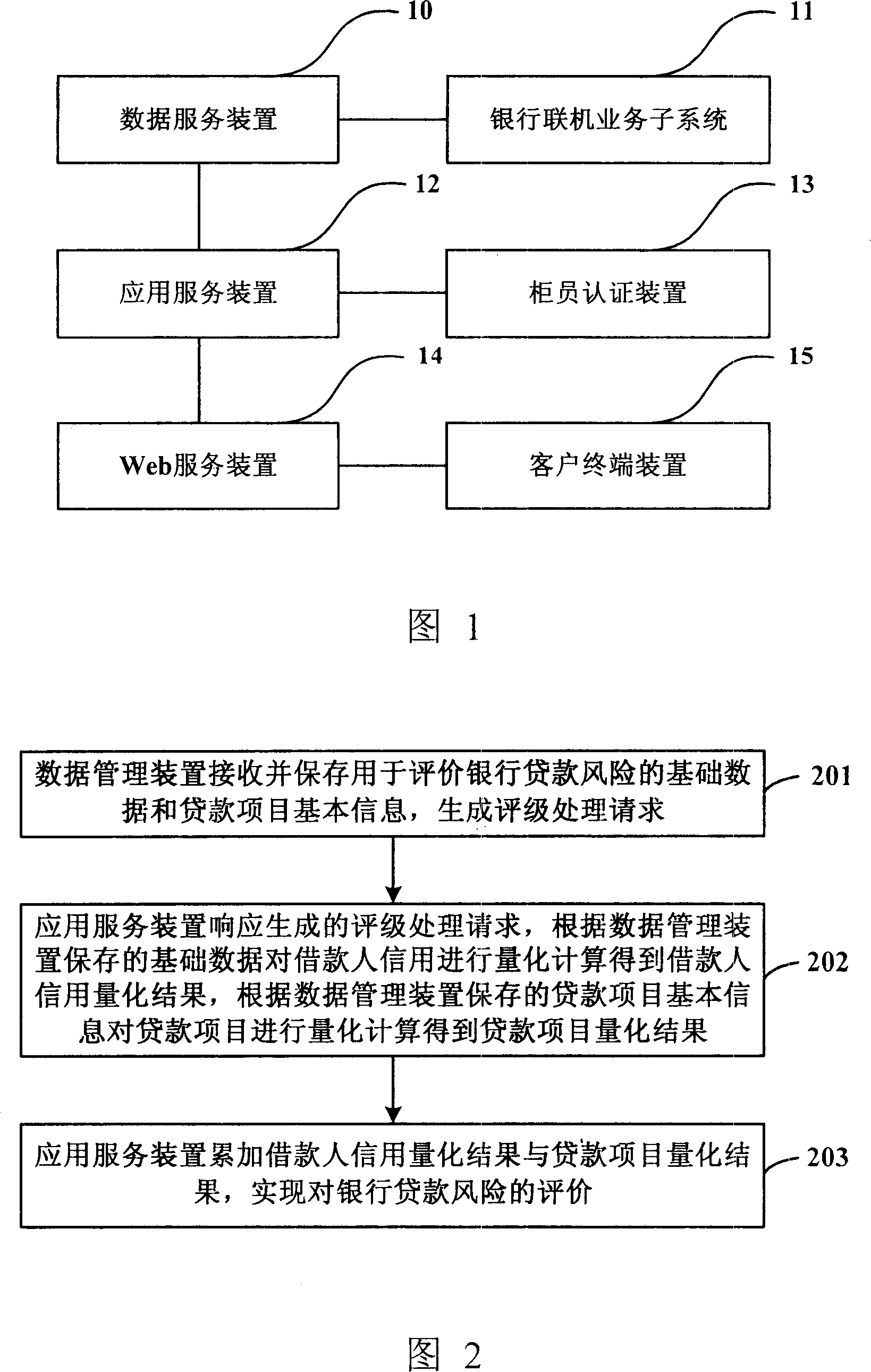

System and method for evaluating bank lending risks

A bank and risk technology, which is applied in the system field of evaluating bank loan risks, can solve problems such as the inability to evaluate bank loan risks objectively, accurately and effectively, and achieve the effects of objective, accurate and effective evaluation, improved efficiency, and improved prevention and control

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

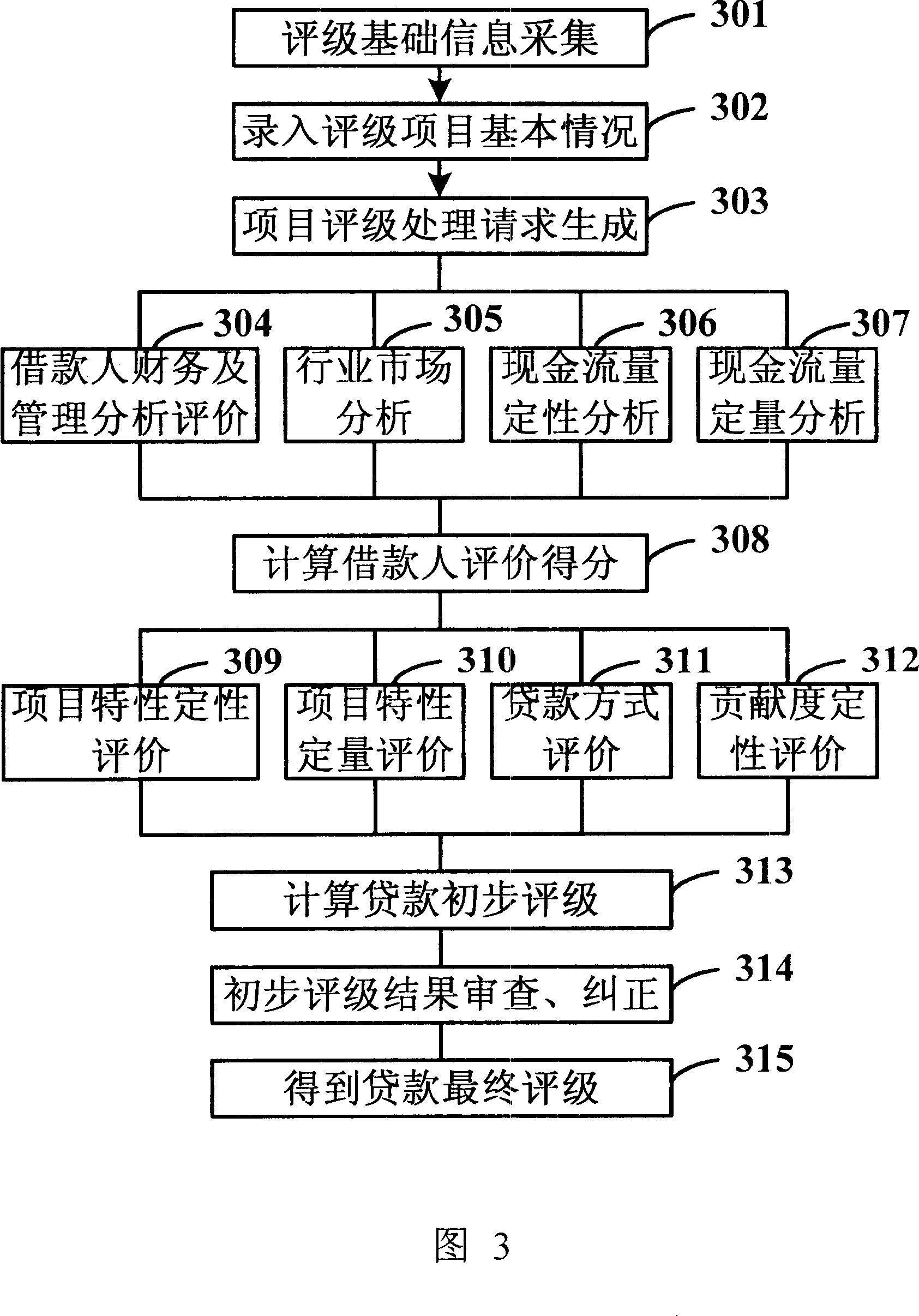

[0048] In order to make the object, technical solution and advantages of the present invention clearer, the present invention will be described in further detail below in conjunction with specific embodiments and with reference to the accompanying drawings.

[0049] The core idea of the present invention is: by adopting the "two-stage method" for automatic rating processing, first evaluate and quantify the borrower's financial and management conditions, industry market conditions, cash flow, etc., and calculate the borrower's evaluation score according to the corresponding quantitative results ; combined with the characteristics of the loan project, the loan method and the measures to avoid risks and other aspects to evaluate and quantify, obtain the preliminary evaluation result of the loan, and then conduct rating review and correction on the preliminary evaluation result, and finally determine a more scientific, Quantified bank loan credit risk evaluation results solve the...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com