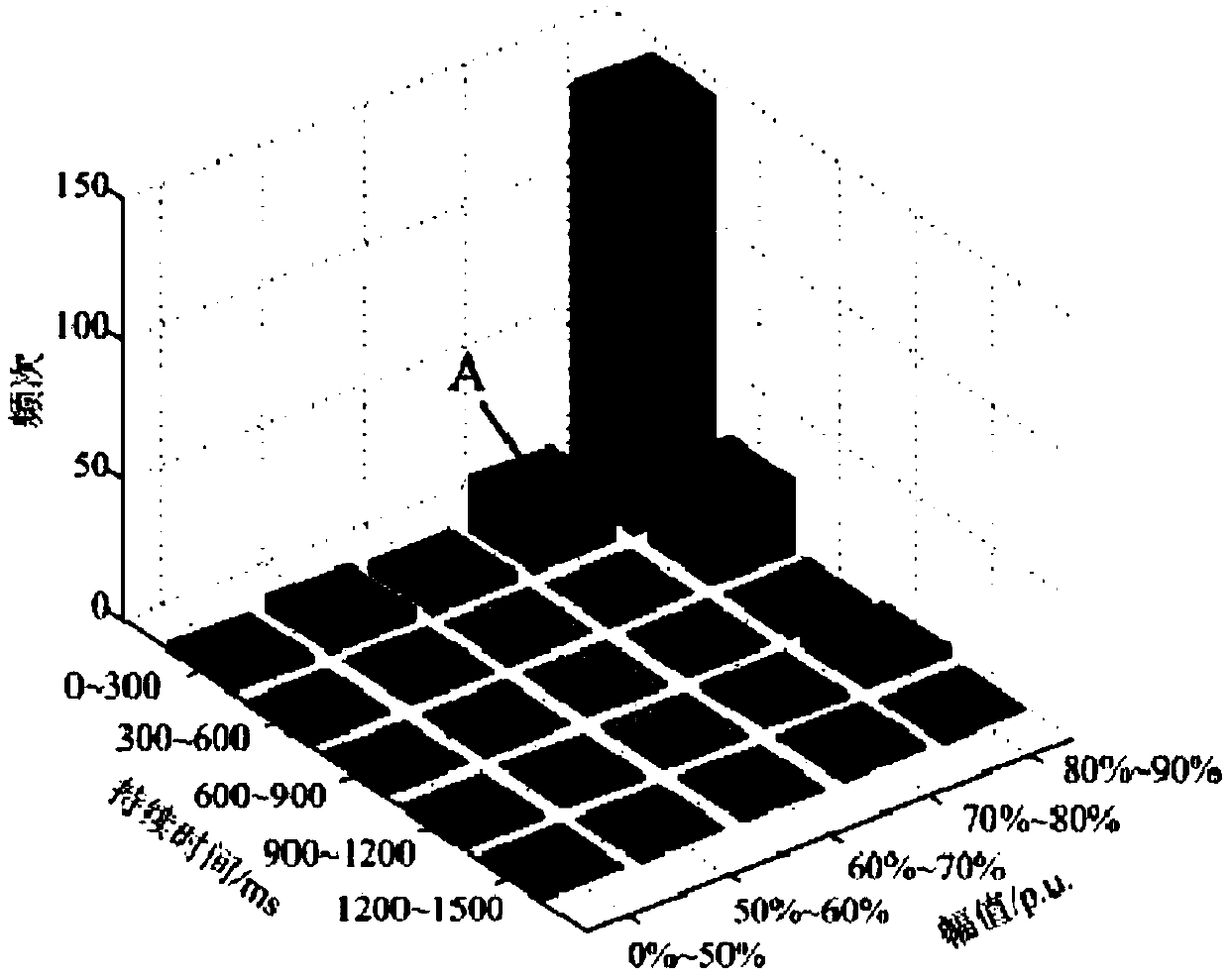

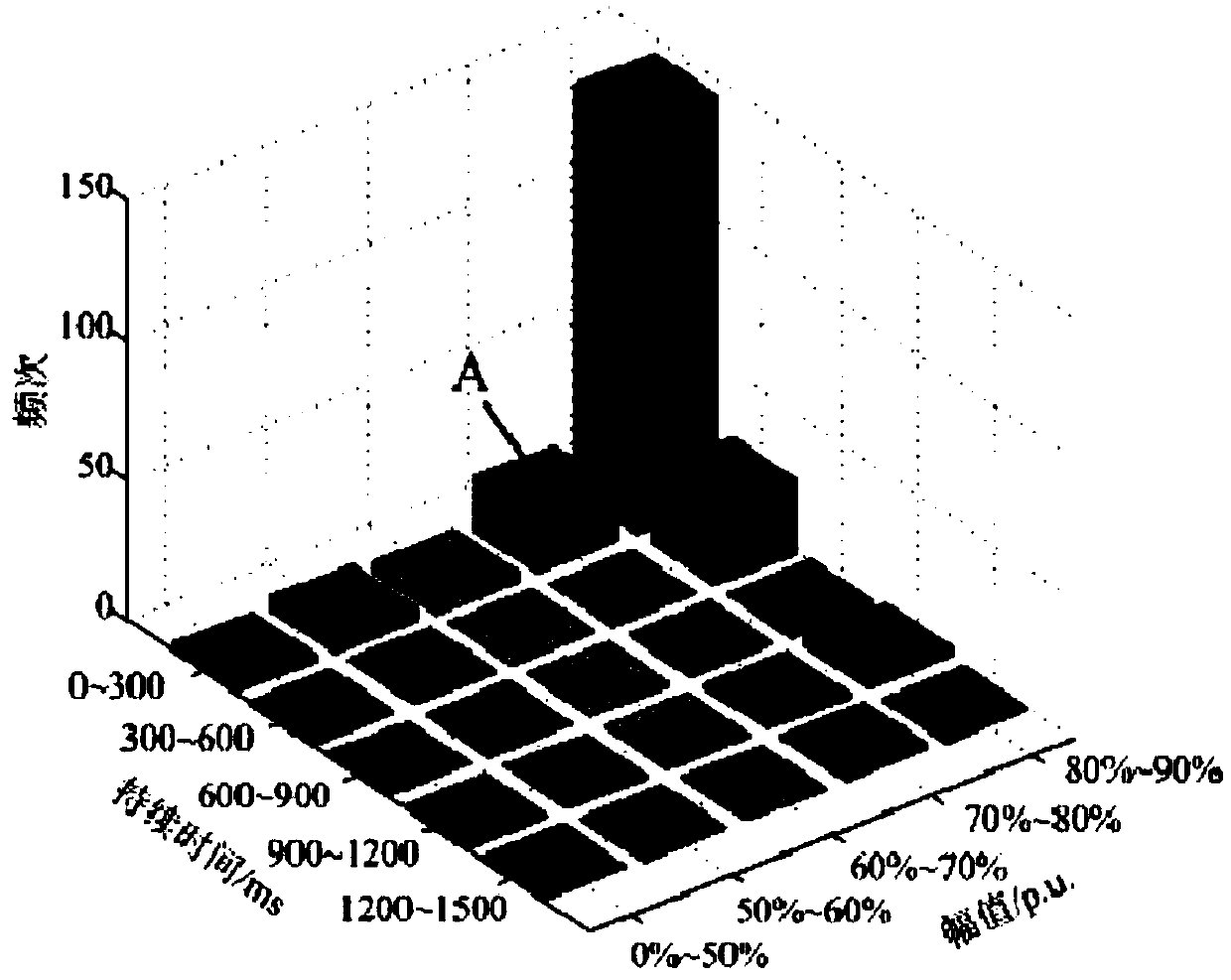

Voltage sag insurance mechanism confirming method for sensitive power user

InactiveCN108492010ASolve the problem of strong subjectivity of weightHigh feasibilityFinanceResourcesDecision schemeElectric power

The invention discloses a voltage sag insurance mechanism confirming method for a sensitive power user, and the method comprises the following steps: constructing a multi-attribute decision matrix ofa decision making subject for a decision theme on the basis of the decision scheme and decision attributes of the decision making subject, and converting the multi-attribute decision matrix into a standard matrix, wherein the decision attributes comprise insurance premium, net income, payment amount, and risk taking degree; calculating decision attribute weights; calculating decision values of alldecision makers on the decision scheme; sorting the decision values to determine the most feasible decision theme. The two-stage multi-target decision making method is employed, and the method integrates multiple types of attribute information. The preference degree of the scheme is optimized, and the attribute weights are obtained, thereby solving a problem that the subjectivity of the weights is high. The method achieves the evaluation of the preference degree of each subject for different mechanisms, and achieves the concluding and unifying of the scattered evaluation information of all subjects. The clear and high-feasible voltage sag insurance mechanism improves the insurability, improves the recognition degree of each side for the insurance mechanism, reduces the loss of each side,and improves the feasibility.

Owner:SICHUAN UNIV

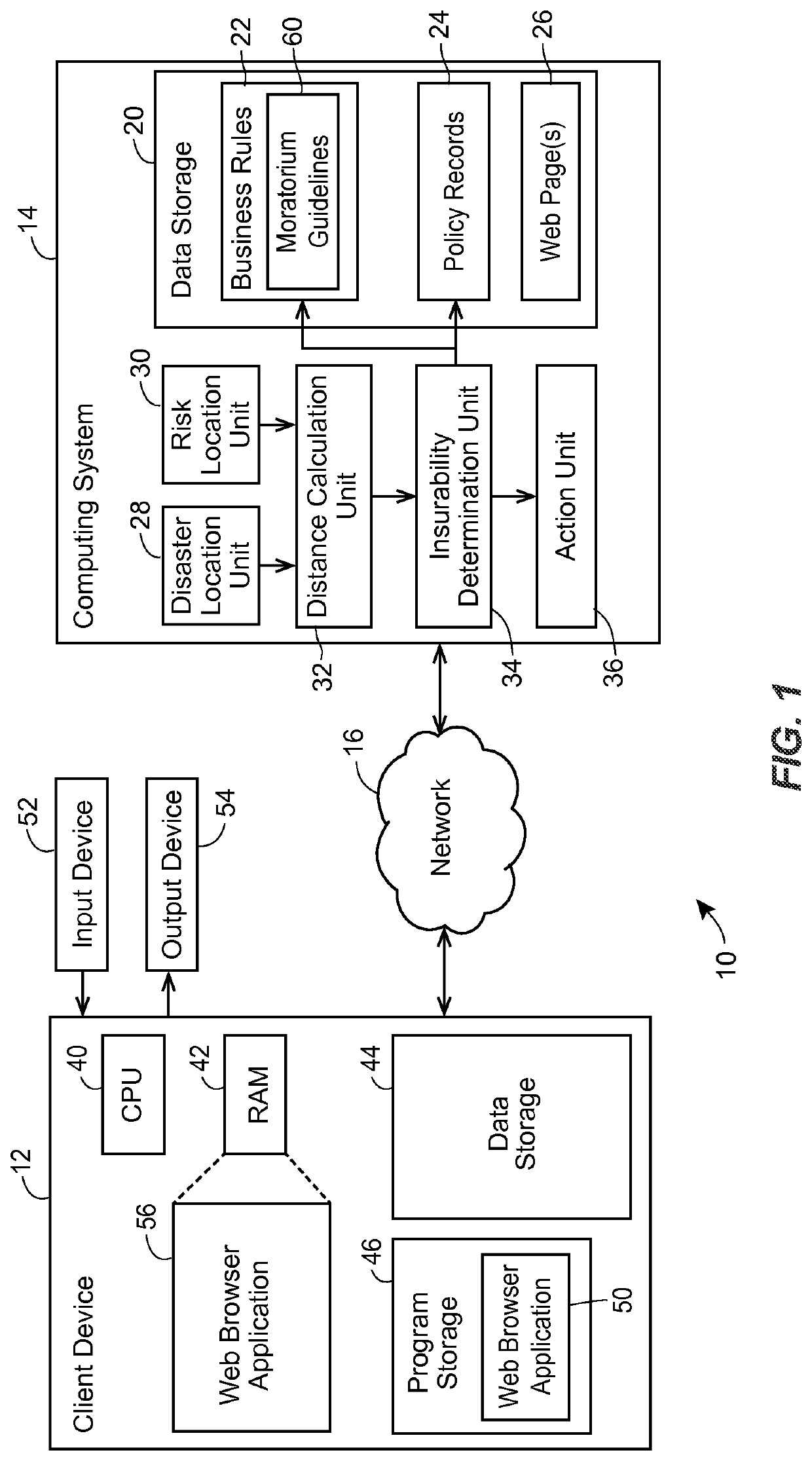

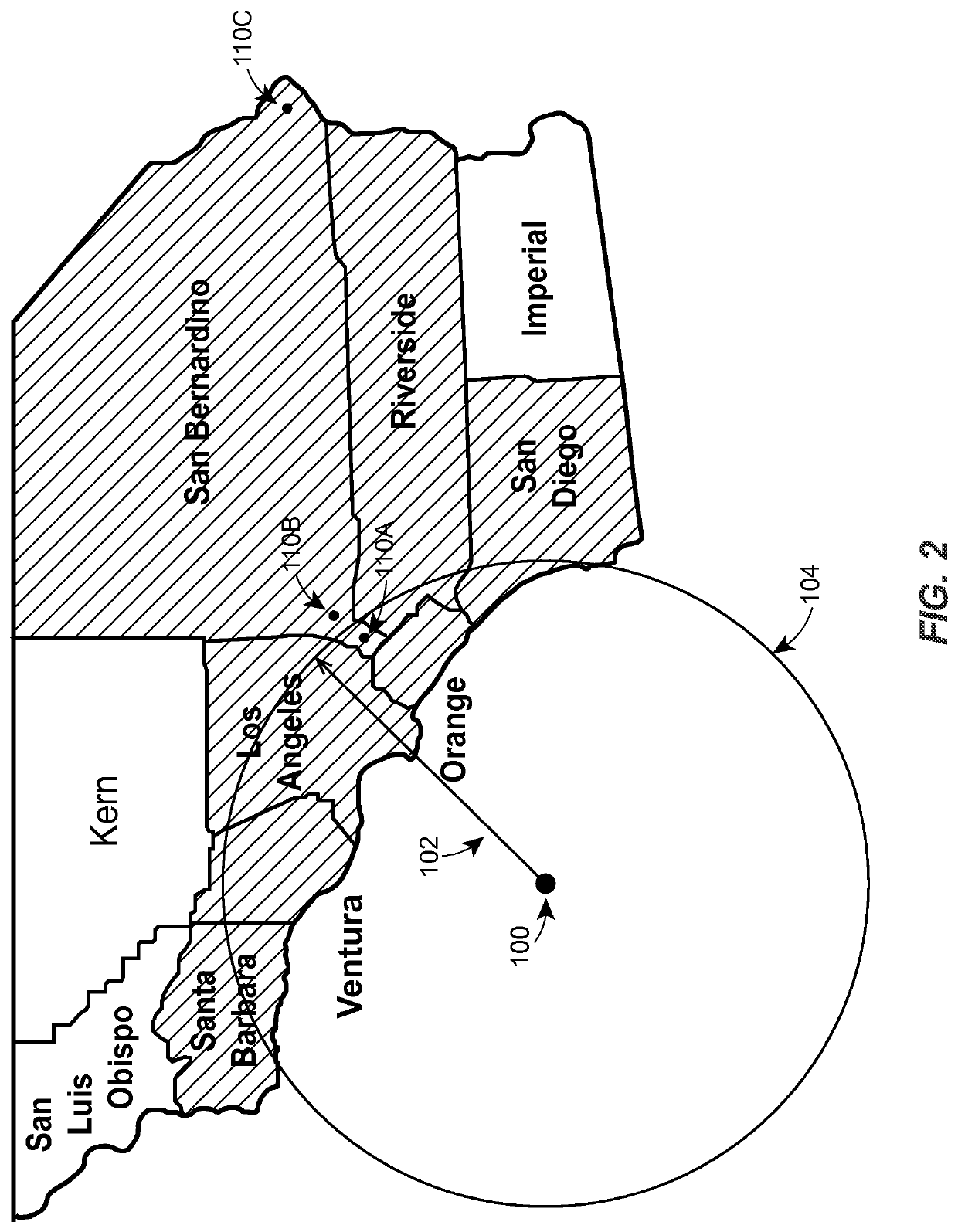

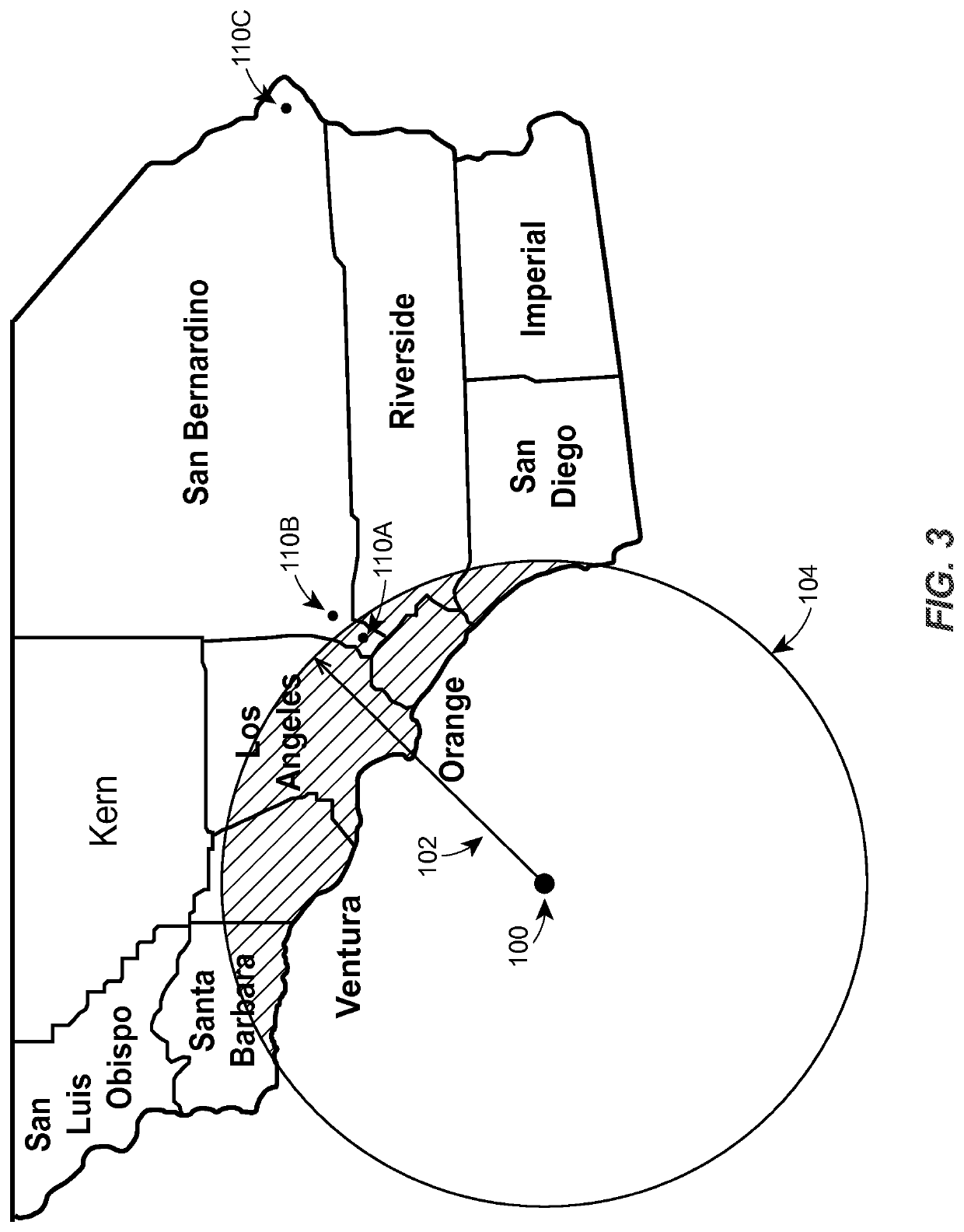

Determination of insurability after a natural disaster

InactiveUS20210326989A1Facilitate providing property insuranceFinanceTelecommunicationsNatural disaster

In a computer-implemented method, disaster location data indicating a location (e.g., latitude and longitude) of a natural disaster may be received, and a location (e.g., latitude and longitude) of a risk (such as a property or home) may be determined. A distance between the location of the natural disaster and the location of the risk may be calculated. It may be determined that the risk is, or is not, insurable at least in part by comparing the calculated distance to a threshold distance. In response to determining that the property is, or is not, insurable, a user interface may be caused to provide an indication that the risk is, or is not, insurable, respectively. When a property is determined to be insurable, the method may facilitate providing property insurance covering properties that otherwise would not be eligible or qualify for insurance as a result of the natural disaster.

Owner:STATE FARM MUTUAL AUTOMOBILE INSURANCE

Method and apparatus for insuring multiple unit dwellings

A method and apparatus for insuring the owner of an apartment or multi-unit dwelling from damage to his building caused by his tenant's unintentional acts comprising: inputting into a computer processor a database of building physical information, occupancy information, and tenant rental information; inputting into the computer processor an insurance qualification program for renters legal liability insurance covering the building owner from unintentional damage caused by the tenant from fire, smoke, explosion, water discharge, and sewer backup, or negligence injuries by the tenant caused to third parties pursuant to predetermined insurability criteria; qualifying the building for renters legal liability insurance, and computer translating and generating insurance coverage for the building owner based on the number of units in the building and insurance coverage limits desired, and billing the owner for renter's legal liability insurance.

Owner:RENTERS LEGAL LIABILITY

Method and apparatus for insuring multiple unit dwellings

A method and apparatus for insuring the owner of an apartment or multi-unit dwelling from damage to his building caused by his tenant's unintentional acts comprising: inputting into a computer processor a database of building physical information, occupancy information, and tenant rental information; inputting into the computer processor an insurance qualification program for renters legal liability insurance covering the building owner from unintentional damage caused by the tenant from fire, smoke, explosions, water damage, or negligence injuries by the tenant caused to third parties pursuant to predetermined insurability criteria; qualifying the building for renters legal liability insurance, and computer translating and generating insurance coverage for the building owner based on the number of units in the building and insurance coverage limits desired, and billing the owner for renter's legal liability insurance.

Owner:RENTERS LEGAL LIABILITY

Workers compensation system for determining a cost of insurance based on real-time payroll data

Owner:WESTGUARD INSURANCE

Method and system for converting an annuity fund to a life insurance policy

InactiveUS8112336B2Least and reduced tax consequenceFinancePayment architectureInsurance lifeEngineering

A method and system for converting an annuity fund to a life insurance policy at a predetermined conversion date comprising the following steps: establishing an annuity fund of a predetermined value and purchasing a fixed or variable annuity for the annuity fund, establishing an irrevocable life insurance conversion plan including selecting the predetermined conversion date, selecting a predetermined mortality death benefit at the predetermined conversion date and purchasing a guaranteed insurability option to guarantee the availability of the predetermined mortality death benefit at the predetermined conversion date, accruing investment income within the annuity fund on a tax deferred basis until the predetermined conversion date, converting the annuity fund to the life insurance policy with the predetermined mortality death benefit at the predetermined conversion date, accruing income within the life insurance policy until the death of the insured under the life insurance policy and disbursing the death benefit consisting of mortality insurance and accrued cash values to the beneficiary at the death of the insured under the life insurance policy.

Owner:BANKERS INSURANCE GROUP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com