Real estate dynamic valuation method and device

A real estate and valuation technology, applied in product evaluation, neural learning method, biological neural network model, etc., can solve the problem that the real estate collateral value evaluation system cannot realize dynamic evaluation of real estate collateral value, and cannot realize dynamic evaluation of real estate collateral value. And other issues

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0018] In order to make the purpose, technical solutions and advantages of the embodiments of the present invention more clear, the embodiments of the present invention will be further described in detail below in conjunction with the accompanying drawings. Here, the exemplary embodiments and descriptions of the present invention are used to explain the present invention, but not to limit the present invention.

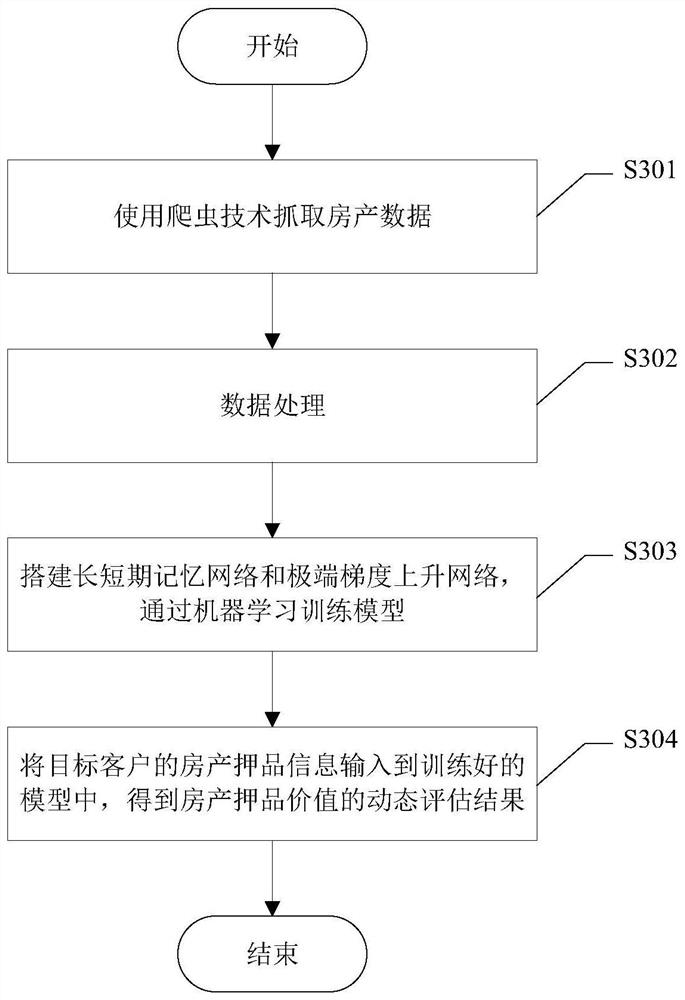

[0019] In order to solve the technical problems of low efficiency, high operating cost and poor real-time performance in the real estate collateral value evaluation process, the embodiment of the present invention provides a real estate dynamic valuation method, which uses aggregation crawlers to capture data from multiple platforms, and utilizes The machine learning algorithm trains the real estate collateral valuation prediction model to efficiently and quickly evaluate the real estate collateral value of target customers.

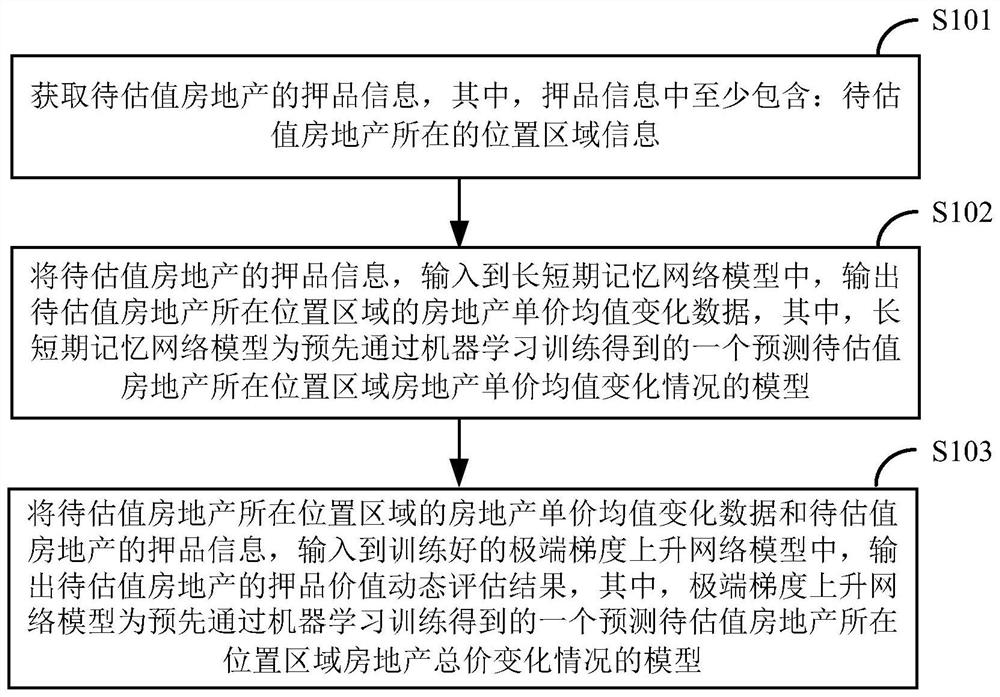

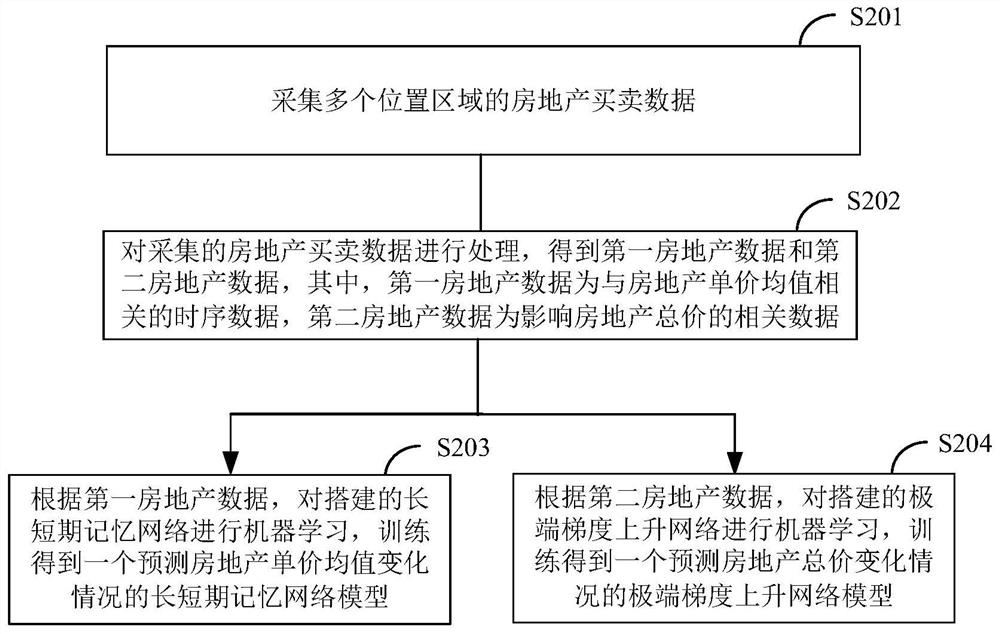

[0020] figure 1 It is a flowchart of a r...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com