Automatic electronic invoice examining method and system

A technology for electronic invoices and invoices, which is applied in the verification of the authenticity of banknotes, instruments, characters and patterns, etc. It can solve problems such as low efficiency, differences, and inconvenience in checking invoices, and achieve the effect of improving efficiency and simplifying the process.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

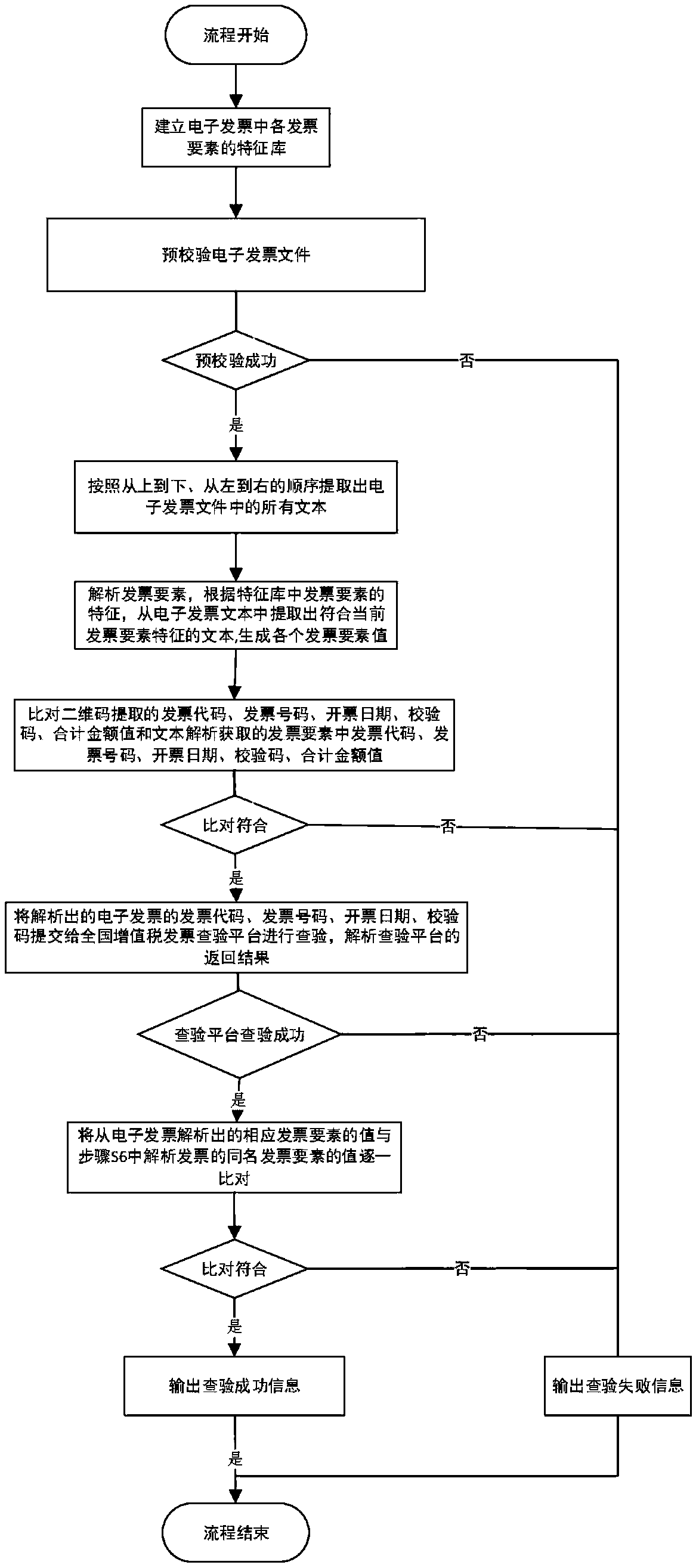

[0050] A method for automatically checking electronic invoices, the specific steps are as follows:

[0051] S1. Establish the feature library of each invoice element in the electronic invoice, wherein:

[0052] The invoice element feature library includes all invoice element features in the electronic invoice, and the invoice elements include invoice code, invoice number, and billing date;

[0053] Invoice elements refer to data items in electronic invoices that have independent meanings and are used to describe invoices;

[0054] The invoice element feature refers to the unique feature of the invoice element value or its context, which is different from other invoice element values. The unique leading word in the text of the electronic invoice and the number of occurrences of the leading word;

[0055] S2. Pre-verify the electronic invoice. Pre-verify the electronic invoice file. If the pre-verification is passed, extract the invoice element value in the electronic invoice ...

specific Embodiment 2

[0077] Roughly the same as specific embodiment 1, the difference only lies in:

[0078] A method for automatically checking electronic invoices: after step S4 is completed, the invoice commodity line must be analyzed, and then enter step S5, wherein parsing the invoice commodity line includes:

[0079] According to the text between the product title line and the total amount line, parse out all the product line texts in the electronic invoice, and then use each line of text as a candidate product line, separate the candidate product lines with spaces, and generate the divided A list of elements, where the first element in the element list is the commodity name, the last element in the element list is the commodity tax amount, the penultimate element in the element list is the tax rate, and the penultimate element in the element list is the amount; If the number of separated elements is less than 4 or the last three elements do not conform to the characteristics of commodity ta...

specific Embodiment 3

[0086] Roughly the same as the specific embodiment 2, the difference only lies in:

[0087] A method for automatically checking electronic invoices. After parsing the invoice commodity line, it is necessary to verify the relationship between the elements of the invoice, wherein: verifying the relationship between the elements of the invoice includes:

[0088] Check the invoice elements according to the relationship between the invoice elements. If the verification fails, output the verification failure information and end this operation. If the verification is successful, go to step S5.

[0089] Furthermore, the invoice element relationship refers to the operational relationship between the value of each invoice element and the commodity line, including:

[0090] The name of the signer of the electronic signature in the electronic invoice should be the same as the name of the seller;

[0091] The total amount plus the total tax equals the total price and tax;

[0092] "Amoun...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com