Methodology and Process For Constructing Factor Indexes

a factor index and index technology, applied in the field of index construction, can solve problems such as the inability to track factor returns well

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

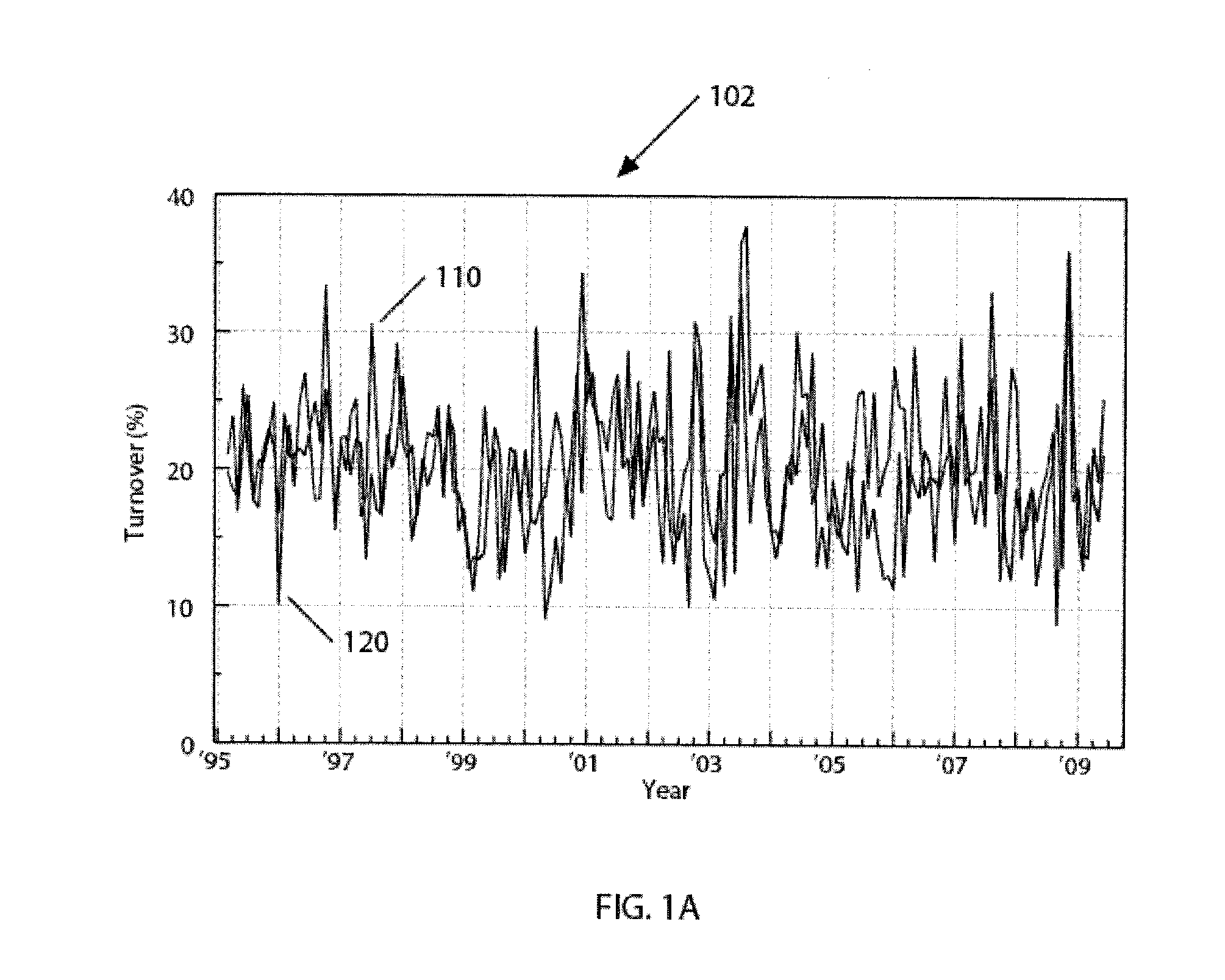

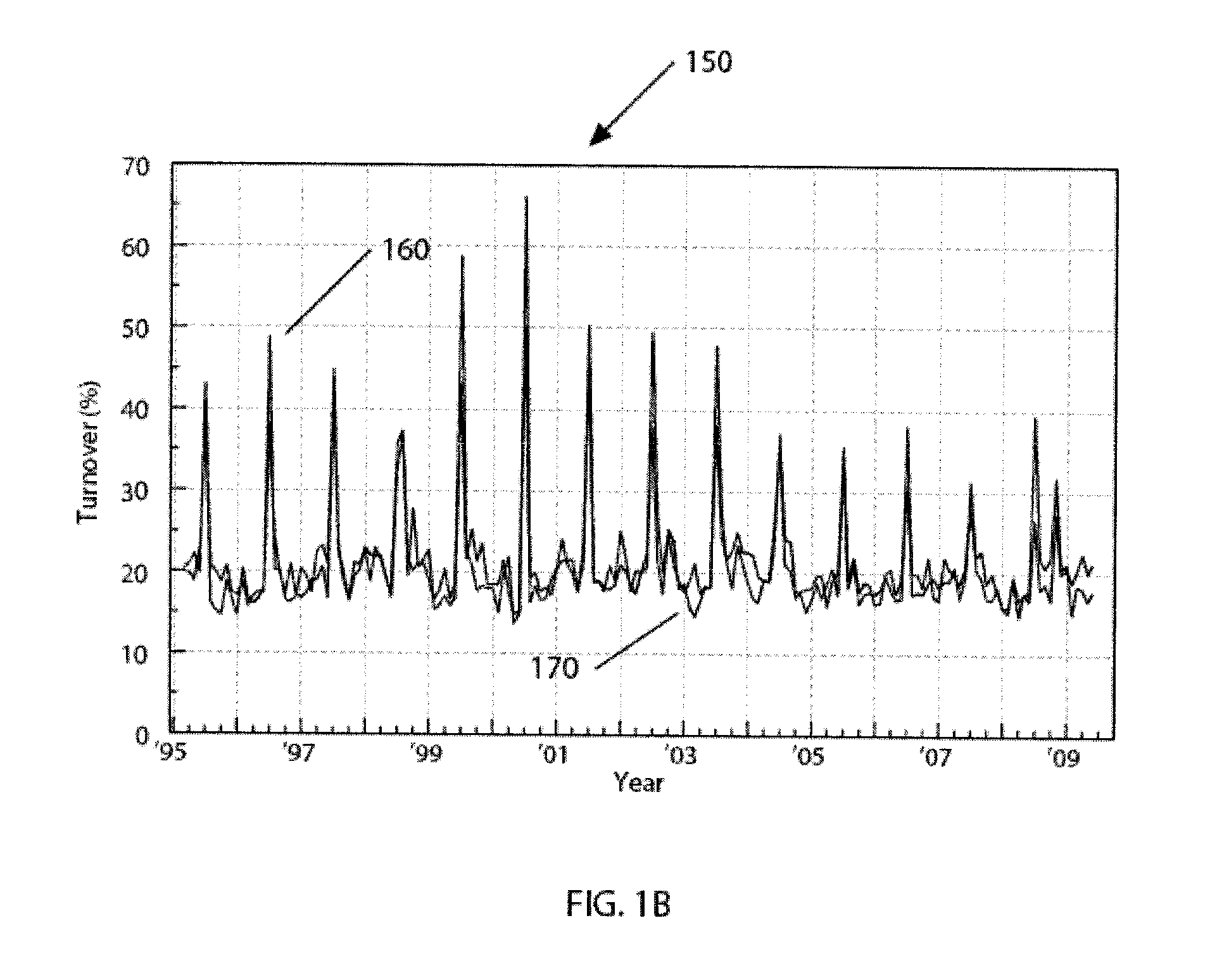

[0041]Non-optimized factor indexes normally hold a large number of names and experience large turnover. FIG. 1A shows a graph 102 of the monthly, one-way, single-side turnover for a simple 35% cap-weighted, long-short momentum index based on a large cap universe from January 1995 through June 2009. FIG. 1B shows a similar graph 150 for a small cap universe. The lines 110 and 160 indicate the turnover of the long side, and the lines 120 and 170 show the turnover of the short side. On average, the monthly turnover is 20% for each side. However, the small cap results have annual spikes in turnover associated with an annual reconstitution of the small cap universe itself. This level of turnover is undesirable both for long term and short teen investment purposes.

[0042]Furthermore, non-optimized indexes often also exhibit strong exposure tilts in other important systemic factors. FIGS. 2A and 2B show graphs 200 and 250 for the price-to-book ratio, a common metric of value, for a simple 3...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com