A credit scoring card development method based on machine learning

A credit scoring and machine learning technology, applied in instruments, data processing applications, finance, etc., can solve problems such as audit difficulties and low labor efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0093] The present invention will be described in further detail below in conjunction with the accompanying drawings.

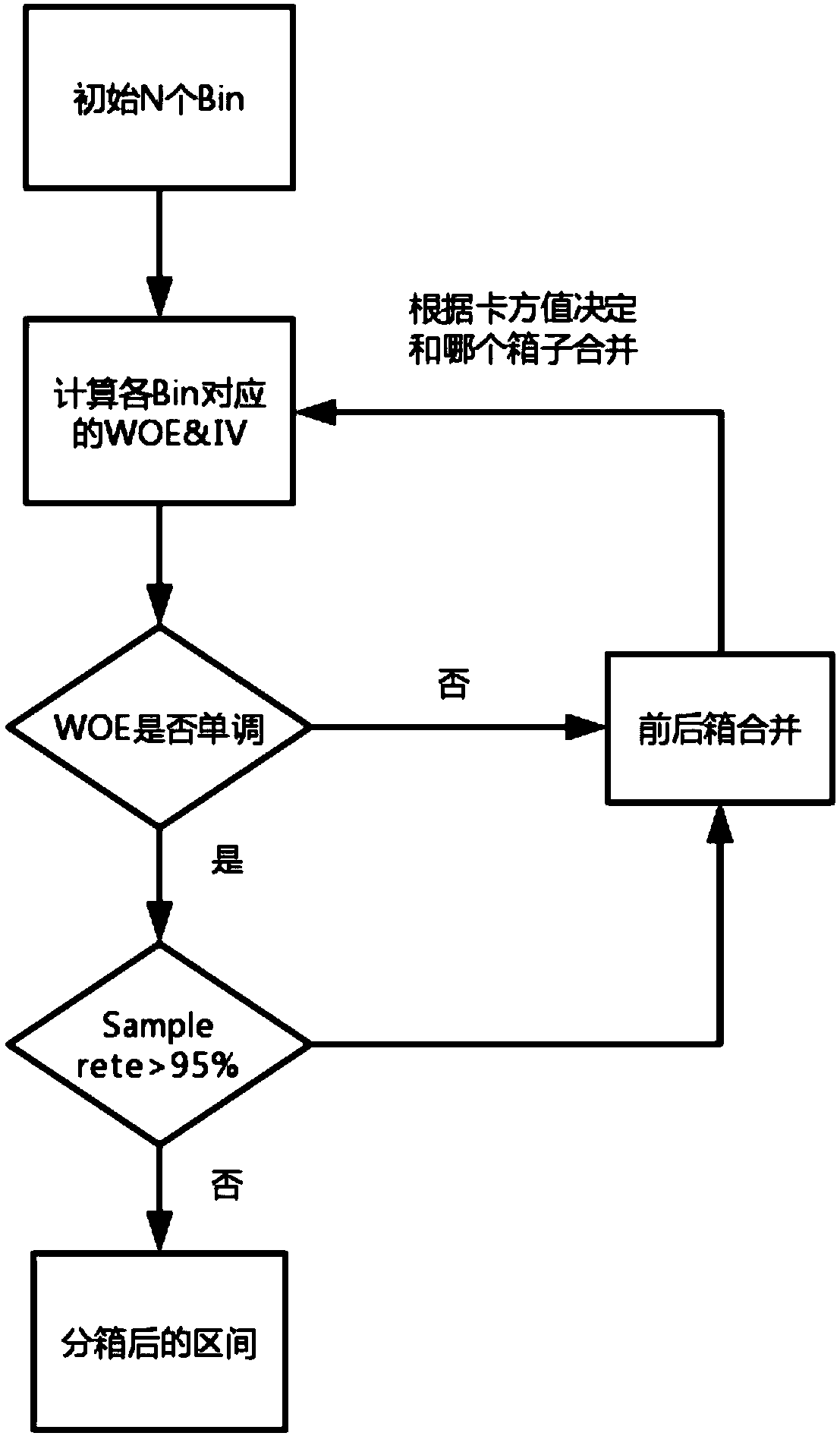

[0094] refer to figure 1 , a scorecard development method based on machine learning, the implementation of this method can solve the problem of difficult selection of high-dimensional data features while solving the low efficiency of manual review, and the invention can be applied to the development of Internet financial scorecards. Such as figure 1 in the scene shown. The optimization method designed for the problem mainly includes the following steps:

[0095] 1) Definition of target variable

[0096] According to the vintage analysis, observe the average overdue trend of each month and determine the time span of the performance window. During the performance period, users whose overdue days are less than 3 days are defined as "good users", those whose overdue days are greater than 30 days are defined as "bad users", and those whose overdue days are gre...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com