A blockchain-based secure tax control invoice data transaction method

A transaction method and blockchain technology, applied in the field of secure tax control invoice data transaction system, can solve privacy protection, data security, data abuse privacy protection, data abuse and other issues, achieve data privacy protection and promote secure transaction sharing. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0065] The present invention will be further described in detail below in conjunction with the accompanying drawings and embodiments.

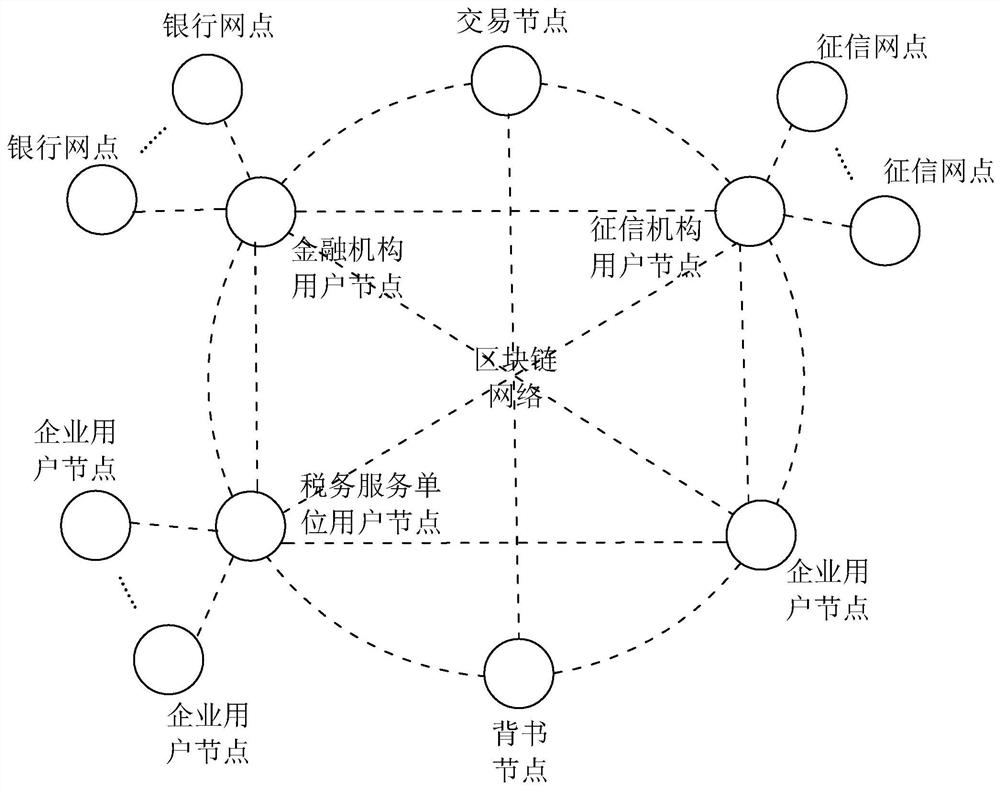

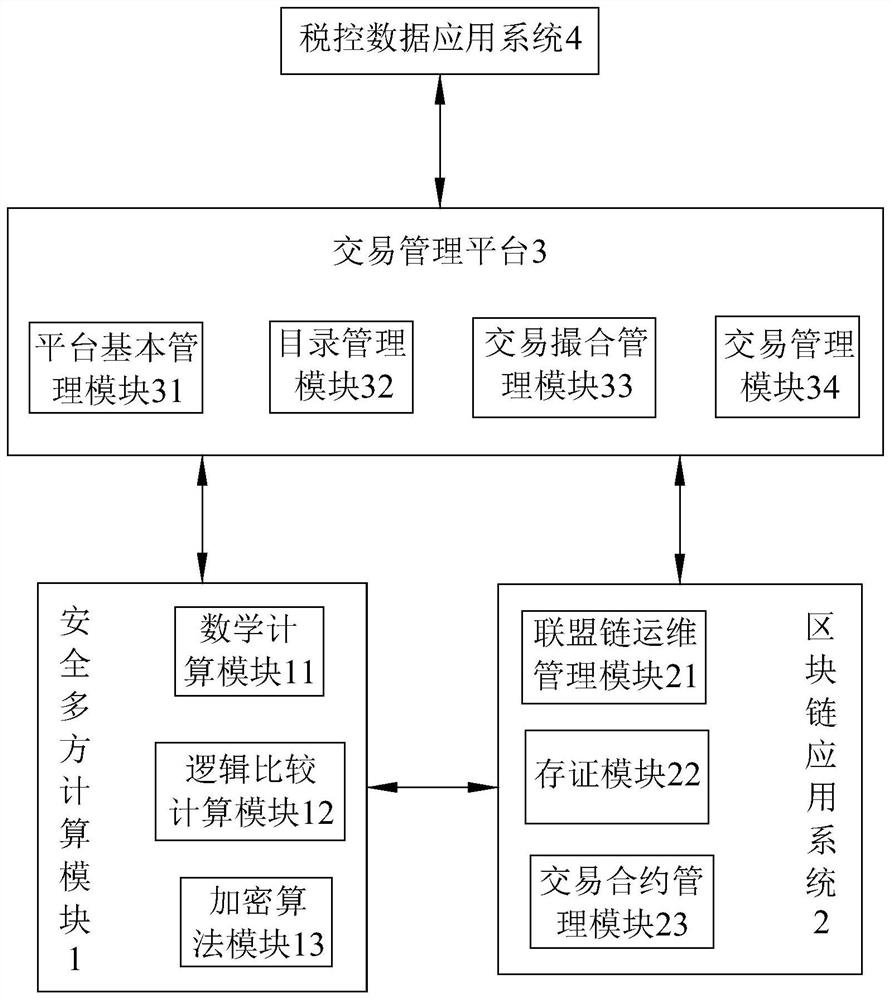

[0066] Such as figure 2 As shown, the blockchain-based secure tax control invoice data transaction system in this embodiment includes a secure multi-party computing module 1, a blockchain application system 2, a transaction management platform 3, and a tax control data application system 4.

[0067] The secure multi-party computing module 1 is set locally on the user, and each user can set up the secure multi-party computing module 1 on the ontology according to requirements. Users in this embodiment include financial institutions, credit reporting agencies, enterprise users, and tax service units, and the tax service companies may be tax service units in various provinces and cities. The secure multi-party computing module 1 is used to perform statistical equivalent calculations on invoice data, and form invoice ciphertext data including lo...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com