Enterprise credit data co-processing method and system based on intelligent contract

A technology of data collaboration and processing methods, applied in data processing applications, electrical digital data processing, digital data protection, etc. The effect of privacy, increased motivation

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

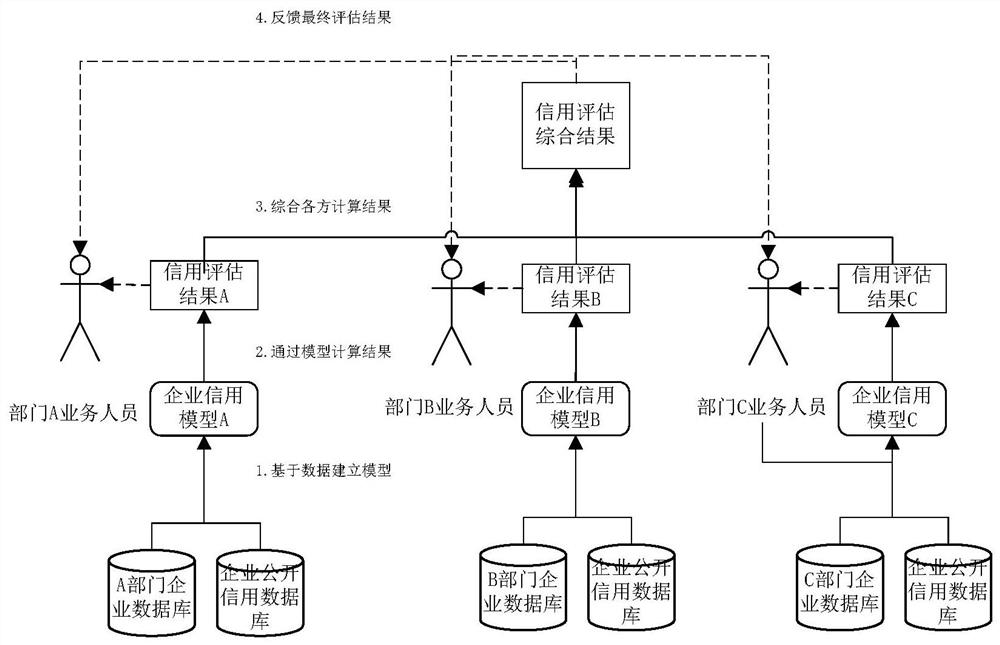

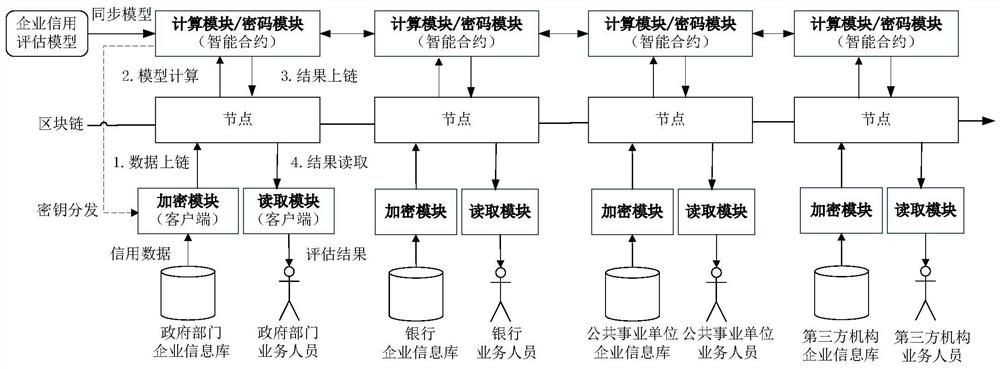

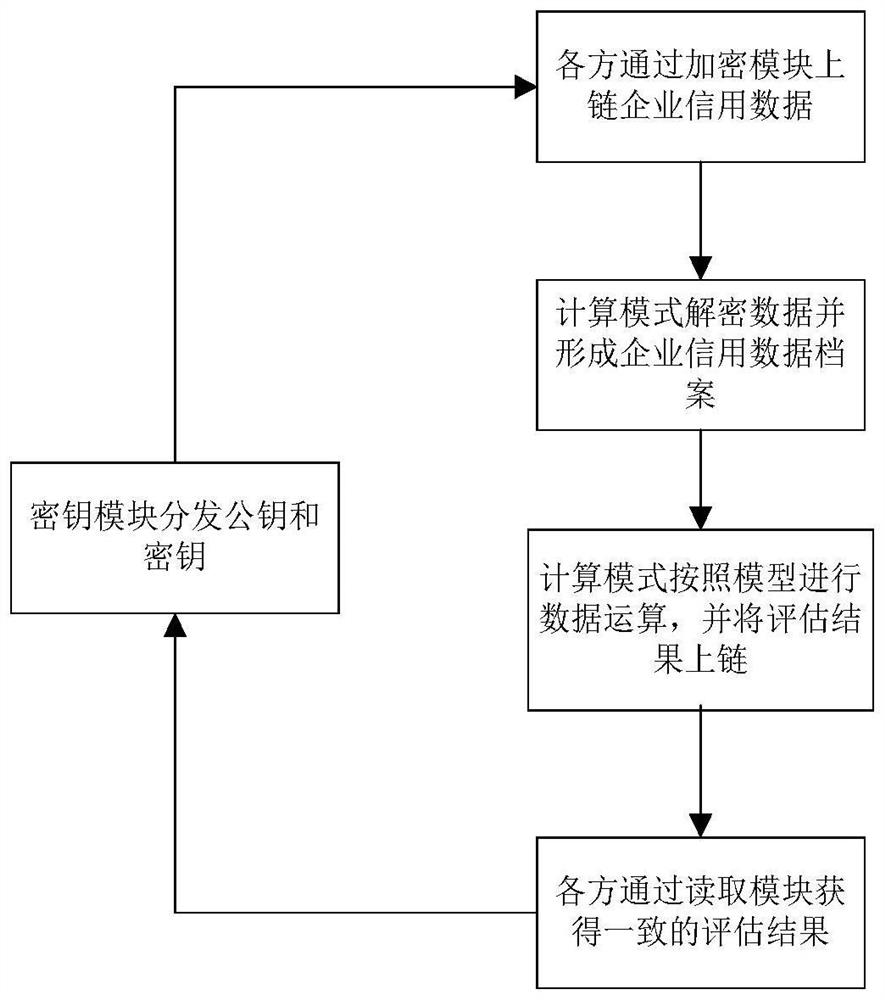

Method used

Image

Examples

Embodiment Construction

[0056] In order to facilitate a better understanding of the purpose, technical solutions and advantages of the present invention, the present invention will be further described below with reference to the accompanying drawings and specific embodiments. Those skilled in the art can easily understand the present invention from the contents disclosed in this specification Other benefits and effects.

[0057] The present invention can also be implemented or applied through other different specific examples, and various details in this specification can also be modified and changed based on different viewpoints and applications without departing from the spirit of the present invention.

[0058] It should be noted that if there are directional indications (such as up, down, left, right, front, back, etc.) involved in the embodiments of the present invention, the directional indications are only used to explain a certain posture (as shown in the accompanying drawings). If the speci...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com