Methods and systems for providing and maintaining retirement income

a retirement income and system technology, applied in the field of methods and systems for the provision and maintenance of risk-protected retirement income, can solve the problems of reducing the probability of retirement income, affecting the safety of retirement income, so as to achieve the effect of reducing costs and ensuring incom

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

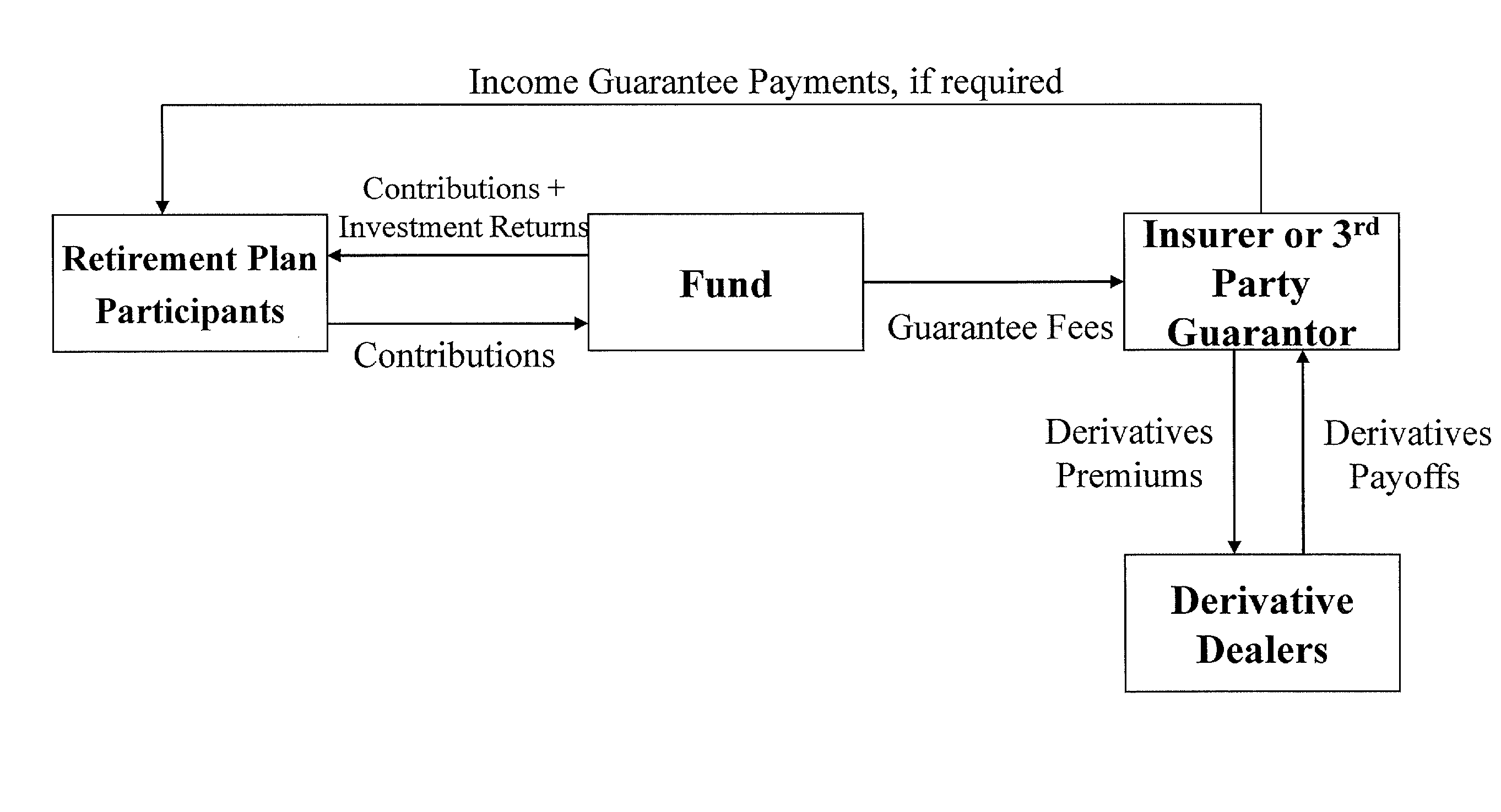

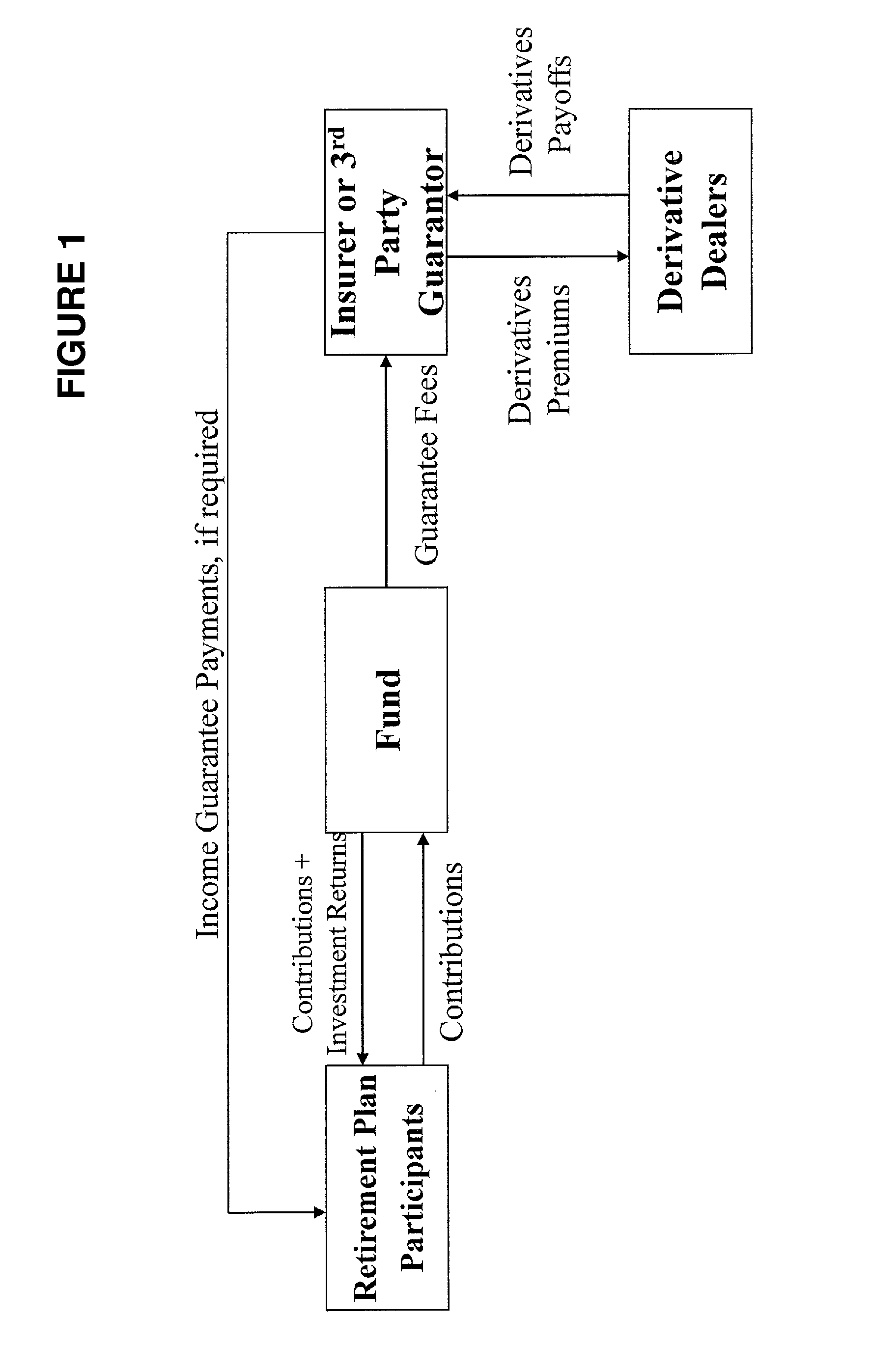

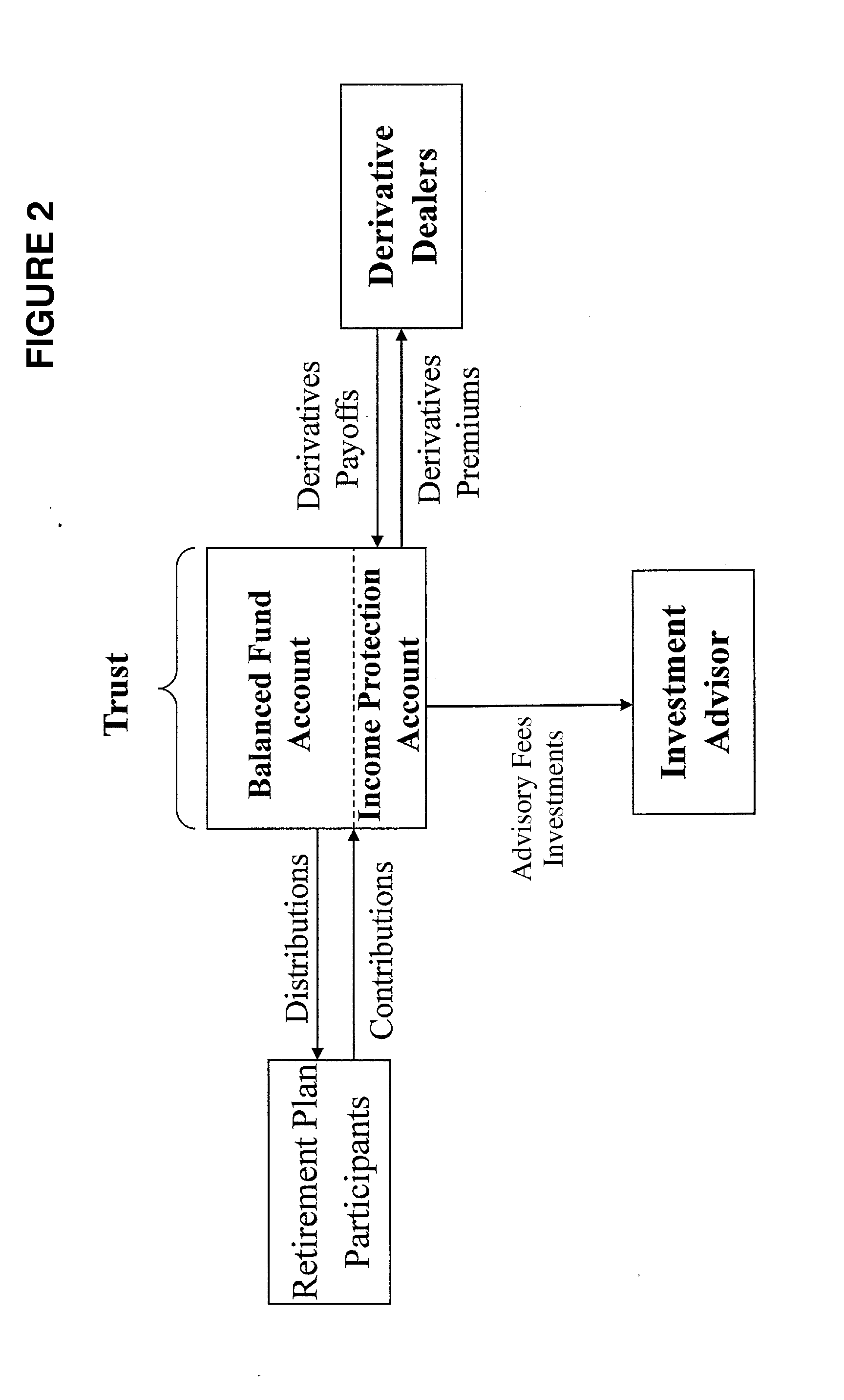

[0028]In one embodiment of the invention, a fund or collective investment trust (both generically referred to as the “Trust”) is established for holding retirement assets of multiple participants. The Trust has an explicitly stated investment objective to provide 1) exposure to equity and fixed income investments (the “Balanced Fund Assets” as further defined below) while 2) protecting for a minimum annual (or other) distribution amount (the “Protected Annual Distribution Amount” or “PADA”) to be distributed from the Trust for the participant's lifetime during a distribution phase which starts after an accumulation phase, e.g. 20 years. The Trust may group individuals with similar ages and years until retirement, e.g. age 45 with 20 years until retirement such that the Trust would maintain a net asset value (NAV) and participants would own units of the Trust similar to a mutual fund. The PADA can be defined in any of a number of different ways, including, by way of example, some per...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com