Decentralized Customer-Controlled Credit Verification

a customer-controlled, credit verification technology, applied in the field of consumer reporting, can solve the problems of preventing consumers from obtaining credit in a timely fashion, consumer has little control over the personal information stored and the consumer has little ability to view, let alone control, the data maintained by the consumer reporting agency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

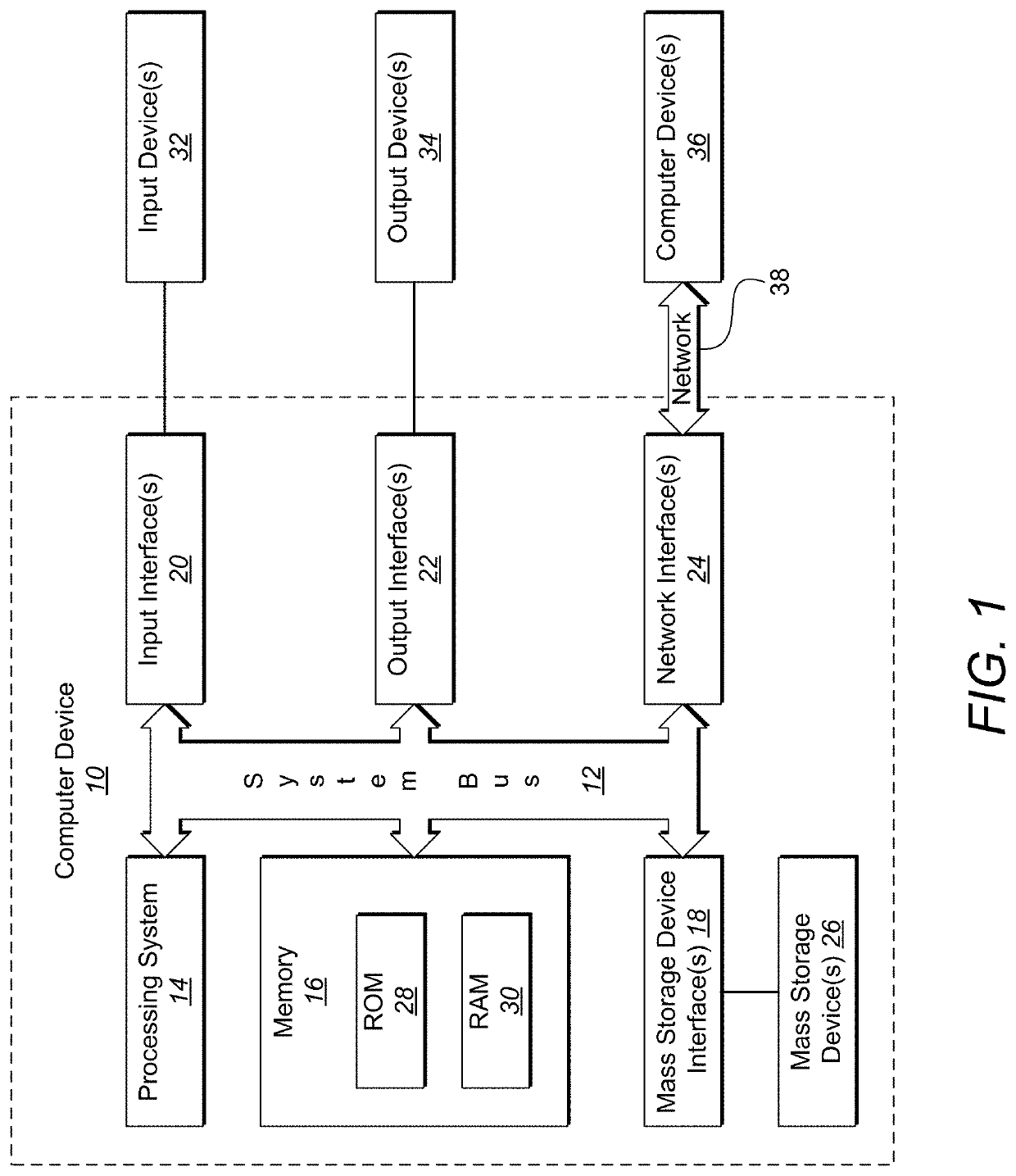

[0024]A description of embodiments of the present invention will now be given with reference to the Figures. It is expected that the present invention may take many other forms and shapes, hence the following disclosure is intended to be illustrative and not limiting, and the scope of the invention should be determined by reference to the appended claims.

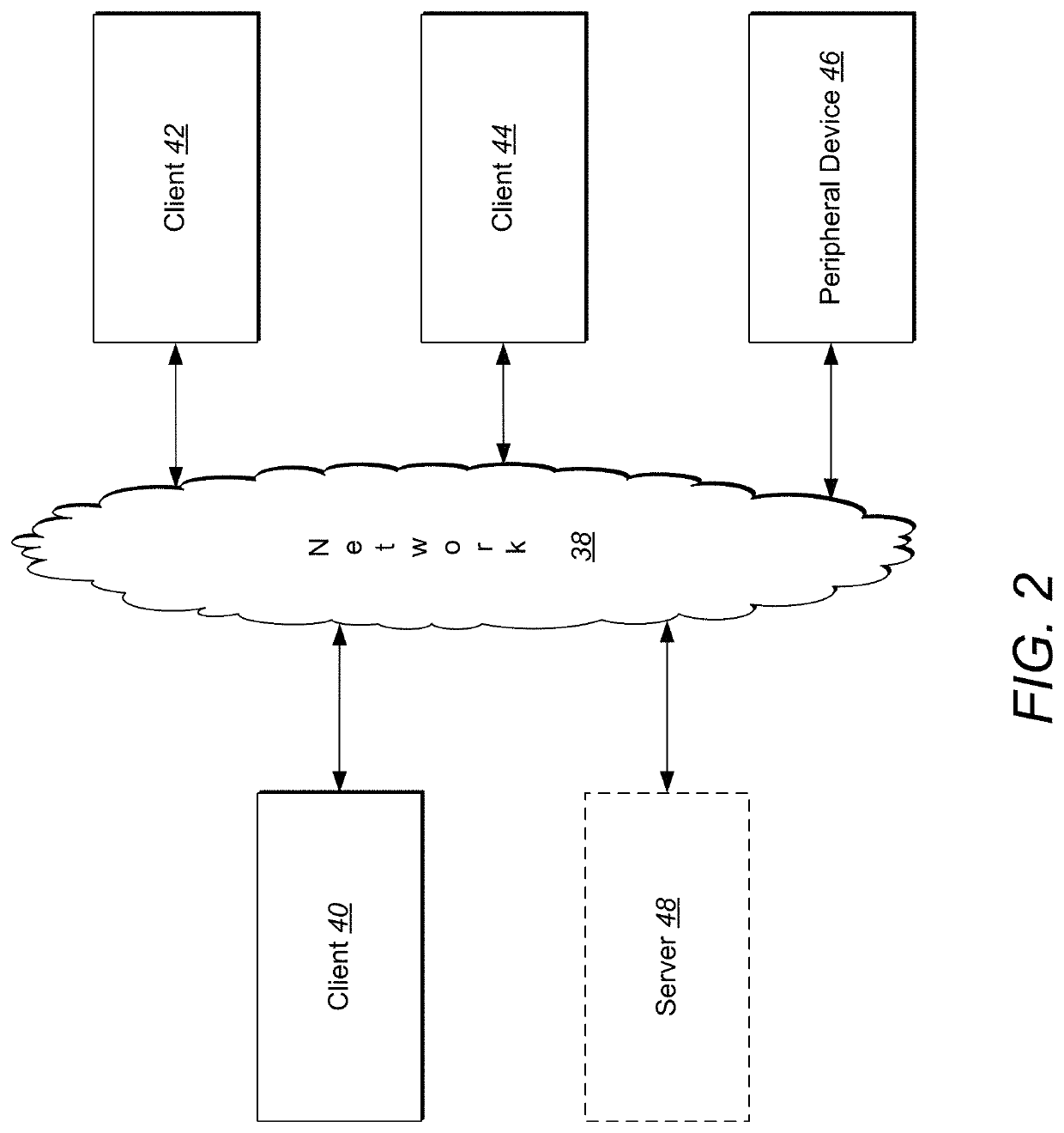

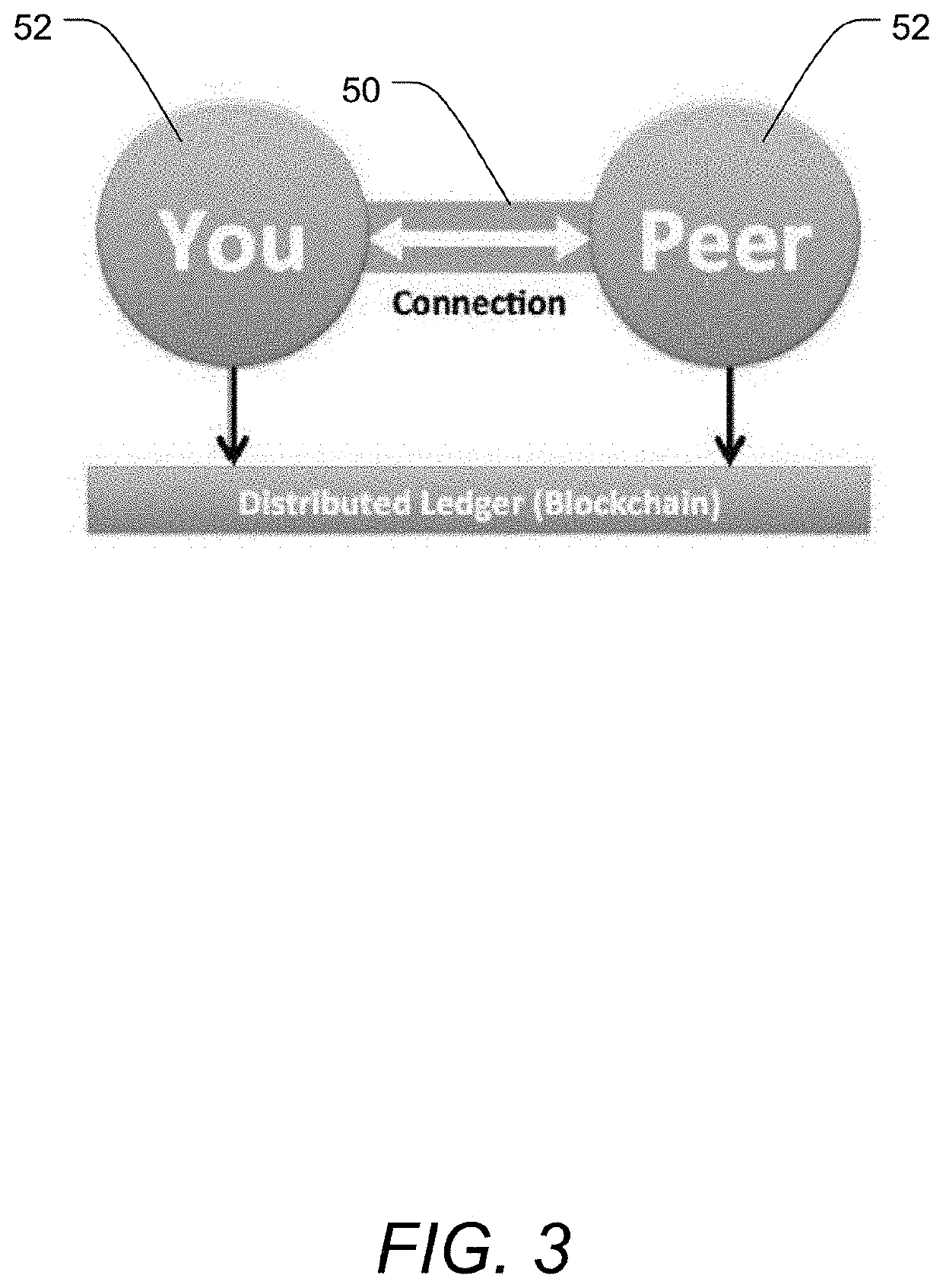

[0025]Embodiments of the invention provide systems and methods for decentralized distribution of verifiable information, such as financial information, without requiring resort to centralized information system at the time of a query or other request for information. Embodiments of the invention may be realized as systems, methods, and as non-transitory computer-readable media for implementing methods discussed herein. According to exemplary embodiments, a decentralized method for providing a verification of a consumer's creditworthiness without resort to a centralized credit bureau includes steps of creating a digital wallet operat...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com