Stock ordering method and device based on reinforcement learning

A technology of intensive learning and stocks, which is applied in the fields of instruments, finance, and data processing applications, can solve the problems of increased transaction costs and achieve the effect of increasing user income and lower transaction costs

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

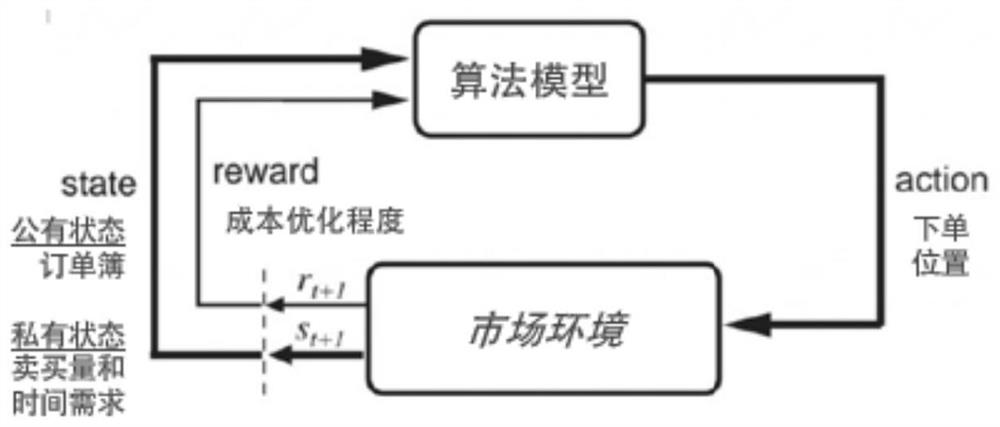

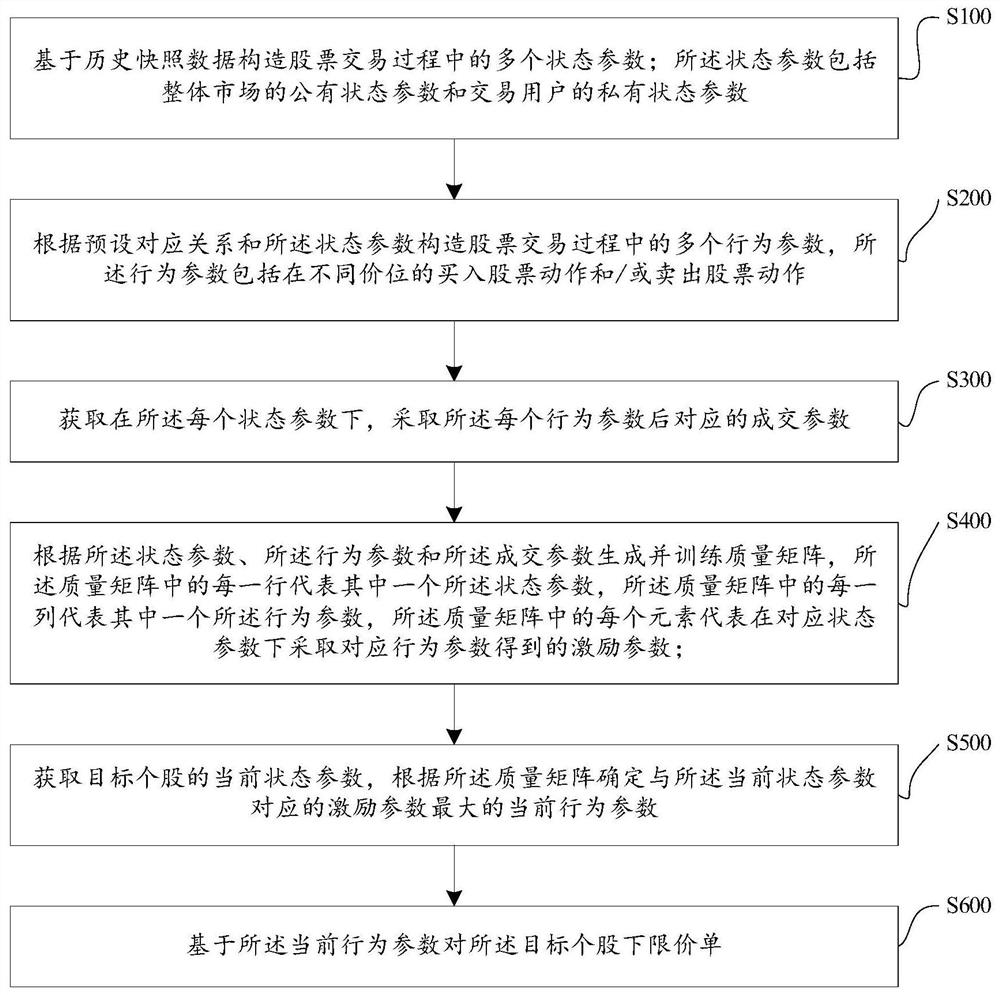

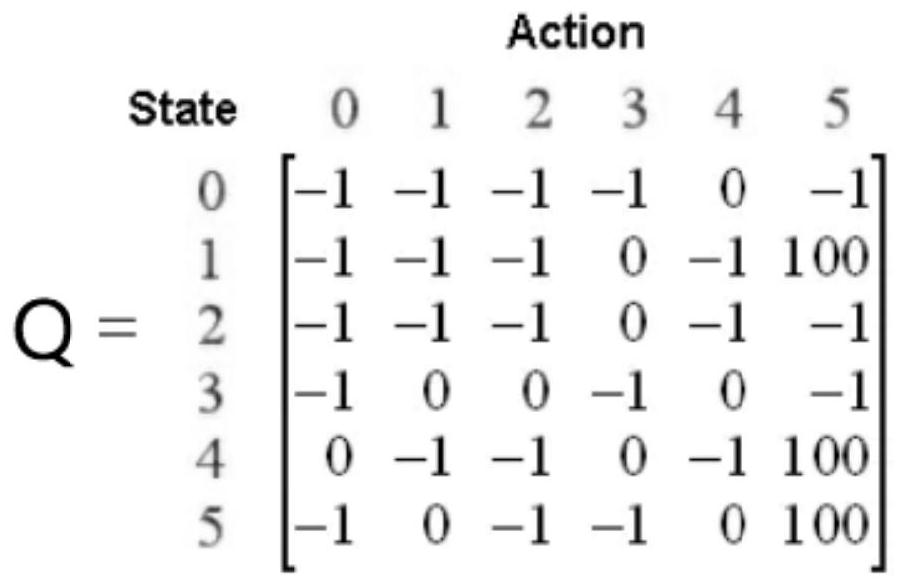

[0054] The present invention is a stock ordering scheme proposed based on a reinforcement learning model. figure 1 A schematic structural diagram of a reinforcement learning model according to Embodiment 1 of the present invention is shown. Such as figure 1 As shown, the reinforcement learning model contains three important parameters, namely state (state), behavior (action) and incentive (reward). The state parameter is the state description of the algorithm model (or agent) itself and the surrounding environment, the behavior parameter is the possible operation of the algorithm model in the current state, and the incentive parameter is the feedback generated by taking a specific action in a specific state. Among them, different calculation methods can be set for the excitation parameters according to different application scenarios. For example, in the application scenario where the cost of trading stocks is minimized, the incentive parameter can be set as the advantage of...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com