Loan risk early warning method and system based on multi-industry data

A risk early warning and cross-industry technology, applied in data processing applications, instruments, finance, etc., can solve the problems of overdue behavior of lenders, blind spots in post-loan management, difficulty in judging the quality of customers, etc., to improve efficiency and accuracy, Improve the loan recovery rate and reduce the effect of non-performing assets

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0037] All features disclosed in this specification, or steps in all methods or processes disclosed, may be combined in any manner, except for mutually exclusive features and / or steps.

[0038] Any feature disclosed in this specification (including any appended claims, abstract), unless otherwise stated, may be replaced by alternative features that are equivalent or serve a similar purpose. That is, unless expressly stated otherwise, each feature is one example only of a series of equivalent or similar features.

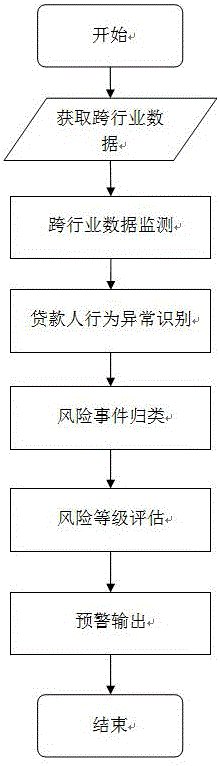

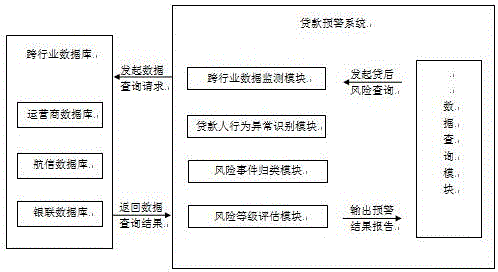

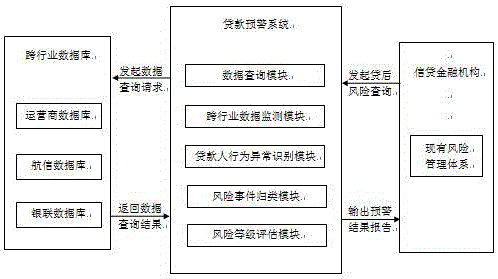

[0039] (1) Loan risk early warning method based on cross-industry data

[0040] A loan risk early warning method based on cross-industry data proposed by the present invention, according to cross-industry data, from multiple dimensions such as risk dimension, social circle risk dimension, crime risk dimension and overdue risk dimension, carries out loan risk early warning for lenders .

[0041] The method of the invention can be used alone as a loan early warning t...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com