Financial lending method and system based on big data technology

A big data technology, big data technology, applied in the computer field, can solve the problems of proof fraud, financial institutions cannot recover funds, borrowers cannot repay in time, etc., to achieve the effect of enhancing controllability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0027] The present invention will be further described in detail below in conjunction with the accompanying drawings.

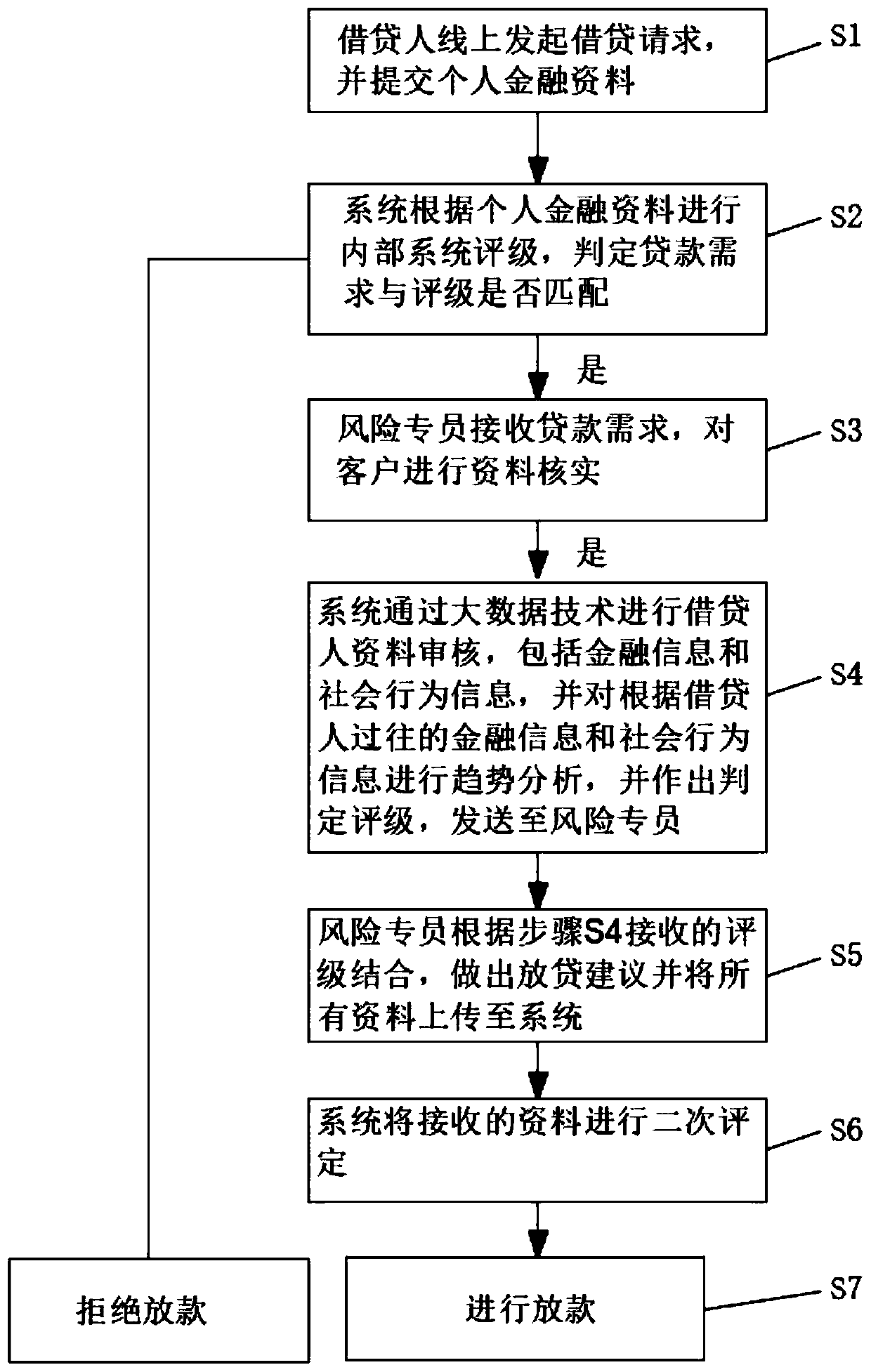

[0028] Such as figure 1 As shown, a financial lending method based on big data technology, the method includes the following steps:

[0029] S1: The borrower initiates a loan request online and submits personal financial information;

[0030] S2: The system conducts an internal system rating based on personal financial information to determine whether the loan demand matches the rating. If it matches, enter step S3, and if it does not match, terminate the loan demand;

[0031] S3: The risk officer receives the loan demand and verifies the customer's information. If it is initiated by the person, enter step S4. If it is not initiated by the person, the loan demand is terminated;

[0032] S4: The system uses big data technology to review the borrower's information, including financial information and social behavior information, and conducts trend analysis ba...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com