Stock right incentive record management method and device based on block chain, and medium

A record management and blockchain technology, applied in data processing applications, instruments, digital data protection, etc., can solve problems such as the inability to verify the distribution of options and equity, and the inability to protect the legitimate rights and interests of shareholders.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0037] In order to explain the overall concept of the present application more clearly, the following detailed description will be given by way of examples in combination with the accompanying drawings.

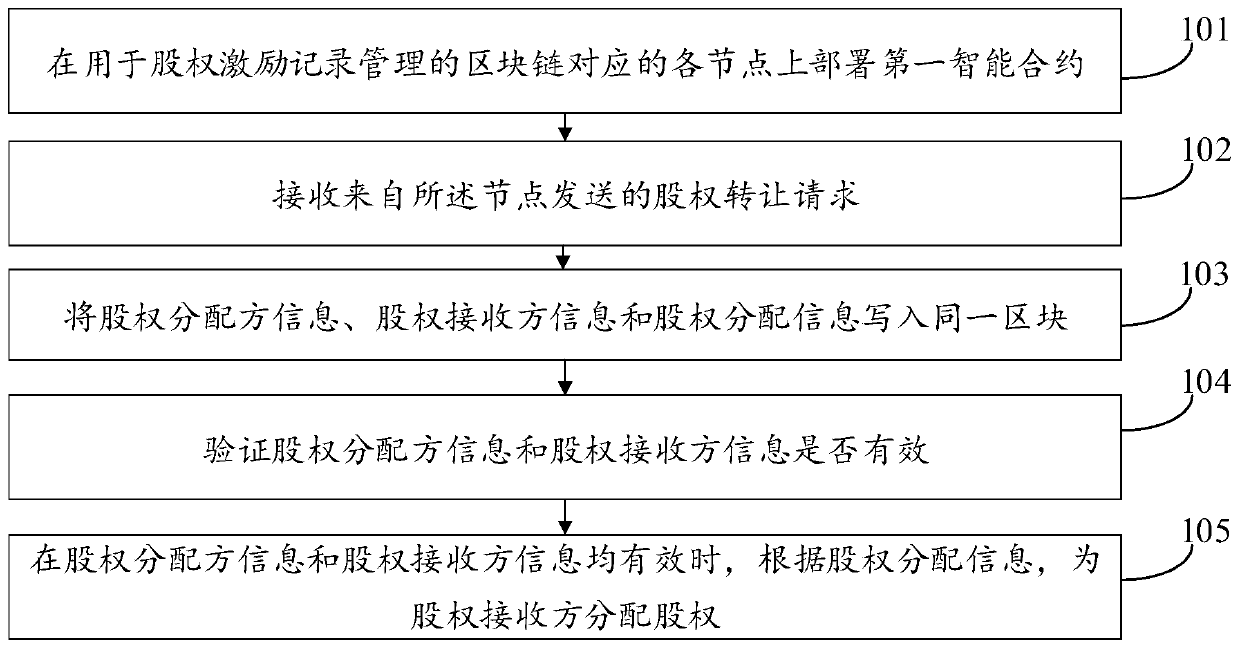

[0038] The embodiment of this application discloses a blockchain-based equity incentive record management method, taking virtual equity as an example, such as figure 1 shown, including the following steps:

[0039] Step 101. Deploy the first smart contract on each node corresponding to the blockchain used for equity incentive record management.

[0040] In the embodiment of this application, the nodes corresponding to the block chain of equity incentive record management include: industrial and commercial management agencies, China Securities Regulatory Commission, investment platforms, enterprises, and local notaries. Among them, the administration for industry and commerce is responsible for equity registration, and the China Securities Regulatory Commission is responsible...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com