Network tax control system based on tax controller combination unit

A tax control system and combination cabinet technology, applied in instruments, cash registers, etc., can solve the problems of the tax bureau's inability to accurately grasp the invoice issuance information, unfavorable collection and management ideas, and tax loss, etc., to achieve a short implementation period, low cost, The effect of reliable verification

Inactive Publication Date: 2010-11-24

INSPUR QILU SOFTWARE IND

View PDF3 Cites 12 Cited by

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

At present, the invoices issued by the commercial retail industry are basically triple handwritten invoices. Since handwritten invoices are not convenient for collecting electronic invoice stub data, the tax bureau cannot accurately grasp the invoice issuance information of the commercial retail industry, which is not conducive to the current tax bureau's implementation of "information management tax". The idea of tax collection and management, and there are loopholes in the loss of tax revenue

Method used

the structure of the environmentally friendly knitted fabric provided by the present invention; figure 2 Flow chart of the yarn wrapping machine for environmentally friendly knitted fabrics and storage devices; image 3 Is the parameter map of the yarn covering machine

View moreImage

Smart Image Click on the blue labels to locate them in the text.

Smart ImageViewing Examples

Examples

Experimental program

Comparison scheme

Effect test

Embodiment Construction

the structure of the environmentally friendly knitted fabric provided by the present invention; figure 2 Flow chart of the yarn wrapping machine for environmentally friendly knitted fabrics and storage devices; image 3 Is the parameter map of the yarn covering machine

Login to View More PUM

Login to View More

Login to View More Abstract

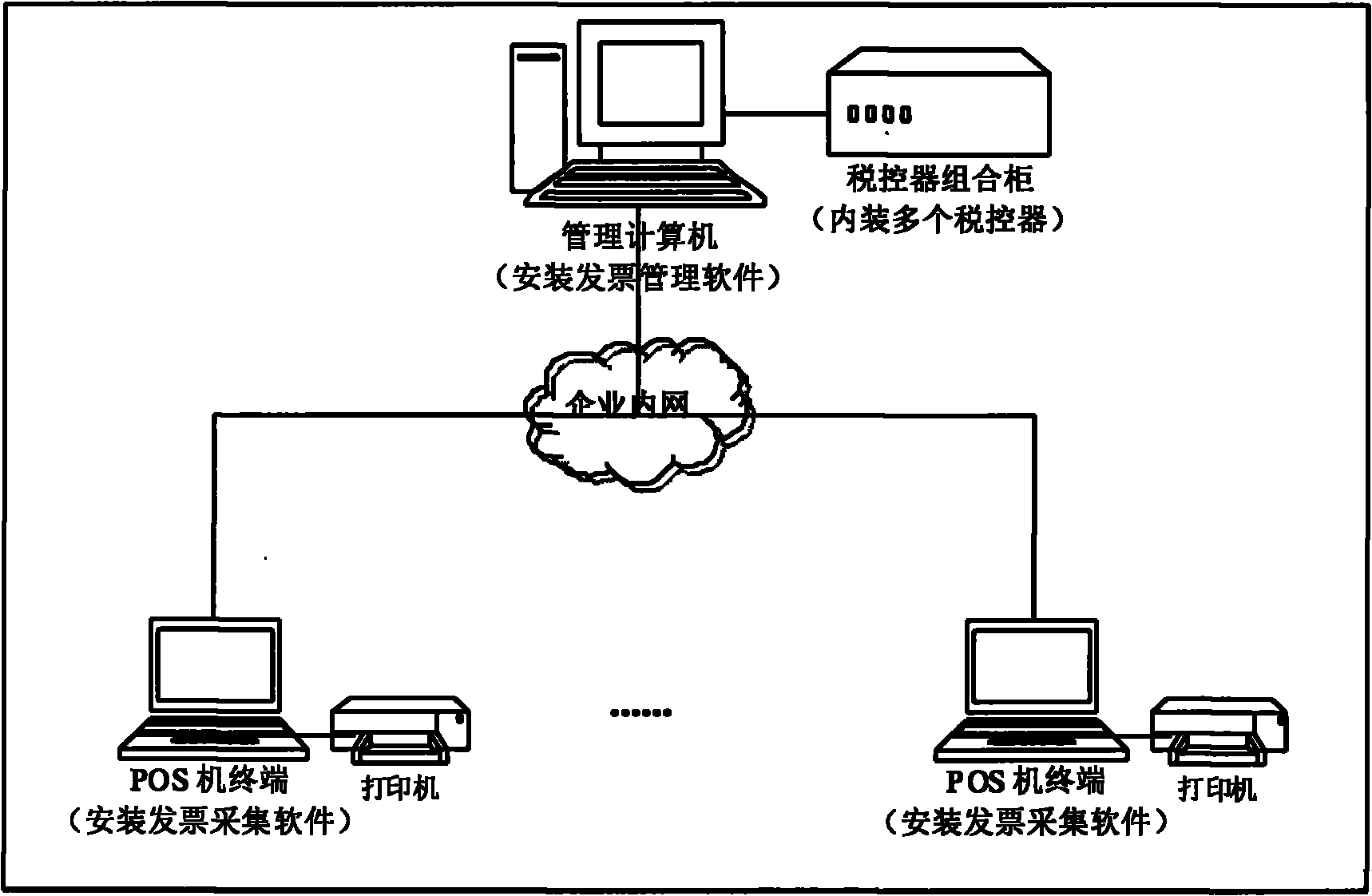

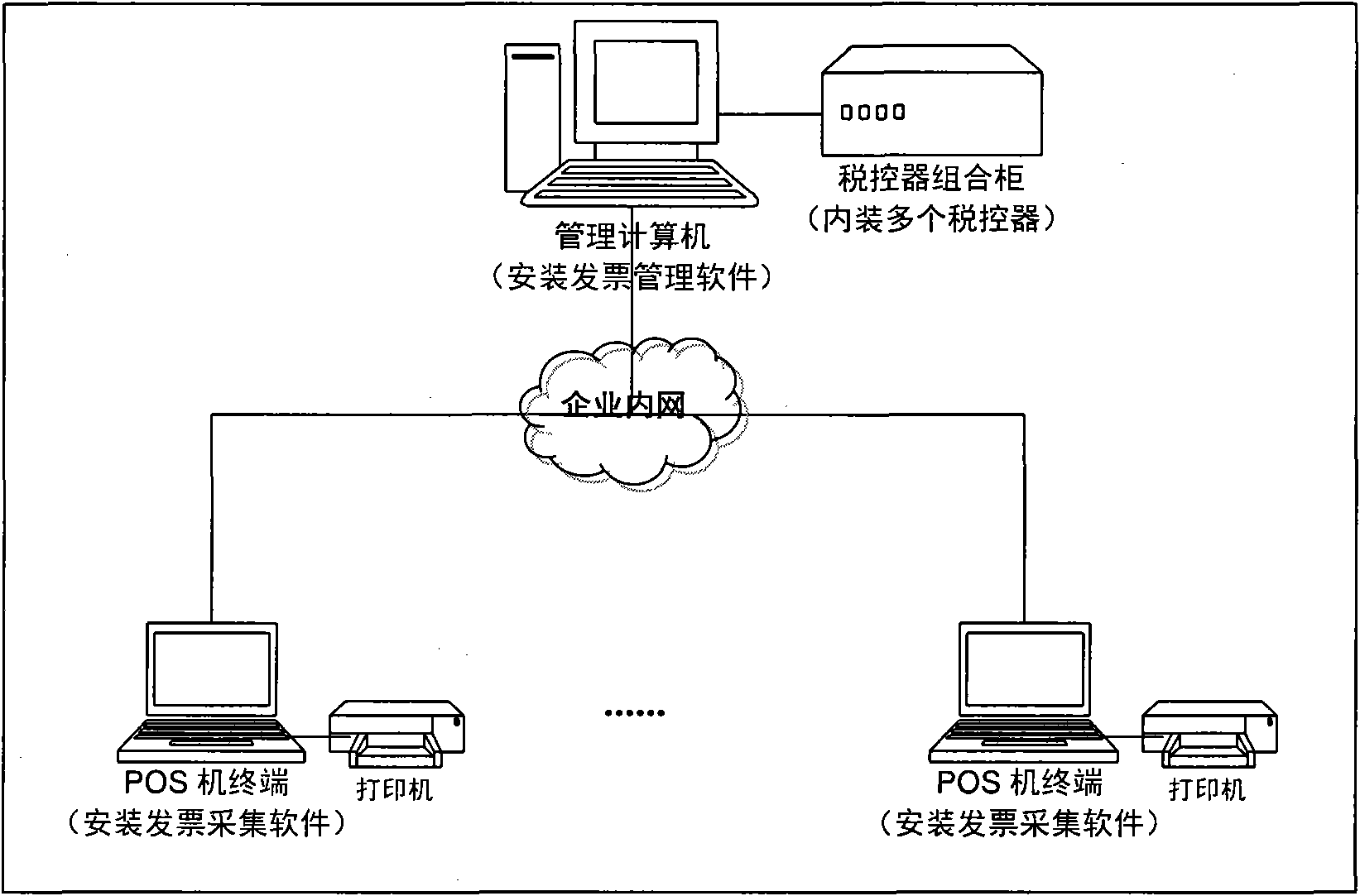

The invention discloses a network tax control system based on a tax controller combination unit. The system consists of invoice management software of an enterprise management terminal, the tax controller combination unit and invoice collecting software of a plurality of billing terminals, wherein the invoice management software runs in a management computer of a taxpayer, serves as the server software of the invoice collecting software of each terminal and the host software of the tax controller combination unit to respond requests of generating invoice tax control codes of each piece of invoice collecting software of a network terminal concurrently and intelligently schedule control commands of each tax controller concurrently and completes the related invoice operation, such as the generation of the invoice tax control codes and the like; the tax controller combination unit is arranged in a computer having the invoice management software by an interface cable, consists of a plurality of independent national standard tax controller devices and responds the related invoice control commands of the invoice management software concurrently; and the invoice collecting software runs on point-of-sale (POS) machines of each sale terminal of a network, collects the sale data of the POS machines of the terminals in a software interception way, applies to the invoice management software for the invoice tax control codes by an enterprise internal internet and prints tax control invoices by using a POS printer.

Description

A network tax control system based on tax controller combination cabinet technical field The invention relates to a network tax control system based on tax controller combination cabinet, which is mainly applied to taxpayers in the commercial retail industry equipped with retail systems such as network MIS and network POS, and realizes the transformation of the taxpayer's commercial retail system and tax control machine printing. Promotional application of invoices. Background technique At present, the invoices issued by the commercial retail industry are basically triple handwritten invoices. Since handwritten invoices are not convenient for collecting electronic invoice stub data, the tax bureau cannot accurately grasp the invoice issuance information of the commercial retail industry, which is not conducive to the current tax bureau's implementation of "information management tax". The idea of tax collection and management, and there are loopholes in the loss of tax r...

Claims

the structure of the environmentally friendly knitted fabric provided by the present invention; figure 2 Flow chart of the yarn wrapping machine for environmentally friendly knitted fabrics and storage devices; image 3 Is the parameter map of the yarn covering machine

Login to View More Application Information

Patent Timeline

Login to View More

Login to View More Patent Type & Authority Applications(China)

IPC IPC(8): G07G1/14

Inventor 张海亭王培元张海宇于静徐兵兵

Owner INSPUR QILU SOFTWARE IND

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com