Personal credit evaluation system of peasant financial mutual cooperation platform

A technology of credit assessment and capital, applied in finance, data processing applications, instruments, etc., can solve the problems of farmers' personal credit assessment, no bank credit record, etc., to break the information island, control business risks, and improve the level of risk control. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

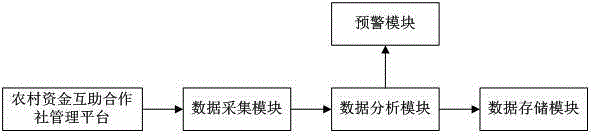

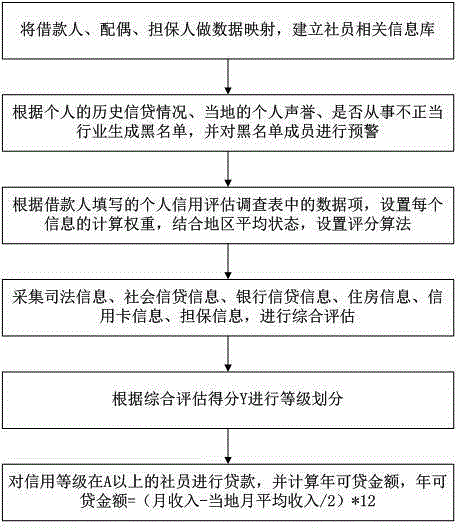

[0040] A personal credit evaluation system for farmers' financial mutual aid platforms, including a data collection module, a data storage module, and a data analysis module connected to the management platform of rural financial mutual aid cooperatives;

[0041] The management platform of rural financial mutual aid cooperatives stores the identity information and economic status of all members of rural financial mutual aid cooperatives within a certain area, including names, ID cards, family information, contact information, economic conditions, deposits, loans, guarantees, etc.;

[0042] The data acquisition module is used to collect all the information of the corresponding customers, summarize their deposits, loans, and guarantees, and at the same time collect relevant information about their spouses and correlate with them; it can directly grab data from the current business platform to ensure real-time data with authenticity.

[0043] The data analysis module maps and cor...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com