Electronic price different trading tool

A transaction and electronic display technology, applied in the direction of buying and selling/leasing transactions, electrical digital data processing, instruments, etc., can solve problems such as price changes

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

example A

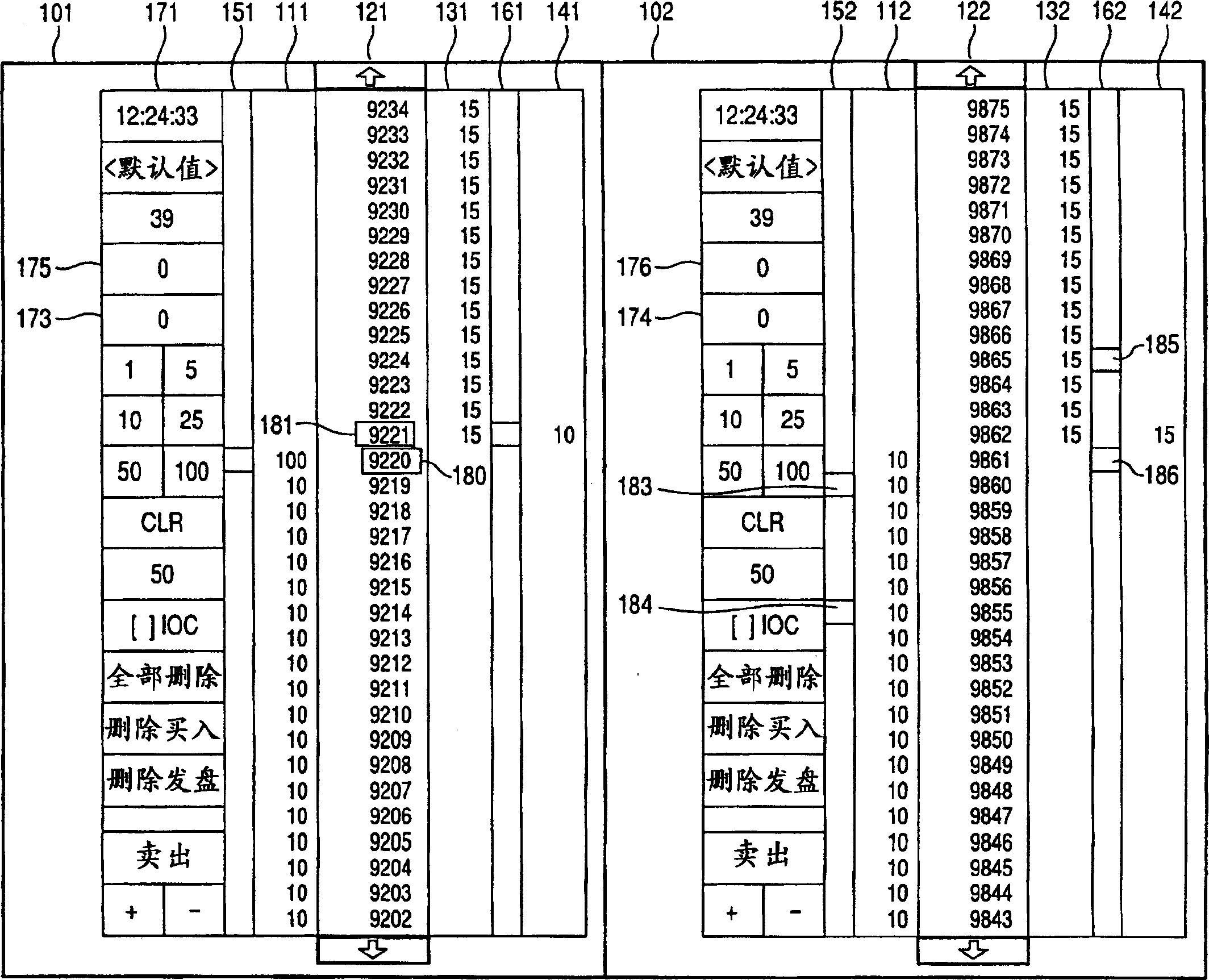

[0090] Example A : As mentioned above, the present invention always starts with the best bid and best offer (and calculates the spread based on both). Thus, a trader entering the market at the best bid price 911 (9861) will have that price offset against the best offer price 921. In this example, the best offer price would be 9221. The best offer (9221) will be subtracted from the best bid price (9861) to determine the spread (640) at which the trader will place the trade. see Figure 7 Line A 731. A buy volume 913 100 displayed on the FGBL bar 910 at the price point 911 at which the trader entered the market would imply that the trader is interested in buying 100 contracts from the corresponding FBGM bar 920 . Since this feature starts with Best Bid and Best Offer, the application will look for a breakout at the Best Offer price 921 (9221) on the corresponding FBGM column 920. The FBGM Best Offer (9221) currently has 65 contracts available 923, so the counter will execu...

example B

[0091] Example B : As a result of the market movement described in Example A, especially the change of the best offer price from 9221 to 9222, the present invention will automatically calculate a new price difference. The spread (639) is determined by subtracting the best offer (9222) from the best bid (9861). see Figure 7 Line B 732. Such as Figure 9 As shown in , the best offer price 925 (9222) currently has an available contract size 927 of 30. Because traders still in the market still expect to buy 35 contracts, and 30 contracts 927 will be available at the new best offer price, again the offset is executed. The result of this counter-off will be that all 30 contracts at the best offer price of 925 (9222) are zeroed out, thus reducing the trader's desired buy from 35 to 5 contracts and forming a third new The best offer price is 9223.

example C

[0092] Example C : As a result of the market movement caused by the action described in Example B, especially the change of the best offer price from 9222 to 9223, the present invention will automatically calculate a new price difference. The spread (638) is determined by subtracting the best offer (9223) from the best bid (9861). see Figure 7 Line C 733 of . Such as Figure 9 As shown in , the best offer price 928 (9223) currently has an available contract size 929 of 50. However, a trader in the market at the best bid price of 911 (9861) only expects to buy (fill) the 5 remaining contracts from his original purchase. Therefore, 50 contracts can be obtained 929 corresponding to the best offer price 928, and the trader has a bid to enter the market at the best bid price, the counter is executed, and the result of the counter will include the best bid The price 911 (9861) returns to zero. In addition, as a result of the aforementioned market action, the best offer price...

PUM

Login to view more

Login to view more Abstract

Description

Claims

Application Information

Login to view more

Login to view more - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap