Volatility index compiling method

A volatility and index technology, applied in the field of options trading algorithm, can solve the problem of large calculation error of CBOE algorithm, and achieve the effect of meeting market demand and reducing compilation error.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0017] The present invention will be described in more detail below by way of examples.

[0018] The invention discloses a method for compiling a volatility index, which comprises the following steps:

[0019] Step S1, select the option contract month

[0020] Determine whether the current month’s contract is more than 3 trading days away from expiration. If the current month’s contract is more than or equal to 3 trading days away from expiration, then select the current month and the next near-month contract for calculation; if the current month’s contract is less than 3 trading days away from expiration , select the next two month contracts for calculation.

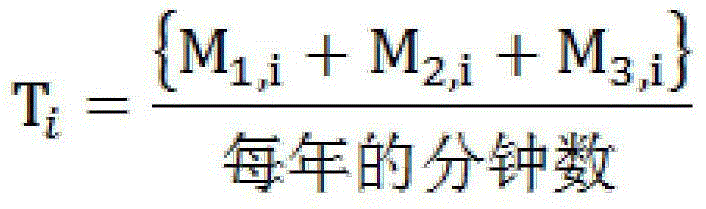

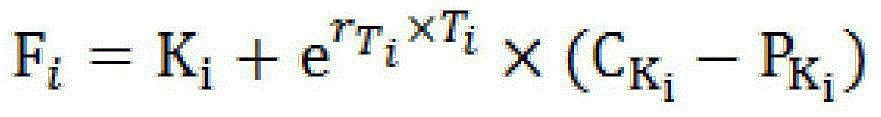

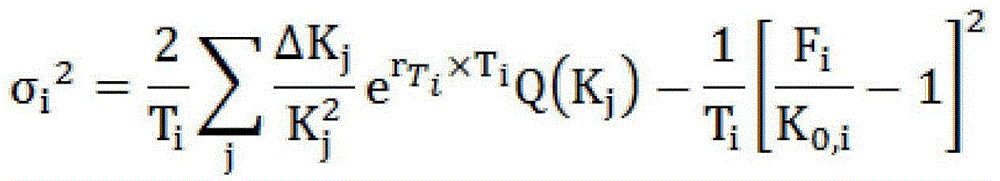

[0021] Step S2, calculate the remaining term of the selected month respectively

[0022] The remaining maturity (calculated in calendar days rather than trading days) is calculated as:

[0023]

[0024] Among them, i=1,2,T 1 and T 2 Respectively, the remaining term of the current month and the next nearest month...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com