Credit installment method and system based on big data

A big data and credit technology, applied in the field of credit staging methods and systems based on big data, can solve the problems that affect the economic benefits of operators, the inability to assess the risk of users' big data, and the influence of users, and achieve the effect of good market prospects.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0026] Embodiments of the technical solutions of the present invention will be described in detail below in conjunction with the accompanying drawings. The following examples are only used to illustrate the technical solutions of the present invention more clearly, and therefore are only examples, rather than limiting the protection scope of the present invention.

[0027] It should be noted that, unless otherwise specified, the technical terms or scientific terms used in this application shall have the usual meanings understood by those skilled in the art to which the present invention belongs.

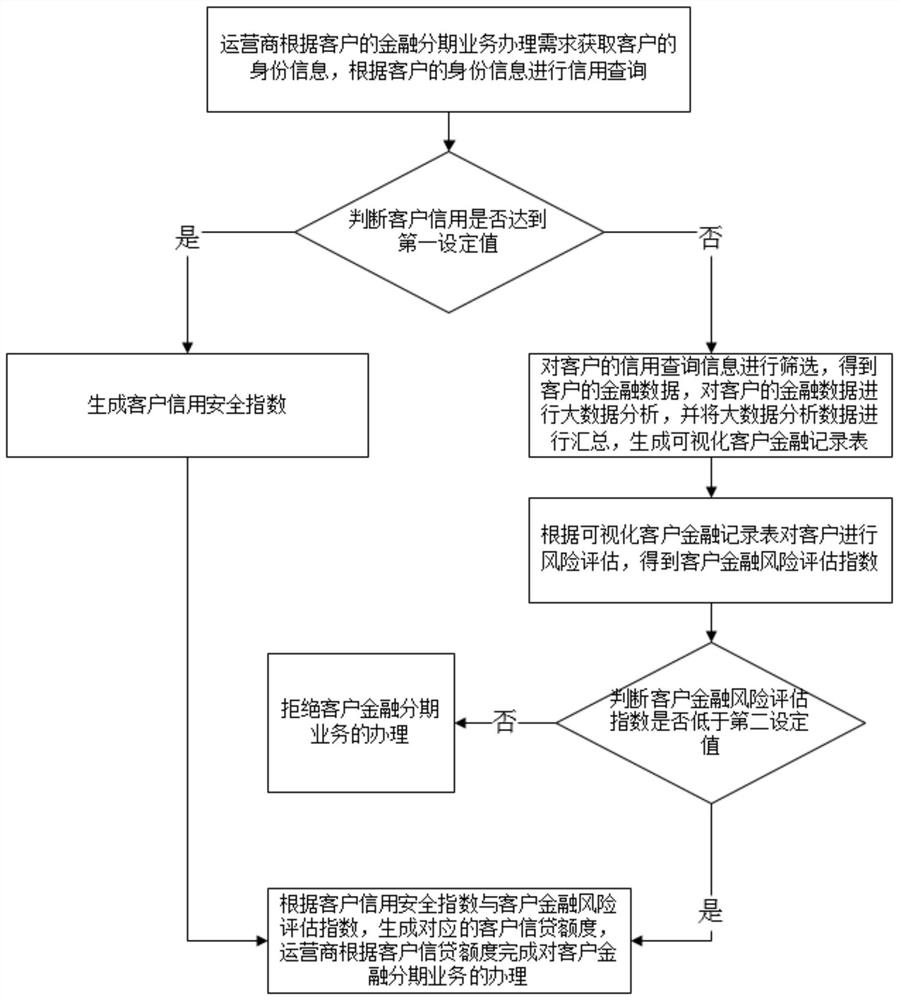

[0028] Such as figure 1 as shown in figure 1 As shown, a financial staging method based on big data includes the following steps:

[0029] S1: The operator obtains the customer's identity information according to the customer's financial installment business handling needs, conducts credit inquiry according to the customer's identity information, and judges whether the customer's c...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com