Insurance fraud identification method and device based on telecommunication data

A technology of insurance fraud and identification method, which is applied in the field of insurance fraud identification based on telecommunication data, which can solve the problems of misjudgment and missed judgment in fraud case identification, and achieve the effects of avoiding innocent losses, reducing resources, and improving efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

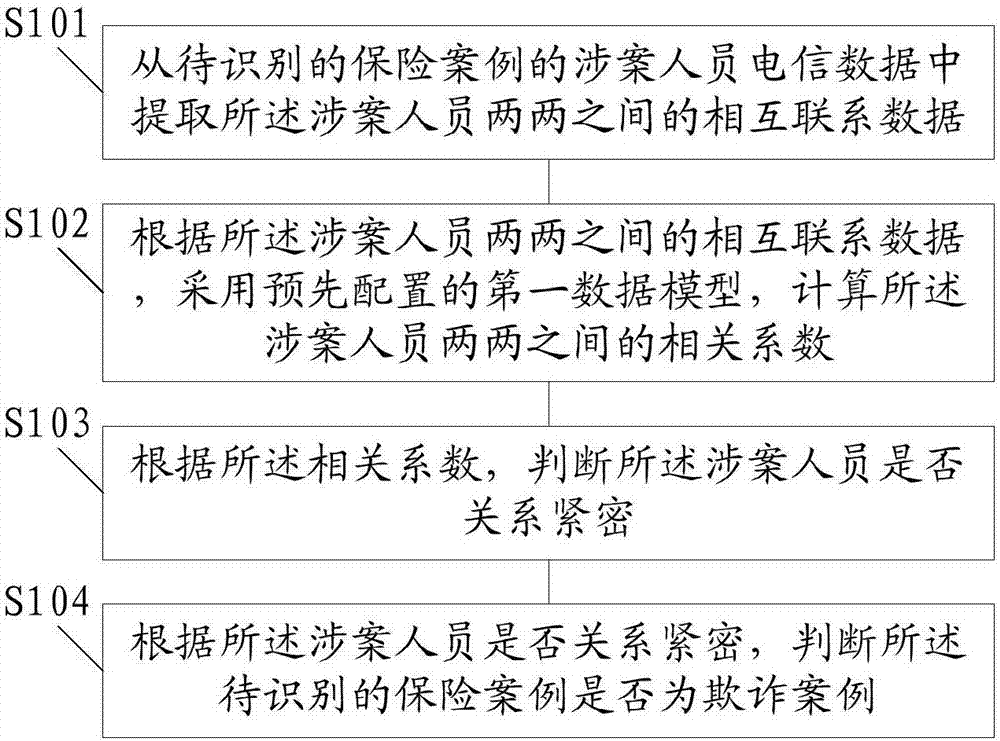

[0059] see figure 1 , is a flow chart of a method for identifying insurance fraud based on telecommunication data provided in Embodiment 1 of the present invention; the method includes:

[0060] S101. Extract the mutual contact data between the persons involved in the case from the telecommunication data of the persons involved in the insurance case to be identified; wherein, the mutual contact data includes at least one of the number of calls, the duration of calls or the length of short messages;

[0061] S102. Calculate the correlation coefficient between the two persons involved in the case by using the pre-configured first data model according to the mutual relationship data between the persons involved in the case;

[0062] S103. According to the correlation coefficient, determine whether the persons involved in the case are closely related;

[0063] S104. Determine whether the insurance case to be identified is a fraud case according to whether the persons involved in ...

Embodiment 2

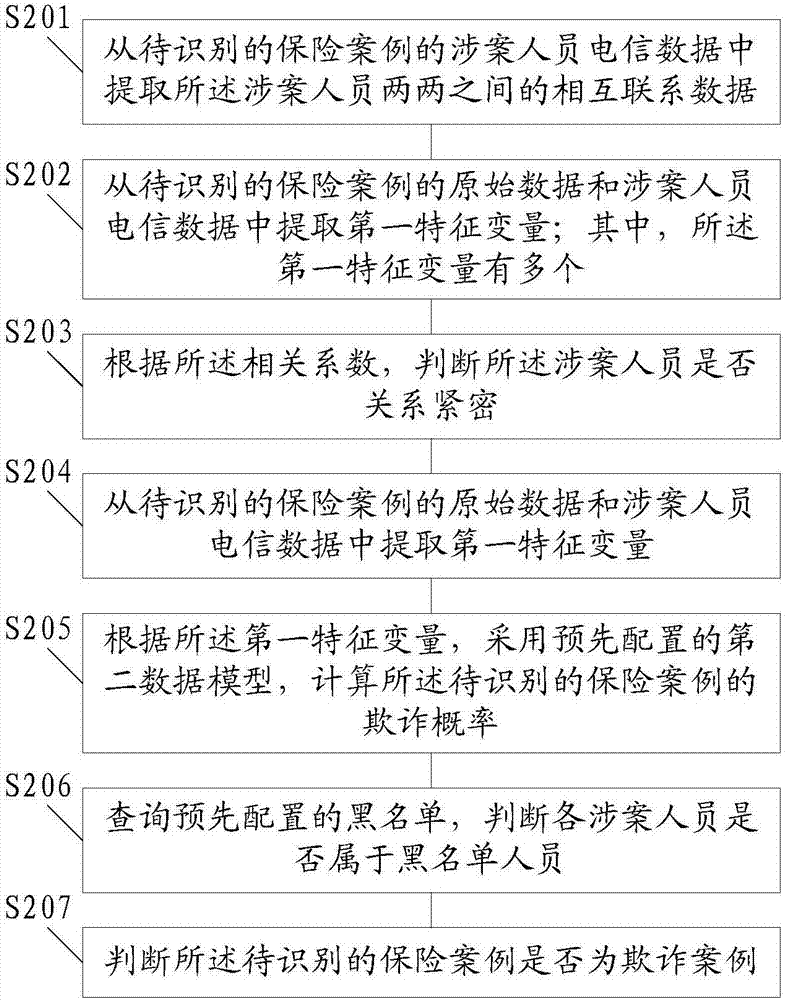

[0067] see figure 2 , is a flowchart of a method for identifying insurance fraud based on telecommunication data provided in Embodiment 2 of the present invention; the method includes:

[0068] S201. Extract the mutual contact data between the persons involved in the case from the telecommunication data of the persons involved in the insurance case to be identified; wherein, the mutual contact data includes at least one of the number of calls, the duration of calls or the length of short messages;

[0069] S202. According to the mutual relationship data between the persons involved in the case, calculate the correlation coefficient between the persons involved in the case by using the pre-configured first data model;

[0070] S203. According to the correlation coefficient, determine whether the persons involved in the case are closely related;

[0071] S204. Extracting a first characteristic variable from the original data of the insurance case to be identified and the telec...

Embodiment 3

[0103] see Figure 4 , is a structural diagram of an insurance fraud identification device based on telecommunication data provided by Embodiment 3 of the present invention.

[0104] Correspondingly, the present invention also provides an insurance fraud identification device based on telecommunication data, including:

[0105] The first extraction module 401 is used to extract the mutual contact data between two persons involved in the case from the telecommunication data of the persons involved in the insurance case to be identified; wherein, the mutual contact data includes the number of calls, the duration of calls or the length of short messages at least one of the

[0106] The first calculation module 402 is configured to calculate the correlation coefficient between the two persons involved in the case according to the mutual relationship data between the two persons involved in the case, using a pre-configured first data model;

[0107] The first judging module 403 i...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com